On our April 28th webinar, we featured a panel of retail professionals from Macy’s, National Harbor and Everlane to share with us their response to Covid and what the future of retail may look like. Here is the full interview:

IMPORTANT: These data and findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency.

American travelers continue to gradually feel safer than they did one month ago. Personal concern about contracting the virus is at a 6-week low (6.7/10.0), with the biggest change among older travelers. The perceived safety of large events like professional sports games and live performances remains low but continues to improve. Although nearly half do not believe the coronavirus sitation will not be resolved by summer, there is continued decline in the number of Americans saying they will avoid all travel until the coronavirus situation is over (5-week low).

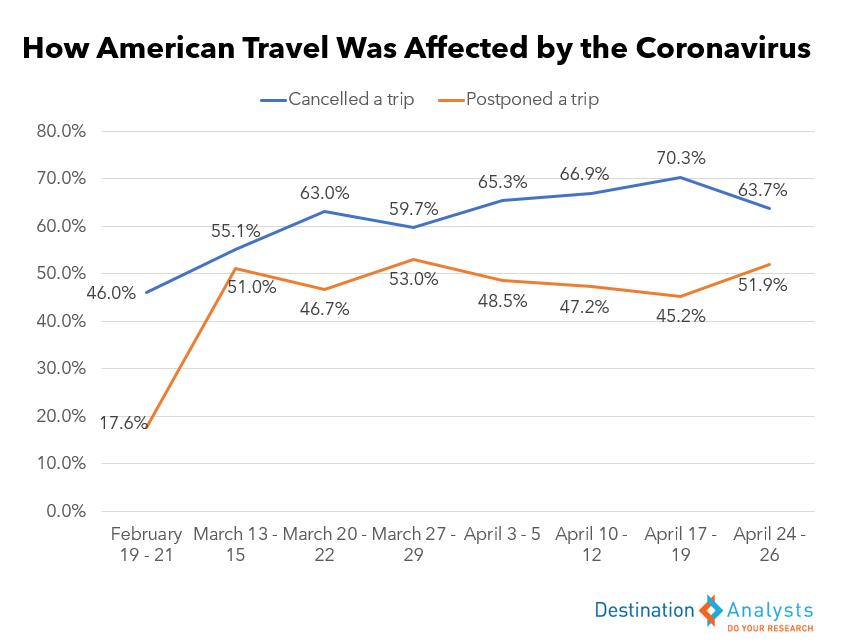

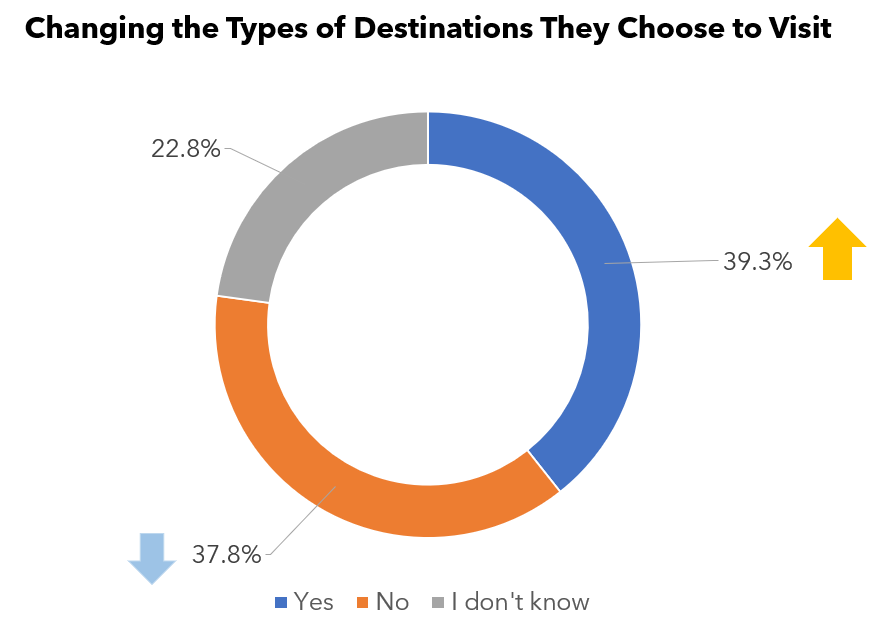

Some Effects of the coronavirus on American travel are lessening. The percent cancelling a trip because of the coronavirus is at a 4-week low (63.7%), meanwhile postponements are at a 4-week high (51.9%). Of those that postponed a trip, 32.8% have at least tentatively picked a rescheduled date. Excitement levels to take a getaway in the next month are depressed but at a 5-week high (4.7/10.0). Agreement about staycationing is at a 3-week low (49.3%), while taking more road trips this year to avoid air travel (37.6%) and avoiding travel outside the United States (77.8%) are both at 6-week lows. Younger travelers in particular are feeling more optimistic about international travel than they were one week ago. Avoidance of conferences and conventions is also at a 6-week low (72.6%). The percent who say they will change the types of travel destinations they choose to visit is back down to 30.7% from a high of 39.3% on April 10th, although over half of American travelers continue to say they will avoid crowded destinations when they travel again.

Nevertheless, the present is still not the time for travel. While there are more positive emotions than 5 weeks ago, Americans largely associate fear and uncertainty with travel right now. This week, 63.5% agree they don’t want visitors coming to their community right now, although the strength of their agreement with this sentiment has lessened (29.0% “strongly agree” down from 35.1% one week prior).

