Nearly 14% of Americans report they took a trip for Thanksgiving 2020. Although government-imposed restrictions and virus anxieties are acting as a depressant on travel sentiment right now, 44% of American travelers agree they are taking a major vacation after a COVID-19 vaccine becomes available, and Americans’ Destination Hot List is looking nearly identical to pre-pandemic times.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected November 27th-29th.

Key Findings to Know:

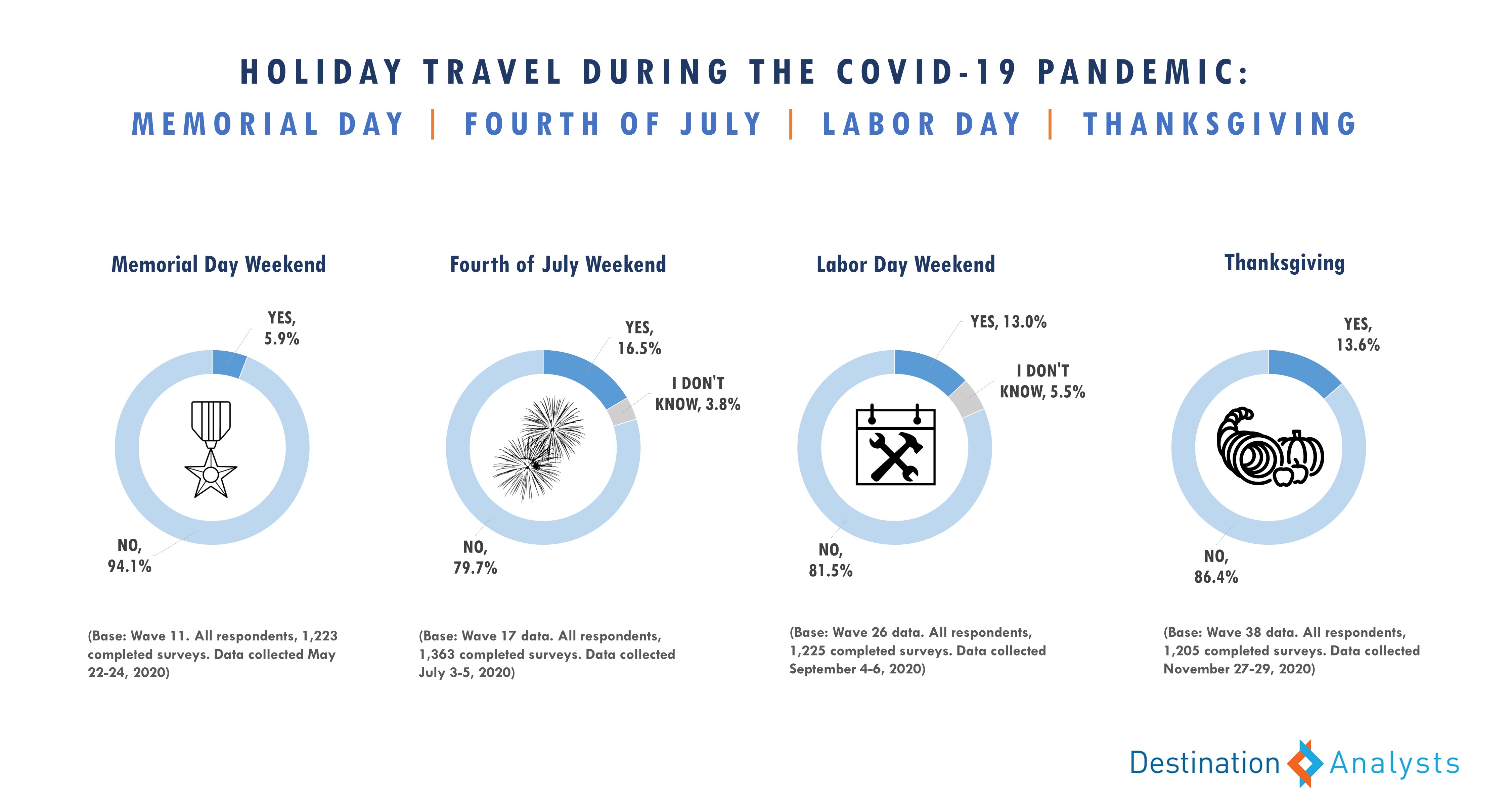

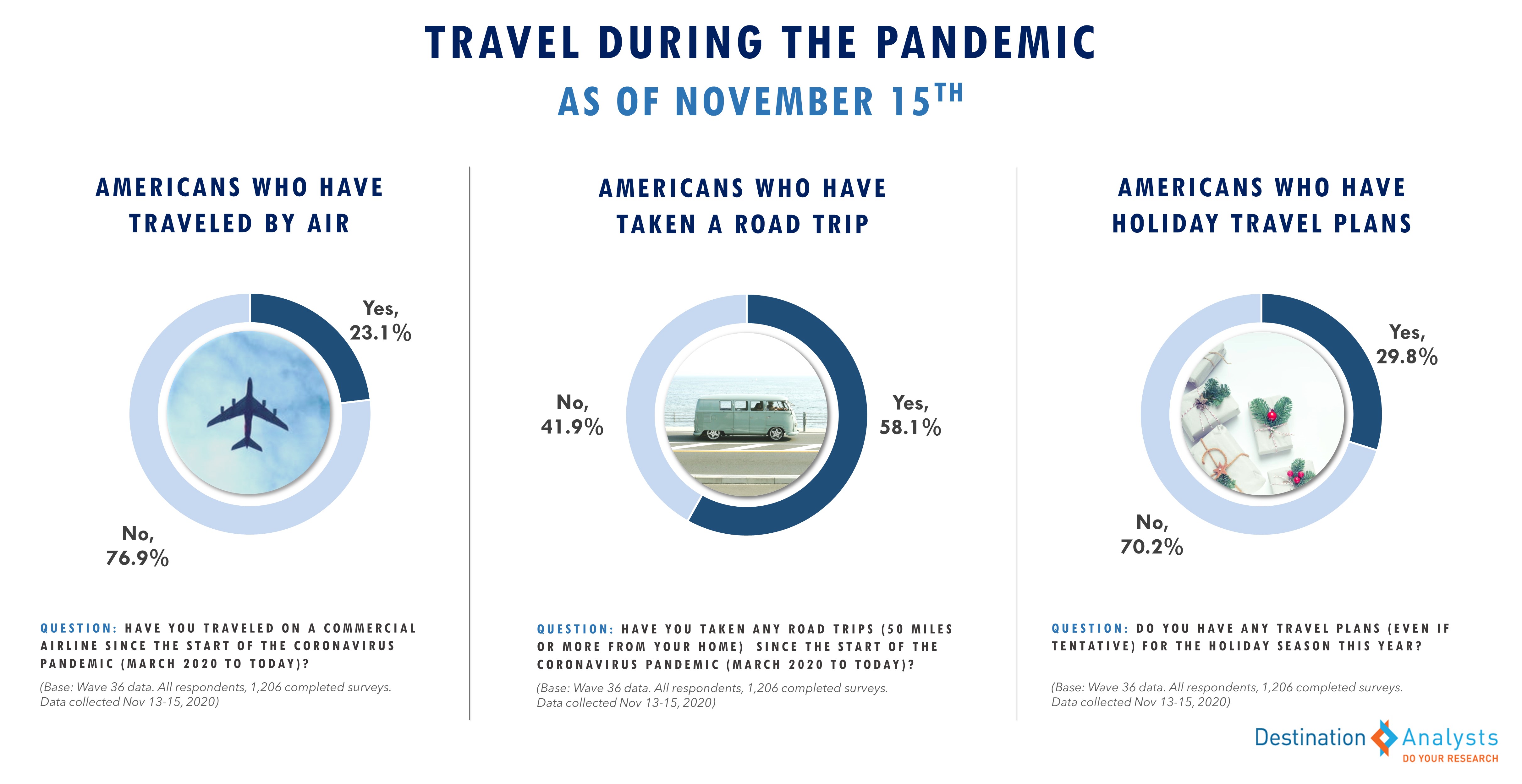

- Nearly 14% of American travelers report that they took a Thanksgiving trip. Nearly one-in-five Americans say they plan to take a Christmas holiday trip.

