Destination Analysts’ Takes on the Dallas Leisure Market

Destination Analysts’ founder recently presented one of our company’s most popular speaking topics to a group of hoteliers and DMO professionals at a joint luncheon hosted by the Hospitality Sales and Marketing Association International and the Dallas Fort Worth Area Tourism Council. Several hundred tourism leaders from the Dallas area were presented new data from Destination Analysts’ The State of the American TravelerTM and The State of the International TravelerTM studies, as well as video interviews of travelers discussing their perceptions of Dallas. A summary of key takeaways follows:

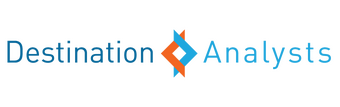

The DFW Metroplex is America’s fourth biggest city. Yet, like many destinations, it suffers from a significant awareness and understanding deficit both domestically and abroad. The situation is shown below, using findings taken from our most recent The State of the American TravelerTM survey–a nationally representative survey of 2,000 domestic leisure travelers. When asked in an unaided question to write in the five domestic destinations they most want to visit in the upcoming year, only 2.3 percent wrote in Dallas. The only other area cities receiving votes were Fort Worth (0.2%) and Arlington (0.1%). These disappointing results are, of course, not commensurate with a great city like Dallas.

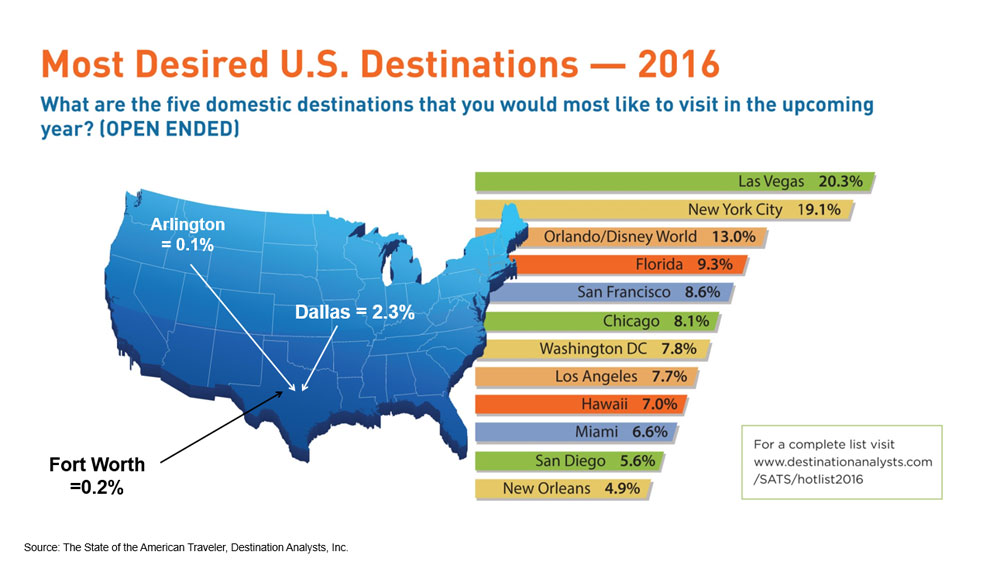

What’s beneath this situation? Despite the outstanding efforts of the metro area’s DMOs and the tourism community overall, the Metroplex obviously faces stiff competition from many compelling and well-funded destinations around the country. Obviously, too, the destination’s message hasn’t penetrated deeply into travelers’ awareness. The chart below shows (for numerous destinations) the relationship between destination appeal, perceived traveler familiarity, and likelihood of visitation. The chart shows visually that the more appealing a destination is, the more likely travelers are to say they are likely to visit it. Further, higher levels of familiarity foster both appeal and likelihood to visit. In this perspective, the Metroplex, while outpacing in-state rivals Austin and Houston, sits in the rear-middle of the pack nationally. This is no place for what is undeniably one of the nation’s most unique and vibrant communities. In our view, this dramatically highlights the need for local communities to continue to support (and very importantly fund) the marketing efforts of area destination marketing organizations.

We won’t go into the detailed data in this blog post, but Dallas’ story is the same for international markets. Our The State of the International TravelerTM survey asked 800 likely international travelers in each of 14 major international feeder markets the same set of questions—measuring traveler familiarity, destination appeal and likelihood of visitation. These international results mirror the domestic ones, with Dallas getting relatively low rankings for all three metrics when compared to an array of other U.S. destinations.

The Silver Lining

The DFW Metroplex is a world-class destination, with fantastic attractions, attributes and significant potential. When you’re familiar with the place, it’s hard not to be optimistic about the possibilities. Despite the destination’s challenged current position, our research shows that the area is seen as attractive by a very valuable audience–sophisticated, younger travelers willing to spend money of leisure travel. A segmentation analysis shows that when we compare travelers who say they find Dallas to be an “Appealing” leisure destination to other travelers (i.e., those who do not find the city to be an appealing leisure travel destination) an interesting profile emerges:

American Leisure Travelers who Find Dallas Appealing are:

(Compared to those who don’t find Dallas Appealing)

Demographically different. They are:

More ethnically diverse (69.9% vs. 80.6% Caucasian)

More likely to be Millennials (37% vs. 21.0%)

Frequent Travelers. They:

Took more leisure trips taken in past 12 months (4.8 vs. 4.2 trips)

Are more likely to be international travelers (37% vs. 21% have traveled overseas in the past 12 months)

Have higher travel optimism (44% vs. 31% expect to travel more this year than last)

Are 68% more likely to expect to visit a metropolitan destination this year for leisure reasons

Consume Far More Travel Content When Travel Planning

(% that used each resource to plan a leisure trip in past 12 months)

User-generated content (69% vs. 55%)

Social media (68% vs. 42%)

Online Travel Agencies (40% vs. 27%)

Information gathered from a mobile phone (69% vs. 42%)

A DMO website (50% % vs. 30%)

Bigger Travel Spenders. They have:

Similar incomes, yet…

“Personal financial reasons” constrained their travels less this year (36% vs. 40%)

Expect to spend more this year on leisure travel (44% vs. 31%)

Have 30% larger annual travel budgets ($4,100 on average)