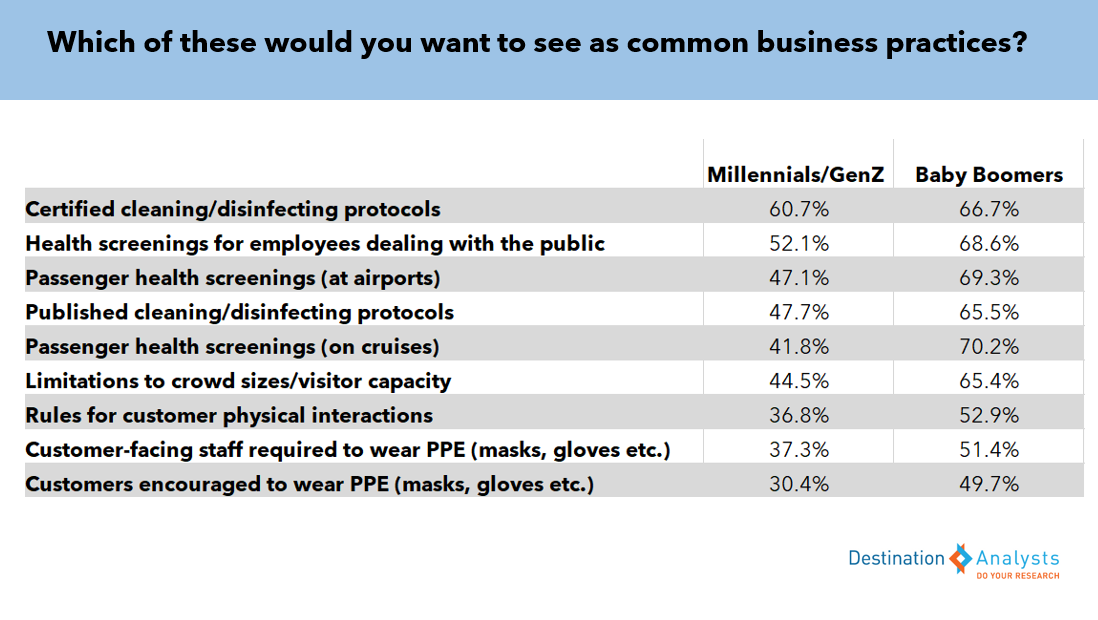

Looking at their lifestyle priorities over the next six months, Americans are most in sync on staying safe from infection (47.8%)–even more so than on making money (27.2%) or their emotional well-being (30.4%). Thus, when asked about the operational practices they want to see used at restaurants and commercial locations like malls and sports venues, Americans appear in most agreement about hand sanitizer, disinfectant wipes and well-explained cleaning procedures.

However, in what becomes common business practices, Boomers want new policies like health screenings more than younger travelers.

A presentation file summarizing these key findings is available for you to download.

During Destination Analysts’ April 21st presentation of the latest findings from our weekly Coronavirus Travel Sentiment Index Study, our CEO Erin Francis-Cummings interviewed a panel of travelers about their perspectives on travel and their upcoming travel plans in the wake of the the coronavirus pandemic. While not a formal study, it is a reminder that qualitative research adds such richness and depth to understanding about how customers think—something that is critical for brands and other businesses as they lead through and after the COVID-19 crisis.

Highlights from what these travelers shared about staycations, travel ads, and desired safety protocols follow below.

On Staycations:

“Mine would probably entail camping up in the mountains or something that would still be avoiding crowds and things like that. I think it would be probably within the same state or relatively close. For me, it doesn’t mean staying in this small area in my house or in the little neighborhood I live in. That’s not really what I’m looking for because I’ve been here for the last six weeks and haven’t been able to leave. So it would be 30-40-50 miles at least up in the mountains–camping or fishing or more of a rural kind of experience I would say.”

“There are two ways that I personally define staycation. There is ‘you’ve been working several months straight and haven’t taken a day off, and staycation is where you decide to take a couple of days off and hang out at home’. The other way I look at it is that staycation is ‘going to visit a city near you or exploring your own city–staying the night there or just doing a day trip…about 40 miles away so its not too far’, I could stay the night there if I wanted to but I could also go home if I wanted to.”

“I would limit how far I was going initially until I had a handle on the area I was going to. Where we live, within a 2 hour drive, I can actually day trip to a lot of different destinations, and after being self-quarantined and sheltered for a while, it’ll be nice to do that. But when you get beyond the staycation, those are the type of criteria I would look at to make sure that I’m taking reasonable risks.”

On Discounts & Deals:

“If I can take an area that is safe, and a secondary of that safe, the discounts and incentives would have an impact…But I would rather pay the few hundred dollars more and go when it’s safe, so that would be my criteria, the safety first. But with all things being equal, obviously discounts and deals help to get people traveling again.”

“I think the best indicator for me is when I see that an area in particular is safe, but I think also if I see a great deal for say an international destination–and I’m talking about probably in Fall, I don’t really expect going anywhere international anytime soon. If I found great deal for somewhere like New Zealand which is also very safe right now, they controlled things very well. If I were looking at Iceland vs. New Zealand and if in this hypothetical scenario Iceland had a bad situation with COVID whereas New Zealand did not, I would pay a little bit more to go to New Zealand as opposed to Iceland. So yeah, but again it all comes down to if a particular area is safe or not.”

“Seeing a deal would definitely catch my eye initially, but I want to make sure the destination I’d be going to is safe, but not only that, I want to make sure that it is safe to leave where I am right now. I want to make sure that where I’m at, we have things under control around the decline, I want to make sure wherever I am going to is not heavily impacted right now, they’re not on an incline– then the deal would definitely be intriguing.”

