Archive for year: 2017

Innovation is our favorite thing here at Destination Analysts. We’ve been on the cutting edge of destination research for two decades now, and still love nothing more than moving the needle forward. Our latest innovation is combining the Voice of the Consumer (i.e., website user survey responses) with website analytics data. The results are impressive and extremely valuable. Imagine being able to see what different user types (leisure travelers, meeting planners, the press, etc.) are actually doing on your website. Or even better, being able to develop your content strategies based on the actual behaviors of travelers at different points in the travel planning funnel. Do potential visitors who have already decided to visit differ from those simply considering your destination? If they do (and yeah, they do) your marketing effectiveness will depend on understanding these differences.

Our recent webinar explores this new approach to DMO website research. We invite to take a little time today and watch. Just click the image below.

If you’re interested in harnessing this technique to take your online marketing to a new level, contact us today.

Did you know that, on average, 3.4 percent of DMO website users are converted by these sites from an undecided potential traveler to an actual visitor? Our recent landmark study of 13 Western U.S. DMO websites revealed that while this conversion factor may seem modest, the resulting economic impact to the DMOs’ communities is very significant. In fact, for every real, new website user of the 13 DMO websites we studied, $37 in new visitor spending was injected into their localities. Read on to learn more!

While the modern DMO must tackle a dizzying array of online marketing objectives, inspiring undecided website users to visit the destination is quite possibly their most important online objective. The reason for this is straightforward. Generating so-called “incremental visits” is the single greatest source of return on investment created by these organizations’ digital expenditures. In partnership with the DMA West Education & Research Foundation, our team recently completed a fascinating comprehensive study of DMO websites, which benchmarks and explains the reach and impact of these websites.

An executive summary of this exciting research approach pioneered by Destination Analysts is now available. This year-long project analyzed visitor traffic to the websites of 13 DMOs in the Western United States. A primary objective of this project was to estimate the direct visitor spending these websites produce for their respective communities. Essentially, we sought to estimate the total amount of direct visitor spending in-market that was generated by and attributable to the DMO website. Alternatively, it’s the amount of visitor spending in the destination that would not have occurred in the absence of the website.

The results are compelling. There is no doubt that DMO websites are invaluable marketing assets and significant generators of economic impact for their communities. Following are the key economic impact metrics that emerged from the study. These findings are based on 8,845,291 real, new website users of all 13 participating DMO websites between January 1, 2016 and January 1, 2017.

- Incremental trips generated by the thirteen participating DMO websites: For 8,845,291 real, new users of the 13 DMO websites during the year, an estimated 304,425 incremental trips were generated for the respective destinations. An incremental trip is one in which the user decided to visit the destination based on their experience with the DMO website, and thus any visitor spending in the destination on these trips can be counted as part of the website’s economic impact. The average incremental trip lasted approximately three days, with a reported in-market spending of $306 per day. These incremental trips are estimated to have generated $270,486,531 in new visitor spending in these destinations.

- Additional days on trips extended generated by the 13 participating DMO websites studied: A second way DMO websites can generate economic value is by inspiring visitors to extend their already planned visits. The research conducted shows that for 8,845,291 real, new users of these thirteen sites, 146,690 new visitor days were generated for the respective destinations. This is estimated to have resulted in an additional $54,278,815 in incremental visitor spending in these destinations.

- Total estimated economic impact: The two components discussed above (spending on incremental trips and additional days in-market) comprise the program’s economic impact as defined in this study. It is estimated that for 8,845,291 real, new users of the thirteen participating DMO websites, $324,765,346 in total economic impact was generated for the respective destinations. Based on these findings, it is estimated that each real, new user to a DMO website ultimately generates $36.72 in visitor spending in the destination the site is marketing. Given the total collective budgets of these thirteen DMOs, these websites brought an average return of approximately four-to-one for their respective destinations.

