More Americans feel ready to travel and are exhibiting strong conviction about their upcoming travel plans, although safety remains an integral part of their trip decision-making process.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic. The findings presented below represent data collected June 5th-7th.

Key Findings to Know:

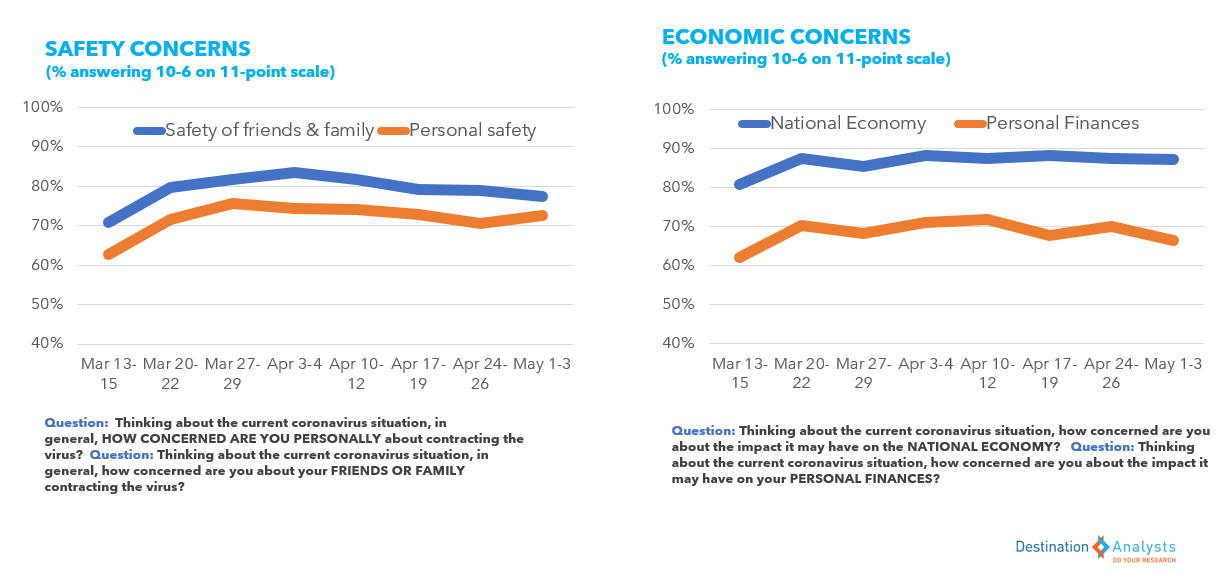

- American travelers’ feelings about their health, financial and travel safety continue to improve.

- More Americans report they are already traveling or ready to travel.

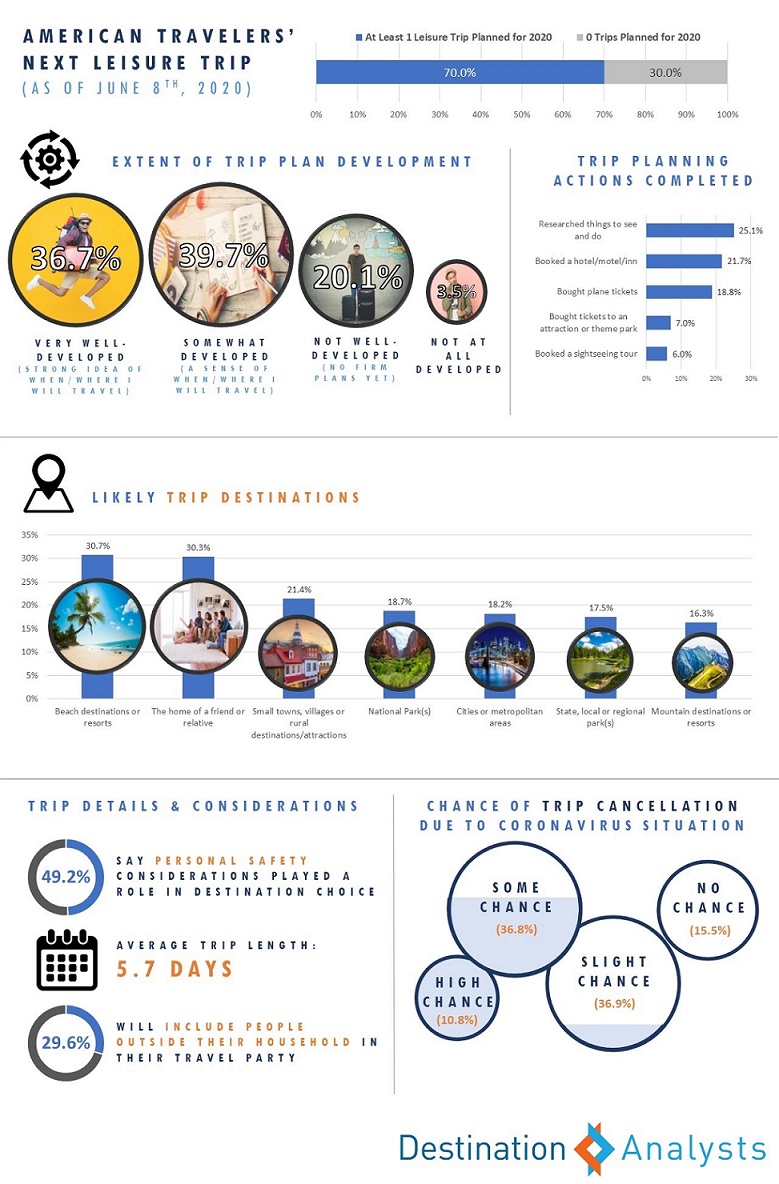

- 70 percent will take at least one leisure trip in the remainder of 2020.

- Over three-quarters have a developed sense of where and when their next leisure trip will take place and the majority say there is little chance of cancellation.