On Seeing Travel Ads Right Now:

“Online is the best way. I’m on social media so you know seeing random ads on Instagram and seeing blogposts on Facebook, I follow certain bloggers, like the Points Guy and Travel Pirates. You’ll see a random article sometimes scrolling saying ‘Hey there are last minute flights’, those are the best ways to get my attention.”

“Publications and online, I think things like Travel and Leisure, even I do a lot of spotting on United, they’re sending out updates-the emails work. Even things like the travel channel or the weather channel little targeted ads, I think it’s something that clearly with the world locked up people will be happy to get out again.”

“Mostly online. I respond best to articles, blogposts, something with a little more description, little more like ‘here are things to do, here is a destination.’ And I think that something that is targeting or somewhat aligned with the notion of health in a particular area. So say there is a blogpost saying ‘come visit here and these are what the statistic are on COVID in this particular region.’ If some sort of advertisement can reassure me without me having to search and see how that destination is handling it, that area is relatively safe then that’s not only going to give me more assurance to go to that place but that’s going to give me more of a reason to trust whoever is advertising to me that they are putting some thought towards my safety, and I think that is important for me.”

On Safety and Protocols:

“I want to avoid crowds…just general anxiety over catching the virus and whether or not I show symptoms sort of unwillingly spreading it to the people I do interact with.”

“The airlines sent me an email saying ‘we’re doing the best that we can, we’re taking extra precaution, we’re scrubbing down the planes with disinfectants and whatnot,’ and I expect larger ones to probably put out some type of memo saying the same thing. As far as the AirBnB, those are mom and pop. I am very big on trying to support local businesses or small businesses, but I think that is probably going to be a little bit riskier. But I’ll be sure to bring my Lysol wipes to disinfect everything. I’m not big on touching remote controls and public telephones, but I’ll be sure to scrub those down extra just in case.”

“I miss going to those live shows, music concerts. I think with everything going on, it’s smart to have extra handwashing stations, to have extra sanitizer around for people to make sure that they’re staying clean. Extra trash cans around to make sure people throw their wipes and they’re bringing masks or gloves and they’re dispensing of that properly. You see a lot of people disposing them in the streets right now and it does not do us any good if you’re disposing of your protective equipment by just littering and exposing other people. We got to make sure that the resource is there to make sure we stay clean, but you have to make sure we can dispose of it properly as well.”

“I think people are just going to have to be more conscious about what a new normal is, and it does not mean that you can’t get this under control. Again different criteria: if you get a problem and you have a pill that is one level. If you have a vaccine that’s a perfect level. But in the meantime, it’s a matter of just being prudent. It’s carrying yourself in a prudent way, because you got a responsibility, again, not only for yourself but to your whole circle.”

IMPORTANT: These data and findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency.

American travelers continue to feel better that the worst of COVID-19 may be on the horizon. Now 34.1% think the situation will improve in the U.S. in the next month up, from 29.5% last week. The impact they feel the pandemic will have on their personal finances is at a five-week low (6.6 on a 10-point scale). Additionally, the perceived safety of travel activities has improved this week relative to last week.

Excitement levels towards taking a getaway in the next month remain low but are at a 5-week high (4.5/10.0). Similarly, interest in learning about travel destinations remains low but is also at the highest its been since March 15th (5.1/10.0). Boomers’ motivation to travel because of discounts and deals bounced back (up to 35.8% from 25.3% a week ago).

When presented a list of leisure and personal activities and asked to select the first things they were going to do when shelter-in-place restrictions are lifted, 22.5% said taking a trip would be among their top 5. Taking a trip comes behind dining out and hangouts with friends, grooming services and shopping in a retail store, and beats going out on a date or to the gym. Indeed, 70.2% of American travelers say they miss travel this week–with 38.6% strongly agreeing they do.