- Incremental hotel room nights generated by the 13 participating DMO websites studied: Given the number and length of incremental and extended trips generated by the DMO websites, and the proportion of these visitors reporting that they stayed in a hotel in the destination, it is estimated that for 8,845,291 real, new users of the thirteen websites during the 12-month period of study, 533,182 incremental room nights were generated in the respective destinations’ hotels.

Of course, the results of individual DMO websites varied greatly—showing that there is no substitute for conducting your own research. Still, the overall story is compelling. The DMO’s influence on local economic performance through inspiring travel to their destinations is inarguably significant.

Click here to read the complete executive summary of findings.

In this most unusual of moments, there is a great deal of angst in the destination marketing world about the outlook for international visitation to the United States. Travel bans and outrageous rhetoric suggesting the possibility of “extreme vetting” for tourists from markets like Germany and France have analysts predicting that foreign demand for American travel product will fall sharply this year. While this situation is an extraordinarily serious problem, signs from domestic travelers point in the other direction. Our recently finished Spring edition of The State of the American Traveler™ shows that, at least on the home front, the outlook for leisure travel is surprisingly positive. In fact, Americans are planning more trips and more spending in the upcoming year than ever before, pointing to a strong performance in the remainder of 2017.

According to our April The State of the American Traveler™ tracking survey, more Americans than ever are expecting to increase the number of leisure trips they will take in the upcoming year. Leisure travel optimism is at a record high, mirroring positive trends seen in more general consumer confidence indices. This enthusiastic outlook is illustrated by a record 39.7 percent of Americans saying they expect to travel more for leisure in the next year, up from 37.9 percent in January. Leisure travel spending expectations are also high, with 39.3 percent of American travelers expecting to increase their leisure travel spending in 2017.

The chart below shows this strong optimism, illustrating the share of American leisure travelers who (in the next 12 months) expect to travel more, less and the same as they did in the most recent 12-month period.

(Percent of all leisure travelers)

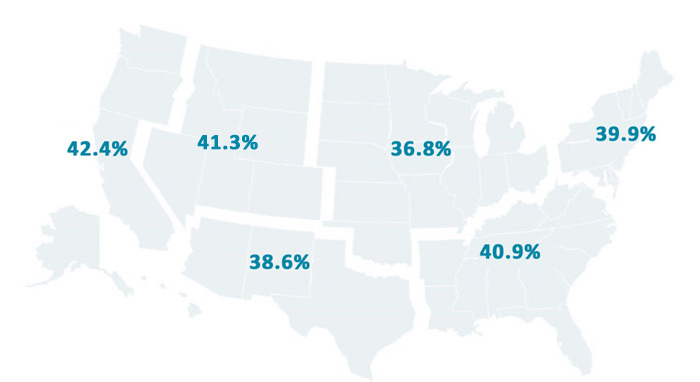

Meanwhile, future travel sentiment across the country remains somewhat uneven, with residents of the West coast showing the highest levels of optimism for travel in the upcoming year. 42.4 percent of residents of the Pacific Coast region expect to travel more in the upcoming year, while 39.9 percent of travelers living in the Northeast and 40.9 percent in the Southeast expect to increase the number of trips they will take in the next year.

(Percent of leisure travelers)

Early to bed and early to rise makes a man healthy, wealthy and wise.

— Benjamin Franklin

Ben Franklin understood something we modern folks have forgotten. Getting ample rest and relaxation is vital to a happy and productive life. Not only are we a chronically sleep deprived nation, with 40 percent of us getting less than the recommended amount of nightly slumber, our use of vacation time has plummeted in recent years. The U.S. Travel Association reports that (on average) Americans take only 16 days of vacation a year, one full week less than in 1980. The list of problems and health risks associated with our “always-on” lifestyle is well-known and includes an array of detrimental effects including heart disease, depression, cognitive impairment, diabetes, anxiety disorders, obesity and even the potential for a dreaded loss of enthusiasm for bedroom fun!