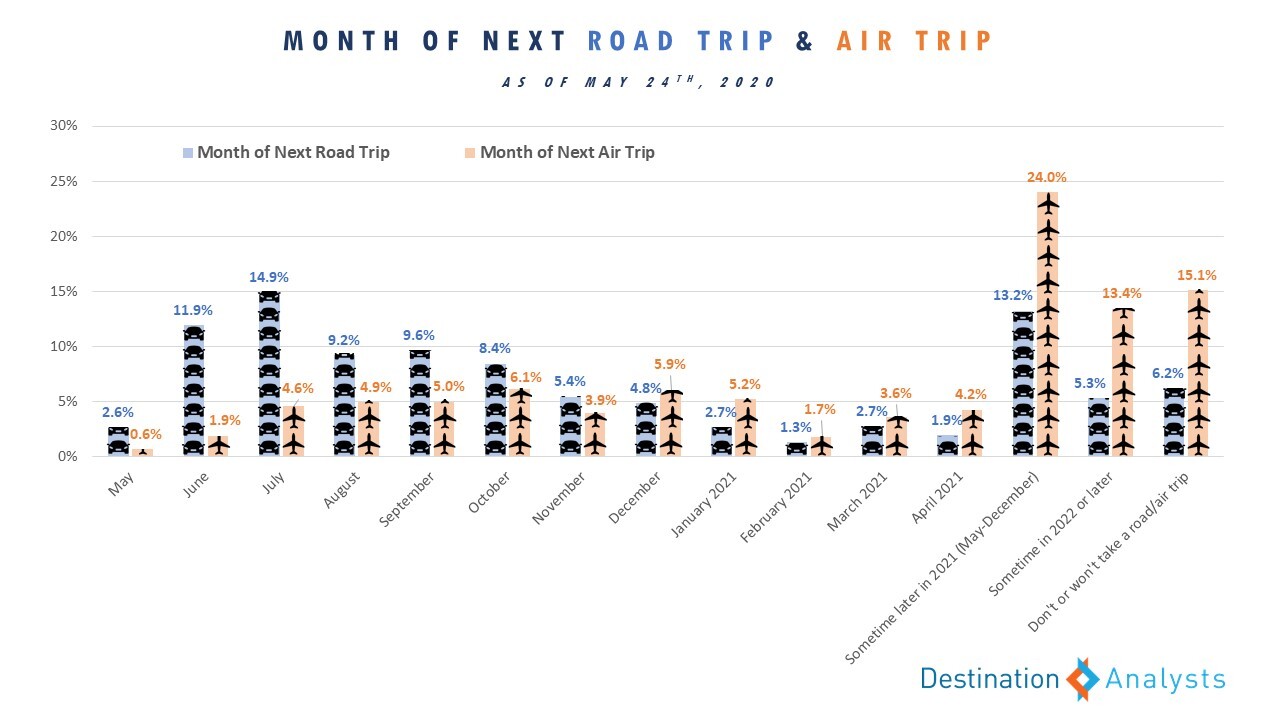

- 40 percent say their next road trip will take place this Summer.

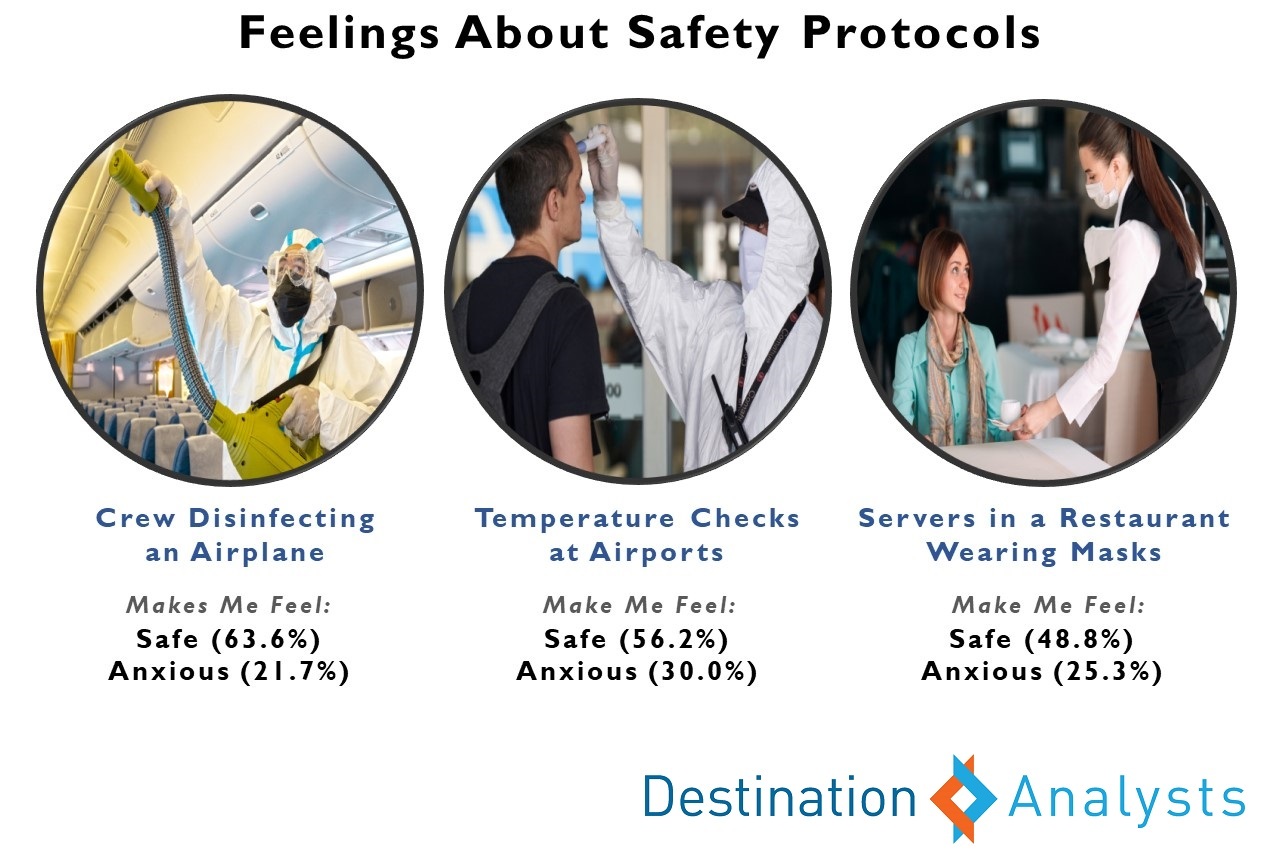

- Safety considerations are still important to travelers’ decision-making, from which destination they choose to visit to the hotels they select.