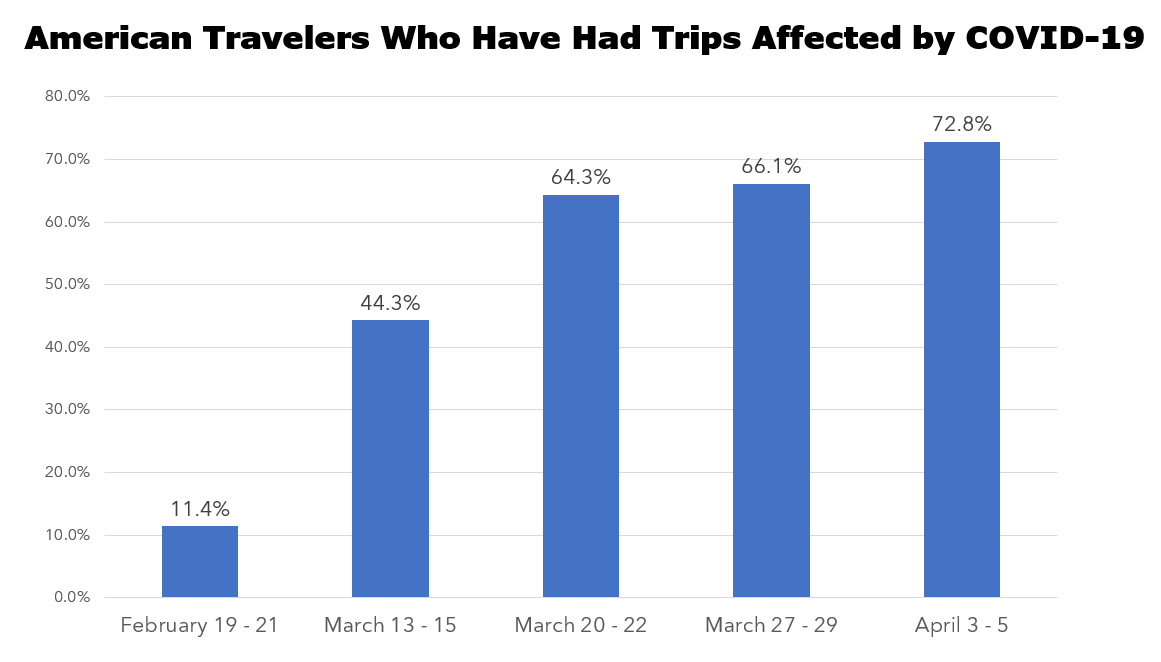

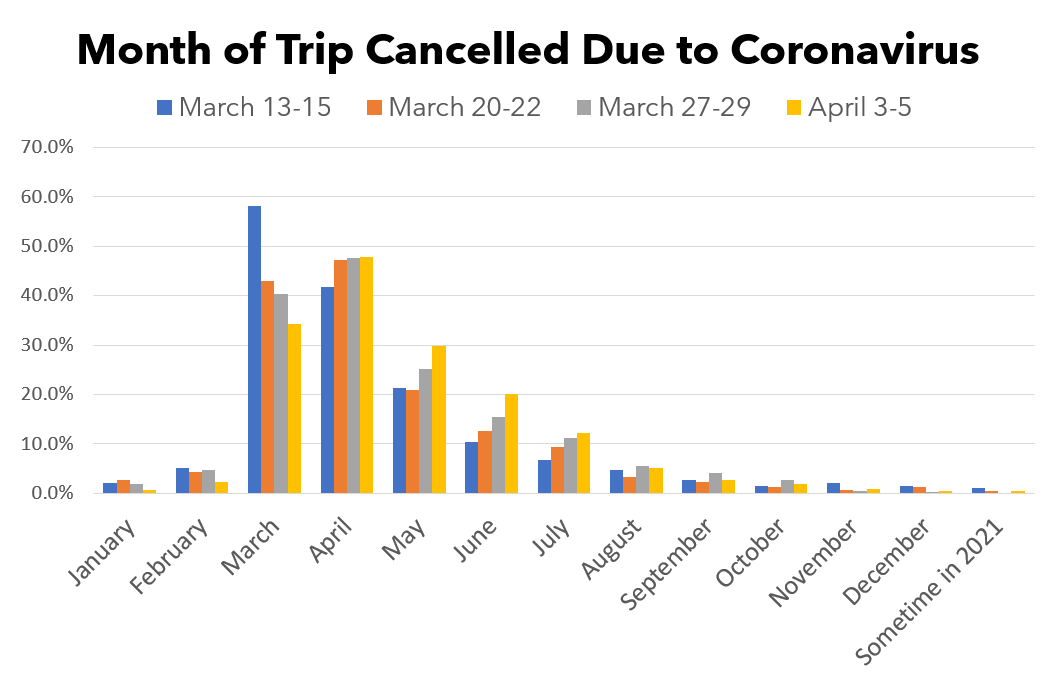

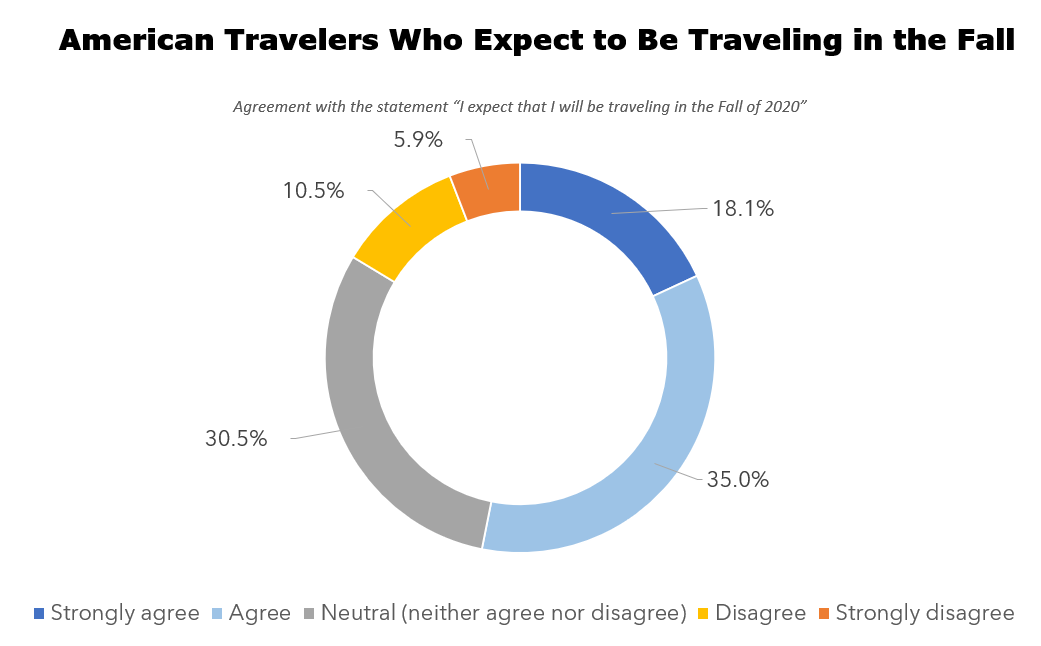

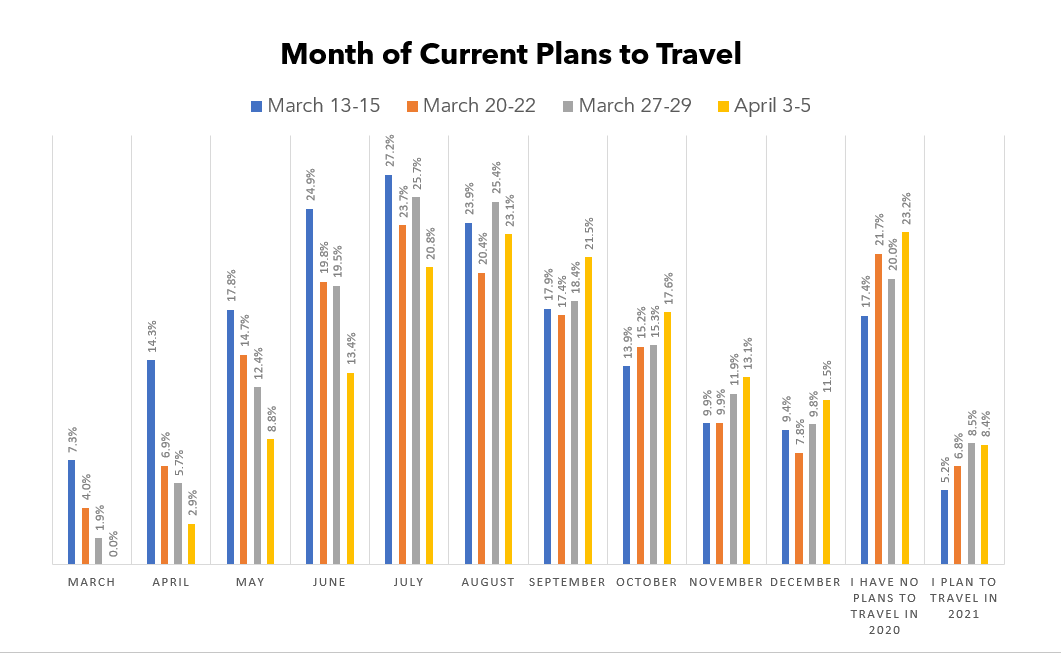

Regarding timing, American travelers increasingly don’t believe or are unsure that the pandemic will be resolved by the summer travel season (44.5% disagree it will). Americans with travel impacted by coronavirus is up 75.3% from 72.8%. The number reporting trip cancellations increased (70.3% from 66.9%), particularly in May and June. Nevertheless, 51.2% continue to feel they will be traveling by Fall, with reported increases in travel plans for September and October.