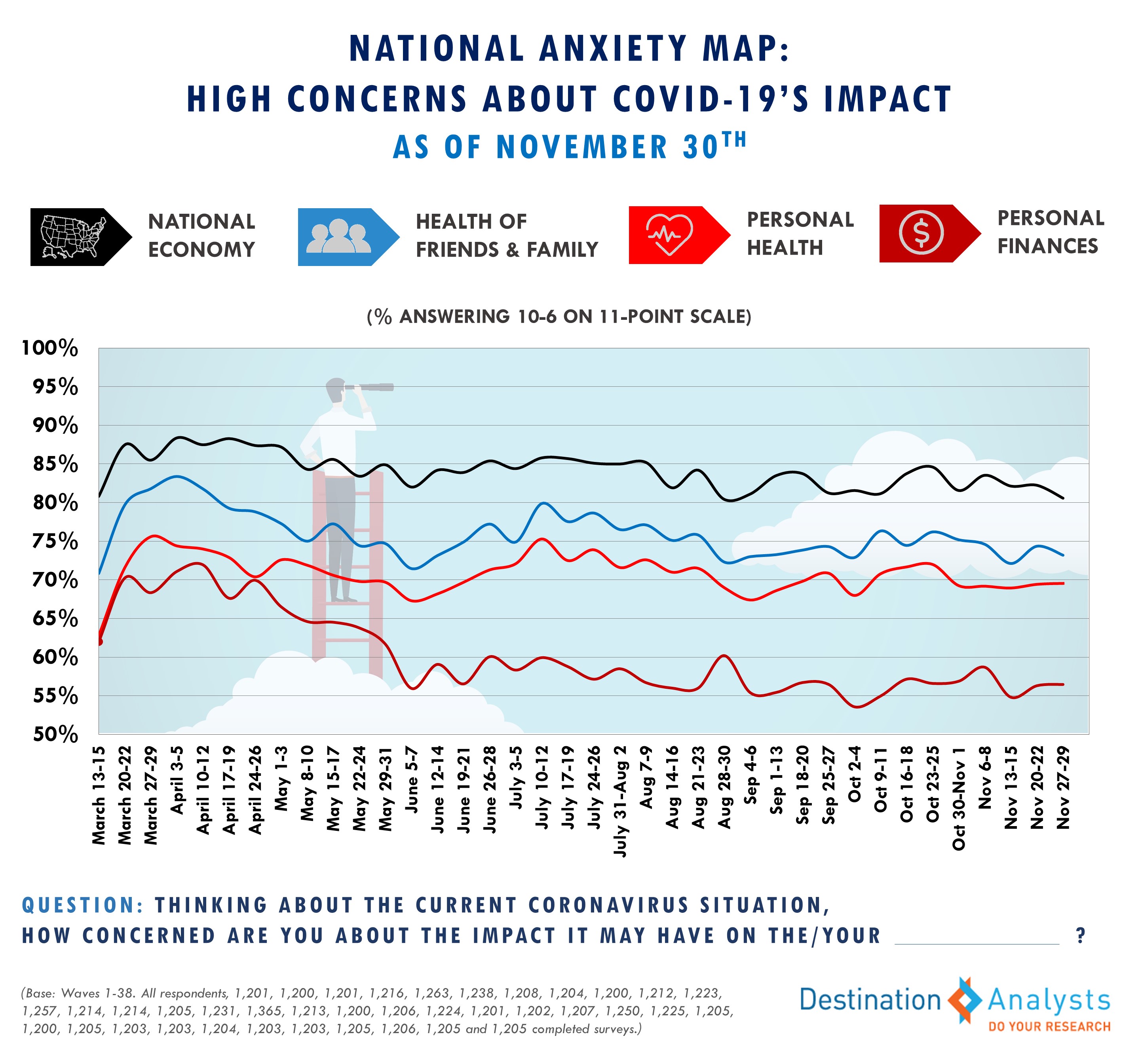

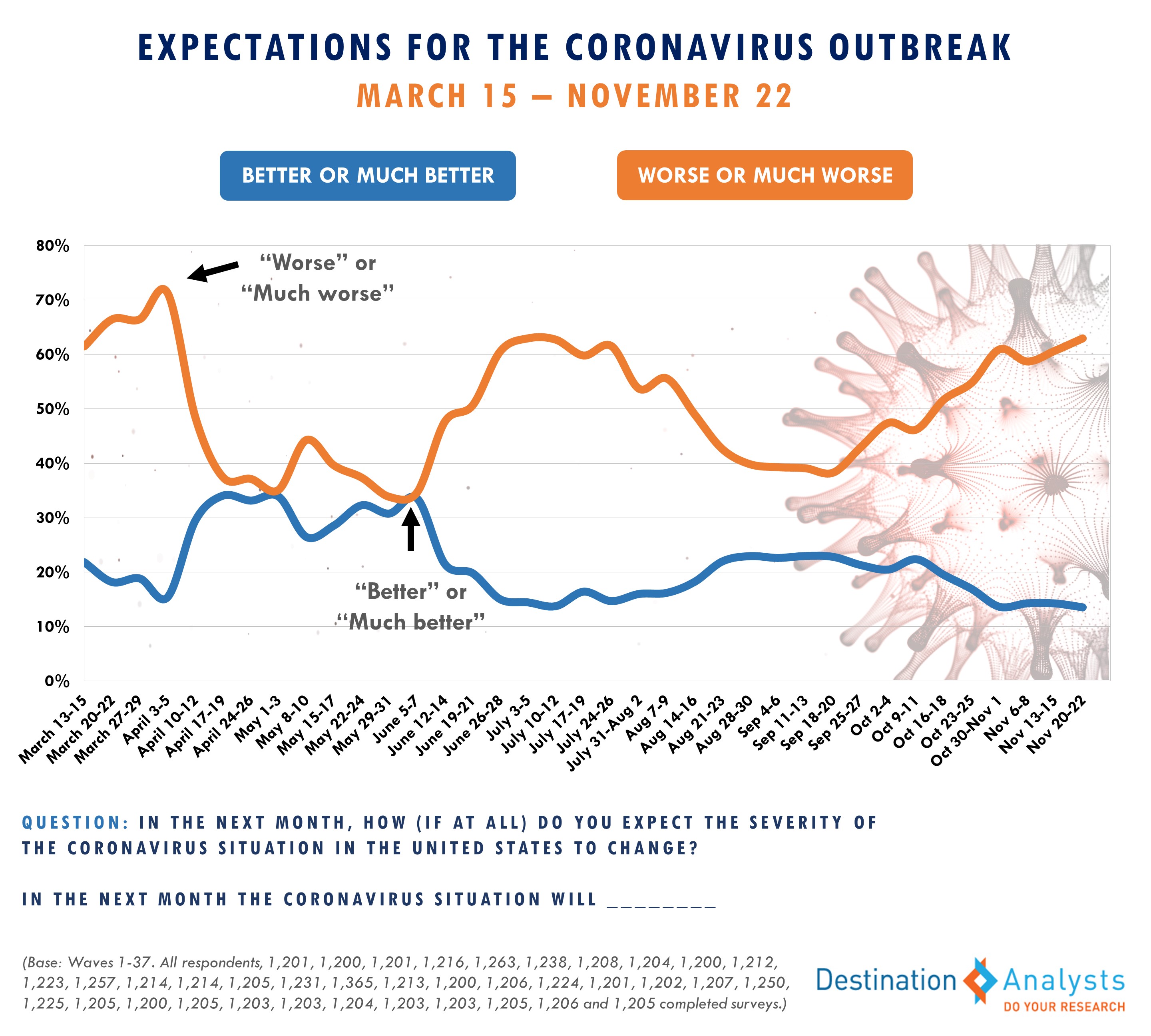

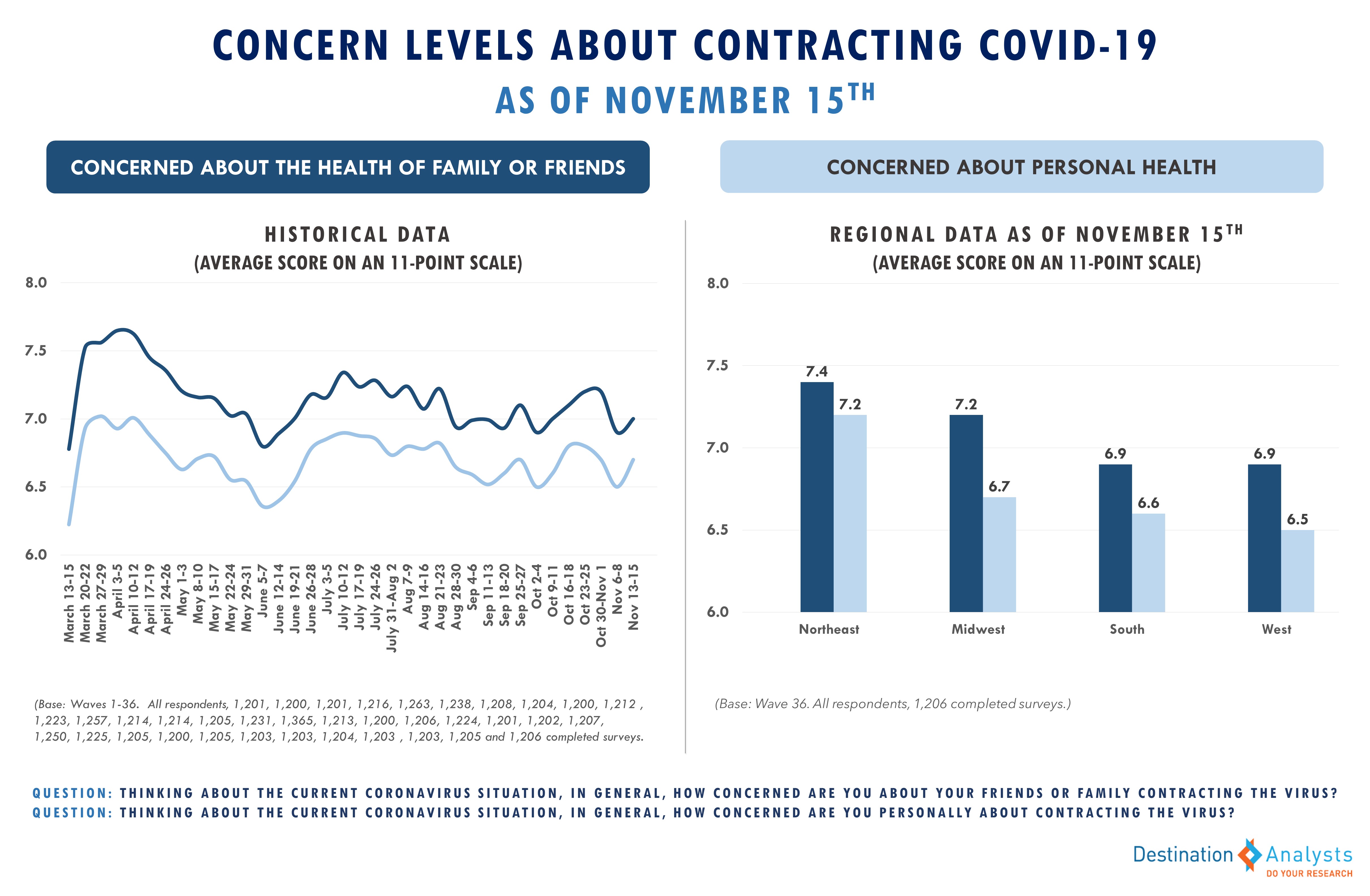

- In terms of how Americans are feeling about the virus, many emotions remain largely unchanged, with anxieties about personally or loved ones’ contracting the virus and the pandemic’s impact on personal and national economics in an elevated but stable period that have not reached the peak levels seen during the two prior surges in March and July.