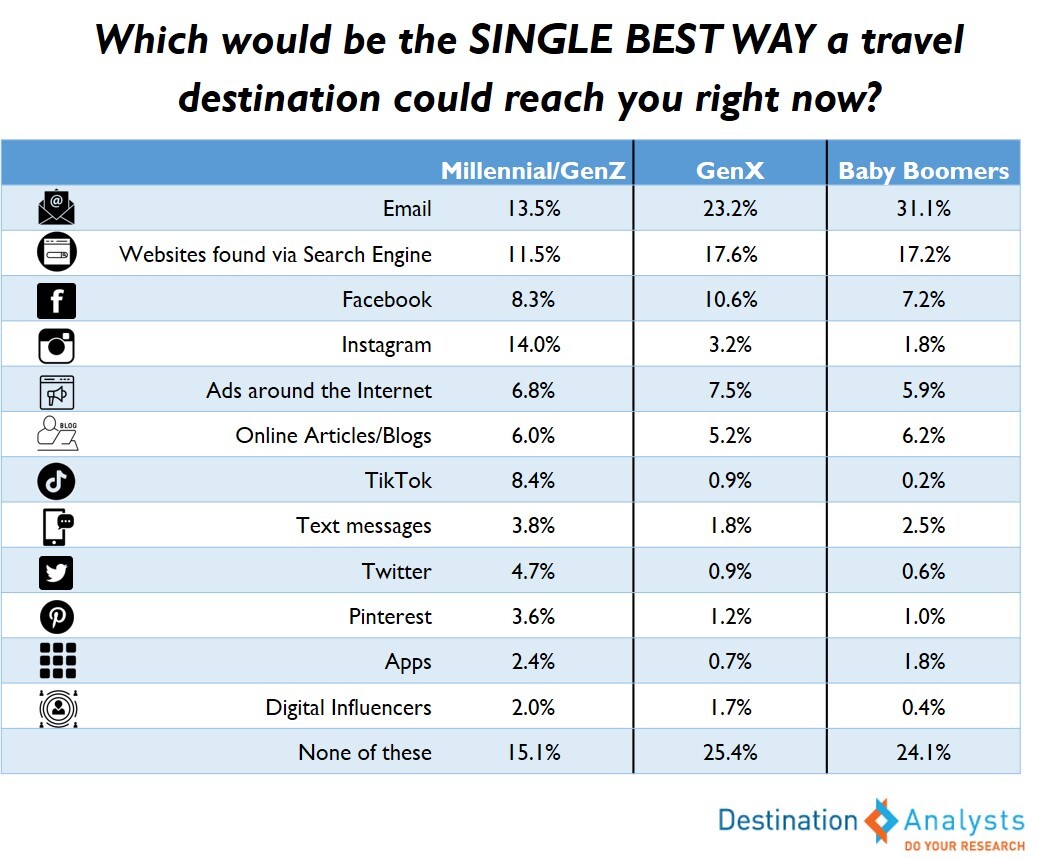

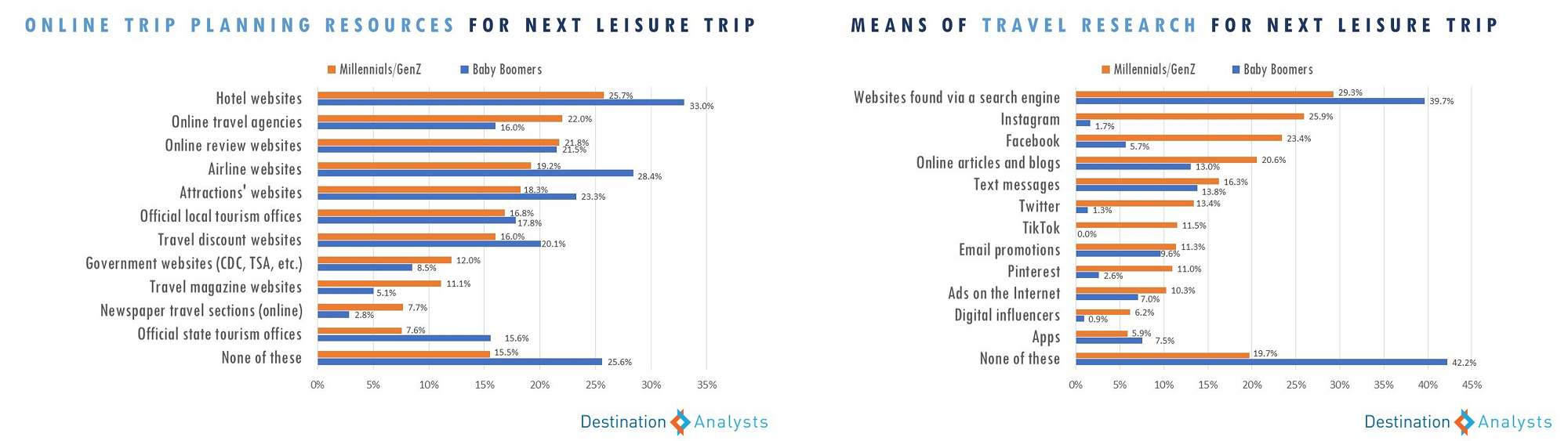

- Younger generations are likelier to use a diverse set of social media and digital tools for their trip research, while Baby Boomers are more likely to concentrate their travel research activity on web searches.

- Four in ten conventions/conference travelers would be happy to attend a convention in the Fall.