Again, there remain continued signs that travel is unlikely to quickly return to what it was pre-pandemic. The numbers of American travelers saying they will choose regional rather than long-haul destinations (50.8%) this year continues to grow, and is at the highest recorded levels since this study began. More than half of travelers say they will take a staycation this summer (51.3%), and 45.4% say they will take more road instead of airline trips.

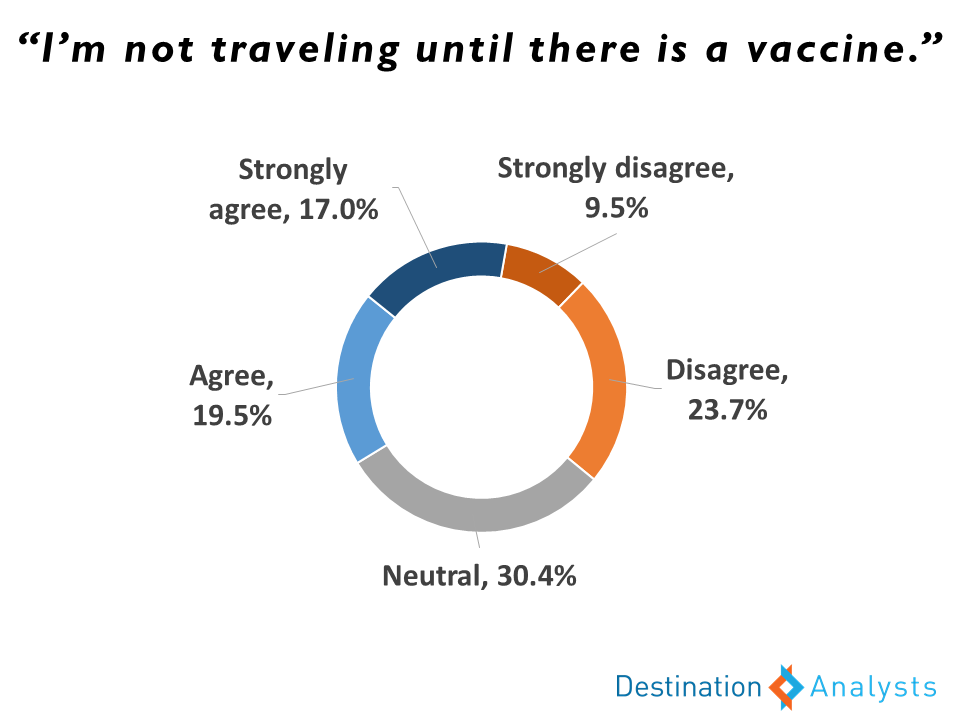

36.5% of American travelers say they agree to some degree with the statement “I’m not traveling until there is a (COVID-19) vaccine”; 43.2% disagree. Younger travelers were actually the most likely to agree they may not travel until there is a vaccine.

