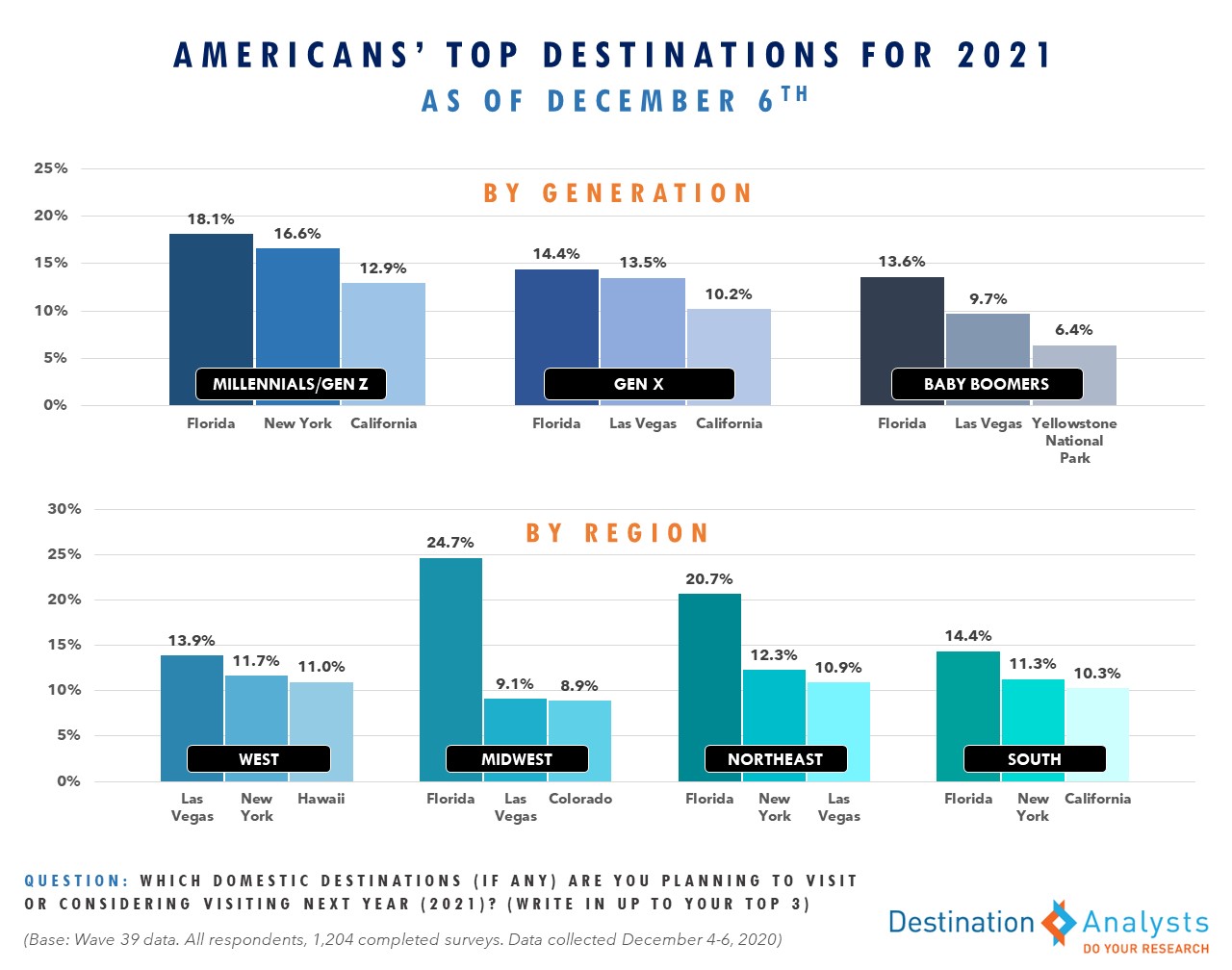

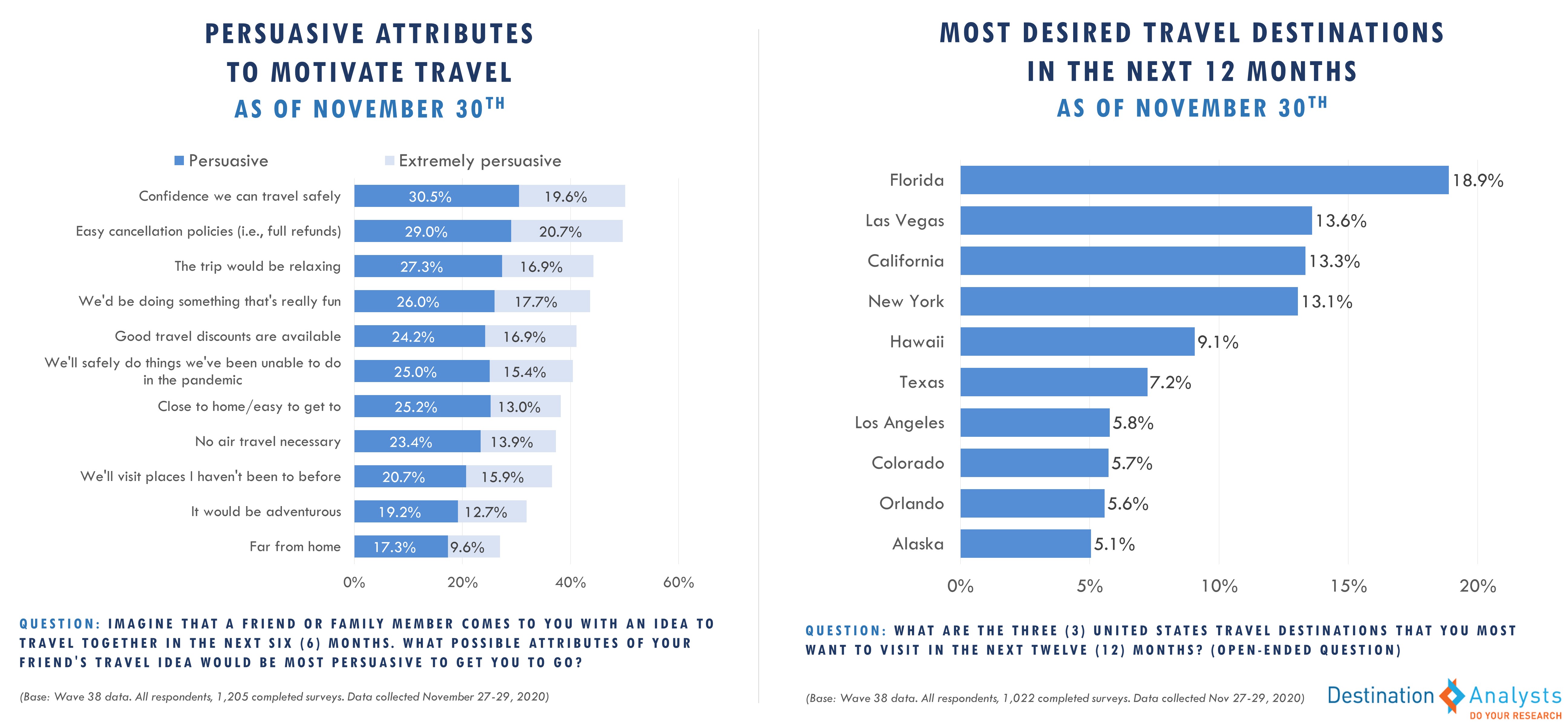

From sunny Florida to cool Alaska, what U.S. destinations are American travelers looking to visit in the next 12 months?