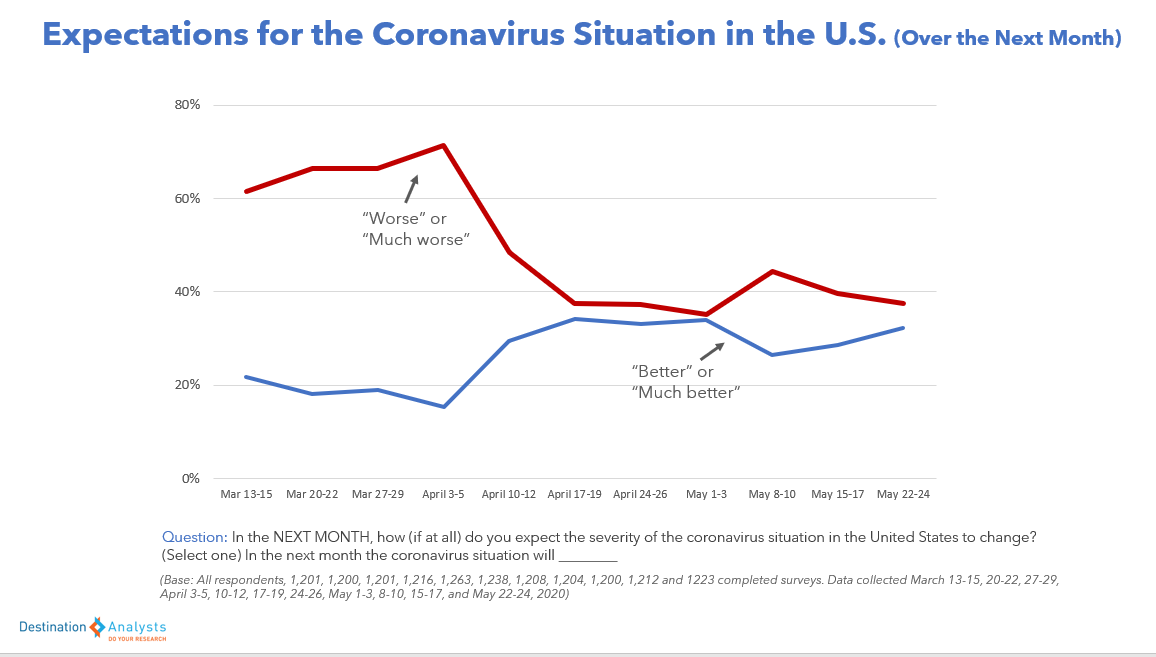

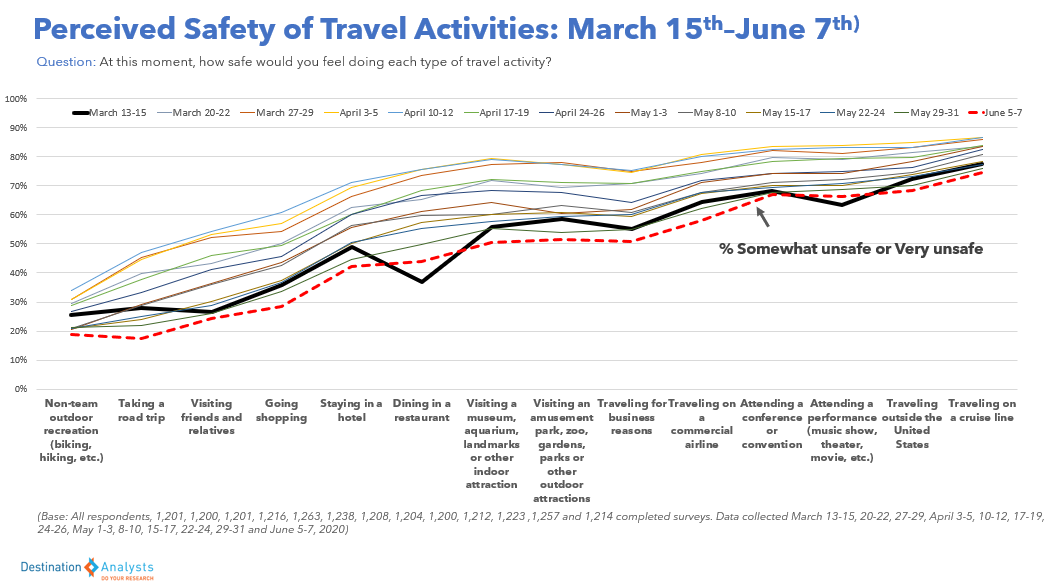

American travelers’ feelings about their health and financial safety continue to improve and perceptions of the safety of travel related activities are now better than they were in mid-March.

