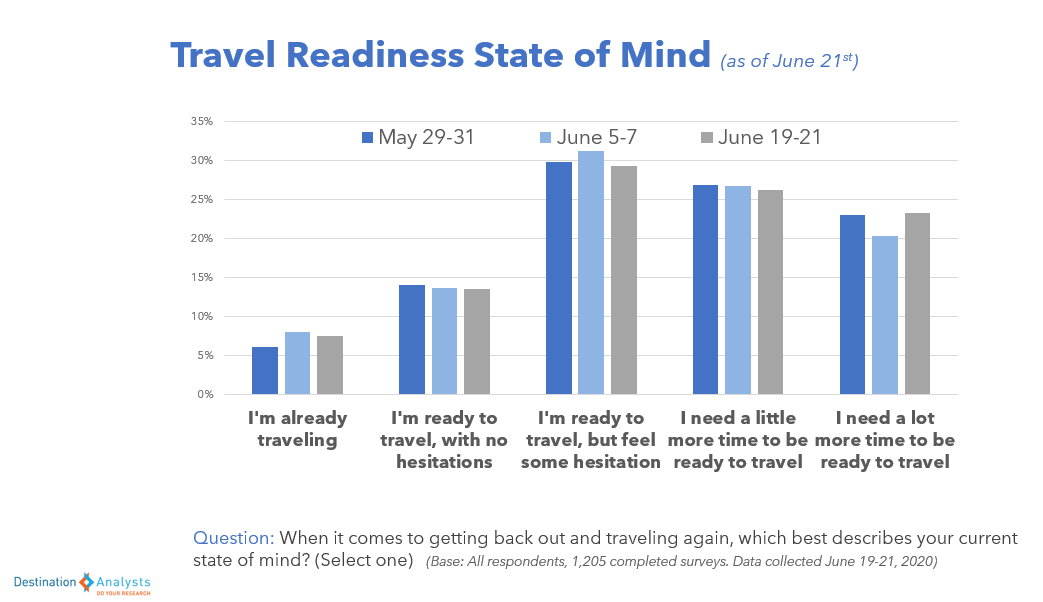

After consistently improving throughout May and early June, with the alarming rise in cases in some of the most popular and populous areas of the country, American travel sentiment has reversed course—now nearly 4 in 10 say they don’t have plans to travel for the remainder of 2020. Travel advertising, nevertheless, still has the ability to inspire happiness, particularly if it communicates many affordable, fun things to do in a safe, uncrowded destination.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected June 26th-28th.

Key Findings to Know:

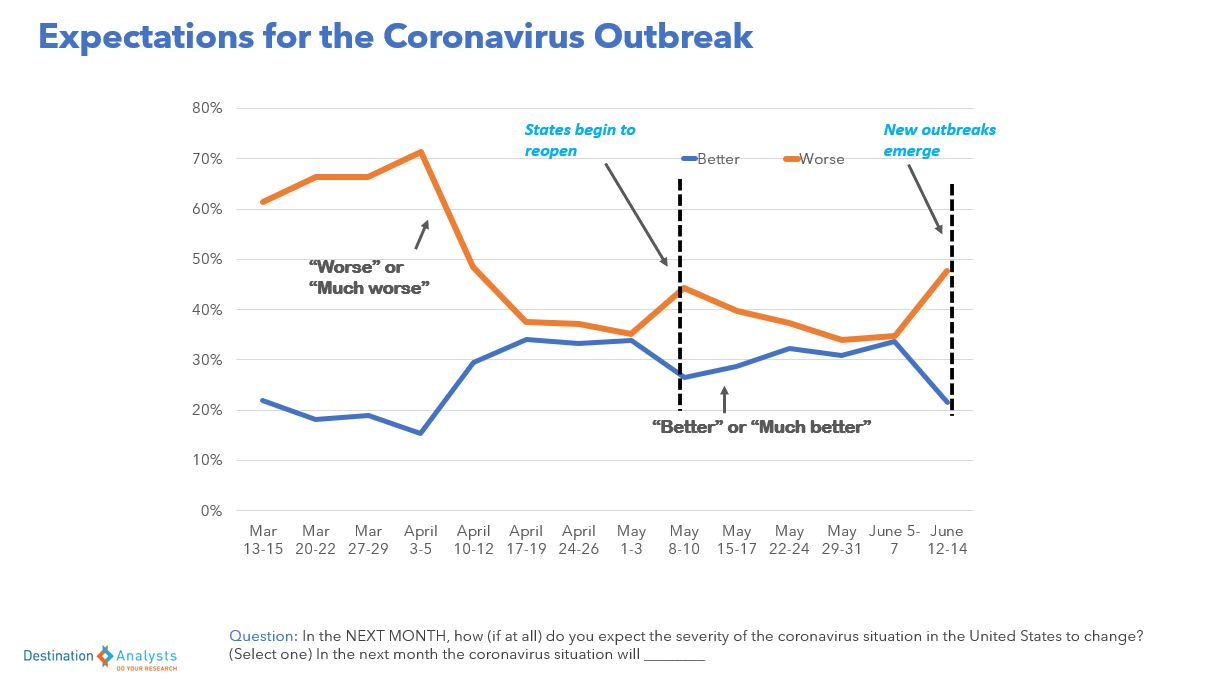

- 60 percent of American travelers feel the pandemic is going to get worse in the US—up 10 percentage points in one week.

- Trip cancellations for July and August jumped up, and now a high of 37.4% of American travelers say they have no trip plans for the remainder of 2020.