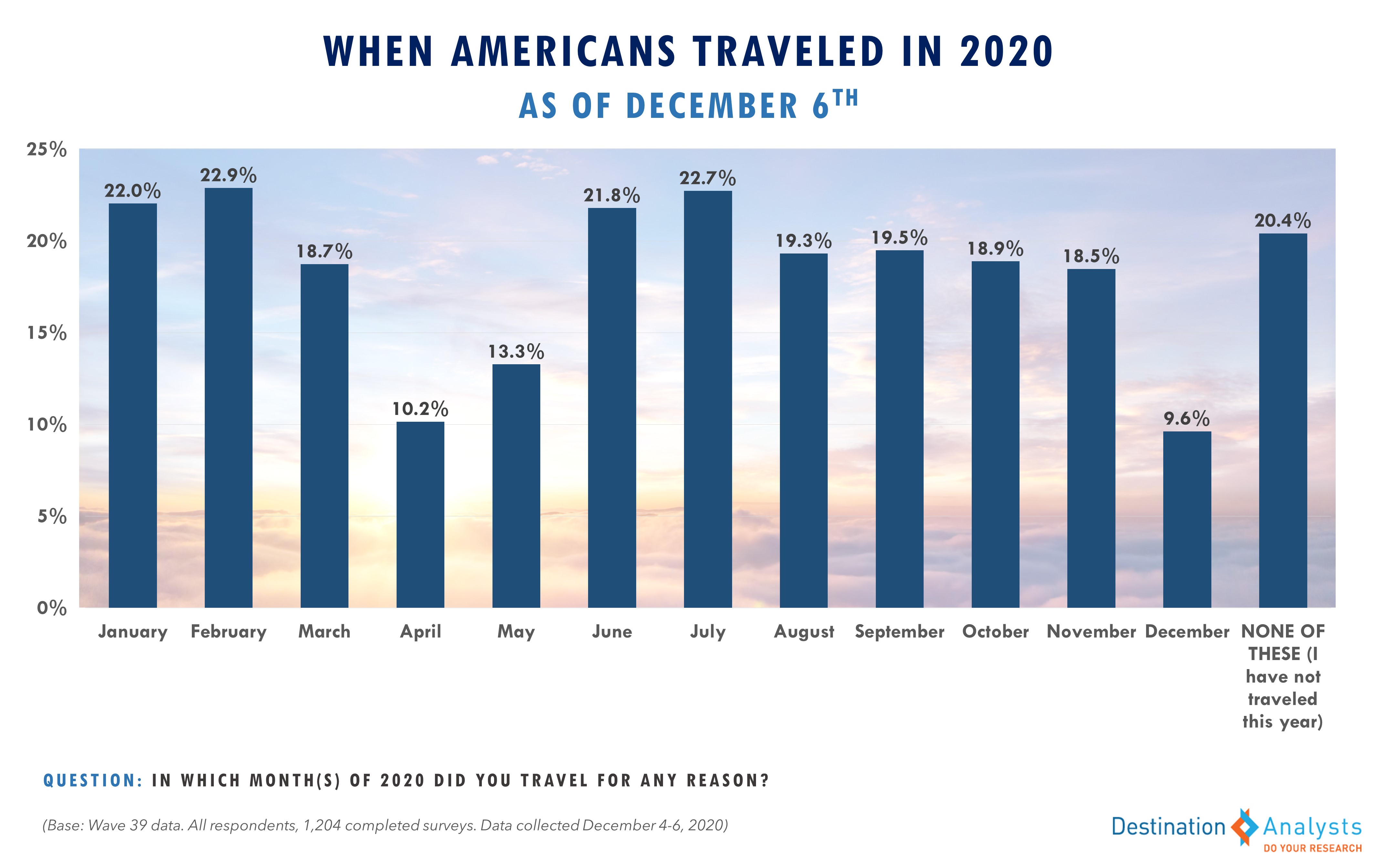

