In our survey of 1,200 American travelers fielded August 18-20, 2021 we examined current opinions and feelings related to pandemic mitigation measures (you can read the full summary here), specifically the COVID-19 vaccine mandates for indoor activities like bars, restaurants and gyms, undertaken by cities like New York and San Francisco, and being weighed by other communities around the world.

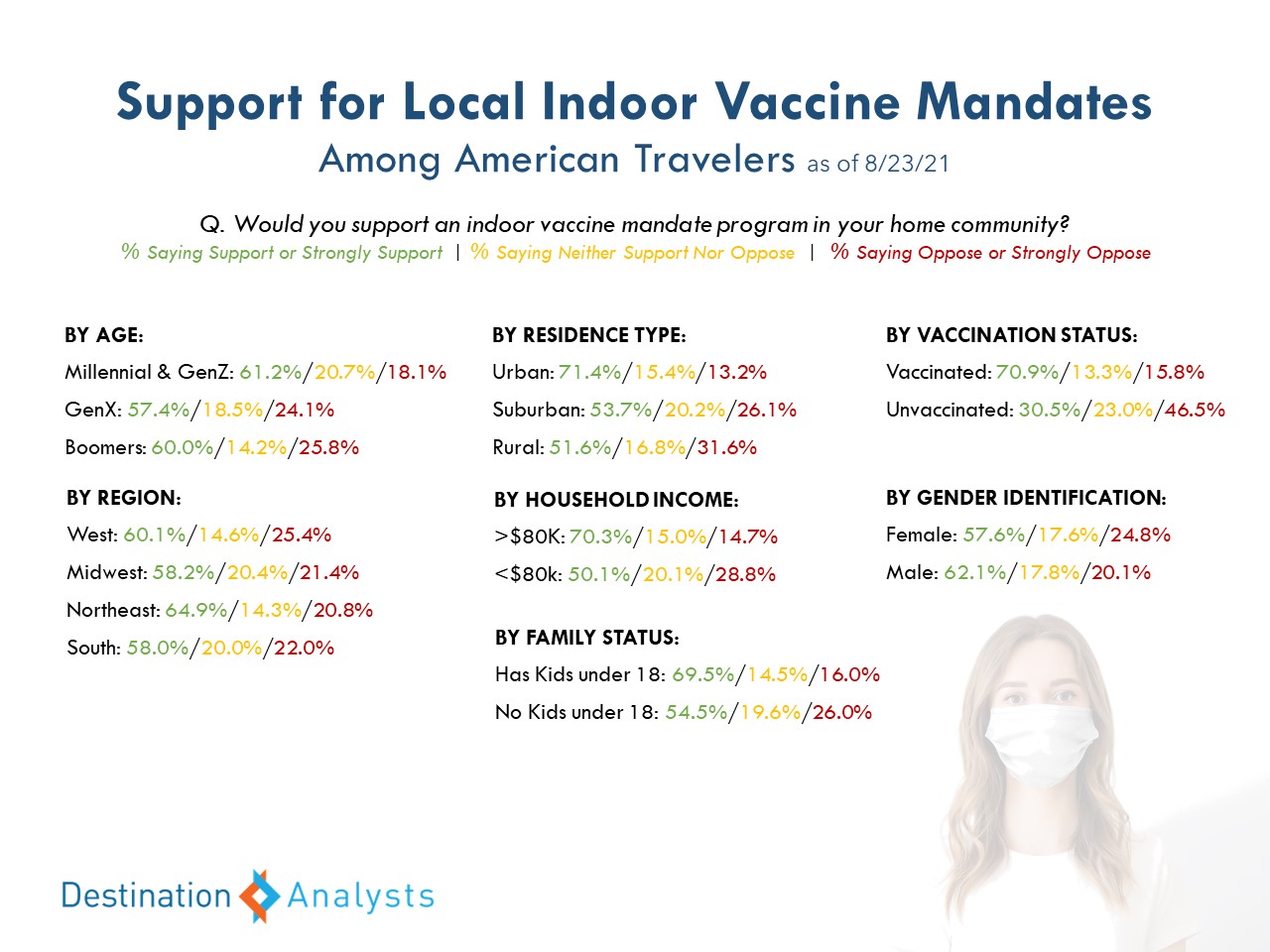

One of the questions we asked American travelers about was their personal support for such indoor vaccine mandates in their own communities of residence. In total, 59.8% support or strongly support these; 17.6% are neutral and 24.8% oppose or strongly oppose them. As illustrated in the infographic below, this majority support is generally across all segments of travelers. Vaccine mandates have the strongest support among, unsurprisingly, the vaccinated, as well as urban dwellers, those with household incomes above $80,000, and parents of children under age 18. Conversely, the greatest opposition can be found among the unvaccinated (again, unsurprisingly), those residing in rural areas and those with household incomes below $80,000. Compared to Millennials and GenZ, opposition is stronger among older travelers (although the majority across generations is in support). And as compared to female-identifying travelers, vaccine mandates enjoy greater support among male-identifying travelers. Around the country, the highest concentration of support is among travelers in the Northeast.

We will continue to track opinions related to vaccine requirements and mandates as policies evolve and will keep you updated. Reminder to join us for live presentations of our latest research findings on traveler perceptions and behaviors. And if you have a question idea or topic you would like our research to look into, please feel welcome to let us know!

We appreciate your support of this research from our small but mighty team of devoted tourism researchers.