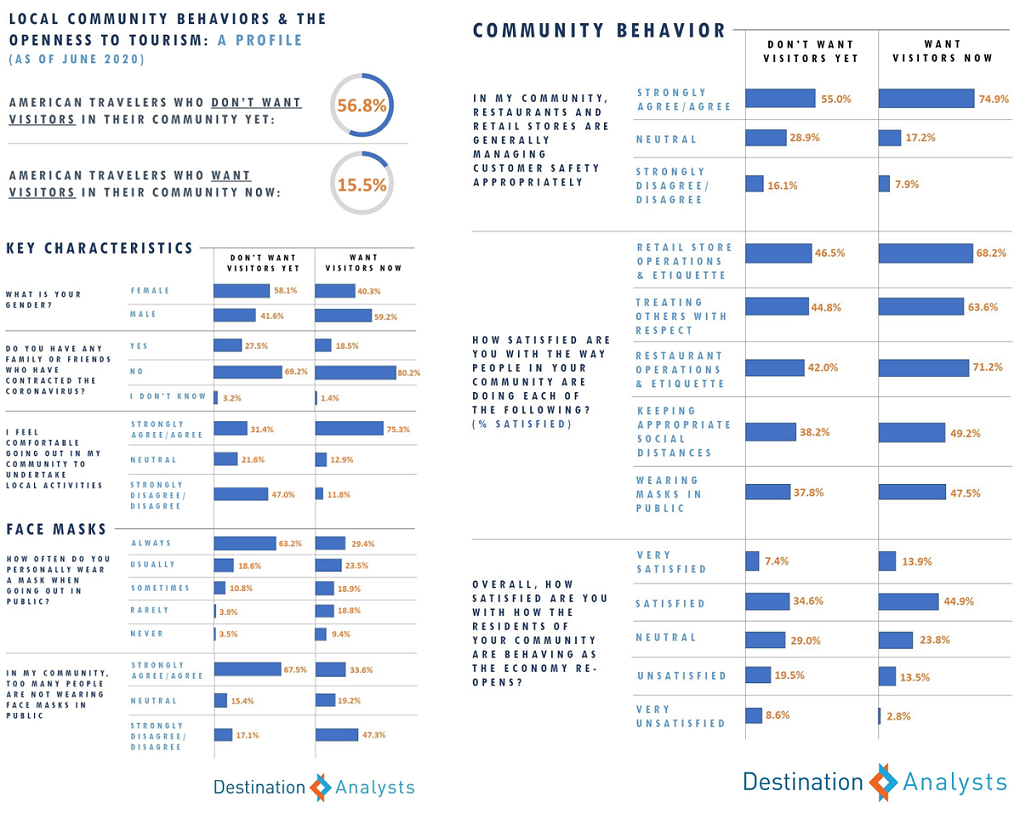

- Three quarters of American travelers are supportive of 14-day quarantine policies for travelers from states with high incidences of coronavirus.

- Despite the backslide in sentiment, 35% of American travelers say they would have at least some likelihood to take a leisure trip that they have not already considered if a good opportunity presented itself soon.

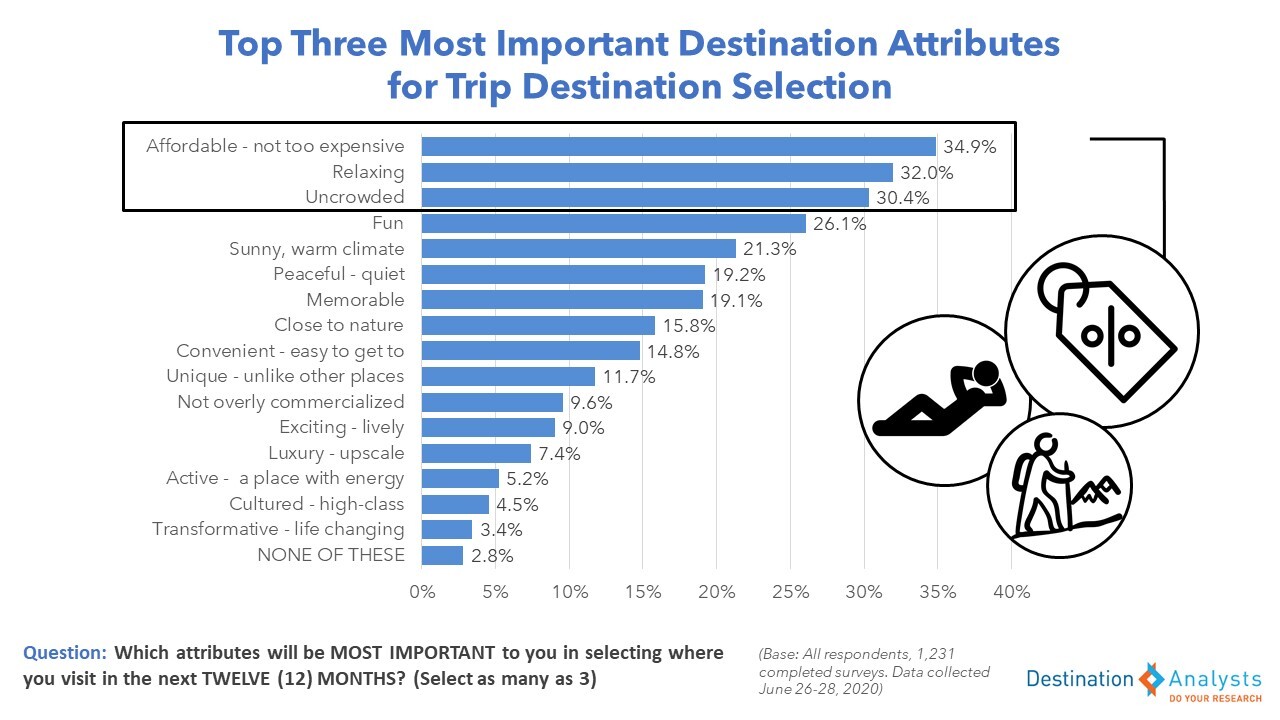

- The most commonly important trip destination attributes are uncrowded, not-too-expensive, relaxing, and fun.