77.4% of American travelers say they would approve of mandatory health screenings for flights between destinations inside the continental United States. 76.5% feel positively about the notion of mandatory health screenings at airports and 61.2% say such measures will increase their confidence traveling to a destination.

The present moment is not the time to travel in the U.S., according to the majority of American travelers. Over two-thirds say they do not want other travelers coming to their community right now.

A presentation file summarizing these key findings is available for you to download.

During Destination Analysts’ April 14th presentation of latest findings from our weekly Coronavirus Travel Sentiment Index Study, our CEO Erin Francis-Cummings interviewed a panel of travelers about if and how the coronavirus pandemic has changed where and how they will travel, including what was going to make them feel comfortable traveling again. While not a formal study, qualitative research adds such richness and depth to understanding about how customers think—something that is critical for brands and other businesses as they lead through and after the COVID-19 crisis. Thus we want to share what was expressed during this discussion to help further the industry’s knowledge about how traveling consumers are approaching their decision making.

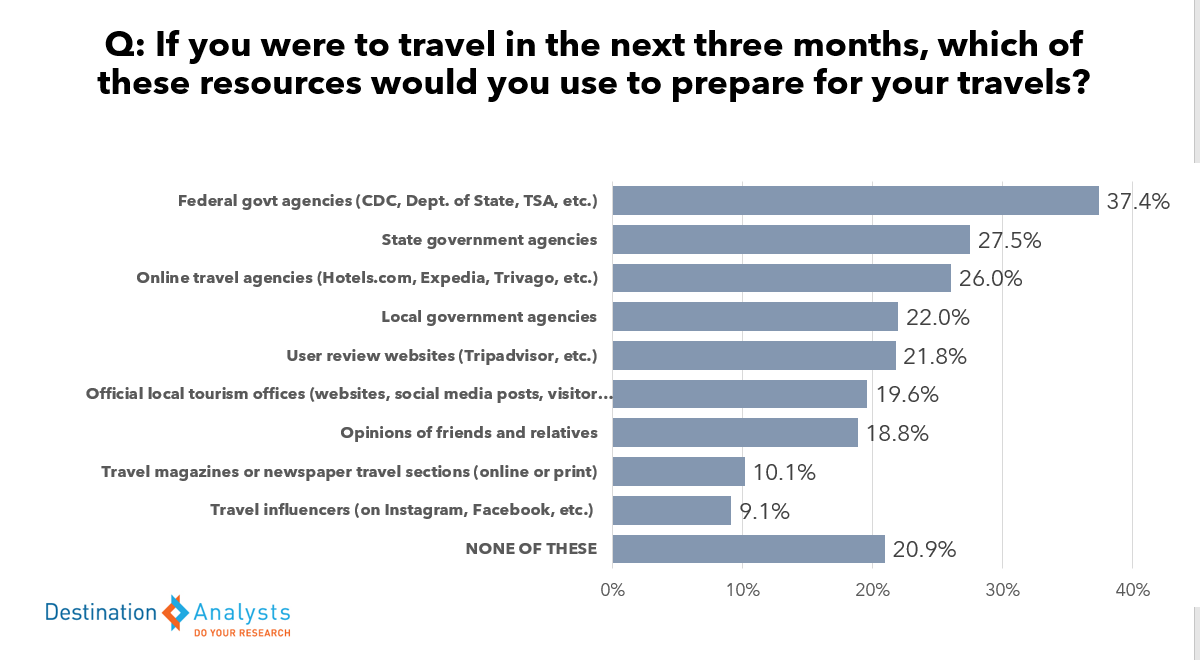

These travelers’ perspectives have some commonality: looking to government and official resources for the indication and messaging that it’s safe to travel and come visit the geographic area they govern/lead, and an expectation that destinations and businesses will responsibly approach opening their doors—only doing so if it is truly safe for visitors. Interestingly, in our survey the week of March 27th, when asked about what they would use to plan travel in the next three months, American travelers largely cited official resources, with fewer stating word-of-mouth—a reversal from “normal” periods.

Responses given to the questions “What is going to make you feel comfortable traveling again? When will you feel good about taking these trips? What do you need to know or learn?” follow below:

“I think just following the news and seeing reports of things being deemed safe to open and both on a federal level as well as the case by case basis so I think it’s a combination of using our best judgement seeing when we personally feel comfortable ….and thinking are we comfortable being in an airport and on an airplane to first get to our destination? And then what it’s like in terms of air quality and in terms of number of cases. There is a belief that I have that this virus is always going to be with us but at some point it’s going to feel like it’s controlled and controlled to the point where it’s manageable—just as we would be susceptible to other things (when we) put ourselves into a new destination away from our home environment that we are kind of used to, so I don’t know if I have a magic bullet answer to when I would feel comfortable or what it’s going to take but it’s going to be a combination of things we know and things we understand. Talking to friends and family that live in the area, we are looking to travel to understand from them how many things are open, what is it going to look like when we get there and putting it all into perspective.”–Ella, New York

“I think there are two important things for me. I will feel safe when Disneyland is back open—that is our current metric in our household. I think lots and lots of people, lots and lots of interaction from the host to the guest. So that is kind of one part of it – the general test for the nation: Is Disneyland open or is it not? I think for me personally anywhere that I’m going I need to know that the infrastructure is in place medically so that if I personally get sick…I know that I can be okay. I think that’s understanding ‘Is access to ventilators a reality?’ That to me is the biggest concern.” –Jake, California

“I’m just waiting for more data to come out. I’m holding a lot of hope out for (cures). I’m hoping that is going to be more easily accessible so if I travel I could go into, let’s say immediate care, and just be able get a prescription for (a cure). That would give me more courage to travel. Also we’d want to see that every place is open too.”–Mary, Illinois

“I think a few things. A part of it is hearing confirmation from national, regional and local governments that it is safe to travel and also safe to travel to those locations. I’m wanting to go to Hawaii (after the pandemic) and part of that is confirmation from government officials saying yes we are ready for visitors, that we have the medical equipment, that yes we have different practices. I also want to see from the hotels that I want to stay at and other businesses that they’re ready, their affirmation. Part of it is saying they are ready for you and ready to take care of their employees. So that affirmation: ‘yep we’re back in business, we’re good to go and come on over. ‘…I just want that confirmation.”–Steven, Colorado

IMPORTANT: These data and findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency.