At Destination Analysts, we don’t need research to tell us that this is simply no way to live. And, possibly in response to this crisis, many Americans now seem to share our concern and are taking their vacation advice from Poor Richard’s Almanac. Many of us are now building vacation experiences specifically around health and wellness. In a recent The State of the American TravelerTM survey, we explored Americans’ interests in travel specifically to nurture personal health and wellness. The results are intriguing, and suggest that destination marketers would be well-advised to keep their eyes on this market and be ready to take advantage when possible. Consider the chart below.

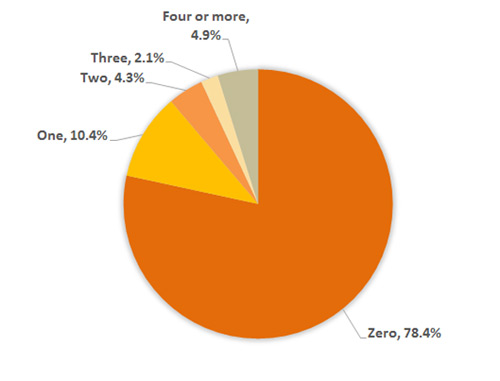

Health & Wellness Trips Taken (Past 12 Months, American Leisure Travelers)

Question: How many of these leisure trips were focused primarily on trip activities to promote your personal health and wellness? Base: Percent of American Leisure Travelers.

Nearly one quarter of American leisure travelers have taken a “health and wellness” trip in the past year. However, one such annual trip is simply not enough for many of these travelers. The average health and wellness traveler took 2.96 such trips in the past year, with one in twenty who took four or more such trips last year. That’s a lot of trips and likely a lot of money spent. Health and wellness travel is clearly a very significant and possibly under-serviced niche market.

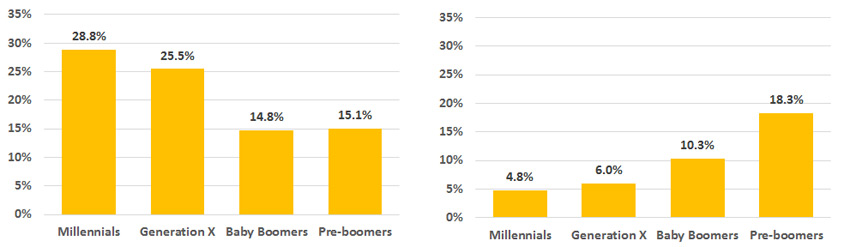

Interestingly, it seems as if those travelers most in need of health and wellness trips may be the least likely to actually take them, and vice versa. The graphs below show that Millennial leisure travelers are most likely to have taken at least one health and wellness trip in the past year. Undoubtedly a result of their relative youth, they are also the least likely generation to report that personal health concerns had kept them from traveling in the past year. In short, they are twice as likely as Baby Boomers to take health and wellness trips, and half as likely to say they reduced their travels this last year over health concerns.

Gen X actually looks like it may be a sweet spot for health and wellness travel. Fully a quarter of American Gen X travelers have taken a wellness trip in the past year and these Gen X wellness travelers have taken 3.6 trips such trips in the past year on average (compared to 2.4 such trips amongst Millennial health and wellness travelers).