- Over half of American travelers say that seeing a travel ad would make them feel happy.

- The features of a travel ad that would inspire the most excitement right now include discounts, pricing, safety and things to do information, as well as beach images.

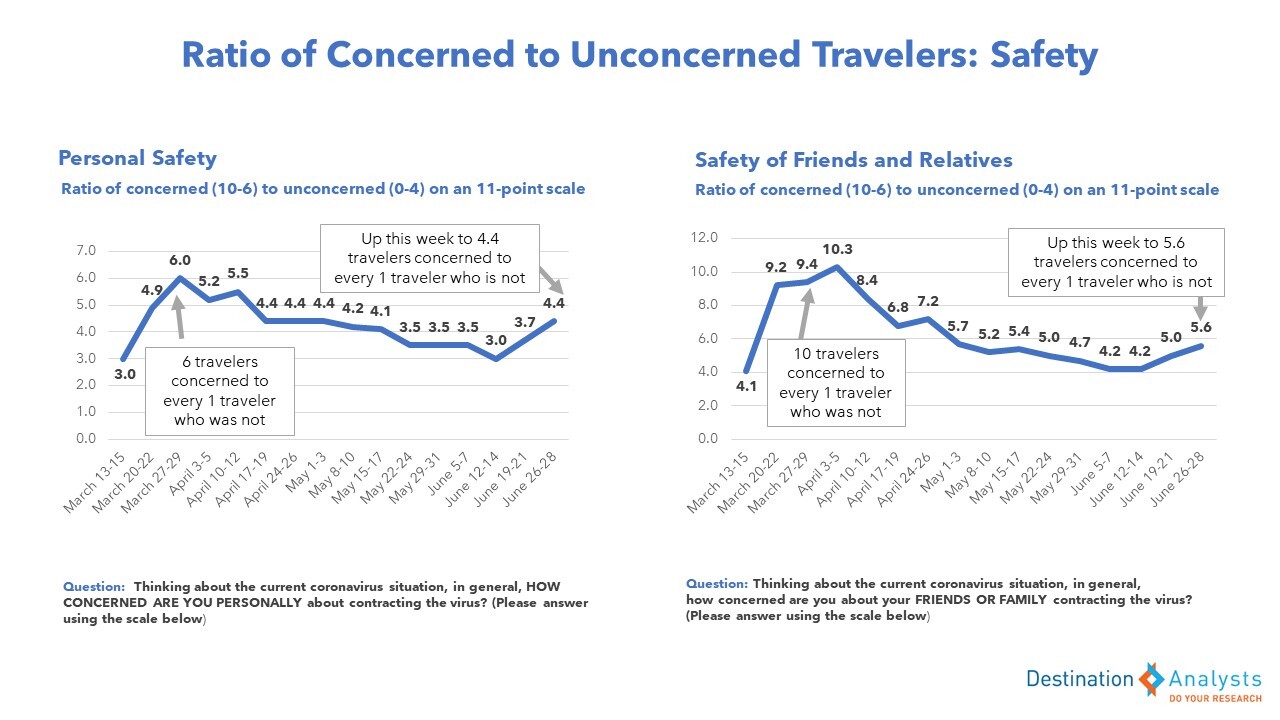

Much can change in two-weeks in the time of COVID-19. With the alarming recent rise in cases in the US, concerns regarding contracting the virus returned to the levels they were at the first of May—with over 70 percent expressing high levels of concern about personally or friends and family getting it. Financial safety concerns are also rising. The percent of American travelers who feel the pandemic is going to get worse in the US in the next month jumped to 60.6%, up 10 percentage points in just one week.