Americans are feeling somewhat better that the worst of COVID-19 in the U.S. may soon be over. The percent feeling the coronavirus situation in the United States will get better in the next month nearly doubled to 29.5% from 15.4%. The percent who say they have had travel impacted by coronavirus remained at the same level this week (72.8%).

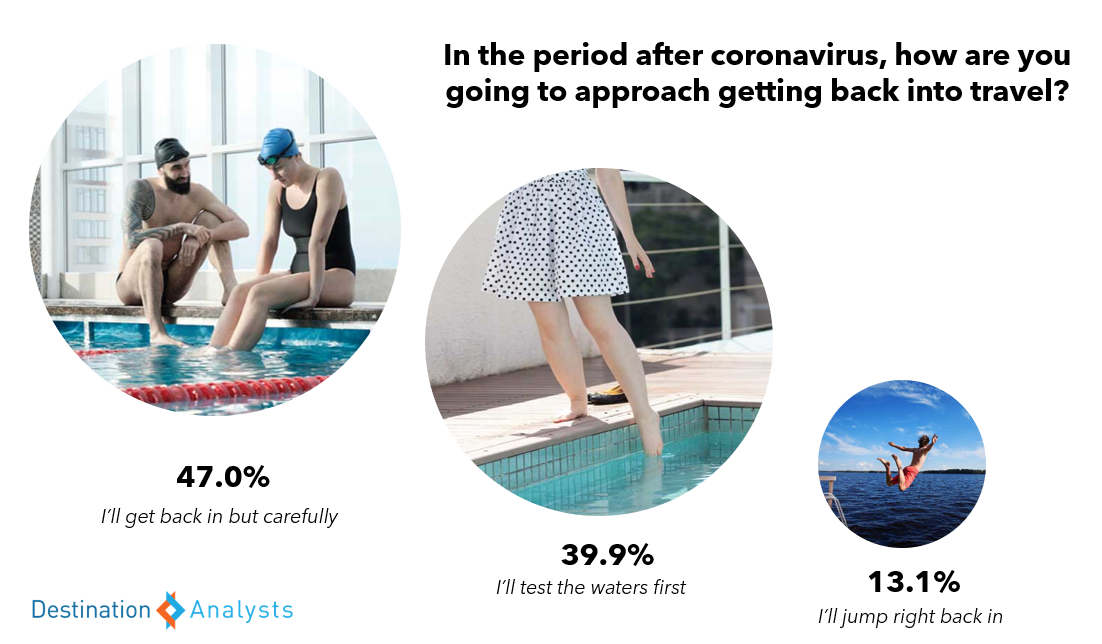

And yet while nearly 70 percent continue to say they miss travel, few American travelers will jump right back in when the coronavirus situation has passed. As demonstrated by the images they selected to represent how they will approach travel in the post-coronavirus period, nine in ten American travelers feel feel this will be done with care and at least some trepidation.

Furthermore, it will not be a simple return to pre-pandemic sentiments and behaviors. Now, nearly 40 percent of American travelers say they will change the types of destinations they choose to visit when they begin traveling again—this is up nearly 10 percentage points from just one week ago.

Beyond the substitution of destinations, the coronavirus pandemic looks to have a, hopefully temporary but, fundamental impact on how Americans travel and the experiences they choose. American travelers increasingly say they will be avoiding crowded places (55.7%)—including conferences/conventions (40.3%)—when they begin traveling again. They are also increasingly saying they will avoid destinations hardest hit by coronavirus (50.5%), and destinations slow to put social distancing measures in place (32.7%). Also on a continual rise: the number agreeing they will take a staycation this summer (55.2%, up from 41.3% one month ago), and the number of younger travelers who say they will take more road trips to avoid airline travel (49.4% from 43.4% one month ago)

