Black travelers generate $63 billion in travel spending each year, making investing in marketing to them great business sense. Yet these travelers still find themselves under represented in travel marketing and subject to unwelcoming treatment. During our webinar on July 7th, 2020, Robin McClain, SVP of Marketing & Communications at Destination DC, led a panel of black travelers in conversation about their travel experiences and what the travel industry can do to market and make travel an equally inclusive leisure activity. Below is what was shared. [Note: comments have been edited for brevity]

On Differing or Similar Travel Considerations That Travel Marketers May Not Be Aware Of, How to Market to Black Travelers and the Black Lives Matter Movement

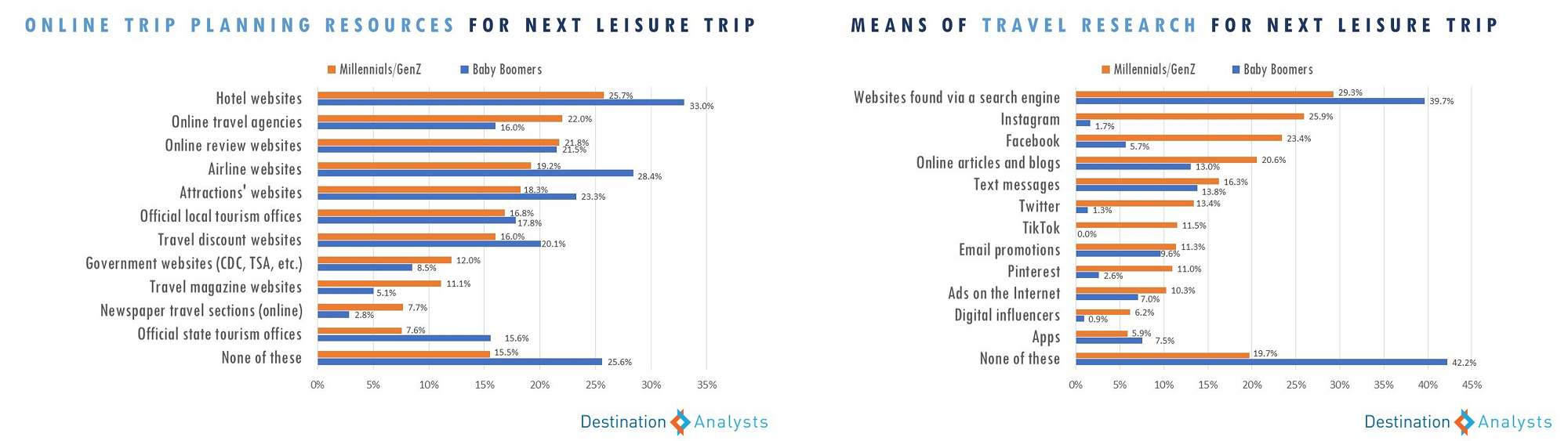

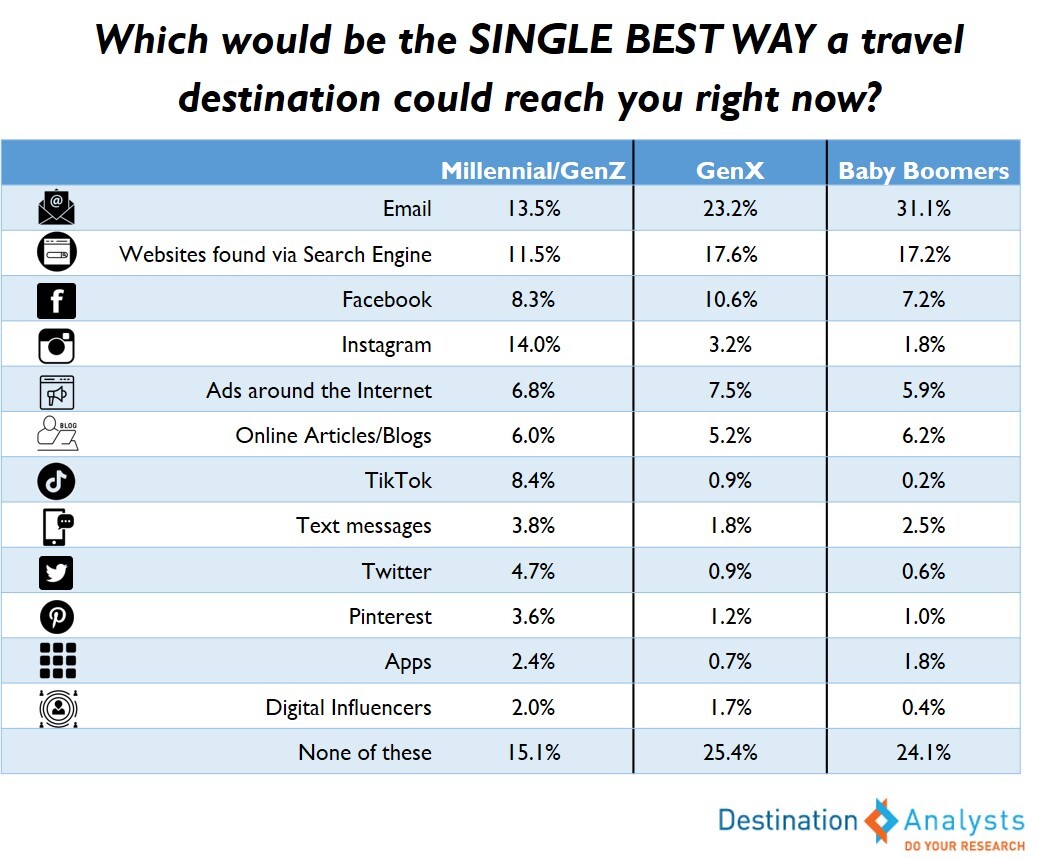

“I do a ton of research online, and so I like to see people in the adverts that look like me. If there is a fighting chance that someone is going to look like me, I’m going to dig a little bit deeper and see what they offer. It just makes me take the next step. My next steps are quite frankly at this point going to Instagram and looking at some of the affinity groups–the Black Girls Travel groups, there is a whole bunch of them—making sure that people have had good experiences in these places, and also recognizing when people have not had such good experiences. And I will unpack that for myself a little bit just to see what that means for me and my family. Also, we’re big walkers, so walking distances to places. Where is a good, safe place for us to be? Even now, I would be looking for how can I walk from point A to point B and is it safe for me to do that? I’m looking for places that have people working there that look like me. And if I leave the hotel, how is that going to be and when I come back, because I can deal with a lot of stuff out in the community in the place that I am visiting if I know I can absolutely relax when I get back to the place that I am staying.”

“I certainly think about traveling below the Mason-Dixon line and what that may mean for me in terms of safety and security. And then internationally, I have had some not so great experiences where I did feel affected by racism. That is certainly something that I look into exploring and researching: if a country or a destination or city is friendly or welcoming to African Americans.”