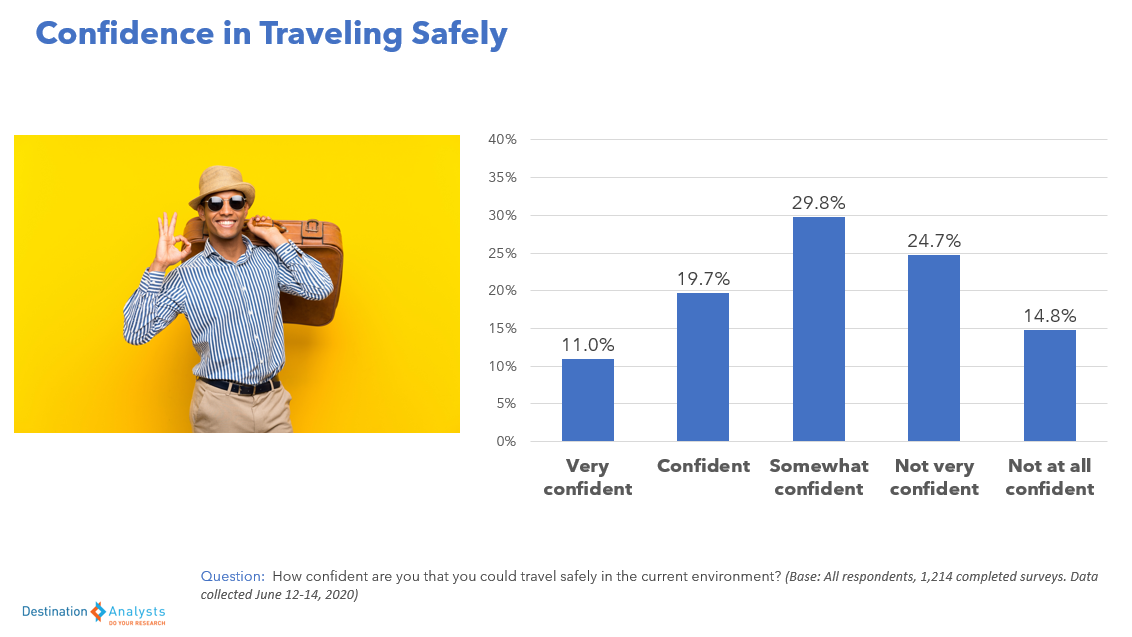

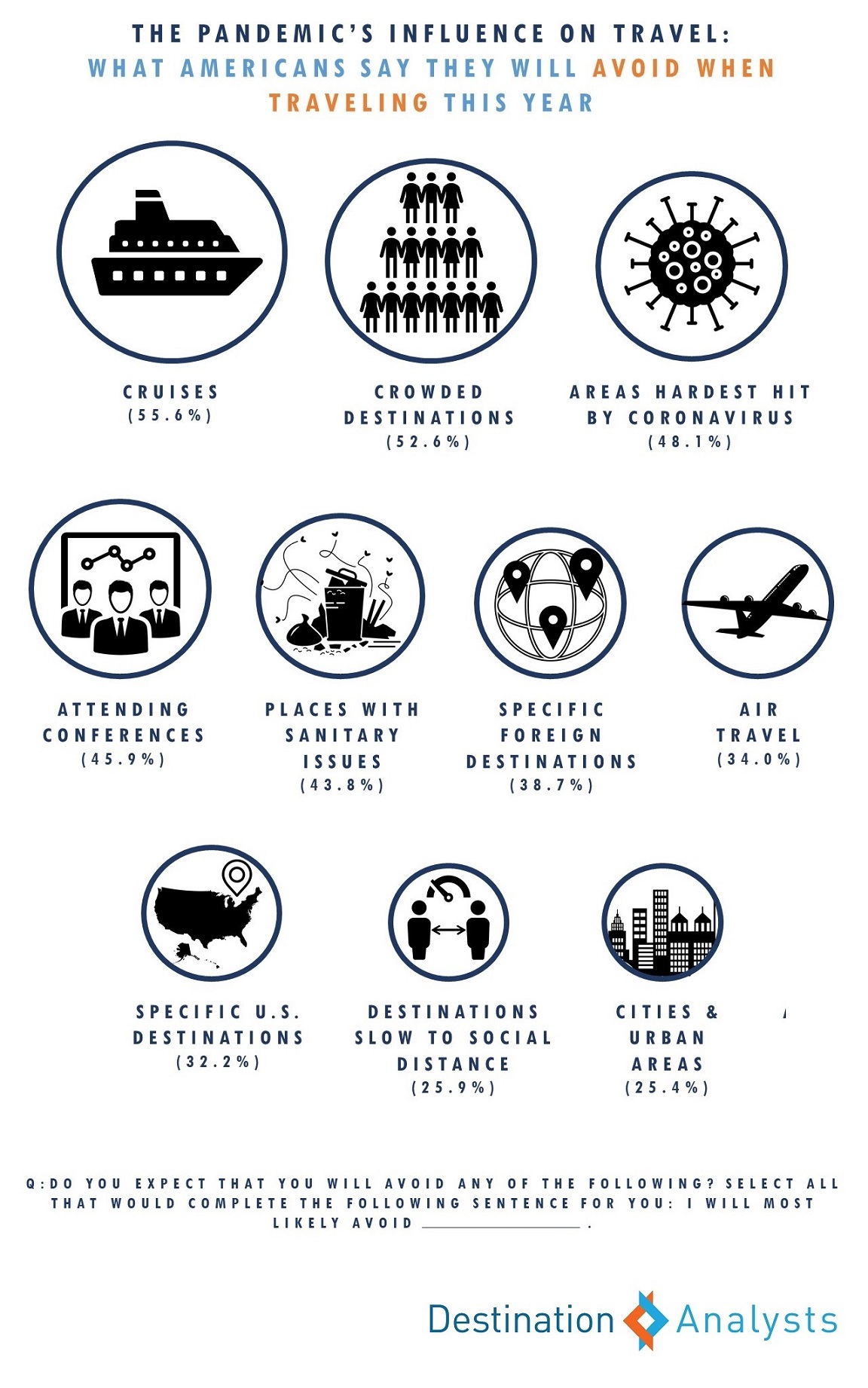

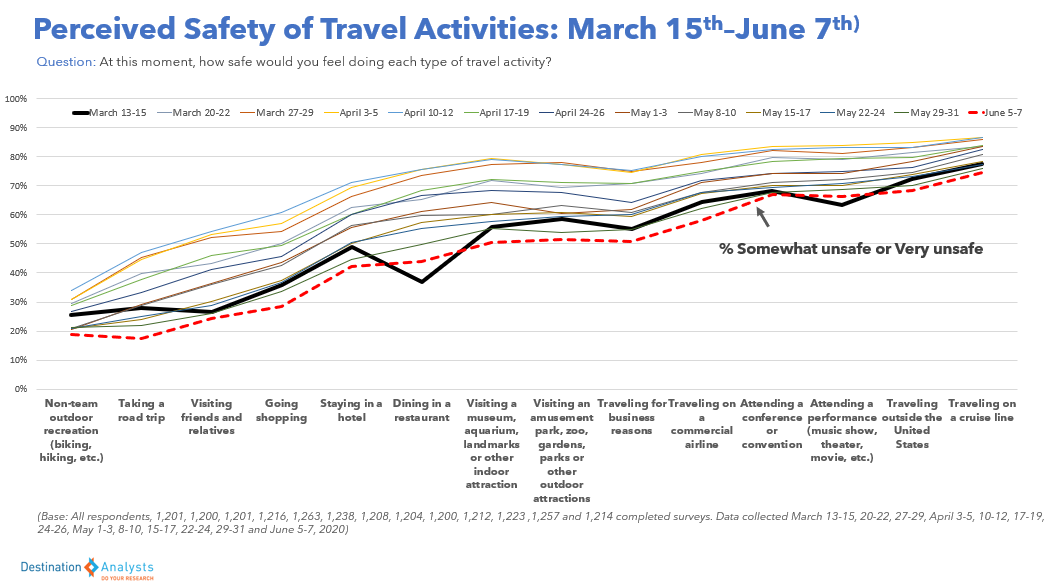

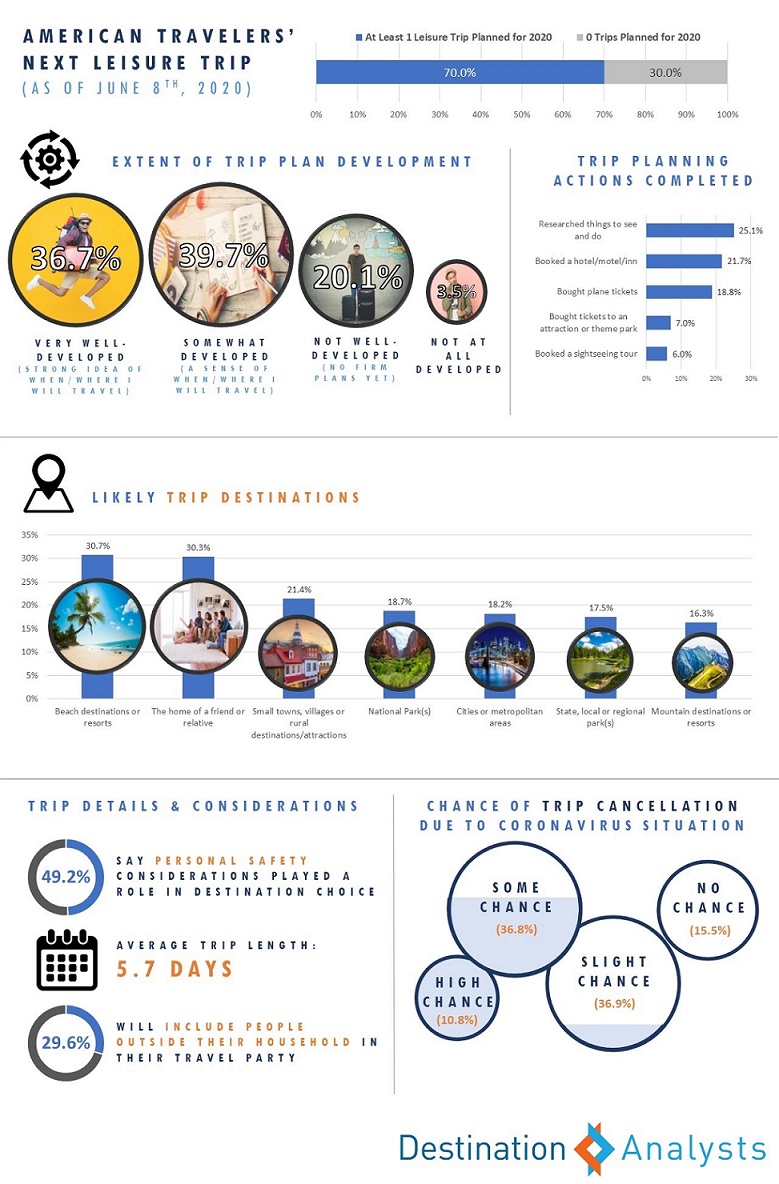

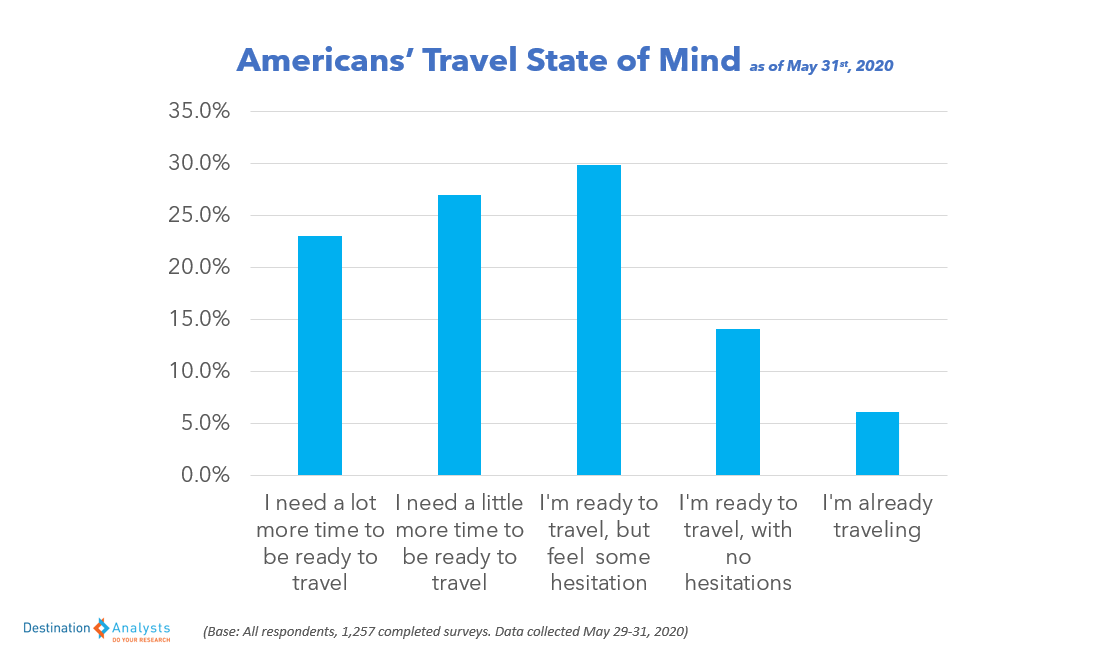

When it comes to travel, for the second straight week, the perceived safety of travel activities generally declined again, returning back to levels seen a month ago. As such, three quarters are supportive of existing or potential 14-day quarantine policies for travelers from states with high incidences of coronavirus. There is even three times as much support for mask enforcement policies as opposition. With the backslide in travel sentiment, excitement for near-term travel and openness to travel inspiration also further declined from the pandemic-period high recorded June 1st. Trip cancellations for July and August jumped up this week, and now 37.4 percent of American travelers say they have no trip plans for the remainder 2020. Nearly 30 percent say they will avoid destinations they would normally consider visiting for the remainder of the year, and over 60% of these travelers say it will be in the second half of next year or later before they will consider these destinations again. 40% are now saying they will put off their next air trip for at least a year from now, and 45.4% feel nervous going too far from home for a trip. Nearly 60% report feeling like they will simply enjoy travel more next year rather than this year.