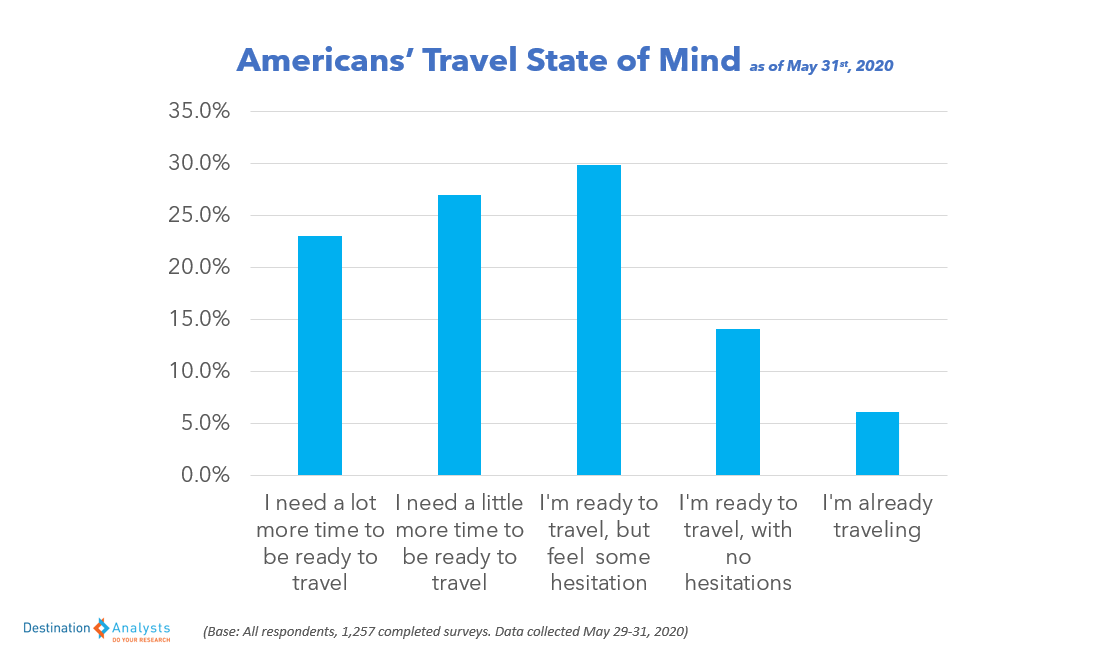

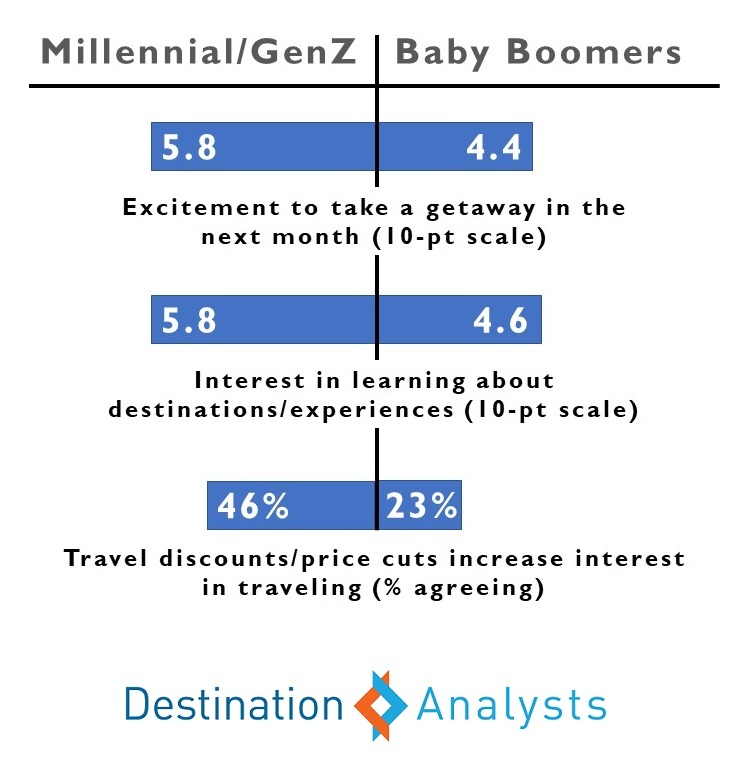

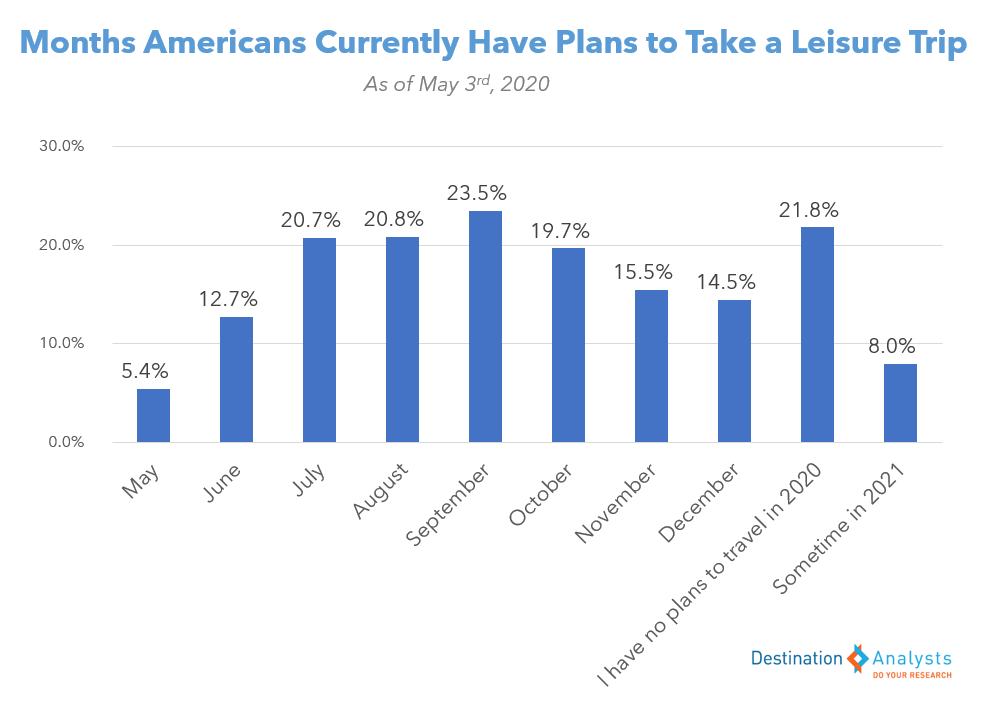

More Americans report they are already traveling or feel ready to travel compared to last week, and 70 percent continue to say they will take at least one leisure trip in the remainder of this year. Younger travelers —those in the Millennial and GenZ generations—and travelers in the Southern U.S. continue to be most excited to travel in the next month and open to travel inspiration.

