The State of the American Traveler: July 2023 — What Trip Spending Will Be Compromised to Keep Traveling

Even with tighter budgets, Americans don’t appear to be sacrificing their travel. Instead, many anticipate spending differently on their trips, making compromises on food and dining experiences and shopping purchases over shortening trip days or even scrimping on lodging.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted, or influenced by any advertising or marketing agency. The key findings presented below represent data from over 4,000 American travelers collected in June 2023 by Future Partners (formerly Destination Analysts).

Financial Outlook Improves—Travel Spending Sentiment is Cautiously Optimistic.

- Expectations that the U.S. will enter an economic recession in the next six months are down -6.2 percentage points from May. Similarly, the share of American travelers who are being careful with their personal finances due to concerns about an impending recession also came down slightly to 60.5 percent, compared to 62.6 percent last month.

- Perceptions of the travel cost being too expensive have abated after two months of consecutive increases, with the cost of gasoline as a deterrent for travel dropping from 37.0 percent in May to 32.8 percent this month, and the cost of airfare as a deterrent dropping from 28.9 percent to 25.2 percent. In fact, the percentage of those who said that high travel prices have kept them from traveling in the past month also saw its first decline since March, dropping from a 2023-high of 46.7 percent in May to 43.9 percent in June.

- This lessening of tension around travel costs is also reflective in travel spending sentiment, with the share of American travelers who say that now is a good or very good time to spend on leisure traveler recovering to 30.2 percent after dropping to 27.5 percent in May (which was a 2023 low). In more positive news, expectations for higher leisure travel spending in the next twelve months rebounded slightly in June (+3 points from May).

- However, the impact of these positive indicators on Americans’ expected leisure travel spending in the next 12 months is tempered, with expected travel budgets for the next year currently averaging at $3,787. While an increase compared to May’s ten-month low of $3,719, it still remains well below the $4,318 average of the first four months of 2023.

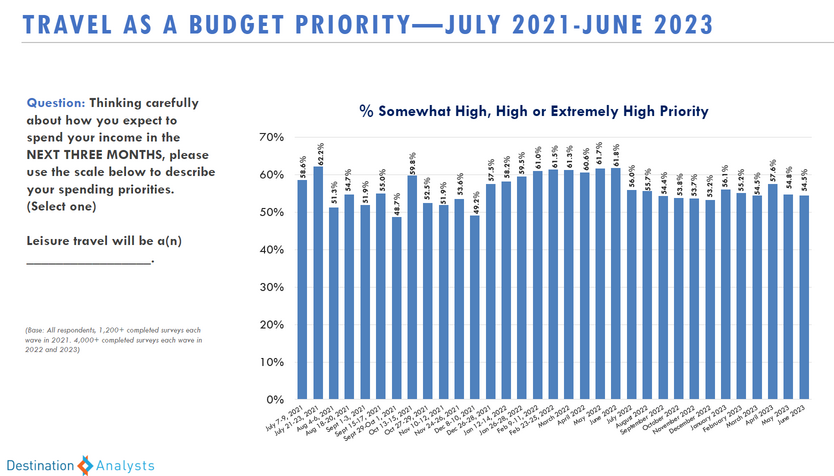

- Even with the ups and downs of recent concerns around a potential recession and high travel costs, Americans’ commitment to travel as a budget priority has continued to hold steady, coming in at 54.5 percent. Also, the average number of leisure trips planned for the next year—3.4–remains at 3-year high levels.