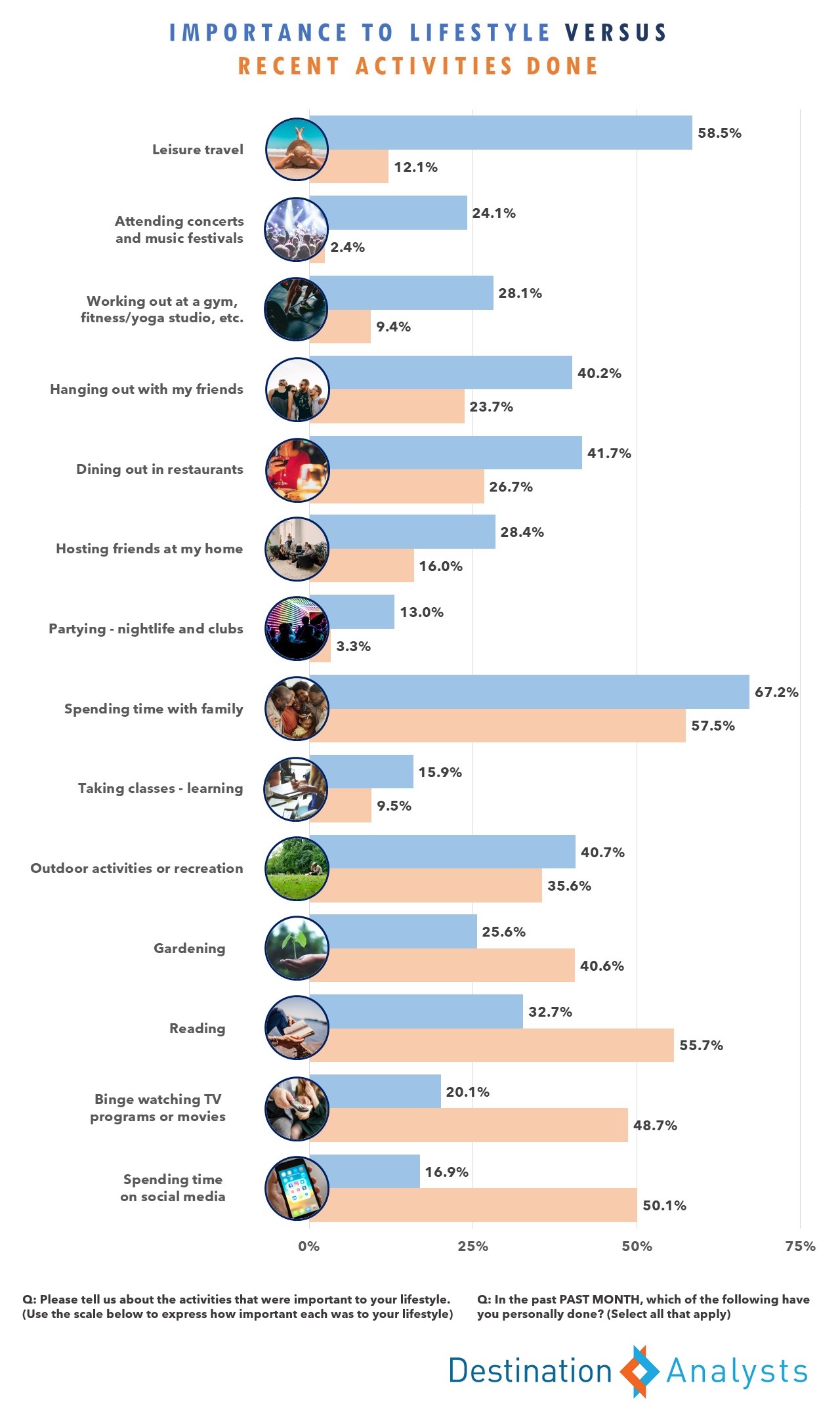

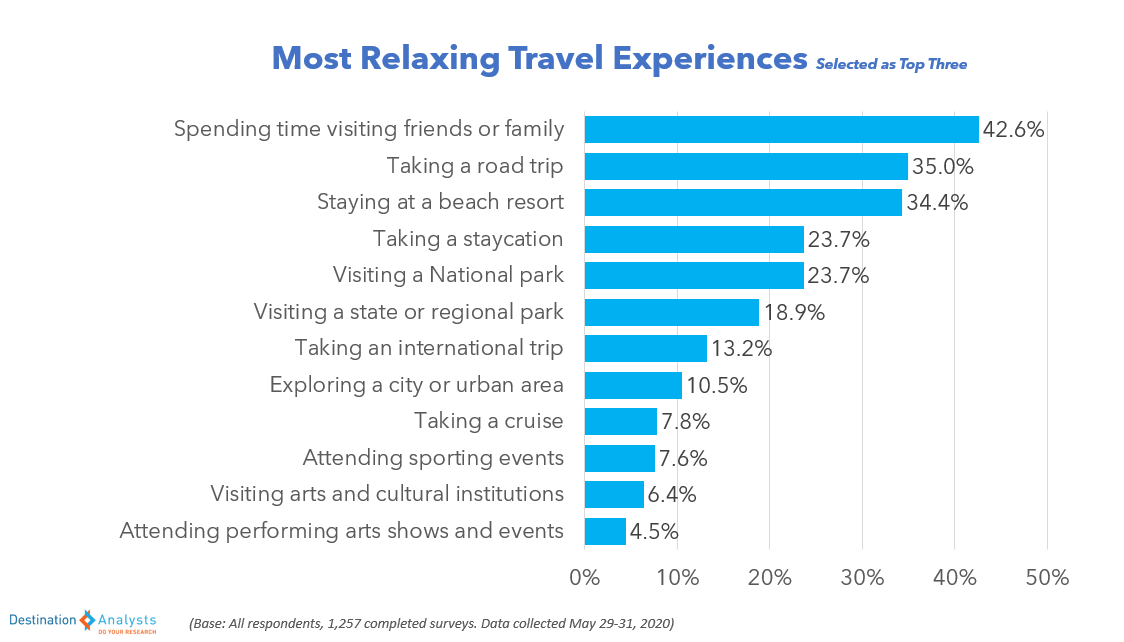

Despite the backslide in travel sentiment, 35% of American travelers say they would have a least some likelihood to take a leisure trip that they have not already considered in the next three months if a good opportunity presented itself. In choosing the destinations they want to visit, 27.3% say it is essentially important that the destination be uncrowded—over 60% of American travelers report being nervous visiting destinations that might be crowded. Otherwise, the other attributes that remain most important are not too expensive, relaxing, and fun.