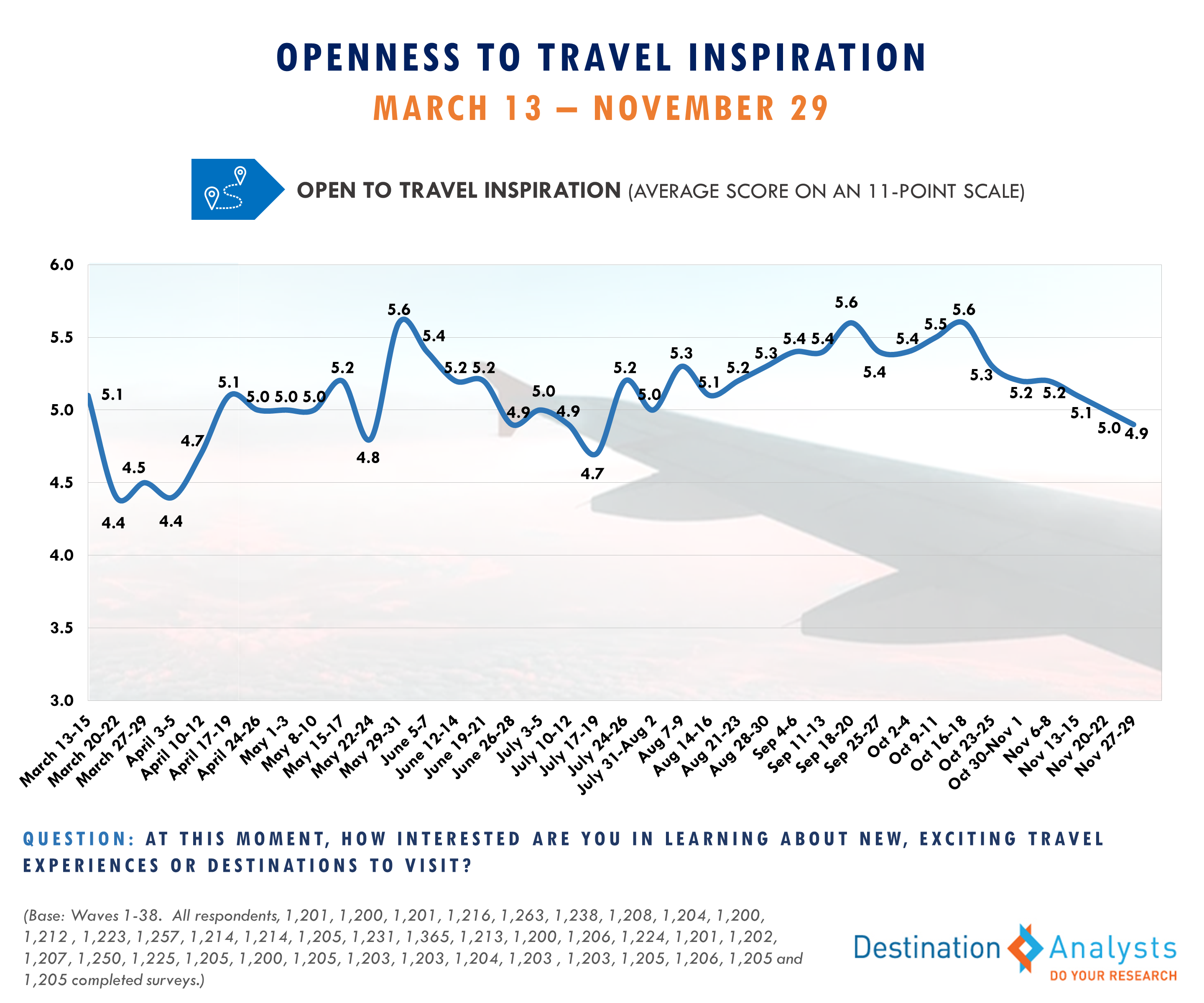

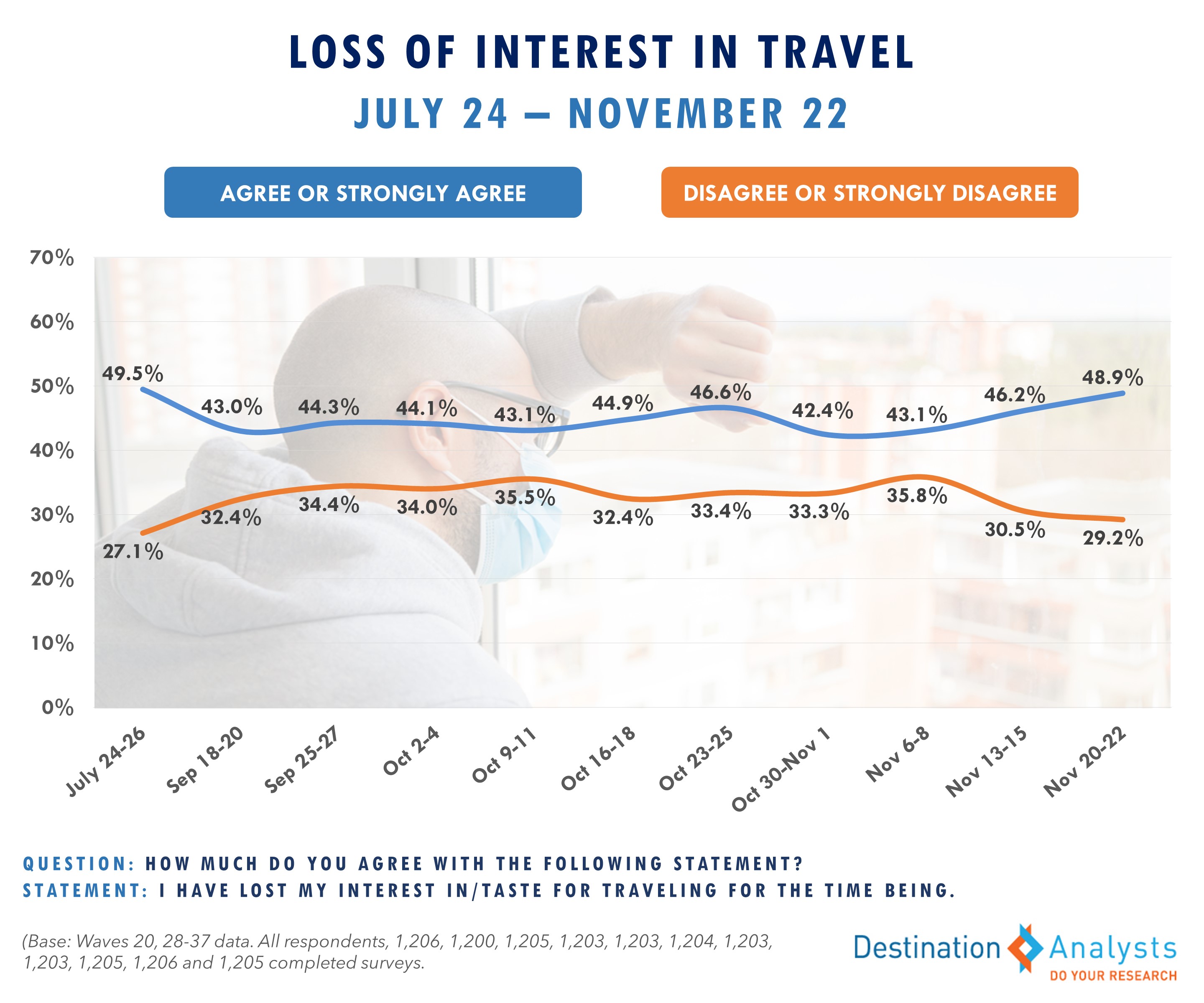

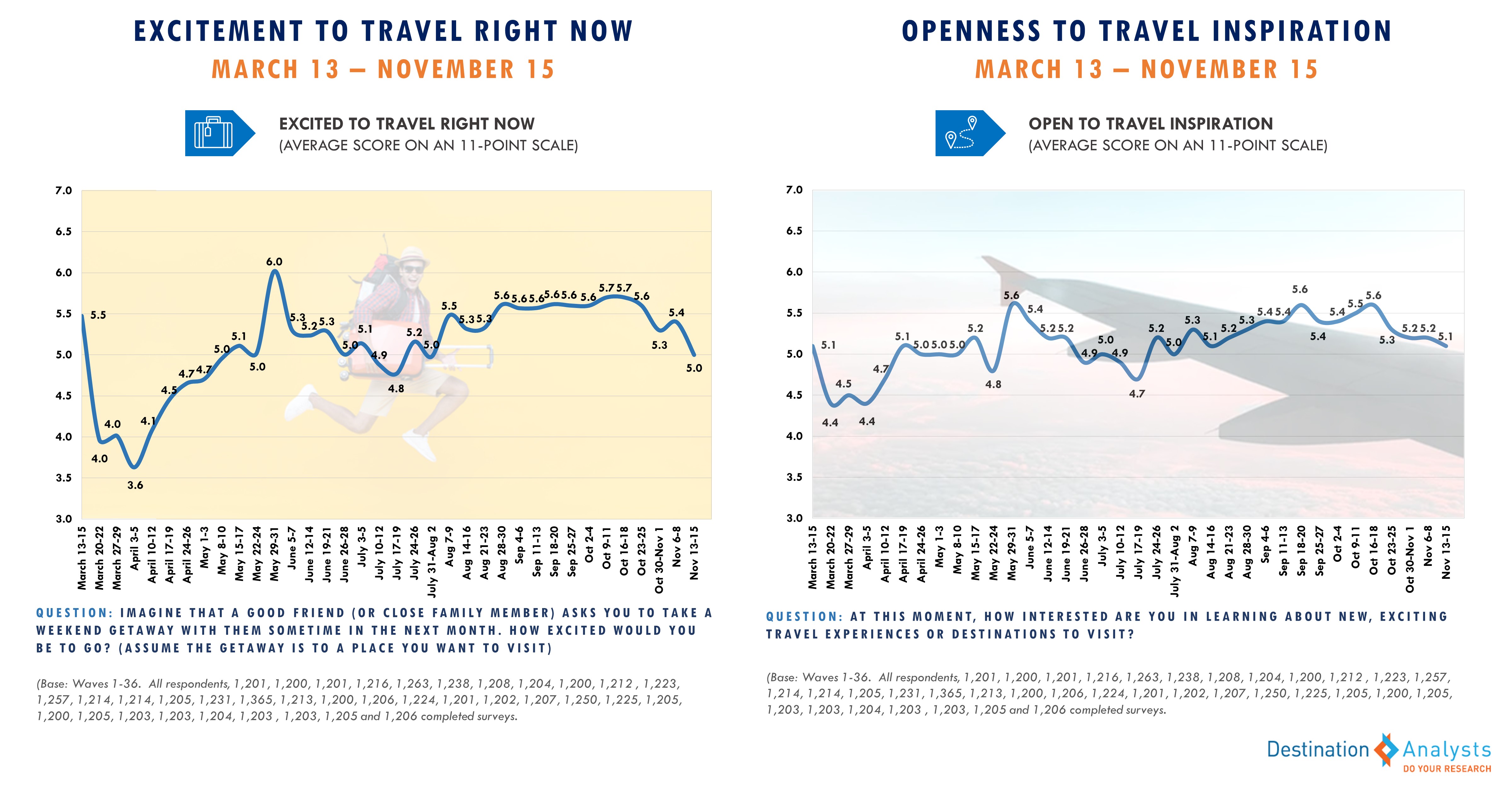

- Such concerns are still impacting Americans’ current travel marketability. Americans’ openness to travel inspiration has been on a steady decline since October 18th and fully half of American travelers say they have lost their interest in traveling for the time being.

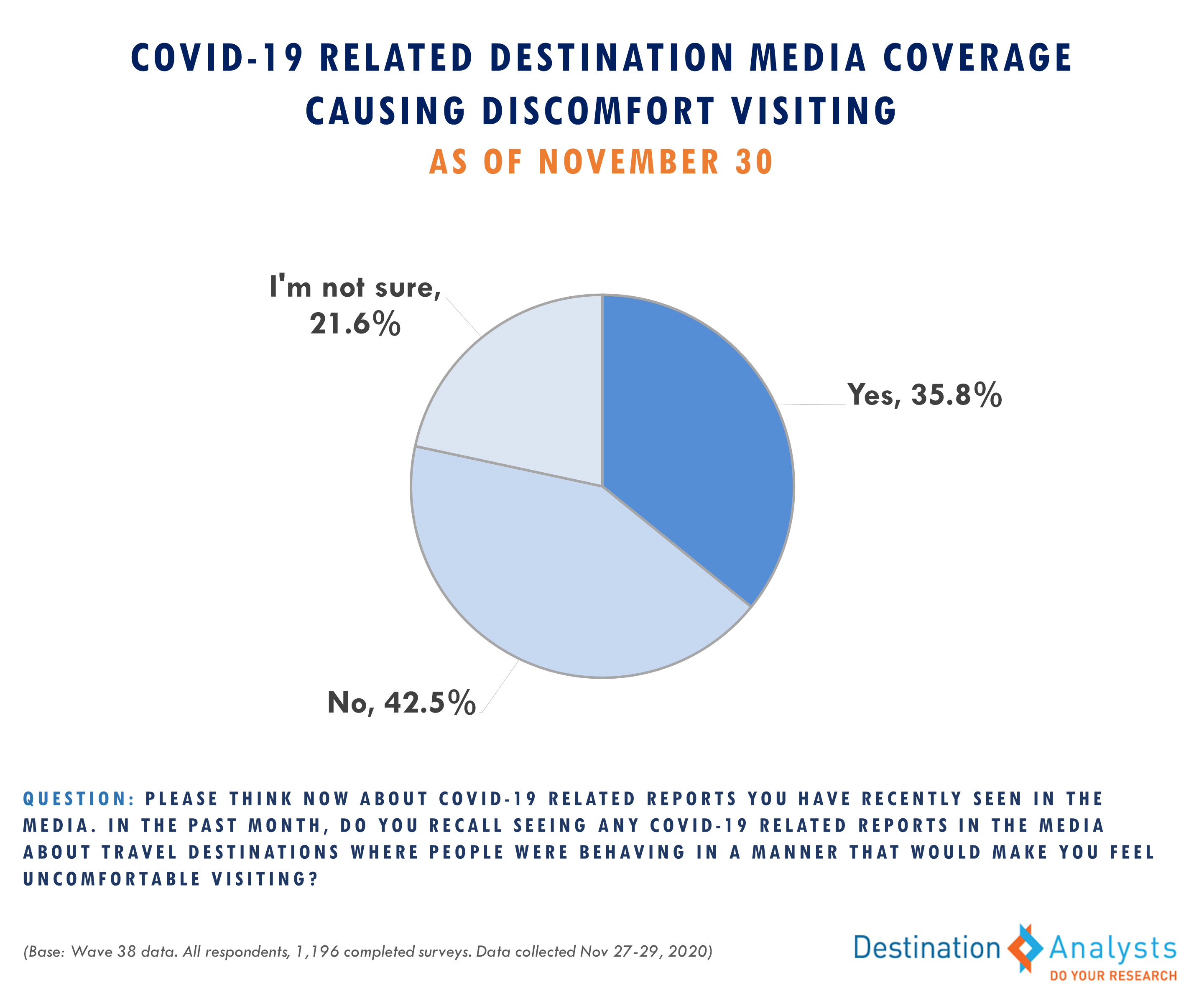

- The focus of some recent news stories on pandemic behaviors in specific travel destinations is also acting as a sentiment depressant. In the past month, 35.8% of Americans report they have seen one or more COVID-19 related reports in the media about travel destinations where people were behaving in a manner that would make them feel uncomfortable visiting.

- While a majority agree with new/reinstituted travel and other COVID related restrictions and agree it’s important people follow them, these restrictions are achieving their intention to deter travel right now.