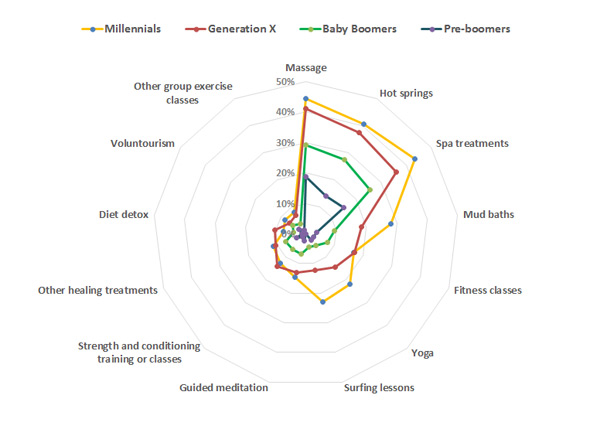

What does health and wellness travel really entail? To find out, we asked survey respondents to tell us what health-related activities they would be interested in doing on their leisure trips. For the most part, American travelers as a whole are most attracted to better known, relaxation-related activities like massages (36.3%), hot springs (35.5%) and spa treatments (32.2%). Other health and wellness-oriented activities fell further behind amongst the general traveling public, although younger travelers clearly exhibit more diversity in the health and wellness activities they are enthusiastic for. The diagram below shows the proportion of leisure travelers in each generation who say they’re interested in an array of health-related activities tested.

Interest in Health & Wellness Activities (Percent of travelers, by generation)

Question: Which of the following would you be interested in doing on your leisure trips? Base: Percent of Leisure Travelers.

Health and wellness travel clearly represents a very large potential market, but one that appears to be more alluring to Millennial and Gen X travelers. While surely niche markets exist for other healing activities outside the mainstream, the health and wellness activities these travelers will most commonly desire are likely to revolve around more traditional spa-related ways to reduce stress. With this focus, we hope that destinations that can position themselves as a unique place to relax and rejuvenate will cash in on those seeking relief from the harried, always-on lifestyle of the American traveler.

There’s little denying that we’re living in uncertain times. Just days ago, who would have predicted mass protests at U.S. airports or newspaper headlines suggesting America’s tourism industry is closed for business? Our industry, and in fact, the American economy as a whole, depends on robust international travel. International travelers spent $246.2 billion in the U.S. in 2015, supporting 1.2 million jobs. Putting this in perspective, travel to America supports more jobs than there are people in San Jose, California, the heart of Silicon Valley. For further comparison, a manufacturing giant like Ford Motor Company employs about 187,000 people in total, with a profit of $6.3 billion. International travel is not mere big business, it’s enormous business, comprising one-third of all U.S. service exports. So it should come as no surprise that travel professionals have been grappling with how the whole of Donald Trump—from his ethos, hospitality experience, and leadership to his many surrounding controversies—will affect the U.S. travel industry.

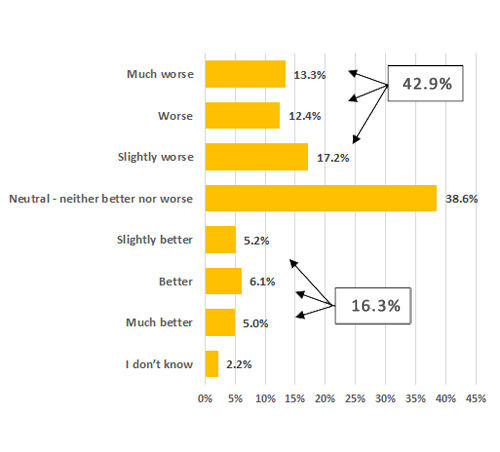

(Average, All Countries Surveyed)

Question – Did the results of the recent U.S. Presidential election change your overall opinion of the United States of America? If so, how? (Please select the answer that best fills in the blank below) As a result of the election, my overall opinion of the United States is _________.

