With Japan reopening its borders to tourism on October 11, 2022, for the first time since the initial lockdowns of the COVID-19 pandemic, we were curious about how interested American travelers are in visiting Japan in the next year.

First, Destination Analysts wanted to understand how many American travelers are aware that Japan is now open for travel. Just over one-third said yes (35.7%), with higher awareness among Asian-Americans (57.0%), urban residents (42.6%), and American travelers who reside in the U.S. West region (41.3%),

In terms of how appealing Japan is as a leisure destination for Americans, overall just over one-third (36.6%) of travelers find it to be appealing or extremely appealing. Similar to the segments that had a higher awareness of Japan’s reopening, Japan’s charm is felt particularly by Asian-American travelers (63.1%), urban residents (48.5%), and U.S. West region residents (45.1%). Those with an annual household income of $200,000 or more (49.2%) and younger travelers (Gen Z: 48.6%, Millennials: 47.0%) were also more likely than the average American traveler to say Japan is an appealing destination.

One-fourth (25.1%) of American travelers are interested or extremely interested in visiting Japan in the next year. Interest levels are highest among Asian-Americans (55.1%), Gen Z (40.2%), travelers with an annual household income of $200,000 or more (39.3%), and urban residents (38.2%).

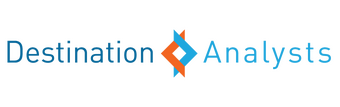

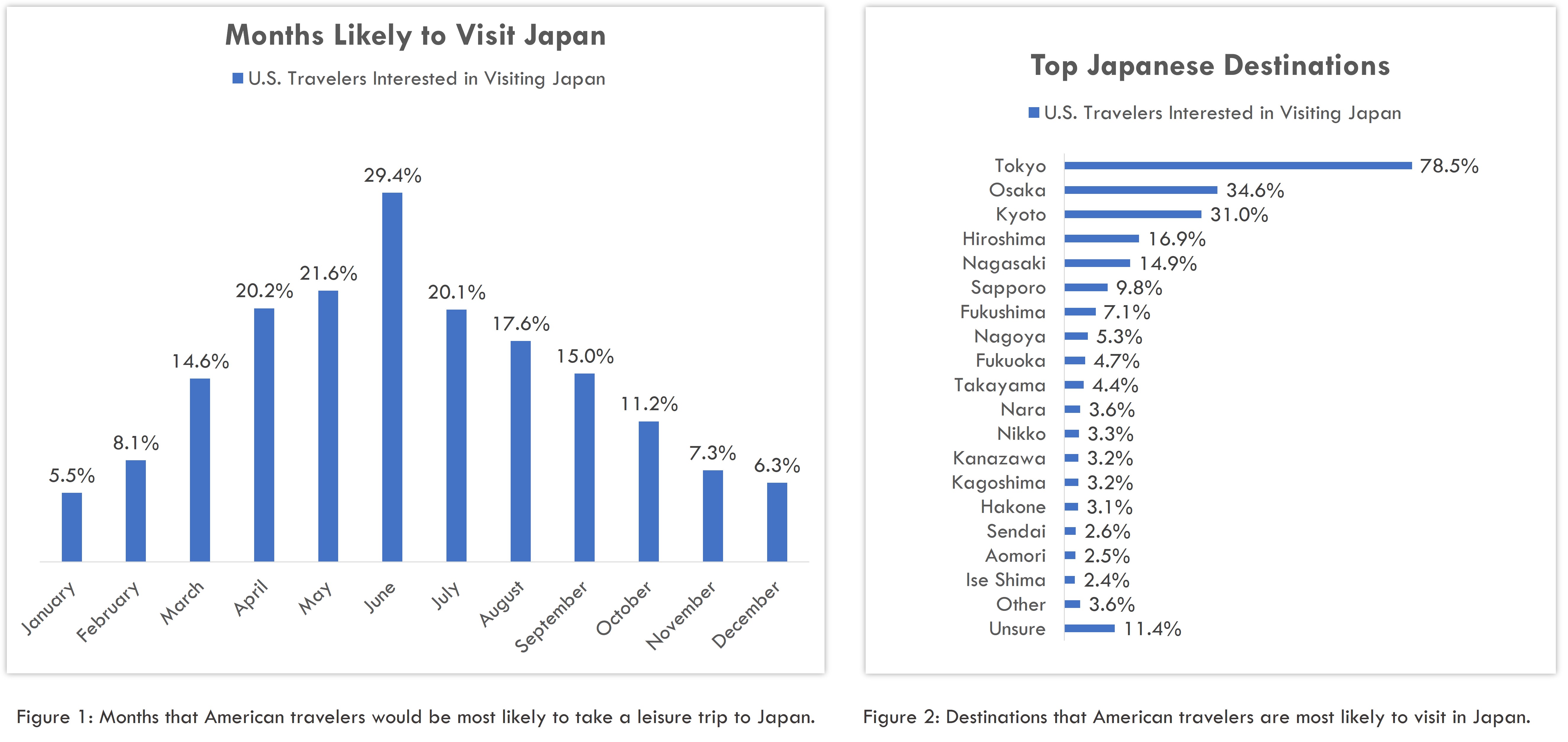

Those American travelers were most interested in visiting Japan during the summer months, particularly in June (29.4%) and May (21.6%) (see Fig. 1). Tokyo is at the top of their list (78.5%), followed distantly by Osaka (34.6%) and Kyoto (31.0%) (see Fig. 2). Among this group, Asian-American travelers were much more likely to say they are interested in visiting Sapporo (21.2%, +11.4 percentage points greater than total interested travelers).