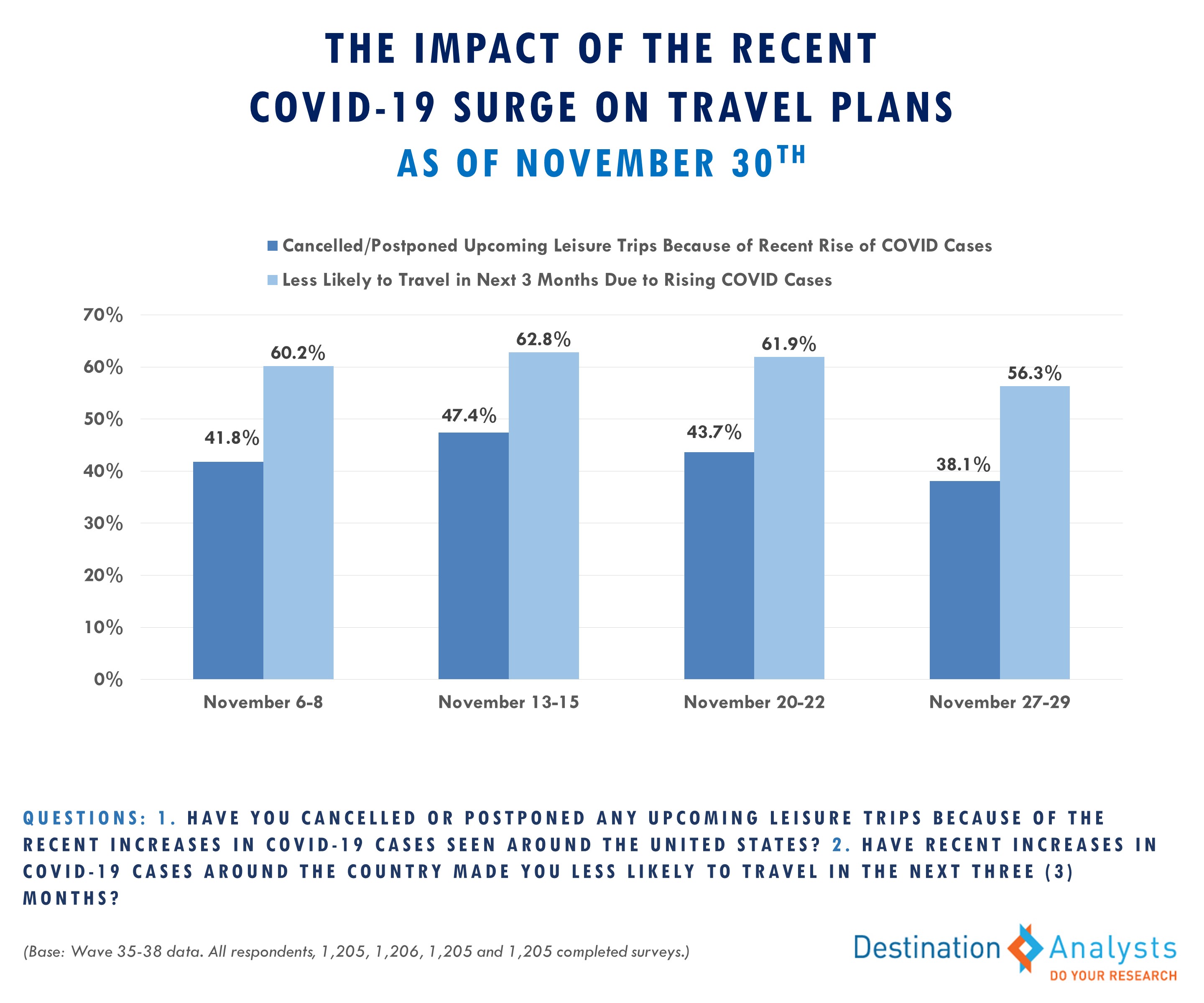

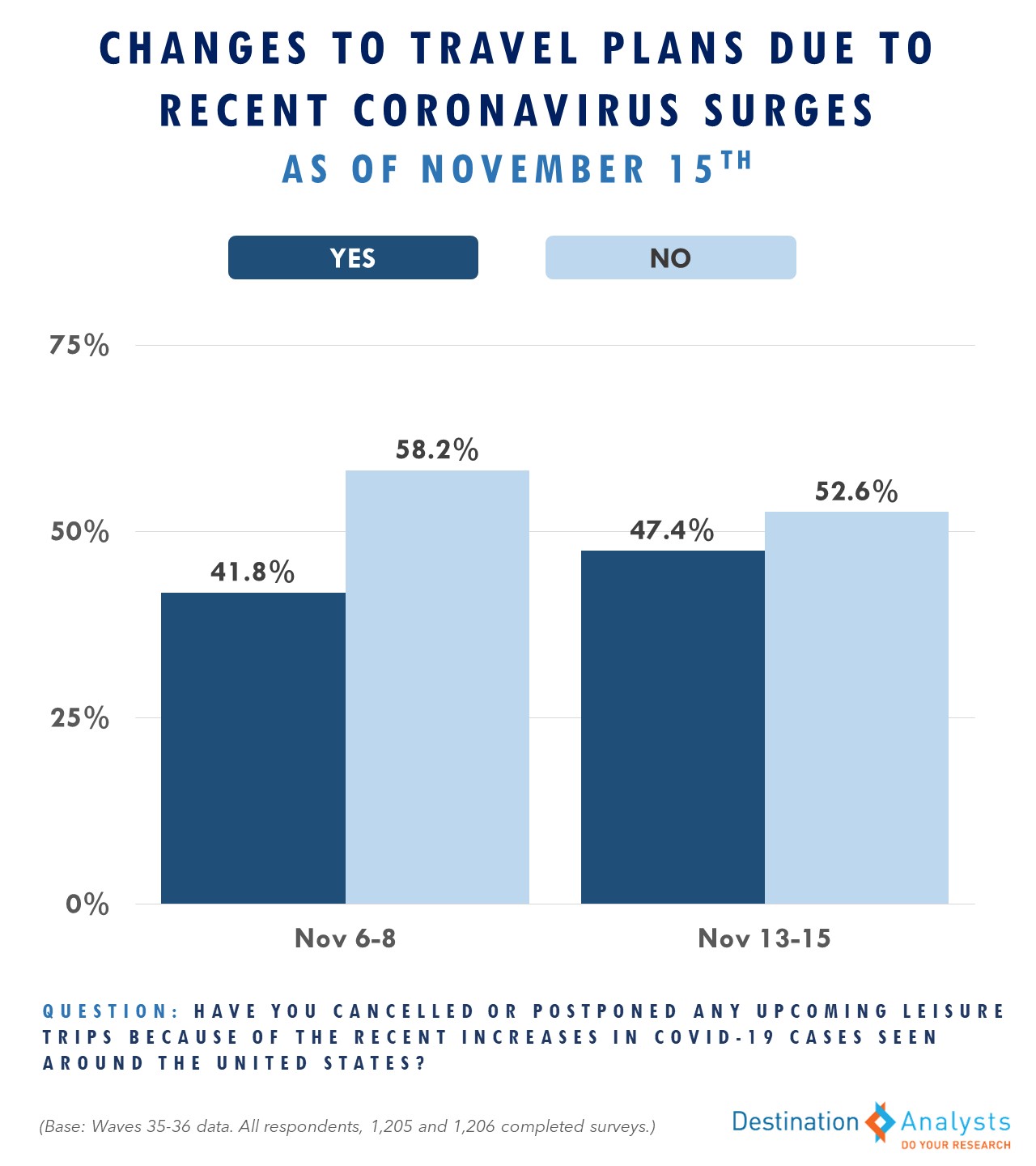

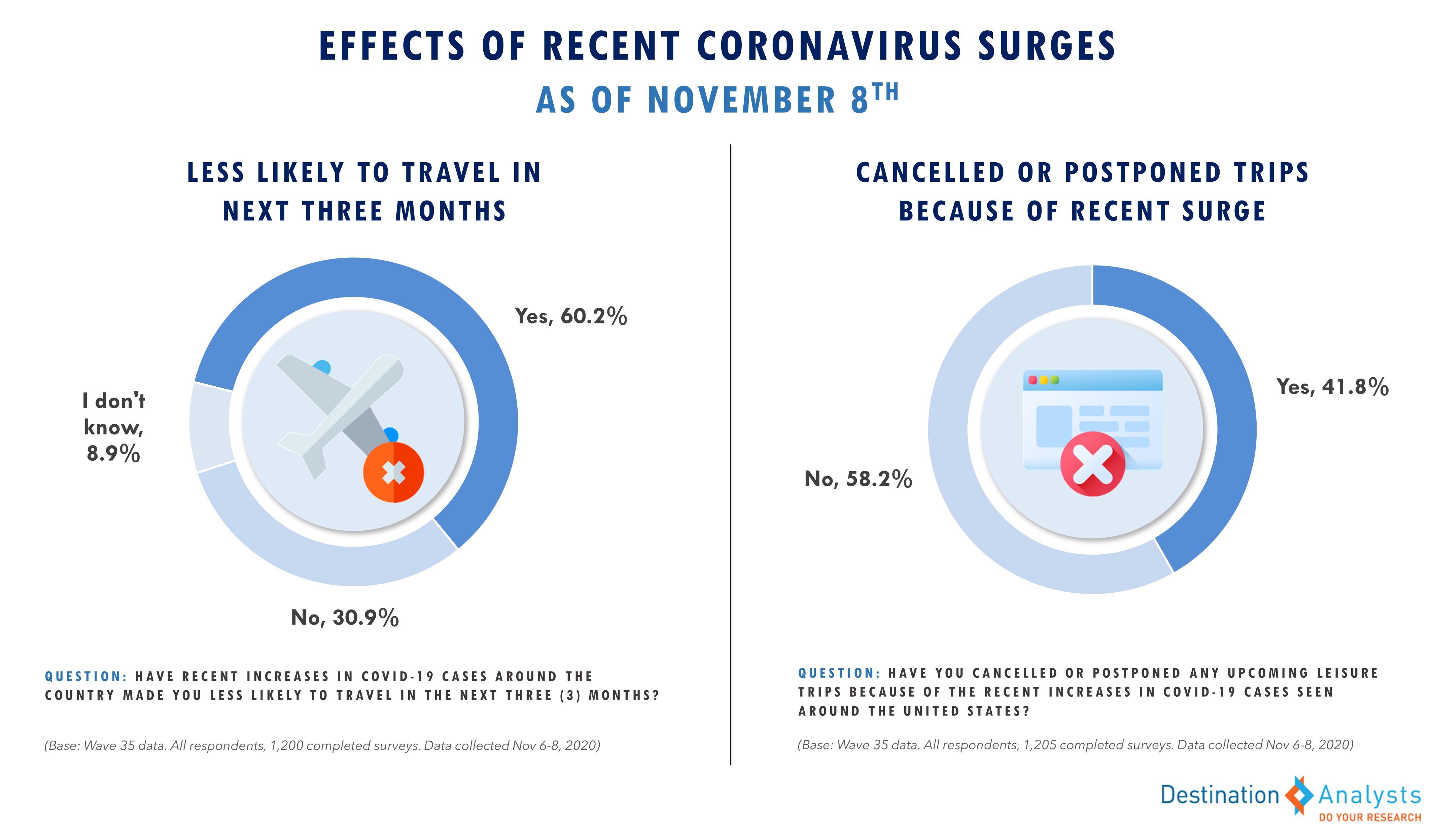

- Still, the worst of this latest surge’s impact on travel behavior may be passing or at least be in a temporary reprieve. The percent of American travelers who report they have cancelled or postponed any upcoming leisure trips because of the recent increases in COVID-19 cases in the U.S. has dropped to 38.1% from 47.4% two weeks ago, and now 56.3% say recent increases in COVID-19 cases around the country have made them less likely to travel in the next three months–down from 62.8% in the same period.

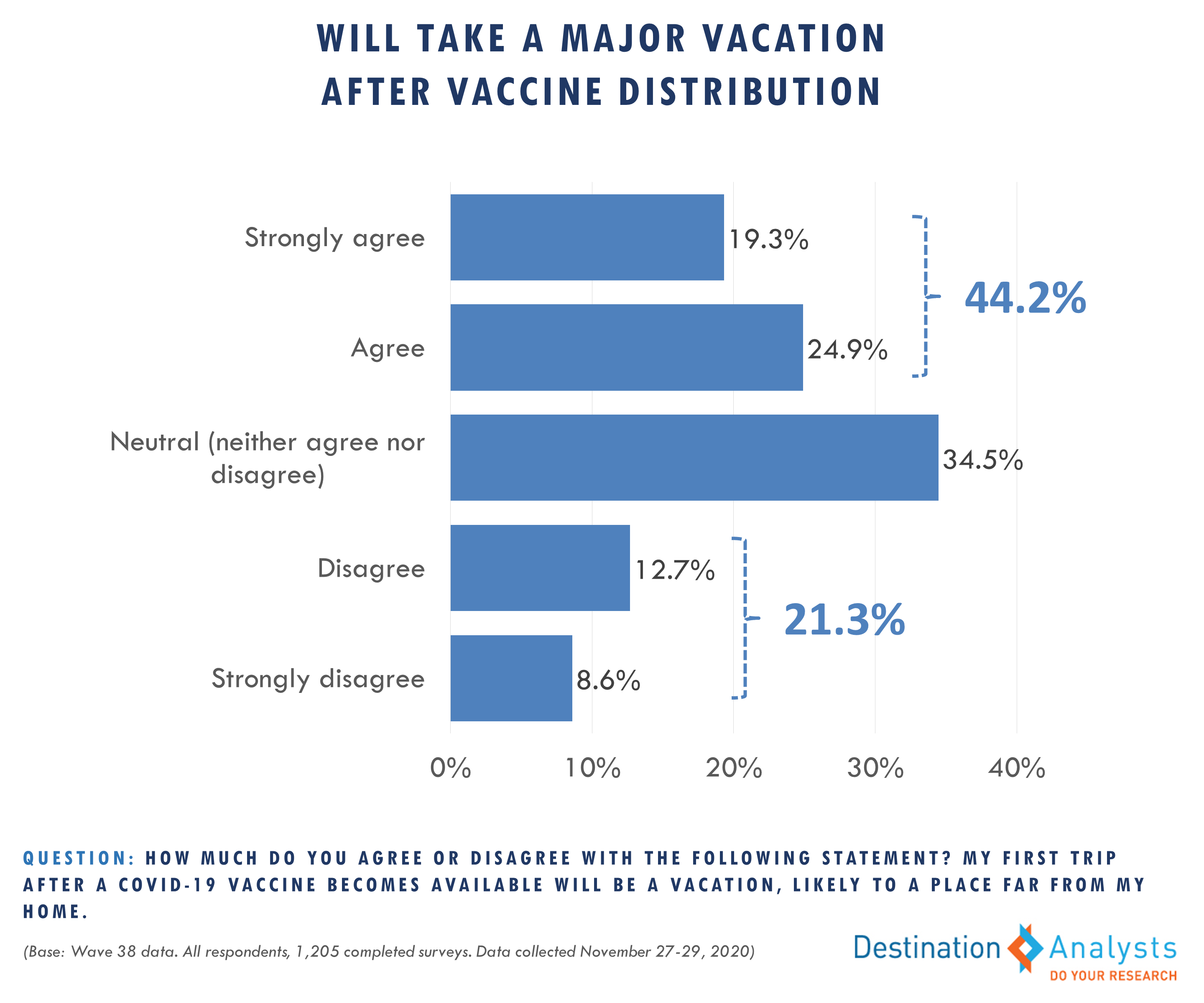

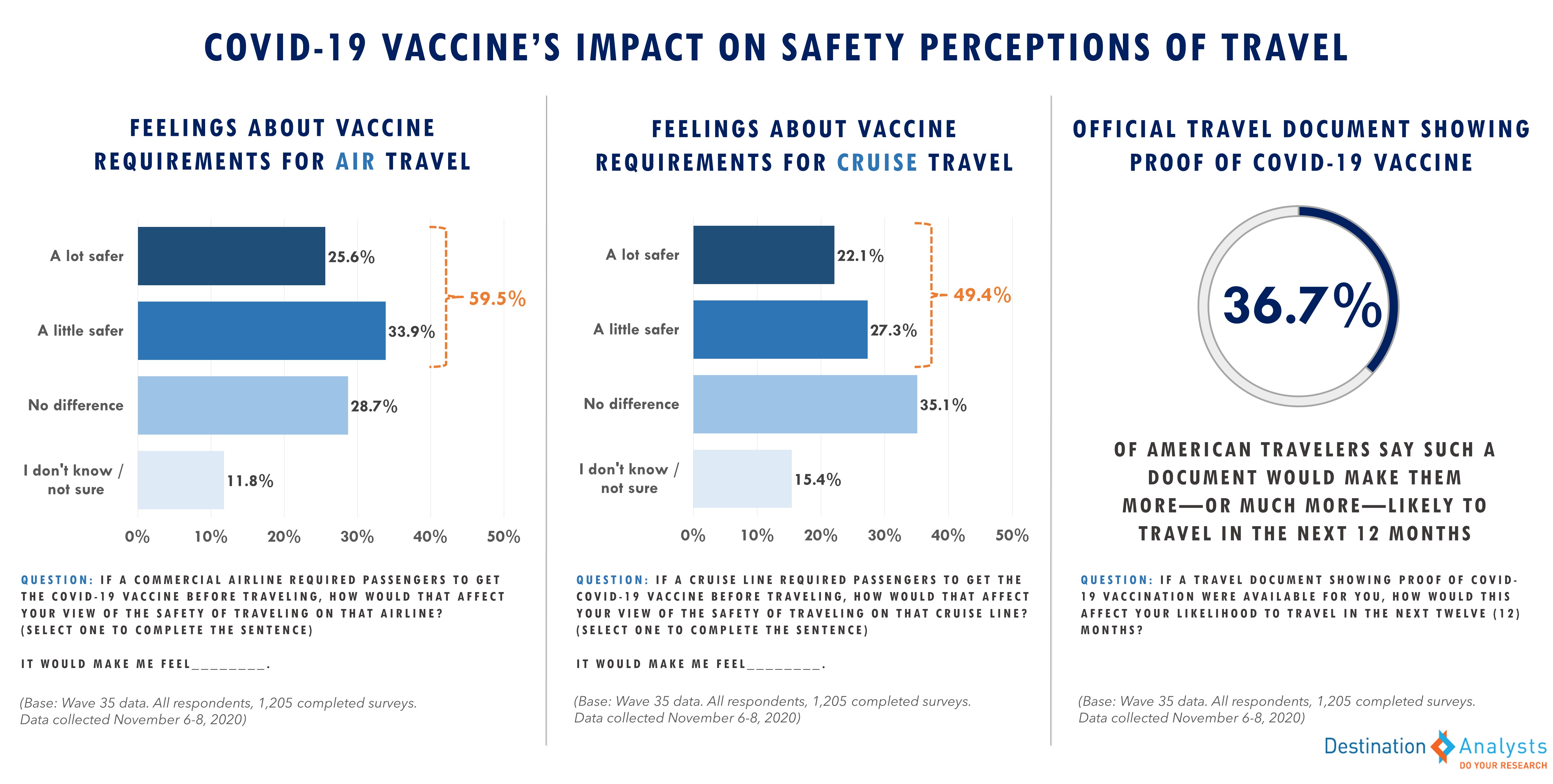

- Reports of vaccine developments also continue to provide Americans hope about their travel future. Over 44.2% agree that their “first trip after a COVID-19 vaccine becomes available will be a vacation, likely to a place far from my home.”