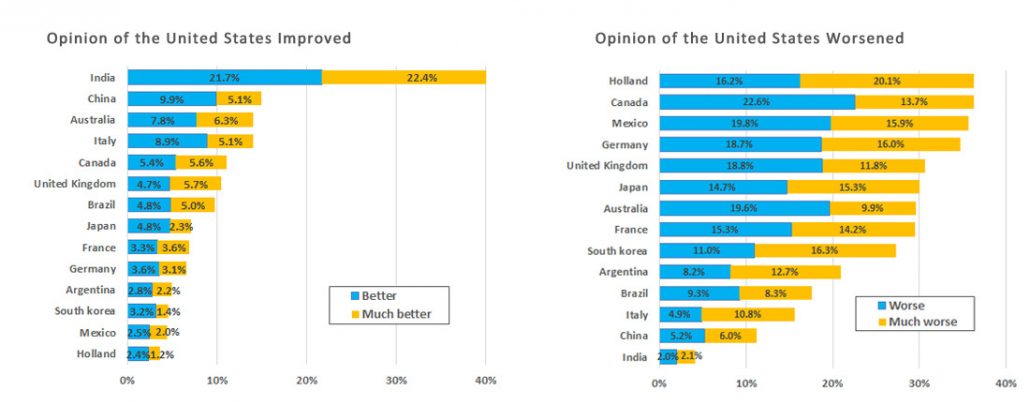

Nevertheless, this sentiment is far from equal across countries. For this same question, Figure 2 (below) illustrates what researchers call the Bottom 2 and Top 2 box scores, or the proportion of survey respondents saying the election has made them feel “Worse” or “Much worse” or “Better” or “Much better” about America.

(Detail by Country)

Question – Did the results of the recent U.S. Presidential election change your overall opinion of the United States of America? If so, how? (Please select the answer that best fills in the blank below) As a result of the election, my overall opinion of the United States is _________.

Countries with a net improvement—where the percent of international travelers’ whose opinions of America improved as a result of the election is greater than the percent whose opinions of America worsened—include Brazil, China and, most notably, India. India’s net opinion changed significantly, with 44.1 percent rating their opinion of America as “Better” or “Much better” post-election. However, as seen in the chart at the right of Figure 2, the majority of countries studied have a declined opinion. Residents of some of our country’s largest international travel markets—i.e. Canada, Mexico and the UK—reported “Worse” and “Much worse” opinions about America as a result of the recent presidential election. This is not good news for our industry, but then the question remains, does the lower overall opinion translate to decreased likelihood to visit America? Figure 3 below offers insight.

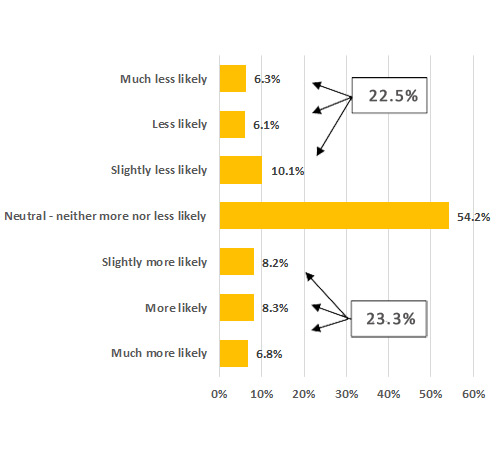

(Average, All Countries Surveyed)

Question — How have the results of the U.S. Presidential election effected the likelihood you will visit the United States in the NEXT FIVE (5) YEARS? (Select the answer that best fills in the blank below) I am ____________ to visit the United States in the NEXT FIVE (5) YEARS.

The net negative feelings President Trump generates are evident in most countries, but it may not translate into a measurable impact on visitation. In fact, slightly more international travelers are more likely (to some degree) to visit the U.S. than less likely. Still more than half are neutral, indicating the election had no impact on their travel plans. This is of course intuitive; simply disliking a politician doesn’t mean America isn’t an entirely awesome visitor destination. For fun, our researchers interviewed a few tourists here in our hometown of San Francisco. The response of one Chinese tourist sums up the consistent sentiment we heard from these travelers: “It doesn’t matter to me. Many Chinese don’t like Trump, but we want to visit America.”

