The State of the American Traveler in August 2023 —Travel Budgets and Planning Windows Shrink, TikTok & Podcasts Keeps Rising

As Americans report lower anticipated travel budgets, they predict there will be less price gouging by travel companies. Meanwhile, on the marketing front, TikTok and podcasting continue to grow their reach as resources for travel inspiration.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. The key findings presented below represent data from over 4,000 American travelers collected in July 2023.

Current Sentiment Towards the Economy & Travel.

Noteworthy Concerns:

- One alarming trend to note is the continuing decline in travel budgets. In January, the typical American traveler said they expected to spend $4,677 on their leisure travel over the next 12 months. Since then, reported travel budgets have steadily declined, now at $3,505—the lowest average budgets have reached since October 2021.

- This month 46.2% of American travelers report that high travel prices deterred them from traveling in the past four weeks—this is the second time this year this sentiment has reached this (high) level. Similarly, the percentage of American travelers citing personal financial reasons as a recent deterrent to travel reached 38.2% for the second time this year. 41.2% believe travel prices are too expensive right now.

- The proportion of American travelers who say the present is a bad time to spend on leisure travel (36.0%) exceeds the proportion who say it is a good time (28.9%)

- Leisure day trips have risen at a higher rate than overnight leisure trips. A year ago, the percentage of Americans reporting taking leisure day trips and overnight leisure trips was about the same (overnight even outpacing day trips 38.7% to 35.8%). Now 45.2% of American travelers report they took an overnight leisure trip in the last month, compared to 54.4% who reported taking day trips.

On the Upside:

- Fears of a recession continue to decline, reaching 49.4%, a 16-month low.

- Despite a somewhat greater proportion who say they are worse off financially now compared to a year ago, American travelers are overall feeling better off financially now relative to how they felt a year ago. This month 30.7% say they are doing better now financially than they were a year ago, up from just 25.8% who reported such last July.

- More than half of American travelers (50.4%) anticipate that they will be better off financially next year compared to now, the most optimistic they have felt since July 2021.

- Nearly one-third of American travelers (32.9%) believe it is likely that the US stock market will enter a bull market in the coming months.

- Although down slightly, excitement for travel remains at record levels (8.1 on a scale from 0-11). Just over 83% of American travelers have existing trip plans for the next 12 months.

Travelers Predict Less Price Gouging and Labor Shortages, More Crowding, Frustration & AI

In January we asked American travelers their predictions about a number of factors, predicaments and issues that impact travel, from geopolitics to technology advancements. This month we revisited these predictions to see what beliefs may have shifted in the past six months, particularly in light of current events and many tourism records set.

- Slightly fewer now say that price gouging will be more common in the travel industry, at 62.6% from 63.8%. There is also a lessening belief that labor shortages will be a problem for the travel industry in the coming year, down to 61.8% from 65.1%.

- There is slightly more belief that domestic travel will become generally more frustrating, up to 61.7% from 60.0% in January. Meanwhile, the belief that popular National Parks will be over run with tourists has jumped to 44.7% from 39.4%.

- American travelers appear to believe that some of the latest technology will be transformative to travel relatively soon. Predictions that AI will start to replace some travel agents/advisors leapt to 54.4% from 38.7%, and predictions that the metaverse will start replacing some real-world travel jumped to 30.0% from 21.3%.

Marketing Travel: Tik Tok & Podcasts Keeps Rising, Travel Planning Windows Shrinking

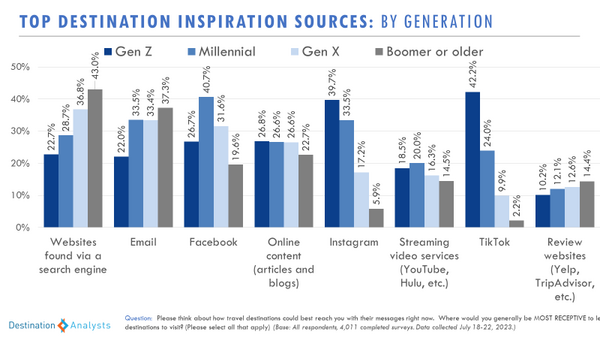

When asked to think about how travel destinations could best reach them with messaging right now, 15.0% of all American travelers cited TikTok. However, it’s likely no surprise that Tik Tok is firmly tops with GenZ: 42.2% of GenZ travelers say it is where they would be most receptive to learning about new travel destinations, which is nearly double the percent of Millennials (whom continue to cite Instagram and Facebook their top travel inspiration sources) who said the same. American travelers who predict TikTok will become America’s top social media channel has risen to 40.9% (up from 38.7% in January).

Also notable is that more than one-third of American travelers now say they regularly listen to podcasts, up from 28.0% just six months ago. Nearly 20% of those who regularly listen to podcosts report that they listen to travel podcasts. (See our livestream on the rise of podcasts as a travel marketing tool)

Meanwhile, the average trip planning window has shrunk. In January, American travelers said they would take 11.5 weeks to plan a week-long domestic trip. Since then, that planning window has continued to get shorter, with American travelers now reporting they would begin planning such a trip just 9.8 weeks out. Americans who traveled in the last month said they planned this most recent trip 6.4 weeks out.

Hot Destinations

When asked to name the five domestic destinations they most want to realisticly visit in the coming 12 months, the top spots go to:

1. New York

2. Florida

3. Las Vegas

4. California

5. Hawaii

Texas, Los Angeles, Chicago, Miami and Colorado round out the domestic top 10. When it comes to Americans’ most desired international destinations for their travel in the coming year, these countries reign:

1. Italy

2. United Kingdom

3. Mexico

4. France

5. Canada

In addition to European and North American destinations, Asian and Gulf destinations also made the top 20, including Japan, China and Dubai—driven by stronger interest from Millennial and GenZ age travelers.

For the complete set of findings, including historic data and custom information on your destination or business, purchase a subscription to The State of the American Traveler study.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.