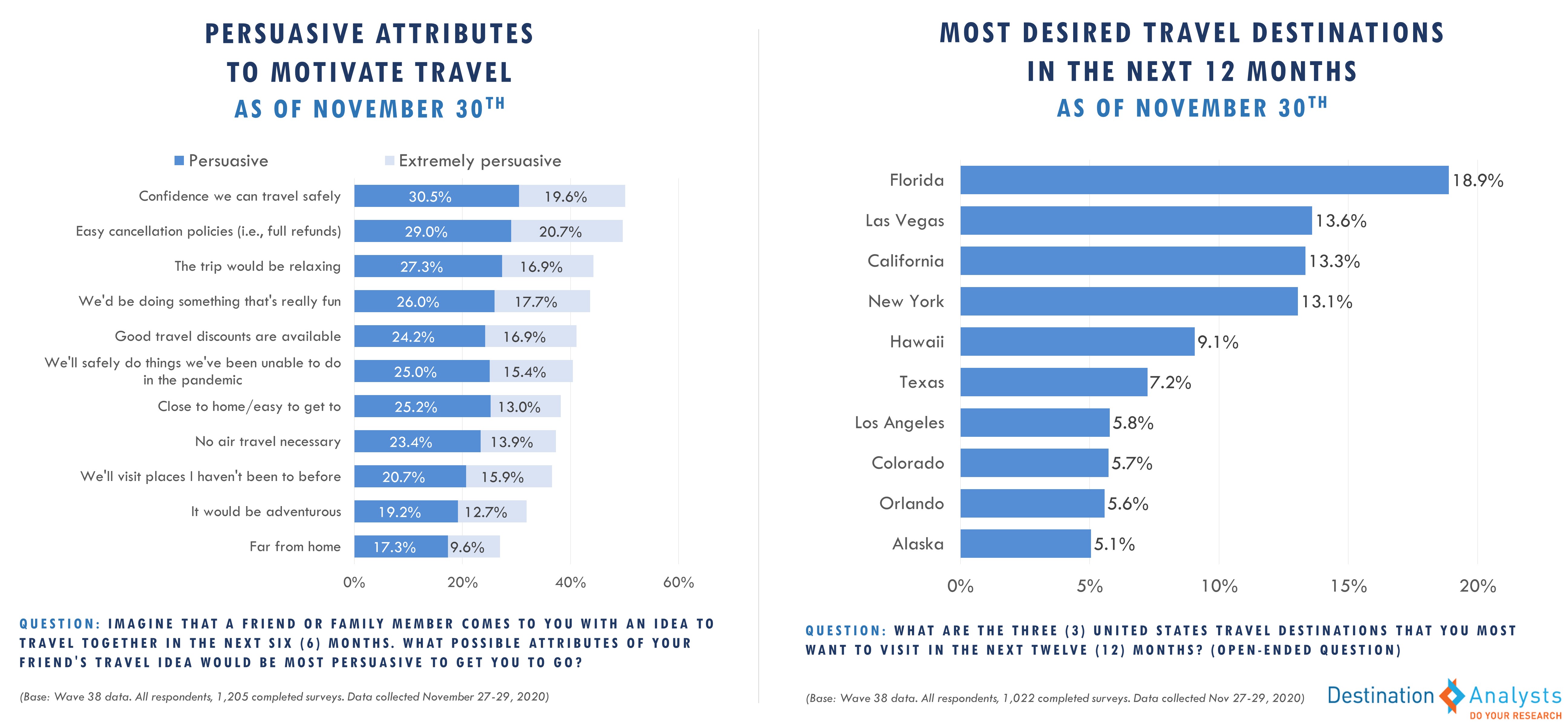

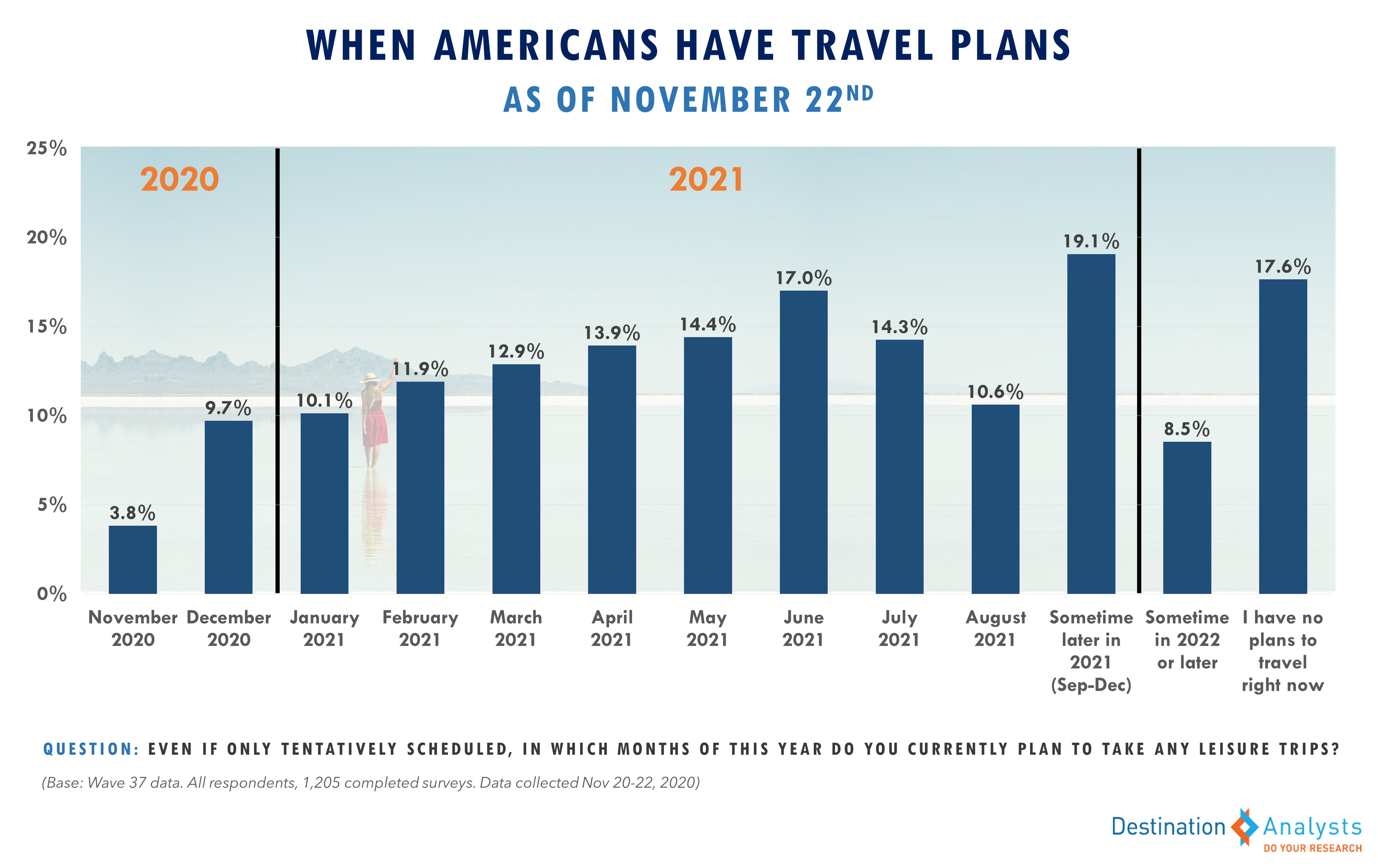

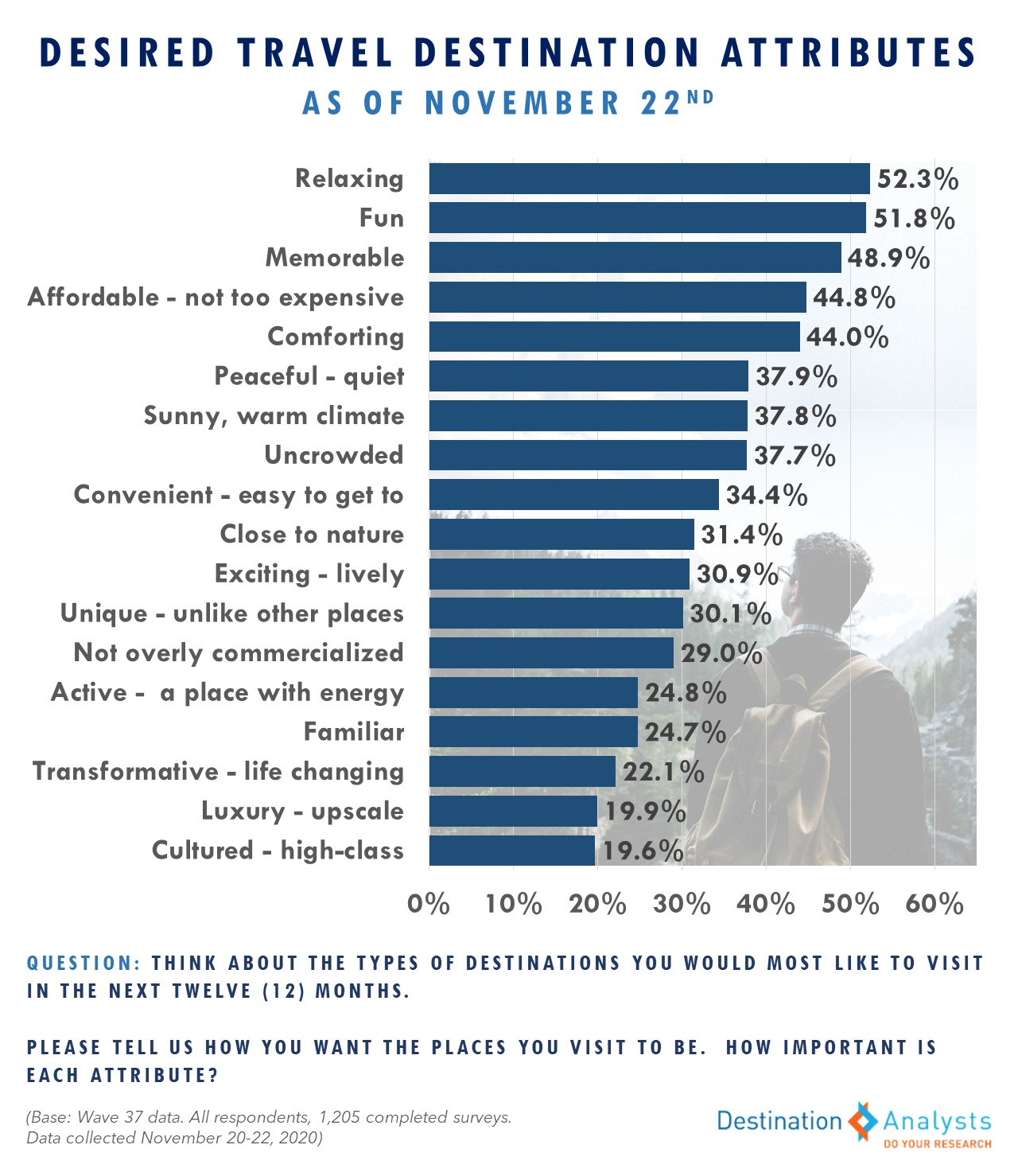

- This week 80% of American travelers have at least tentative trip plans for the future. The pandemic clearly still weighs heavy, with confidence travel can be done safely, easy cancellation policies and relaxation the top motivational attributes for taking a trip.

- However, when asked where they most want to travel to in the next 12 months, the Hot List looks nearly identical to pre-pandemic, with Florida, New York, California, Hawaii and Las Vegas coming out on top.

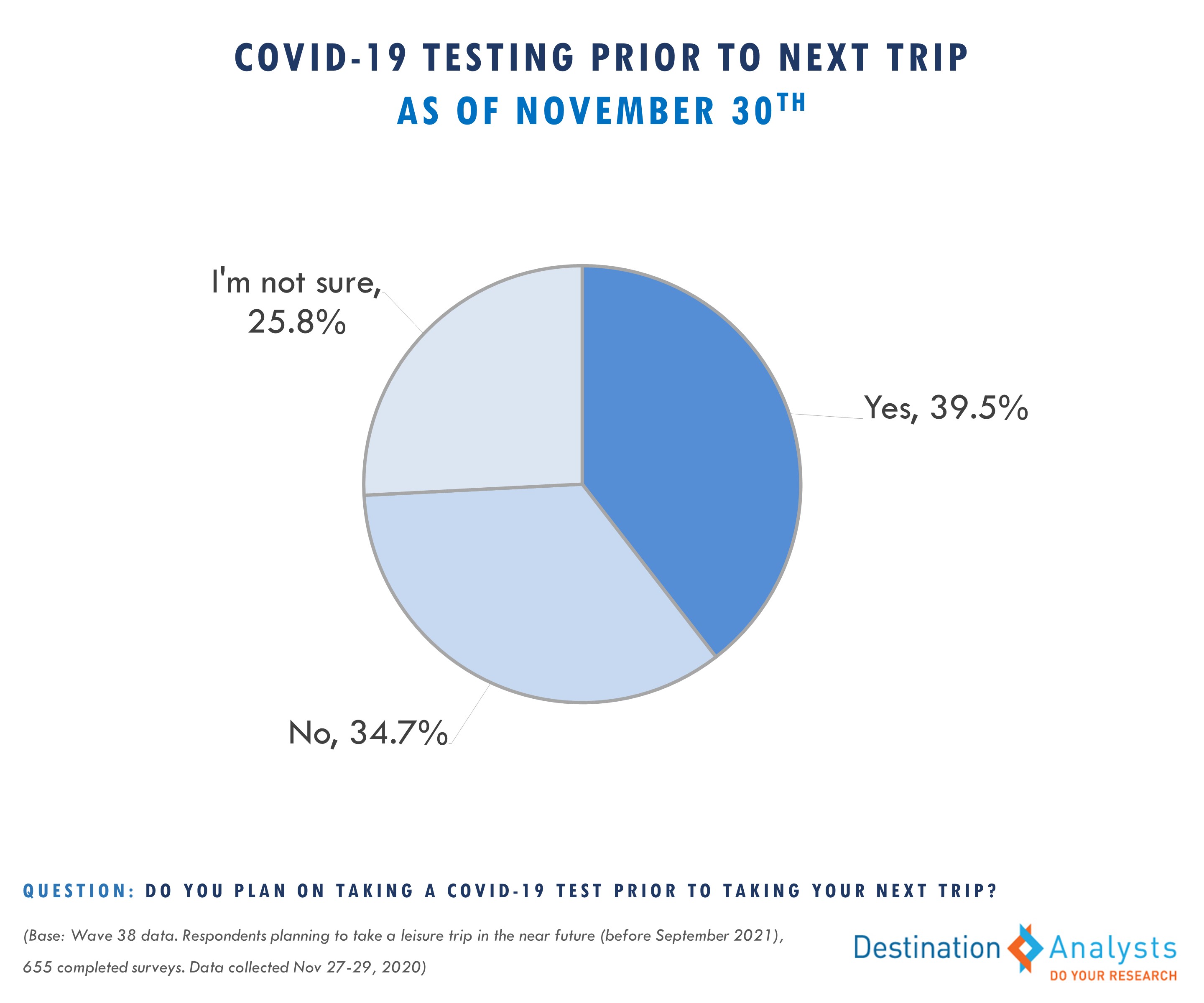

- COVID-19 testing will likely remain part of American travel behaviors for the near future.