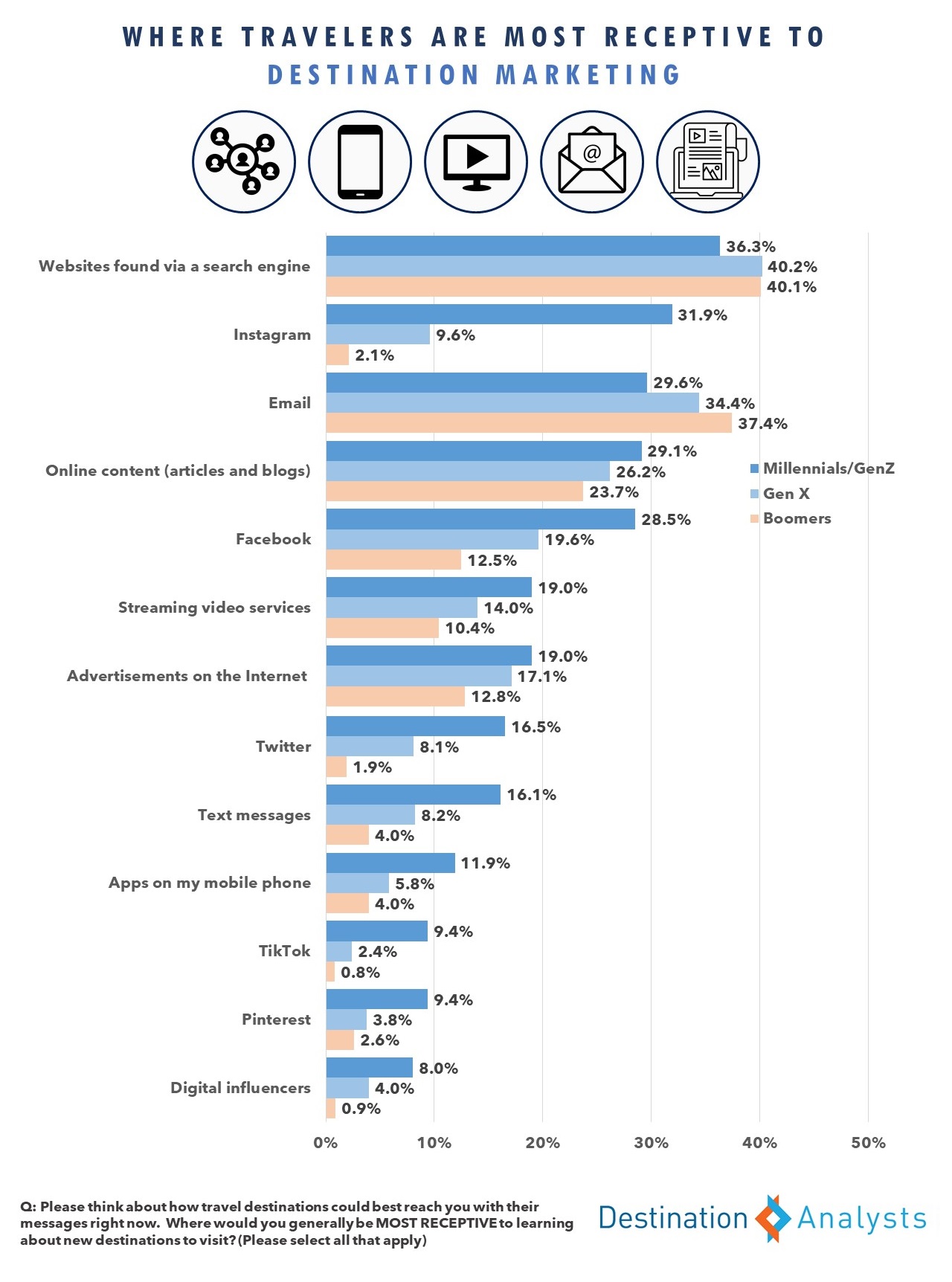

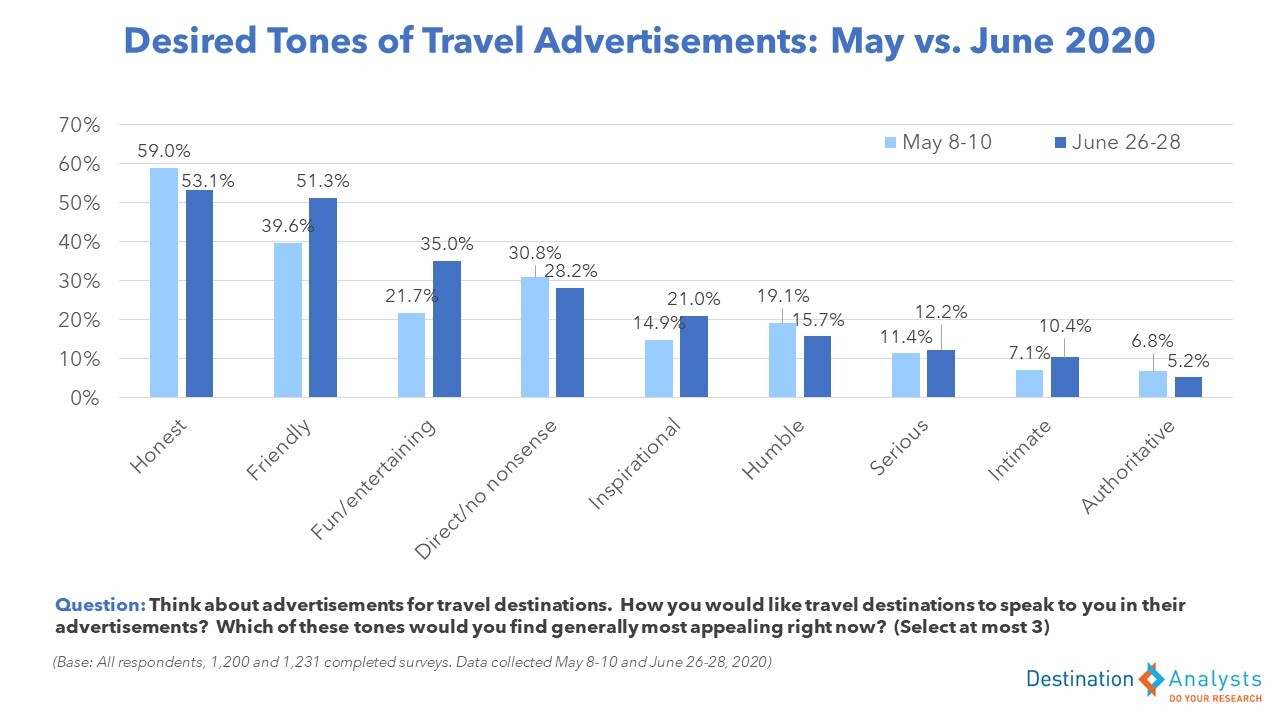

Travel advertising also still has the ability to inspire joy, with over half of American travelers saying that seeing a travel ad right now would make them feel happy. Compared to a month ago, travelers are more desiring of advertising tones that are friendly, fun and inspirational.

When asked to imagine an ideal travel ad and cite the features that would inspire the most excitement to travel right now, Americans most agreed on discounts, pricing, safety and things to do information, as well as beach images. Consider also that 55.4% say they will do a lot of extra planning before traveling in this environment.