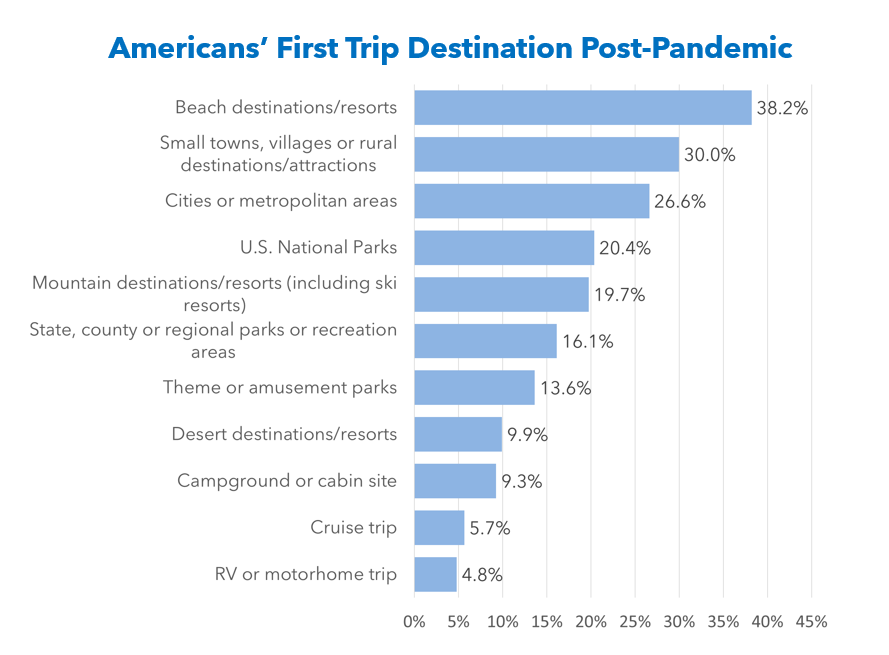

When asked the place they will visit on their first post-pandemic trip, beach/resort destinations top the list (38.2%), followed by small towns/rural areas (30.0%) then cities (26.6%).

If you are looking to discounts and deals as a strategy to attract travelers, this is likeliest to be most effective with younger travelers. This week, 42.1% of Millennial and GenZ travelers say price cutting and discounting makes them more interested in traveling in the next three months. In comparison just 31.3% of GenX and 25.3% of Boomers agreed. Also, while July and August are currently the months with the highest percentage of travelers saying they have trip plans, later months continue to show gains, including October and December.

A presentation file summarizing these key findings is available for you to download.

During our presentation of the week of April 6th findings of our Conronavirus Travel Sentiment Index, we invited three meeting planners to join us to discuss their perspectives on the impact of COVID-19 on the meetings industry now and into the future, as well as their advice for CVBs right now. Following are key highlights from what they said.

“It would be a bad move to not participate. You have to be in our face. You have to let us know you know what’s going on and be in control.”

“Personally, I wouldn’t pause your marketing. You might change the tone until things get back to normal. I love what some destinations are doing with putting out virtual visits so people who can’t travel can watch videos of the destination.“

“In the short term I expect a huge spike in virtual meetings because people do see that this will work. It will be an impact for us moving forward but in the long term, people will still need that face-to-face interaction, but they won’t need it for every meeting.”

“A critical role the DMO can have is providing an experience. Not just sitting around talking. It includes dinner, activities, team-building aspects, to a face to face meeting. That’s where DMOs should stress the total experience rather than just exchange of information.”

“These things are affecting our entire industry. We need to look at encouraging groups to meet and taking away some of the objections. Maybe CVBs can be starting that conversation with their hotel partners. It would encourage clients to keep their meetings in place.”

“I’m thinking third quarter we will be back to normal or the new normal. We need to conduct business so it is very important to have a strategy in place now to help us move forward.”

“CVBs need to be letting meeting planners know what they are going to do about reopening hotels. Information about when it can come back online. How quick can they be up and running again?”

“[DMOs] need to lead by example. It’s just putting on your leader hat, period, and doing what leaders do. You have to be tenacious. It’s a fight. This is not a time to be relaxed. Put your energy into it and it will work out.”

IMPORTANT: These data and findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency.

As the United States has become an epicenter of the COVID-19 pandemic, concern among American travelers about personally contracting the virus is high, with steady week-over-week increases in the Midwest and Northeast (where concern is the highest in the country) regions. Interestingly, Gen X has been given accolades as the generation who acted swiftly in taking coronavirus seriously and implored others to; indeed, Gen X travelers continue to express the most concern about their friends and family contracting the virus.

After a small dip last week, concerns about the virus’ impact on personal finances is back up—7.0 on a 10-point scale; the week prior it was 6.8. Travelers in the Western U.S. demonstrate the most concern about what coronavirus may do to their personal financial situation.

This week, Florida has jumped to the third most named place travelers associate with coronavirus issues, after New York—which is far and away the destination most commonly associated with coronavirus—and California—which has seen declines this week as a place associated with coronavirus issues.

Over the last week, even more travel was affected by the COVID-19 outbreak—now 72.8% of travelers say they have had trips affected by the coronavirus situation, up from 66.1%.

Nearly two-thirds (65.3%) report having cancelled a trip; the highest rate in the last four weeks (Note: Gen X travelers were the likeliest to report trip cancellations due to coronavirus this week). An uptick in cancellations was reported for the months of May and June, suggesting that travelers are less confident about being able to travel until July or later. Americans are likeliest to report that it is their vacation-type trips being impacted (40.3%), but even trips to visit friends and relatives have steadily risen in cancellations or postponements (26.0%).

The percent of American travelers who feel the coronavirus situation will get worse in the U.S. next month has grown to 70.3% (up from 66.5% a week ago). Those confident that coronavirus will be resolved by the summer travel season plummeted to 31.0% (Back on March 15th, 52.5% of American travelers felt the situation would be resolved by summer). Millennial travelers remain the most optimistic.

Nevertheless, 53.1% of American travelers say they expect they will be traveling in the Fall. The percent who say they have trip plans in September and later in 2020 have ticked up, as well.

As shelter in place and social distancing measures continue on, even more travelers are saying they miss traveling. This week, 69.1% said they “can’t wait to get out and travel again” up from 63.0% last week. However, half of American travelers feel that they will avoid crowded destinations in the six-month period after the pandemic ends.

In addition, more travelers are showing their support for their own communities. This week, 60.6% of American travelers said they have undertaken specific efforts to support local businesses where they live.