- Don’t forget to register to attend a full update of these findings on Tuesday, December 1st at 11:00am ET.

With the fourth major travel holiday of the pandemic passing amongst a litany of restrictions and warnings, the burning question is: did Americans take trips for Thanksgiving 2020? Nearly 14% said they did—a rate similar to Labor Day weekend. About half of these Thanksgiving travelers plan to quarantine for some period after their trip while the other half will resume their normal activities. As we look ahead to December, nearly one-in-five Americans say they plan to take a Christmas holiday trip.

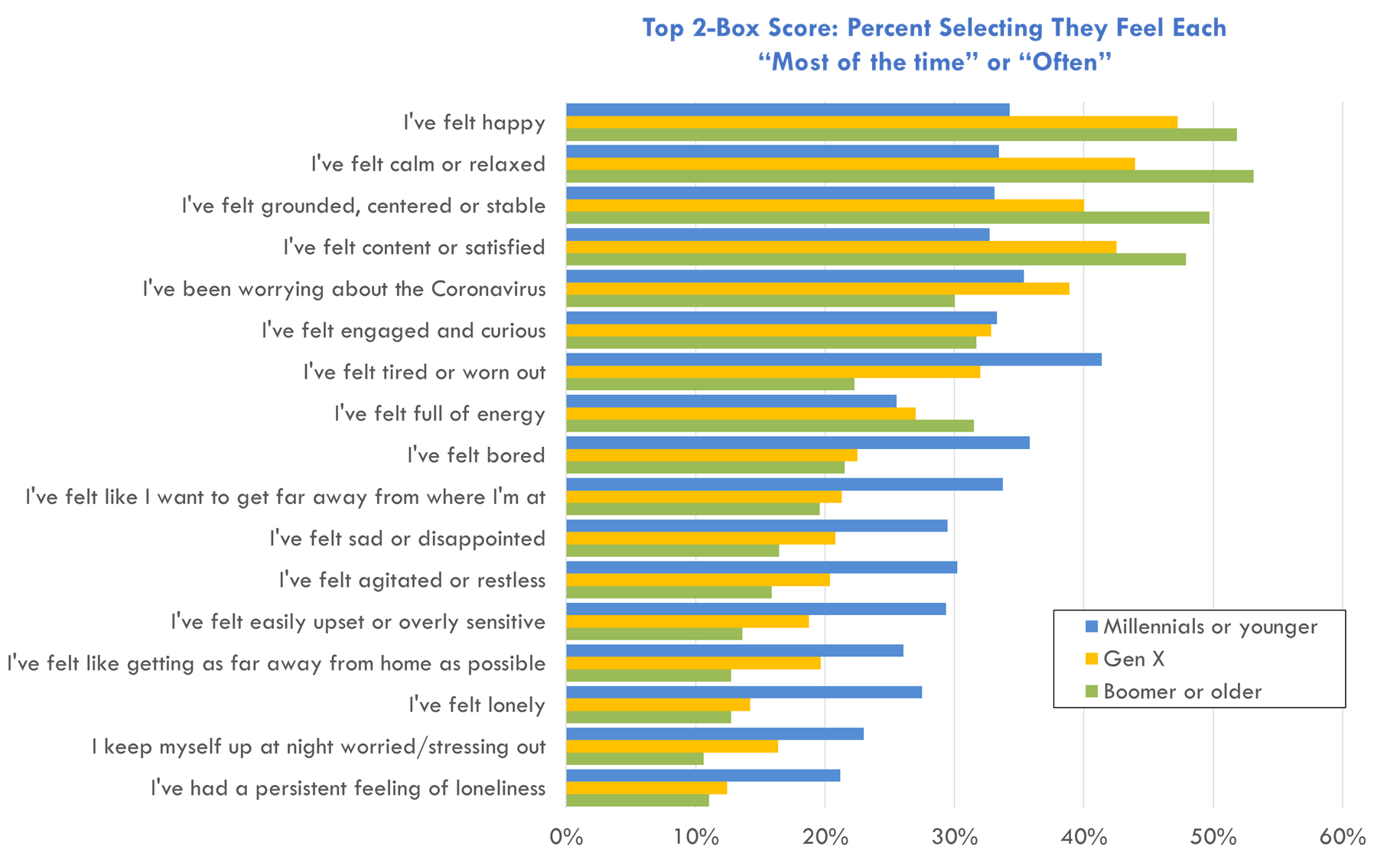

In terms of how Americans are feeling about the virus, many emotions remain largely unchanged. Anxieties about personally or loved ones’ contracting the virus and the pandemic’s impact on personal and national economics are in an elevated but stable period that have not reached the peak levels seen during the two prior surges in March and July. Over 60% of Americans continue to believe the pandemic is going to get worse in the next month.

Such concerns are still impacting Americans’ current travel marketability. Americans’ openness to travel inspiration has been on a steady decline since October 18th, when it hit a pandemic peak, but is now at 4.9 on a 0-11 scale. This week, fully half of American travelers say they have lost their interest in traveling for the time being, and 62.0% say if they were to travel right now, they wouldn’t be able to fully enjoy it.

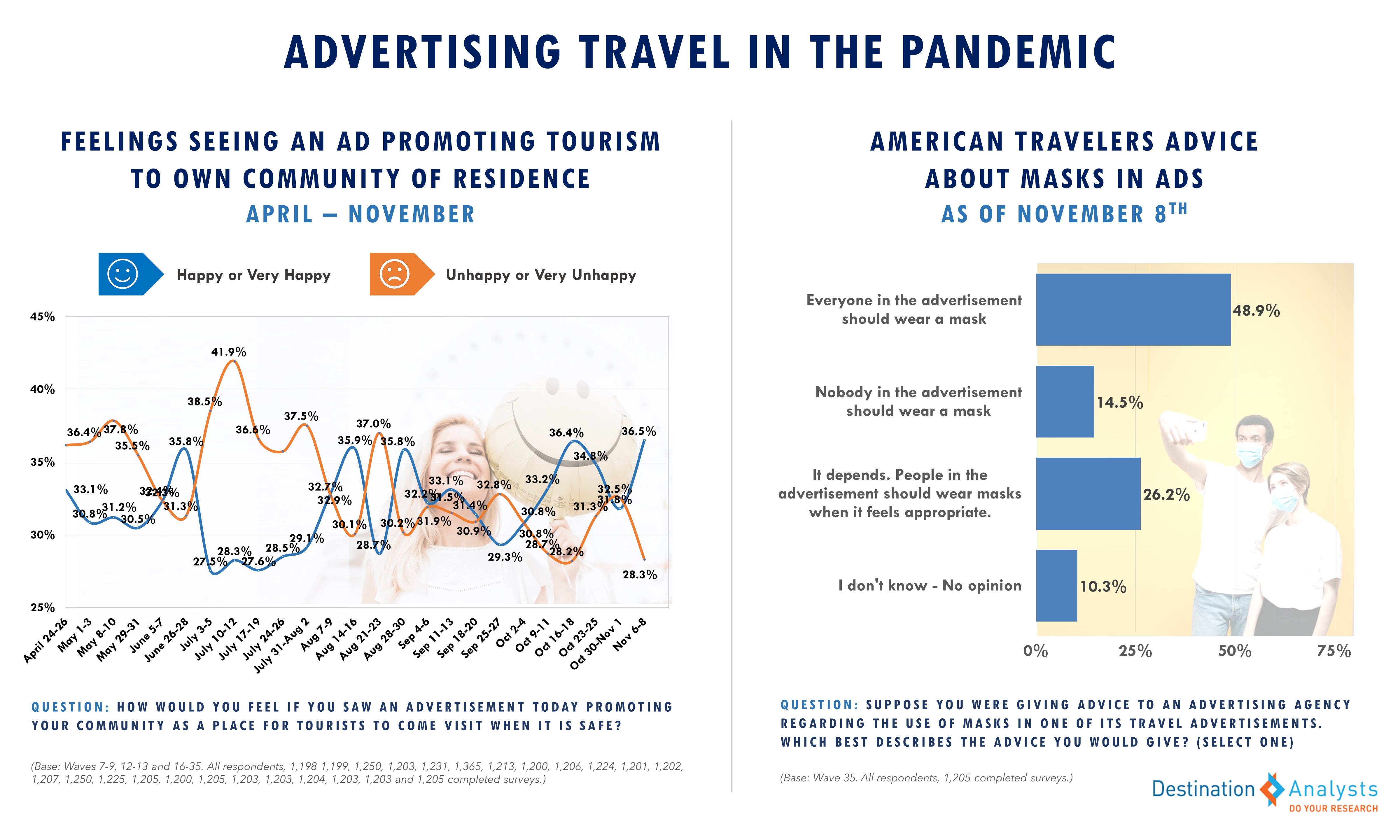

The focus of some recent news stories on pandemic behaviors in specific travel destinations is also acting as a sentiment depressant. In the past month, 35.8% of Americans report they have seen one or more COVID-19 related reports in the media about travel destinations where people were behaving in a manner that would make them feel uncomfortable visiting. Unsurprisingly, 79.8% of those who have seen reports of such behaviors say that this news makes them less interested in visiting these destinations.