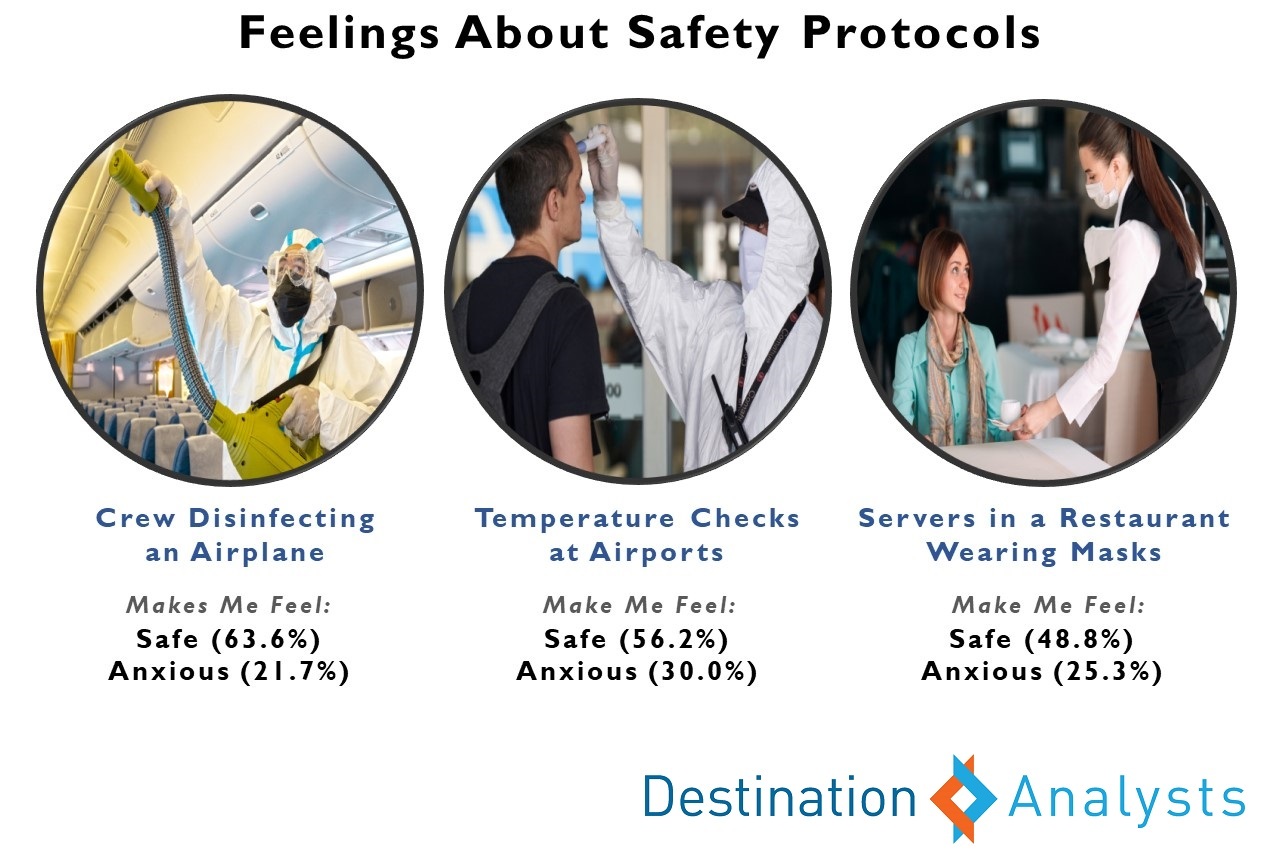

“I do love traveling but as an African American I’m a little bit more hesitant–even though I am going to do it–just because of the current situation, the current climate, we could say that a different climate is going on right now in the world just as far as police brutality and things like that, and our protests. I feel like there is a little bit more tension than there has ever been before, actually a lot more. I’m a bit more protective of myself and my family. I’m just trying to take it one day at a time with travel.”

“I’m an abrasive researcher, so before I travel, I’m trying to find as much information as possible, so what I need to know is what kind of activities in any destination would be relevant for my family’s type of interest as well as my interests so we can kind of map out a portfolio of things we can possibly do while we’re traveling. [Even though I live in Atlanta] I was very hesitant to travel throughout the South. There are probably great casinos and beaches in Biloxi, but to this day I’m still hesitant to plan a trip there because, even if I got there and everything is cool in Biloxi, I have to get there, and drive through those states and the small towns. And images of Antebellum South and confederate statues…that to me conveys that maybe I’m not welcome there.”

“If I saw that a country or a city had a Black Lives Matter rally or a march or a protest, that would actually make me consider going to that city. There are a couple of cities that I’m like oh wow, they are really rallying around BLM and maybe I should give thought to going there because they embrace people like me.”

“I think that use your words like rich experience, cultural experience, and accepting experience something on those lines I think would attract me. Wording I think has to be chosen very carefully. Advertisements of lots of different places, it’s the wording, it’s the hook that gets people excited, the first few sentences–those key words that kind of fly off the screen or fly off the page you are reading. Then pictures, pictures of cultures, picture of cultural cities, pictures of happy times, positive, pictures of things that are light-hearted because again the current situation in our world right now is pretty daunting. Being able to see this as a great getaway and it just seems like I can see myself there, I can see myself as an African American traveler going here because look at all this beautiful brown people. And not just African American but lots of different cultures that are attracted to that location.”