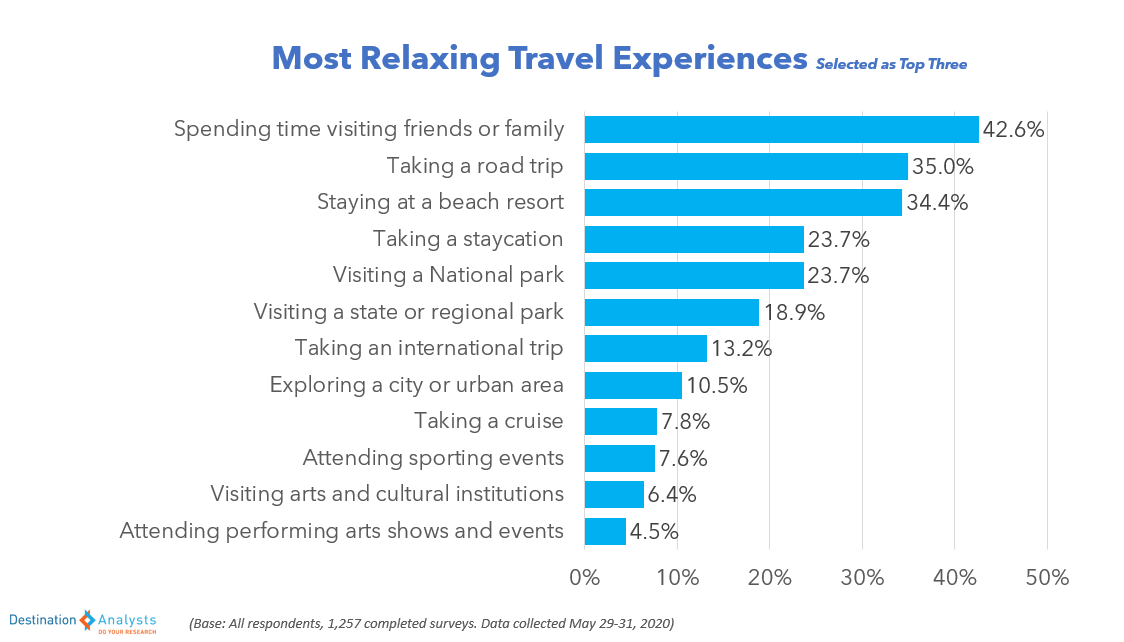

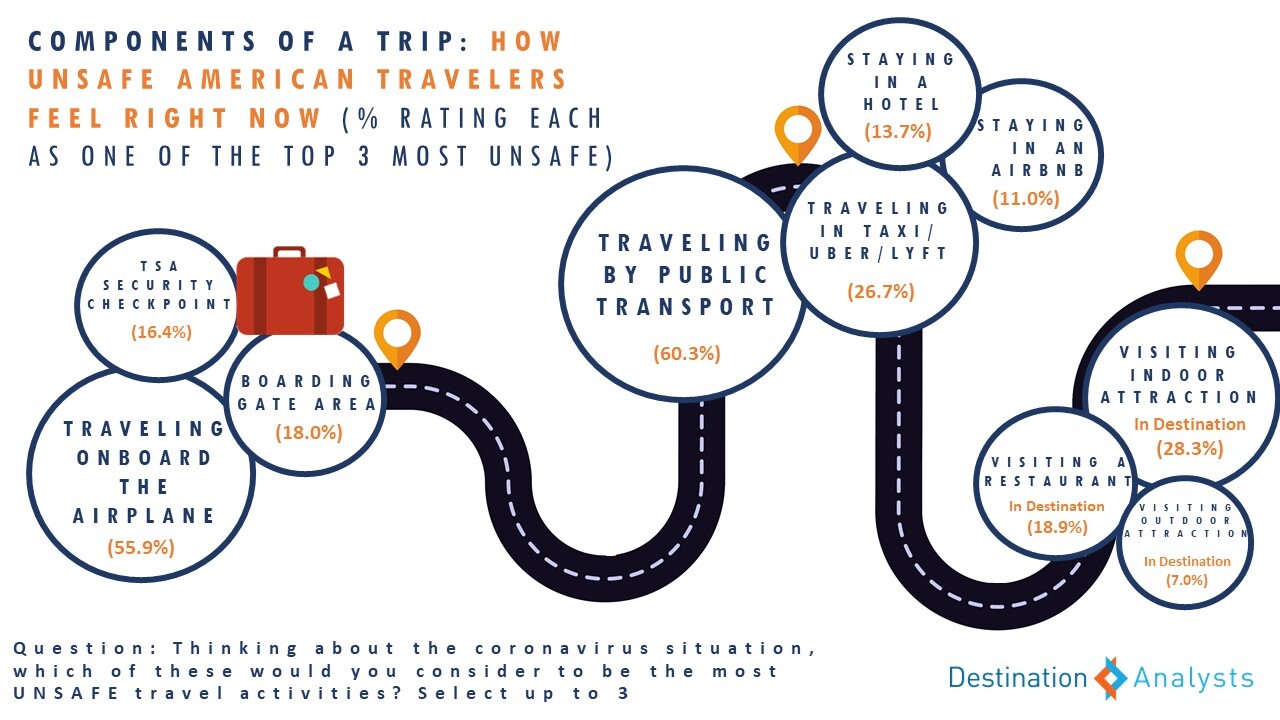

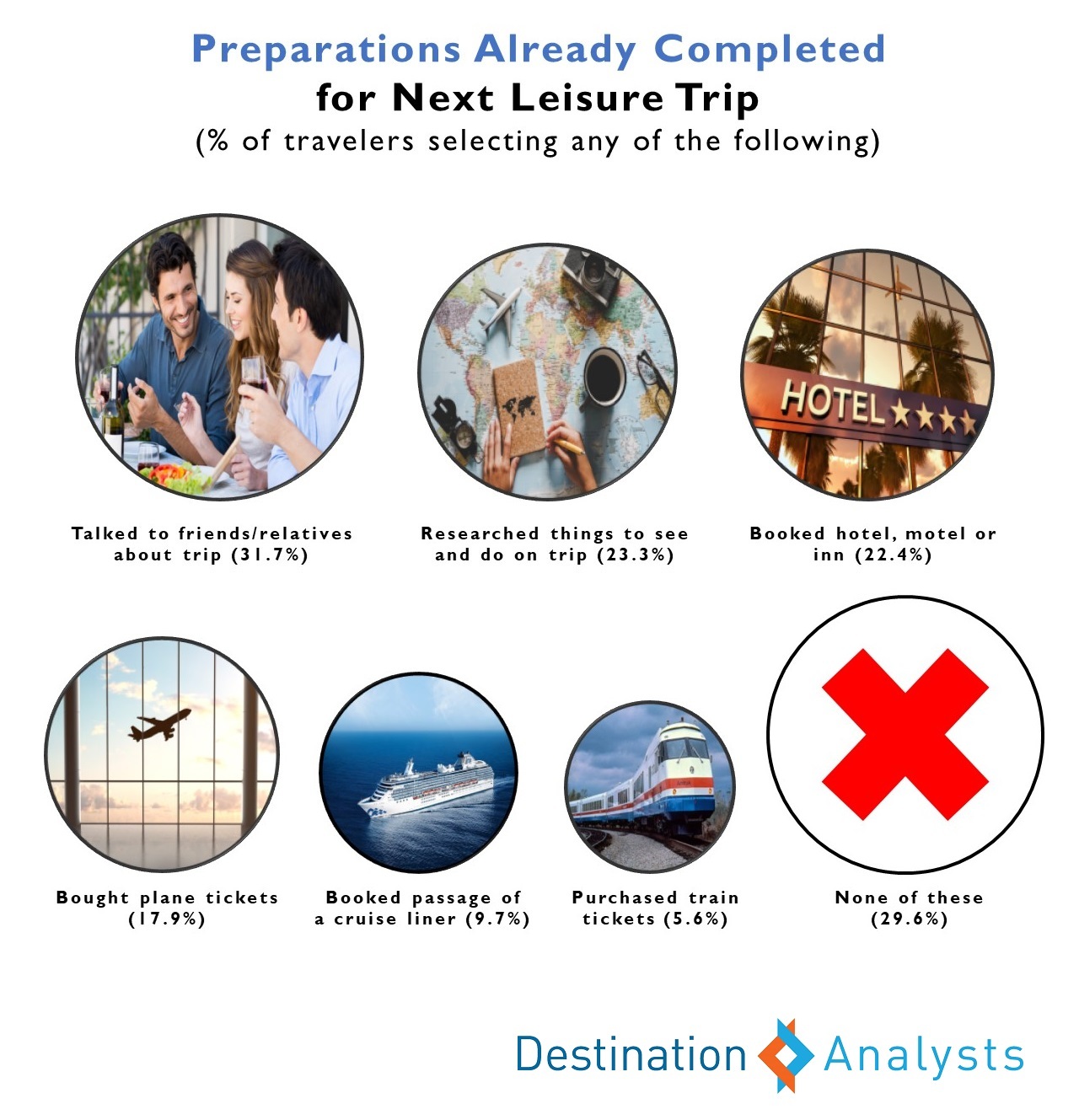

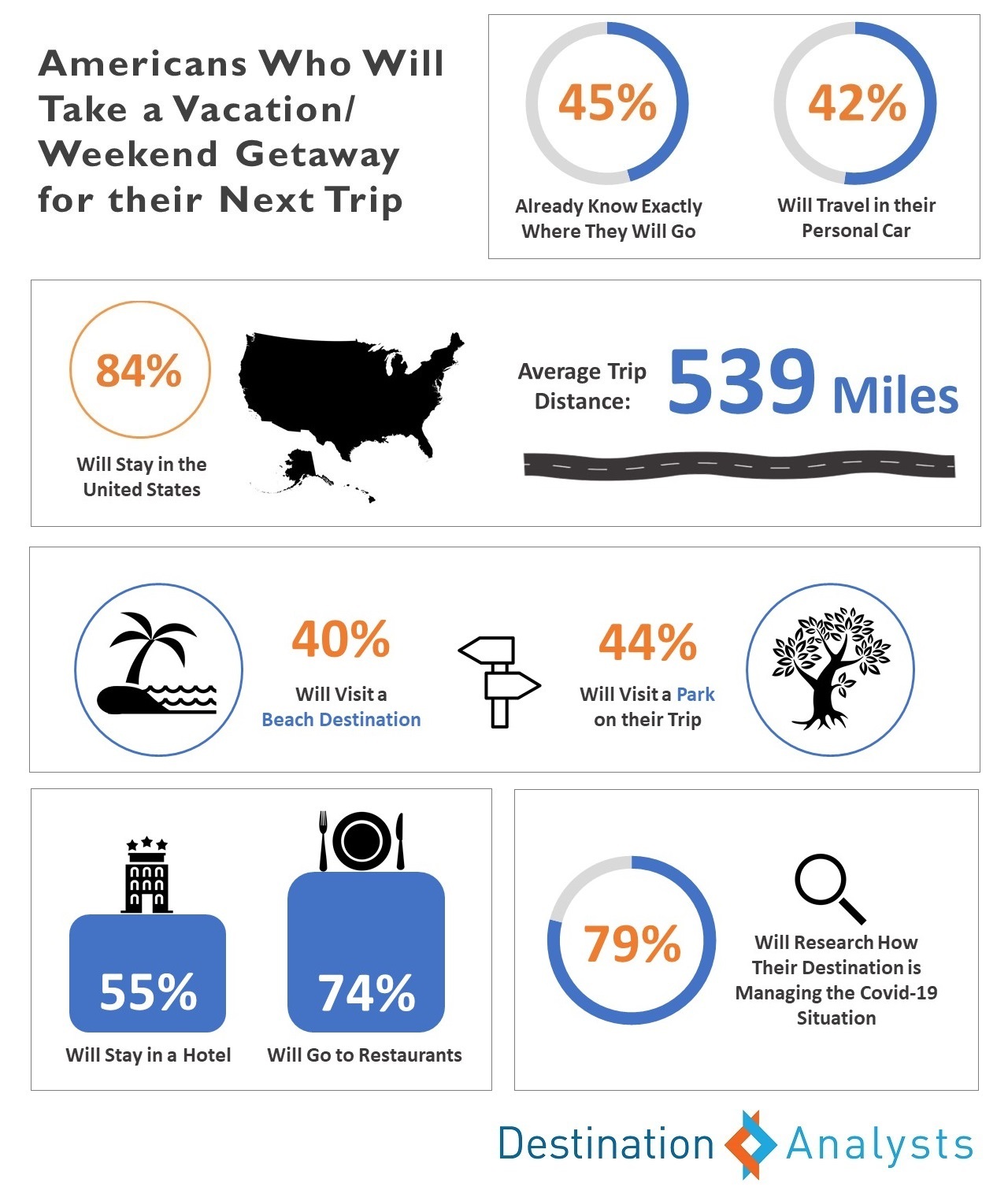

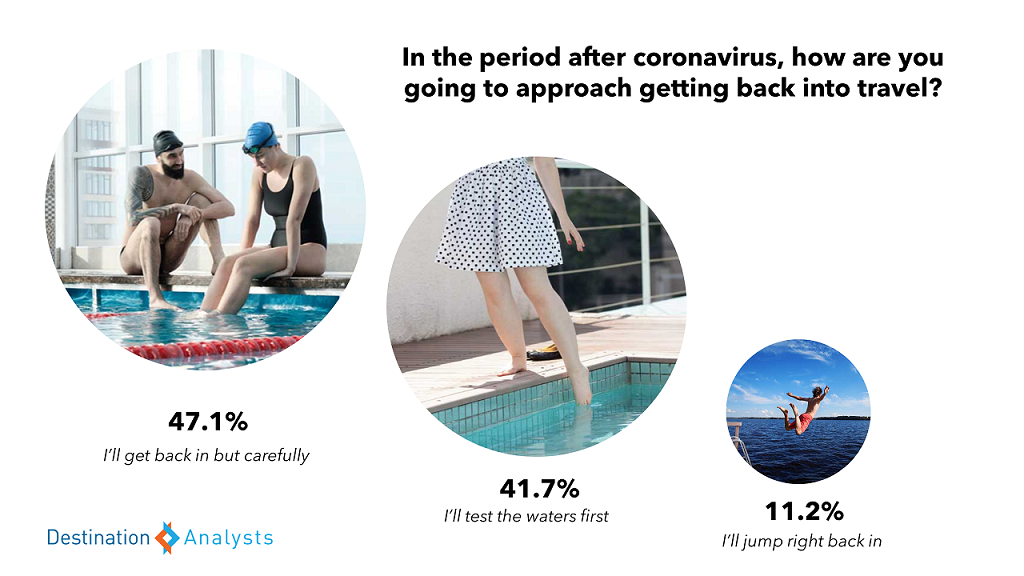

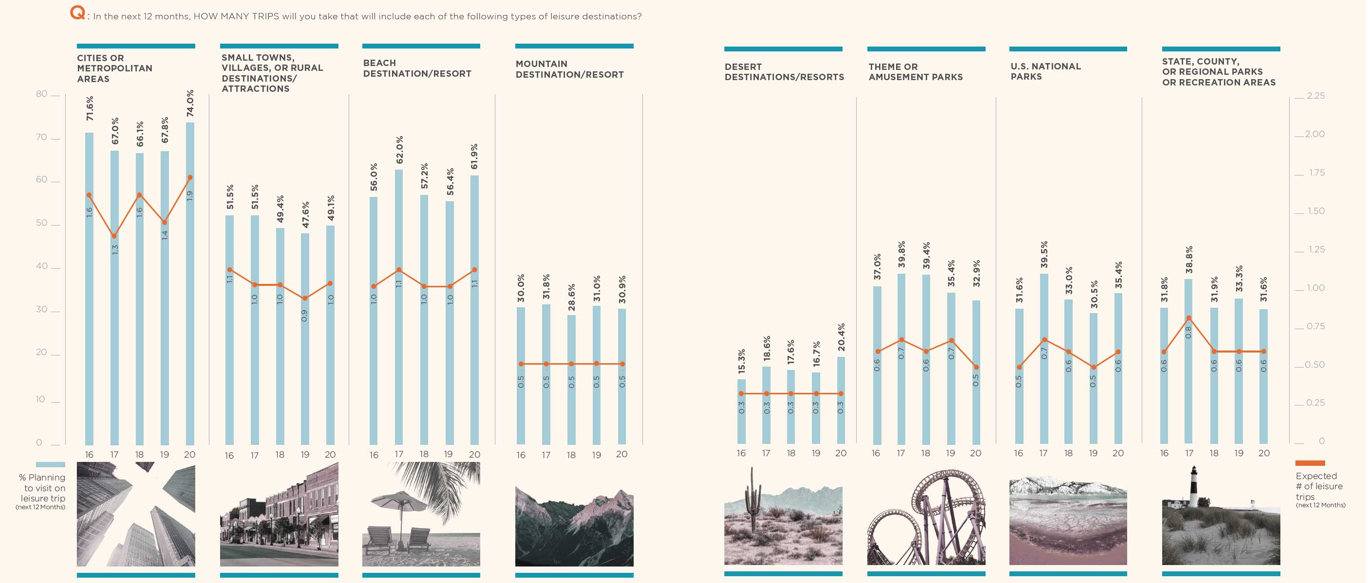

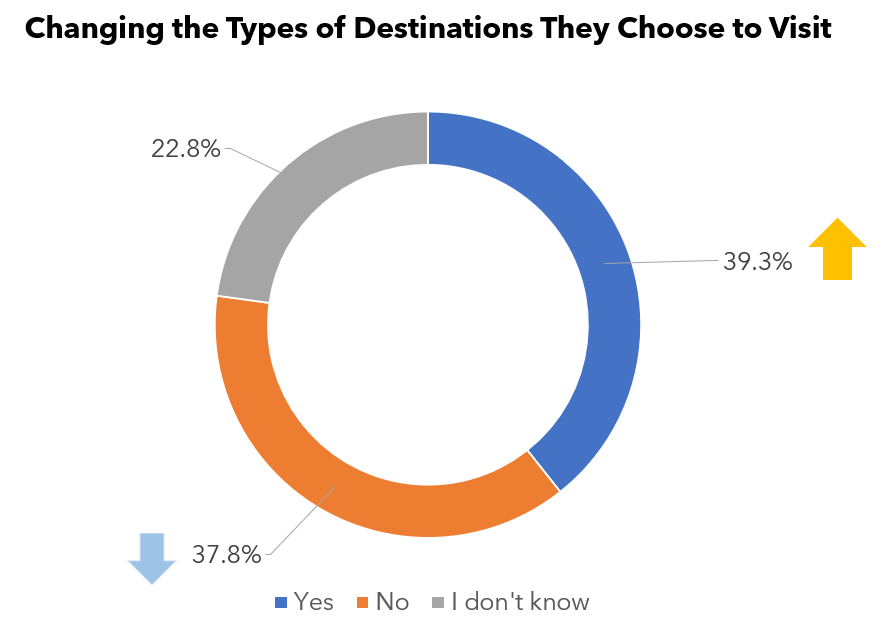

Americans are also exhibiting conviction about their leisure travel plans, rather than tentativeness. In looking at their next leisure trip, over three-quarters (76.4%) have a developed sense of where and when this travel will take place. There is also a notable degree of confidence that this trip will happen, in spite of coronavirus issues that may arise: 52.4% say there is absolutely no—or only a slight—chance they will cancel this next trip. Nevertheless, safety considerations are still important to travelers’ decision-making, from which destination they choose for this trip, to their selection of lodging and transportation options. The majority of American travelers continue to opt for beach, outdoor and rural type experiences for their next leisure trips.