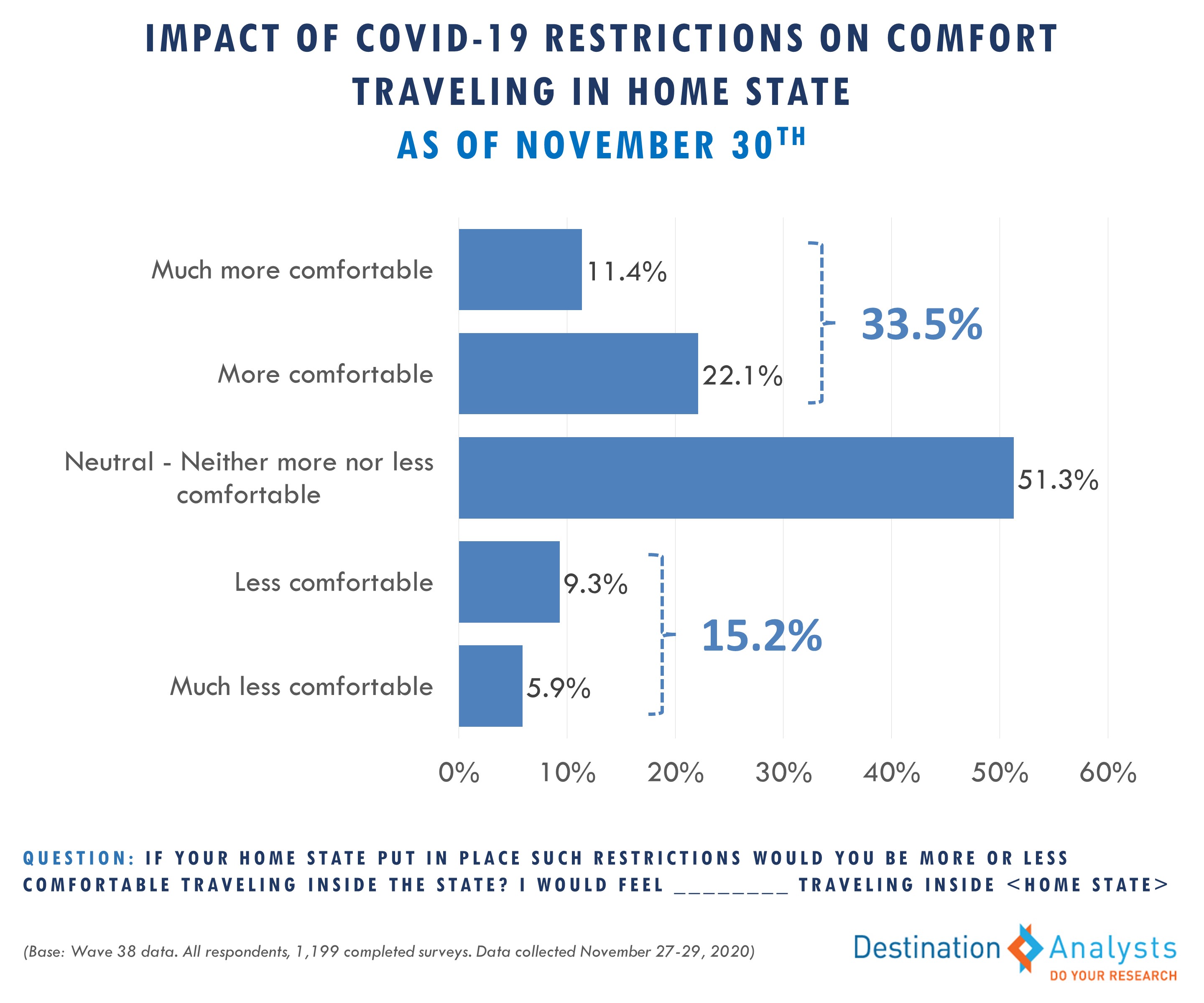

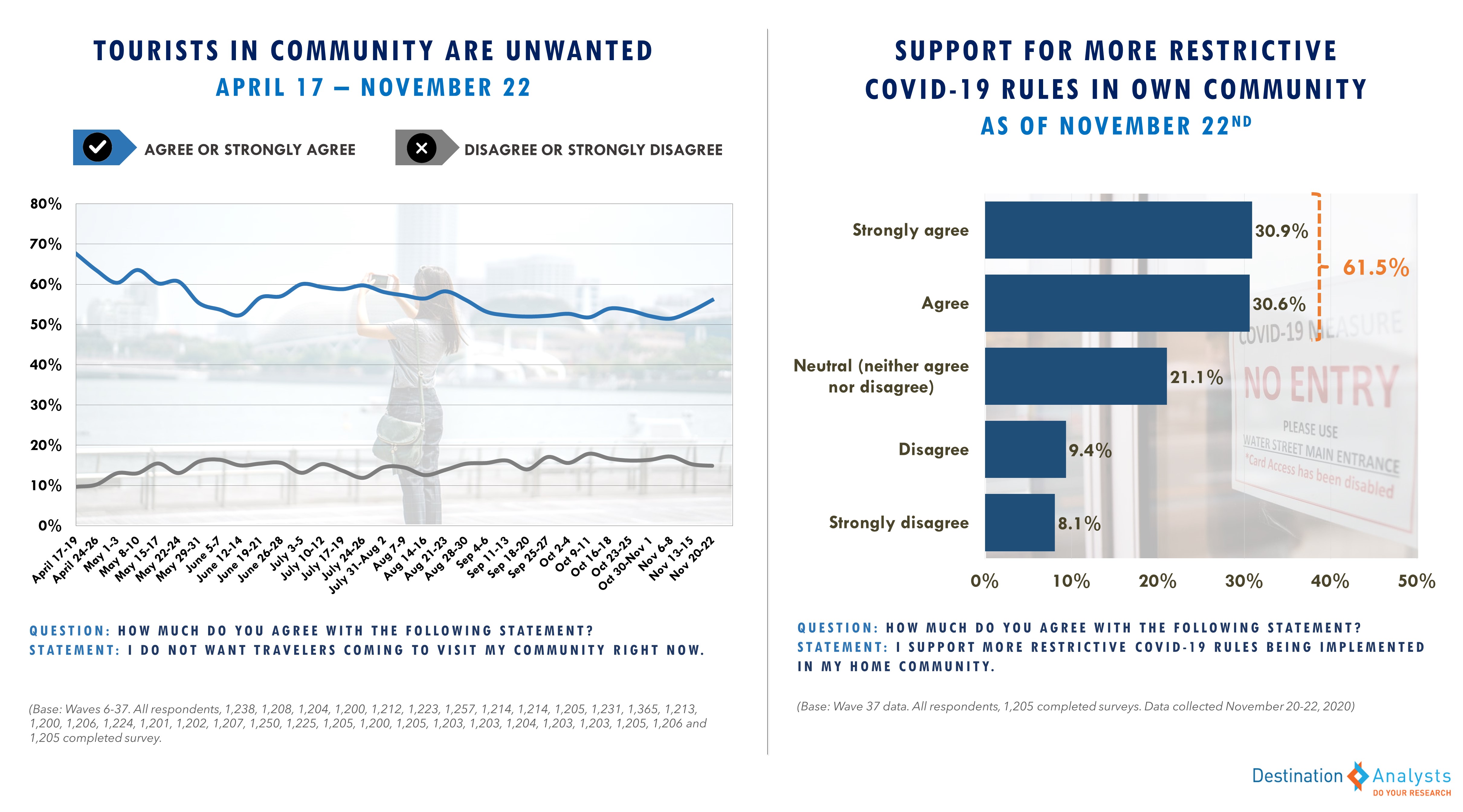

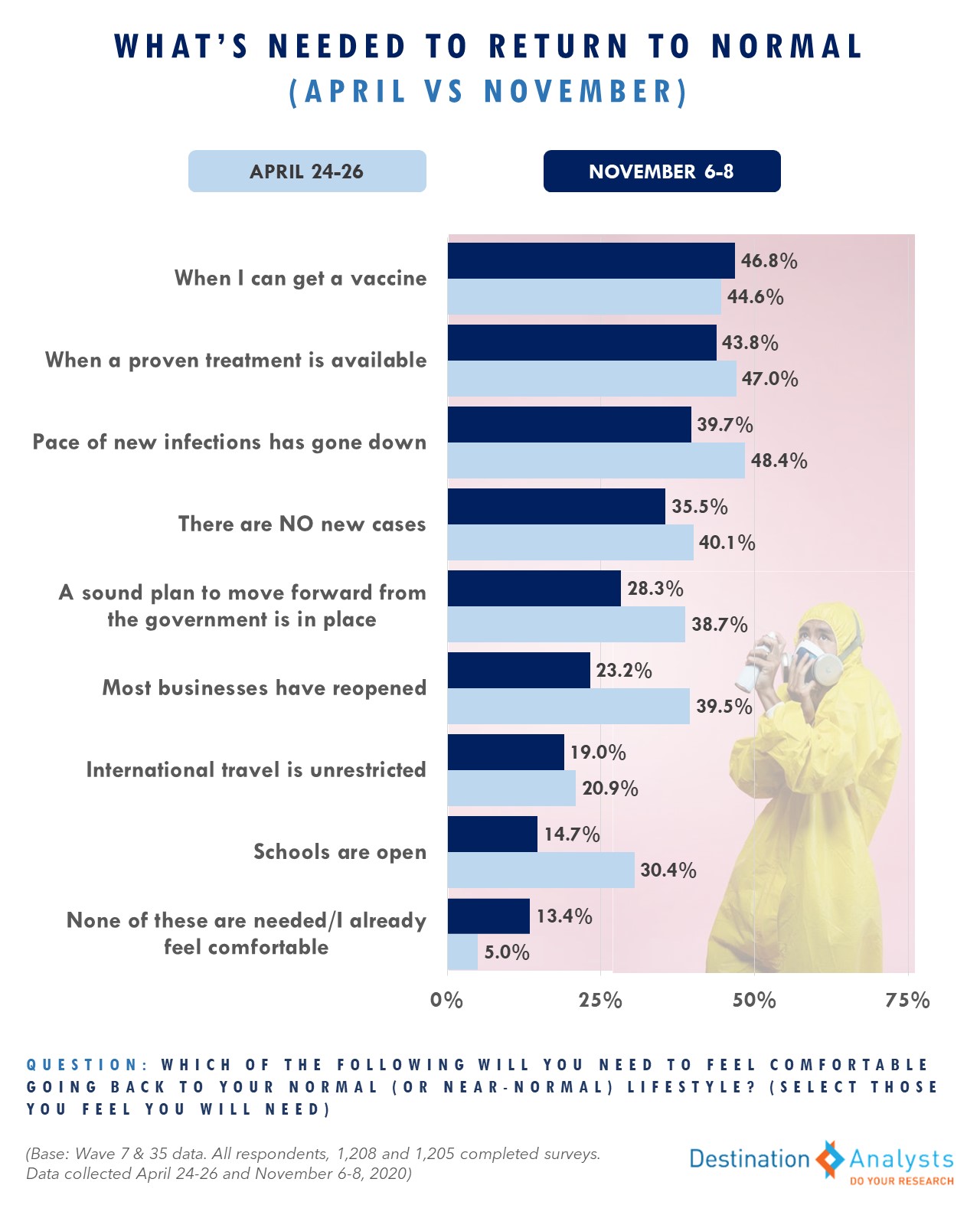

The significant increase in cases has resulted in new or returning consumer restrictions around the United States. Over half of Americans reports that their local community has instituted more restrictive COVID-19 rules in the past month and over half feel more restrictions are coming. Just under one-third say new travel restrictions have been imposed where they reside, and just over one-third say they would be more comfortable traveling within their home states under such restrictions. And while a majority agree with new/reinstituted restrictions and agree it’s important people follow government restrictions and recommendations related to controlling COVID-19, these restrictions are achieving their intention to deter travel right now. 29.4% of those with trip plans cancelled or postponed by the pandemic say this was due to government travel restrictions and over 30% said new travel restrictions make them less likely to travel even within their own states in the next two months.

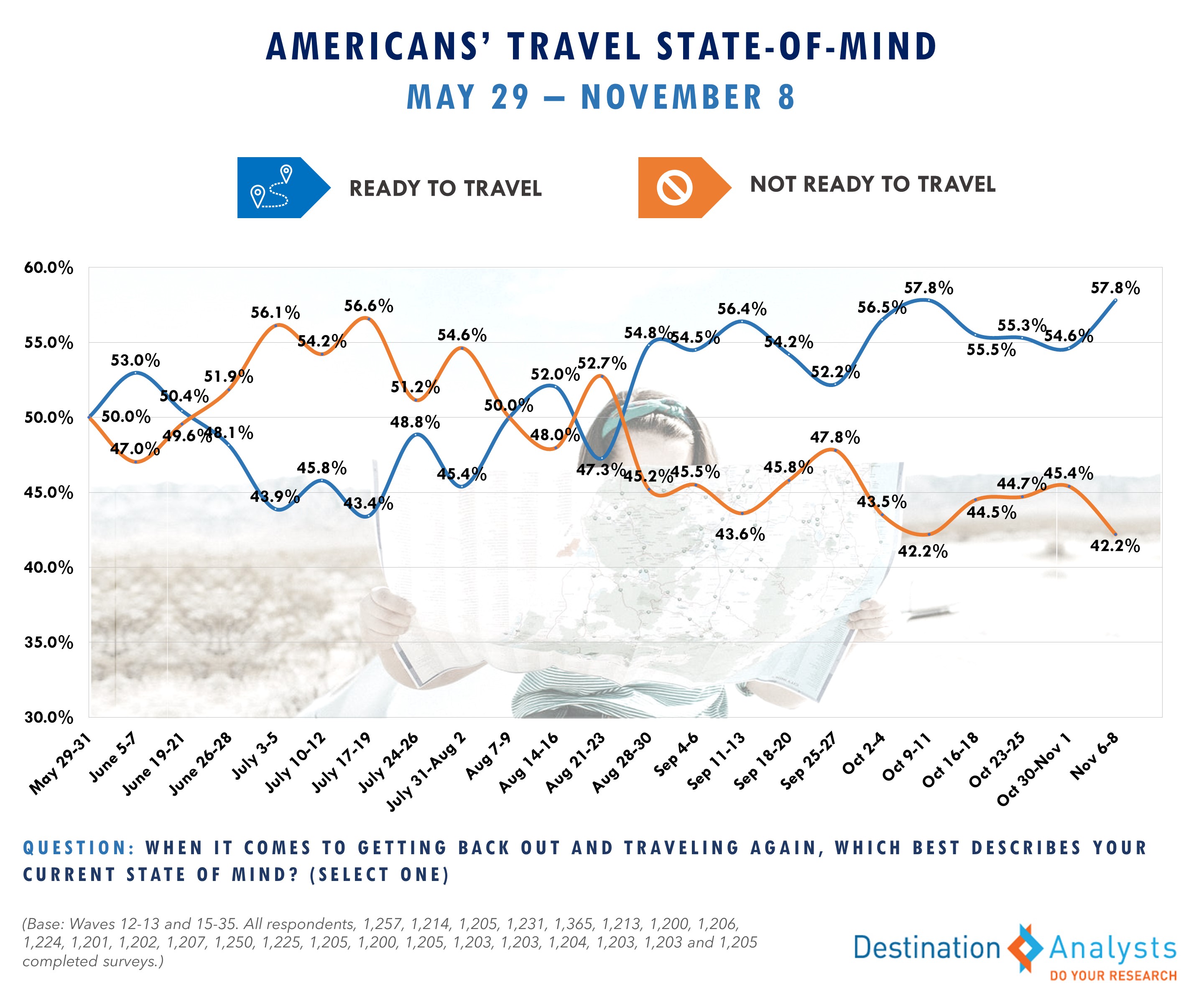

Still, the worst of this latest surge’s impact on travel behavior may be passing or at least be in a temporary reprieve. The percent of American travelers who report they have cancelled or postponed any upcoming leisure trips because of the recent increases in COVID-19 cases in the U.S. has dropped to 38.1% from 47.4% two weeks ago, and now 56.3% say recent increases in COVID-19 cases around the country have made them less likely to travel in the next three months–down from 62.8% in the same period. This week 55.5% have returned to a readiness (versus hesitation) state-of-mind about travel.