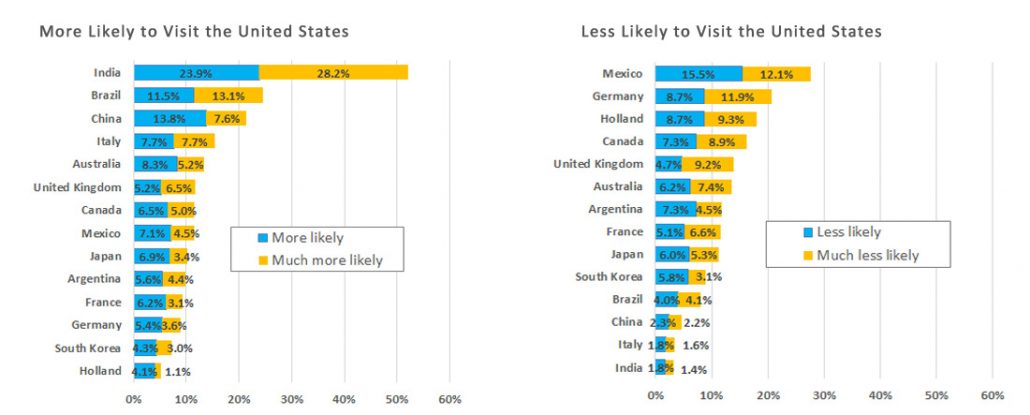

(Detail by Country)

Question — How have the results of the U.S. Presidential election effected the likelihood you will visit the United States in the NEXT FIVE (5) YEARS? (Select the answer that best fills in the blank below) I am ____________ to visit the United States in the NEXT FIVE (5) YEARS.

Even though the overall impact may be relatively muted, again there are large differences by country. There is a larger net number of international travelers in India, Brazil, and China who indicate that they are more likely to visit because of the election results than less likely. These countries have become prominent international travel players as their economies have developed over the past fifteen years. The combined visitation of India, China and Brazil makes up 7.6 percent of all international travel to the U.S. Thus, as a result of the election, we may potentially experience continued, or even slightly higher, increases in visitation from these markets.

On the other hand, Mexico, Germany, Holland and Canada indicate that they are net less likely to travel to the U.S. because of the election results. The unfortunate reality we face with this finding is that Canada and Mexico are our nation’s greatest sources of international travel volume and spending. Combined, visitation from these two important countries account for half of all international travel to the U.S.

The different national perspectives on President Trump amongst international travelers are striking. To dig a little deeper, we asked international travelers in these 14 countries, “What one word best describes Donald Trump?” With this, we hoped to gain a broader sense of how each country viewed the 45th President of the United States. Comparing two countries reporting the greatest impact by the Trump election, India and Mexico, vividly illuminates the differences in perceptions across markets. The word cloud below summarizes responses written in by Indian travelers.

Question – What one word best describes Donald Trump?

Amid all the controversial news and executive orders flying around, it may be difficult to easily understand why Indian travelers have such positive feelings about President Trump. In India, it appears that the Trump brand is primarily associated with luxury. The brand is a glitzy, golden, rich business that offers prestige and the appearance of wealth. Trump Towers Mumbai, is expected to open next year with 300 apartments available to purchase. Its apartments are reportedly selling at a 30 percent premium over other apartments in the area. Indians may also see similarities between Trump’s election and their own Prime Minister. Both ran on platforms of being an outsider to the political dynamic and ability to take charge and get things done. Additionally, India is largely untouched by Trump’s well-publicized ire, which seems mostly directed at Mexico, China and the Middle East.

While India, for the most part, views Trump positively, it’s no surprise that our neighbor to the south rates him differently. The word cloud below illustrates Mexican sentiment.

Question – What one word best describes Donald Trump?

President Trump’s relationship with Mexico is well documented and hardly needs repeating—and the word cloud above very clearly and directly describes the nation’s sentiment. One man, two countries, and their opinions of him are like night and day.

The overall impact of President Trump’s actions is yet to be seen. However, as evidenced by the response to President Trump’s recent travel ban, it is likely to be pronounced and uneven across international markets. Destination Analysts’ eye is firmly on this for the industry, and we will share with you what we learn from travelers as this presidency progresses.