Faced with Tighter Budgets, Americans Likelier to Cut Back In-Destination Spending Over Trip Days

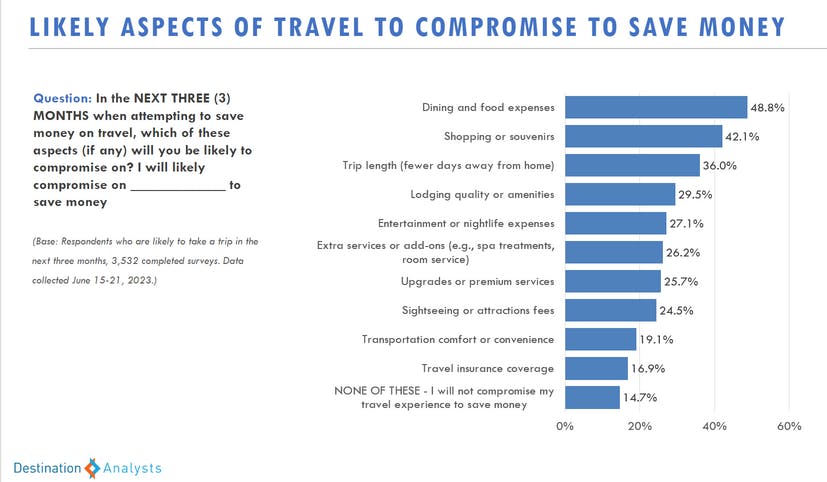

- It’s clear that American travelers are not willing to give up travel as a budget priority, even if said budgets are a bit smaller than projected at the start of the year. But something’s got to give, so if travel itself is non-negotiable, where are travelers willing to cut down in order to make sure they can take their trips? This month, we asked American travelers who said they will take a trip in the next three months how likely they would be to compromise on certain aspects of their travel experience in order to save money. Just over 60 percent said they would be likely or very likely to make money-saving compromises, with only 16 percent saying they would be unlikely.

- Nearly half of these trip spending compromisers said they would compromise on dining and food expenses (48.8%) while on their trips, and 42.1 percent said they would trim down their shopping or souvenir spending to save money. These potential compromises exceed the 36.0 percent who said they would go far as to shorten their trip length and 29.5 percent who said they would make sacrifices around lodging quality or amenities to make their travel budgets work.

- In terms of what such dining compromises may look like, these travelers said they would most likely opt to pack their own snacks or meals for outings or day trips while traveling (46.7%), and/or seek out budget-friendly restaurants or eateries (46.3%).

- When asked specifically about lodging options they would use to save money while traveling in the next three months, 38.0 percent of these travelers would use budget-friendly hotel chains, and 30.9 percent said they would stay with friends or family.

– The likeliest behaviors these travelers would engage in to save on trip entertainment costs include free attractions and landmarks (47.2%), as well as visiting local parks and recreation areas (39.8%). - In terms of cost-saving transportation options on trips in the next three months, the largest share of these trip-expense negotiating travelers said they would simply travel closer to home (30.8%), while one-quarter would use travel discount websites (24.9%) and one in five would use discount airlines or low-cost carriers (20.5%).

Electric Vehicles and the American Road Trip

- The vast majority of American travelers say they still own or lease traditional gasoline-powered automobiles (87.0%), with only 11.3 percent reporting they have a hybrid automobile, and 3.8 percent saying they own or lease a full electric vehicle (EV). (However, note that EV ownership/lease amongst travelers is above the US average.)

- Among those who currently own or lease an EV, the majority of them (85.1%) have used their EV to take a trip to a destination 50+ miles from home in the last year.

- In fact, seven in ten (71.5%) of these travelers said they would be moderately or extremely comfortable taking their electric vehicle on a road trip of 300 miles or more from home.

- When asked what reasons make them less than extremely comfortable taking a 300+ mile road trip in their EV, these travelers were most likely to cite range anxiety or the fear of running out of battery power, at 47.0 percent, followed by limited or inconvenient charging infrastructure (43.9%). Over one-third also said lengthy charging times (36.2%) were a source of their discomfort.

- As you might expect, EV- car owning travelers are far less likely to feel deterred by the cost of travel right now and have a higher average anticipated trip volume. They are also more technology-oriented compared to other travelers.

For the complete set of findings, including historic data and custom information for your travel brand or destination purchase a subscription to The State of the American Traveler.

Learn more about the latest trends during our monthly livestream.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.