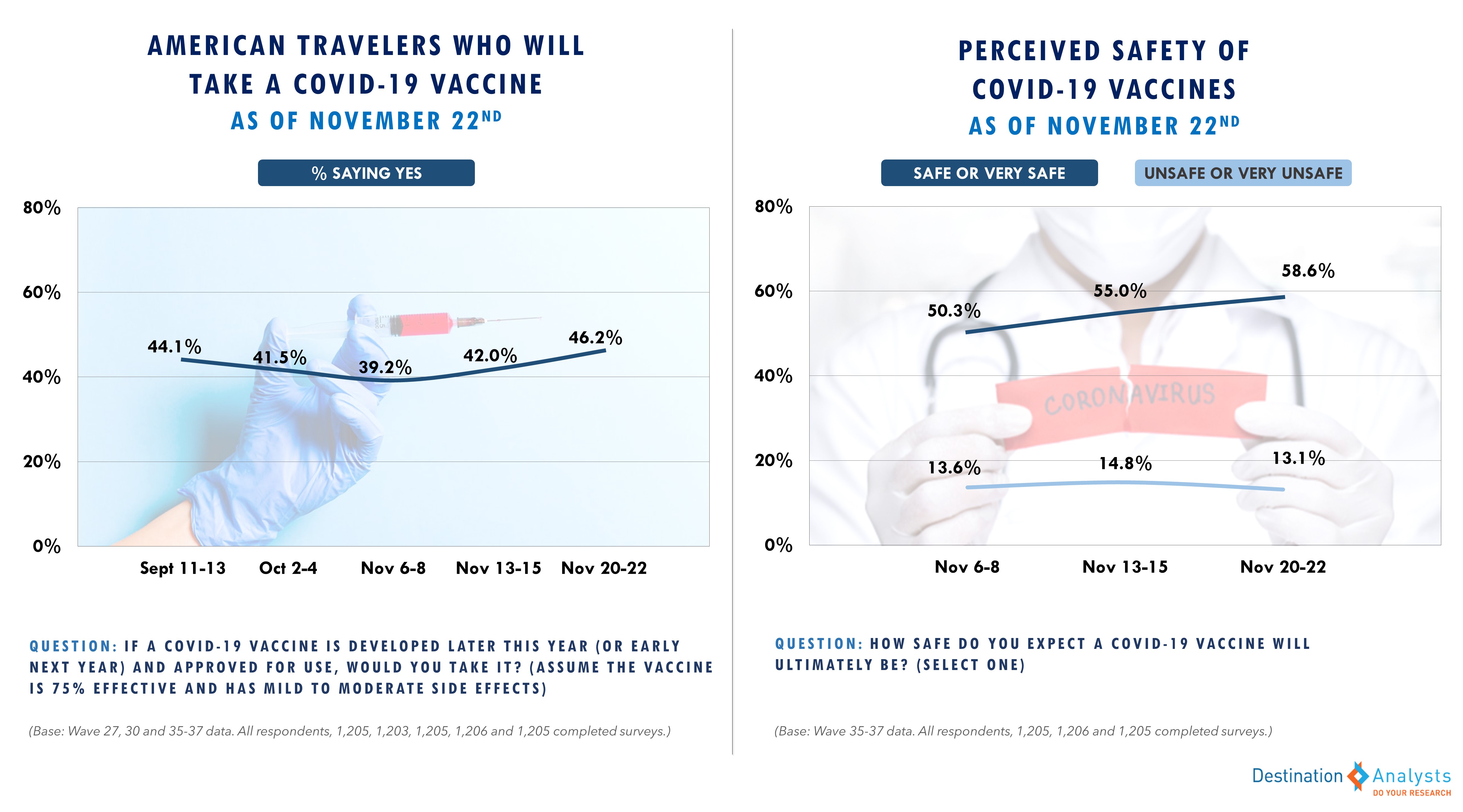

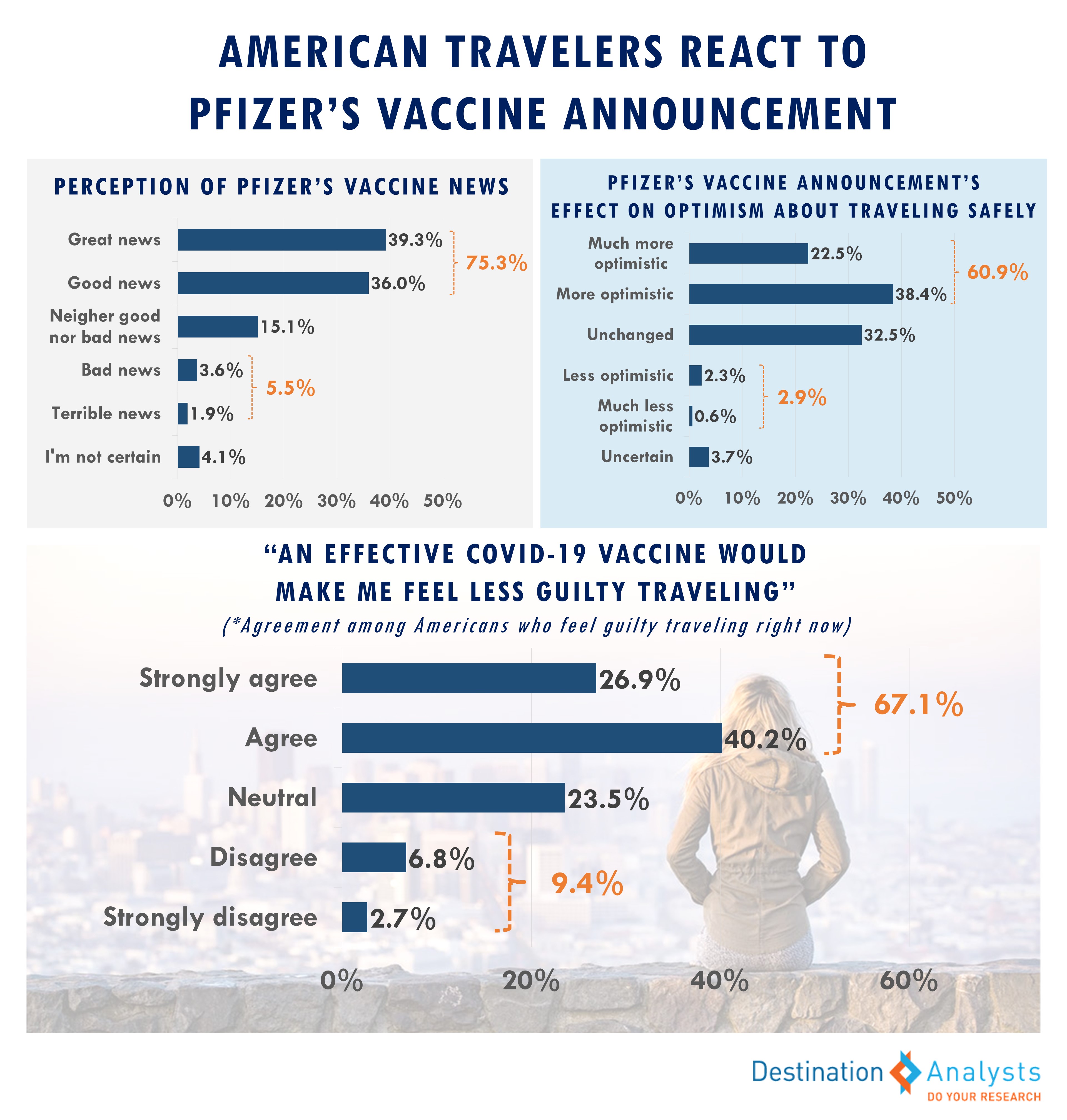

Reports of vaccine developments also continue to provide Americans hope about their travel future. A majority of Americans still feel the latest vaccine news makes them more optimistic they can travel safely in the next six months. Over 44.2% agree that their “first trip after a COVID-19 vaccine becomes available will be a vacation, likely to a place far from my home.”

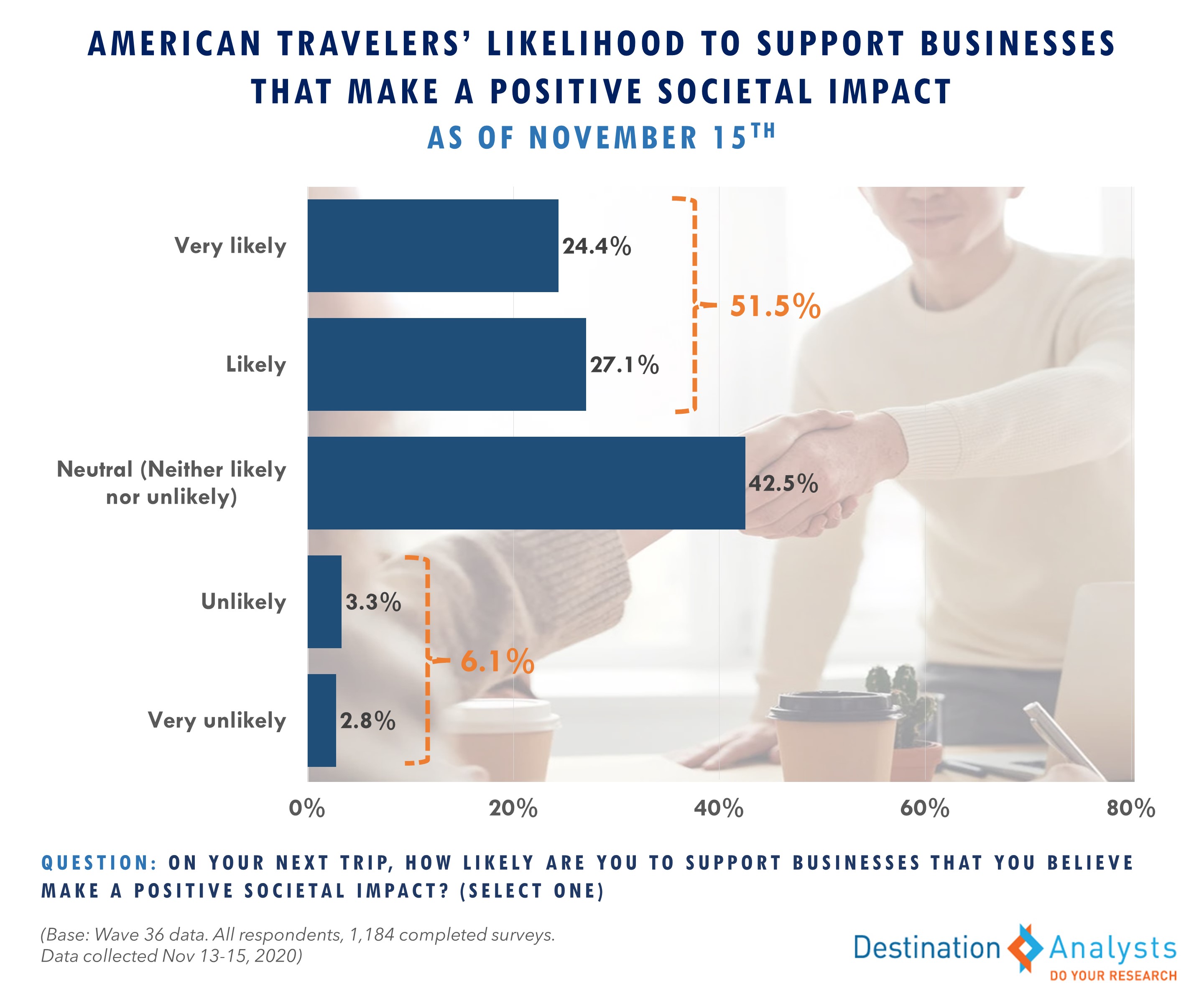

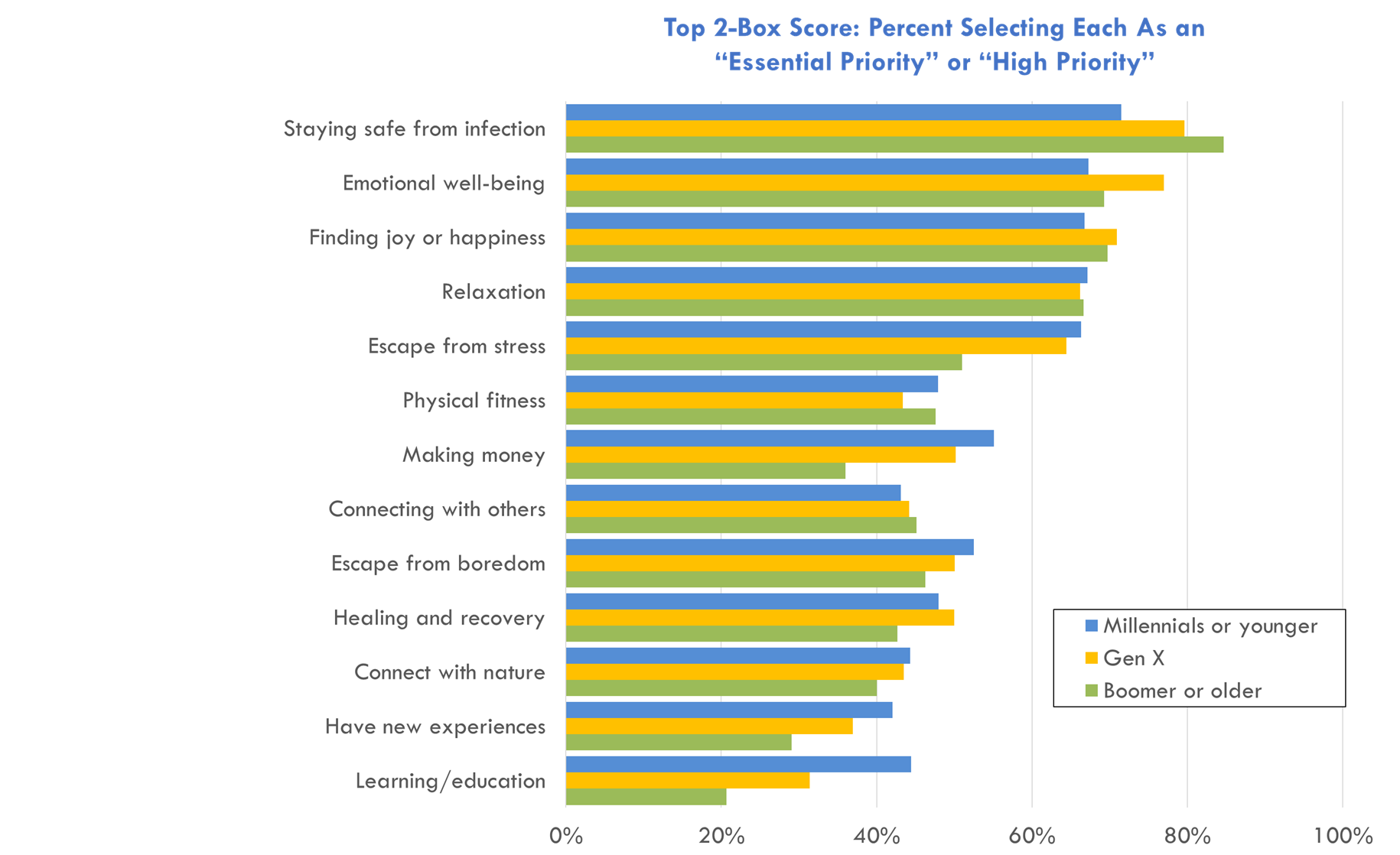

This week 80% of American travelers have at least tentative trip plans for the future. In trying to understand what will motivate Americans to take trips, we requested those we surveyed to imagine that a friend or family member came to them with an idea to travel together in the next six months, and then asked what possible attributes of their friend’s travel idea would be most persuasive to get them to go. The pandemic clearly still weighs heavy, with confidence travel can be done safely, easy cancellation policies and relaxation the top motivational attributes. However, when asked where they most want to travel to in the next 12 months, the Hot List looks nearly identical to pre-pandemic, with Florida, New York, California, Hawaii and Las Vegas coming out on top.

COVID-19 testing will likely remain part of American travel behaviors for the near future. 28.7% of those who have traveled by air during the pandemic said they tested themselves after their most recent commercial airline trip. Nearly 40% of Americans say they plan on taking a COVID-19 test prior to taking their next trip.