For their research and planning of this next trip, American travelers are now largely looking directly to travel providers and travel content producers rather than sources like the CDC—perhaps an additional display of their confidence about navigating the coronavirus situation. Younger generations are likelier to use a diverse set of social media and digital tools for their travel research for this next trip, while Baby Boomers are more likely to concentrate their travel research activity on web searches.

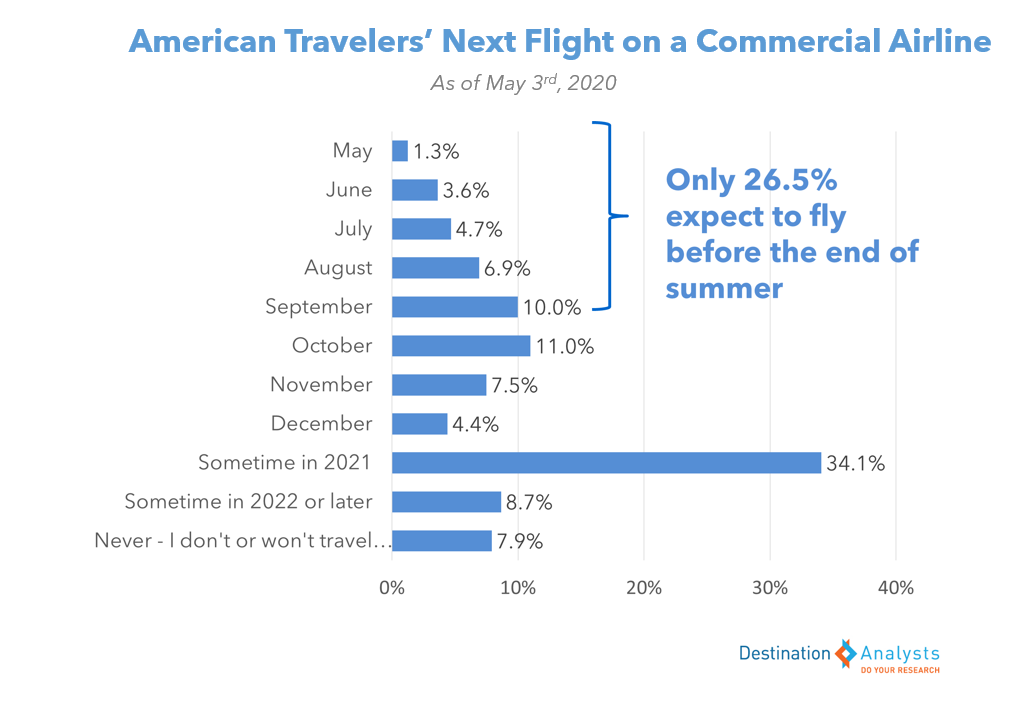

Many American travelers continue to say their next road trip will be this summer, with 40% listing June, July or August as their timing. About half that number say their next trip by air will occur in the summer; 30% say their the next commercial airline trip will be September or later in 2020, with the remainder putting it off until 2021 or later. This week, an increased number of Americans reported they have at least tentative leisure trip plans in the months of June, August, October, November and December.

To understand how employee feelings may play into when business and convention travel return, this week a series of questions were asked to gauge emotions around this type of travel in the Summer and Fall. Nearly half of employed Americans reported they would be unhappy if their employer asked them to take an out-of-state business trip in July; meanwhile, about a quarter would be happy to. However, 40.8% of those that typically travel for conventions and conferences said they would be happy if they were asked to attend a convention in the Fall (35.3% said they would be unhappy). As of this week, 25.0% of convention/conference travelers say they have at least a tentative plan to attend a group meeting in the remainder of 2020.