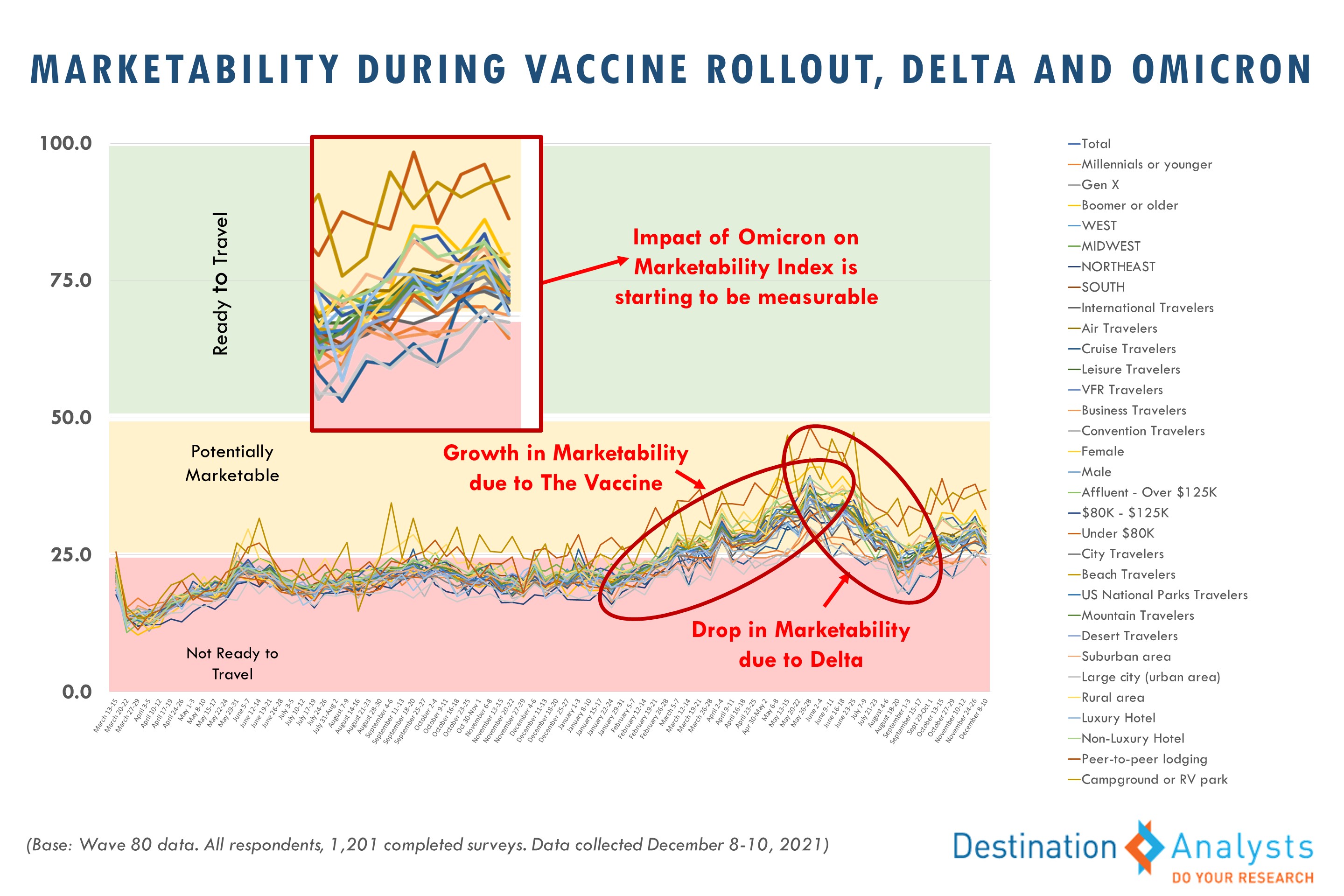

The impact of the Omicron variant on travel sentiment, trip plans and travel marketability are now measurable, although not yet at lows reached during the Delta variant period. Meanwhile, 30% of American travelers are still heading out for Christmas Holiday trips.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15, 2020, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel—specifically in the wake of the coronavirus pandemic—and explored a variety of topics. The key findings presented below represent data collected December 8th-10th.

Key Findings to Know:

With the Omicron variant front and center in the news while the holidays approach, American travelers are feeling more anxious and less optimistic about the near-term. Those that expect the pandemic situation to get worse in the U.S. over the next month rose nearly 10 percentage points in the last two weeks to 42.6%, and about two-thirds now say that another significant wave is likely to occur in the next three months (another ~10-point increase). Belief in COVID’s long-term presence jumped to over 70%. Here is what our latest research found about the impact of the Omicron variant and the current pandemic situation on travel:

Other Trends for Travel Marketers to Note: The average American traveler continues to report a sense of financial wellness. Nearly half say that travel will be a high priority in their budget over the next 3 months and the mean reported annual travel budget is $3,746.

Follow us on social for infographics of these and other key findings. You can also download recent infographics here. Need assets for a presentation or something else? Find all the presentation decks from our ongoing traveler research here—new decks posted on Tuesday afternoon. And please join us Tuesdays at 11:00am EST for a live presentation of the latest insights into traveler perceptions and behaviors.