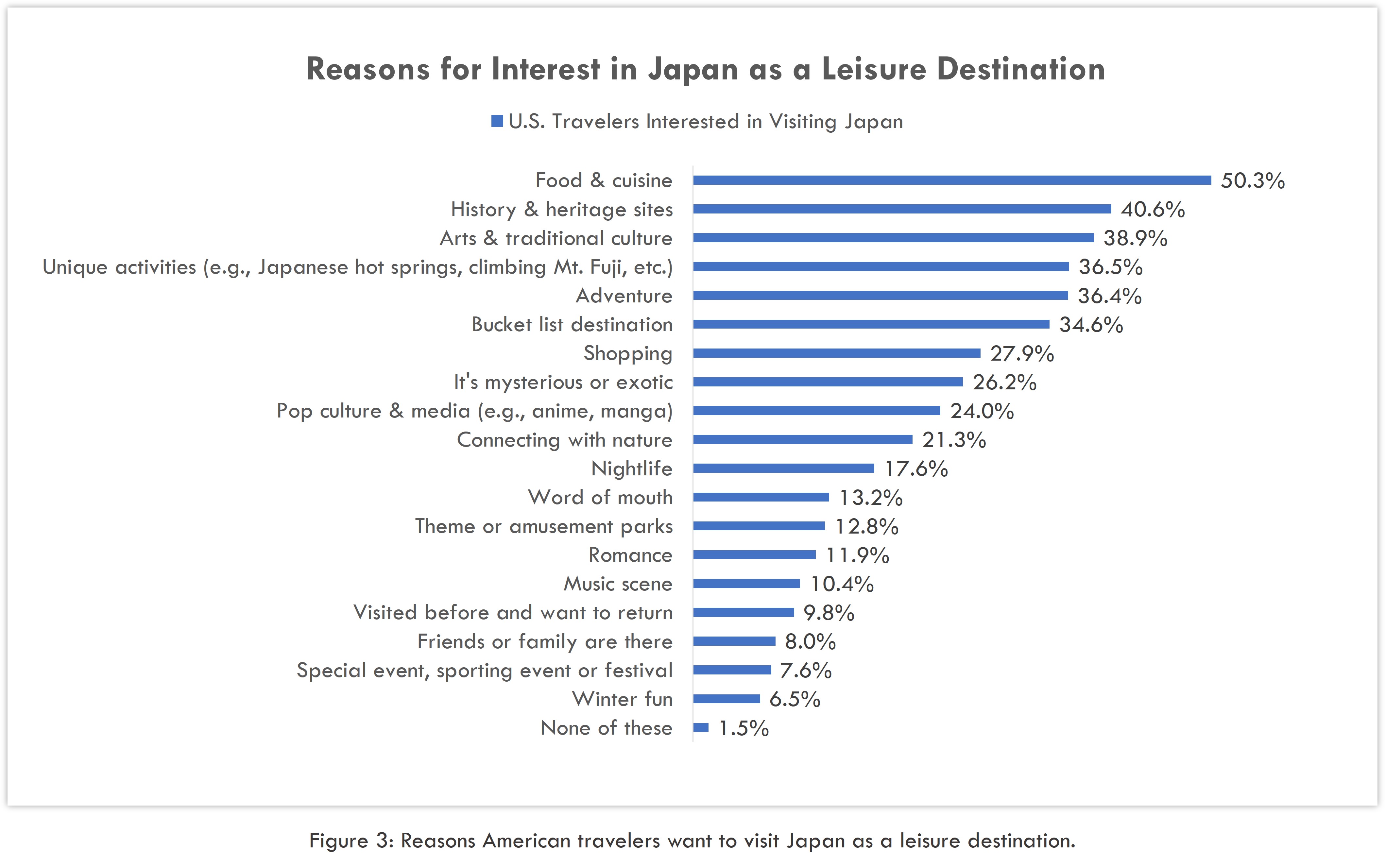

When asked what reasons drive their interest in visiting Japan for leisure, half of Americans selected the food and cuisine (50.3%) (see Fig. 3). This was followed by history and heritage sites (40.6%), though for Baby Boomer travelers history and heritage sites were actually the top reason for their interest in Japan (53.8%). 38.9 percent of American travelers also selected arts and traditional culture.

We found that LGBTQ travelers have a greater interest in Japan’s culture from both the traditional side (60.6%, +21.7 percentage points greater than total interested travelers) and the pop culture side (44.7%, +20.8 percentage points greater than total interested travelers). There is also notably higher interest in the unique activities Japan has to offer, such as visiting onsen (Japanese hot springs) or climbing Mount Fuji, among the LGBTQ traveler segment (58.5%, +22.0 percentage points greater than total interested travelers).

But interest in a destination is only one piece of the puzzle. We also examined how motivated Americans are to actually take a leisure trip to Japan in the next 12 months. When asked to rank their motivation to visit Japan in the near term on a scale of 1 to 10, just 15.3 percent of all U.S travelers ranked an 8 or higher. However, Asian-Americans (37.3%), higher income travelers (29.1%), and urban residents (28.8%) were significantly more likely to say they were highly motivated to take a leisure trip to Japan in the next year.

For further insights into prospective American travelers to Japan, such as what kind of media they are consuming, what travel planning resources they use, and what other destinations they are interested in visiting, please reach out to our research team at info@destinationanalysts.com.

To stay up-to-date on traveler trends, sign-up to receive monthly updates and Key Things to Know from our State of the American Traveler Study here.