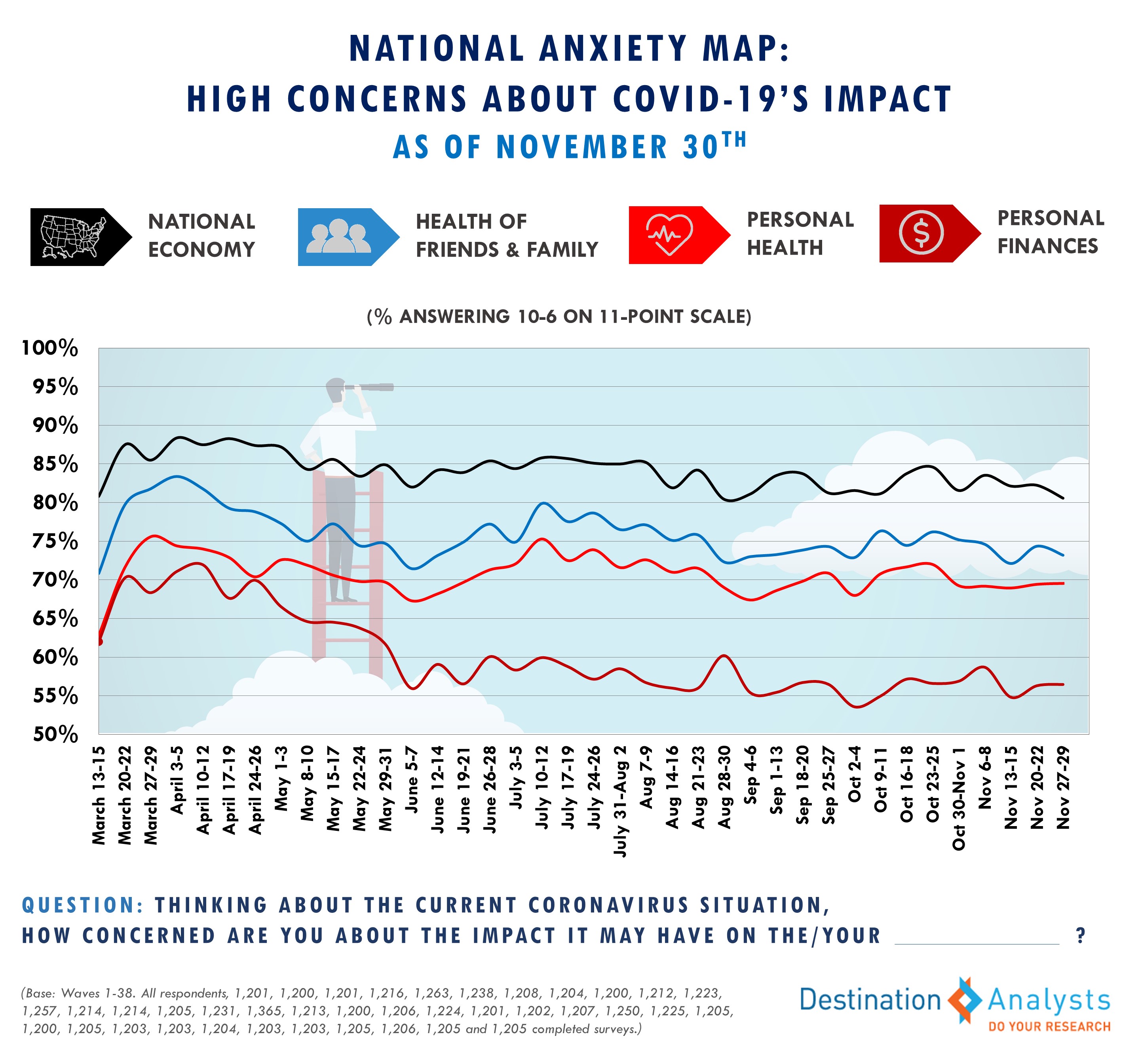

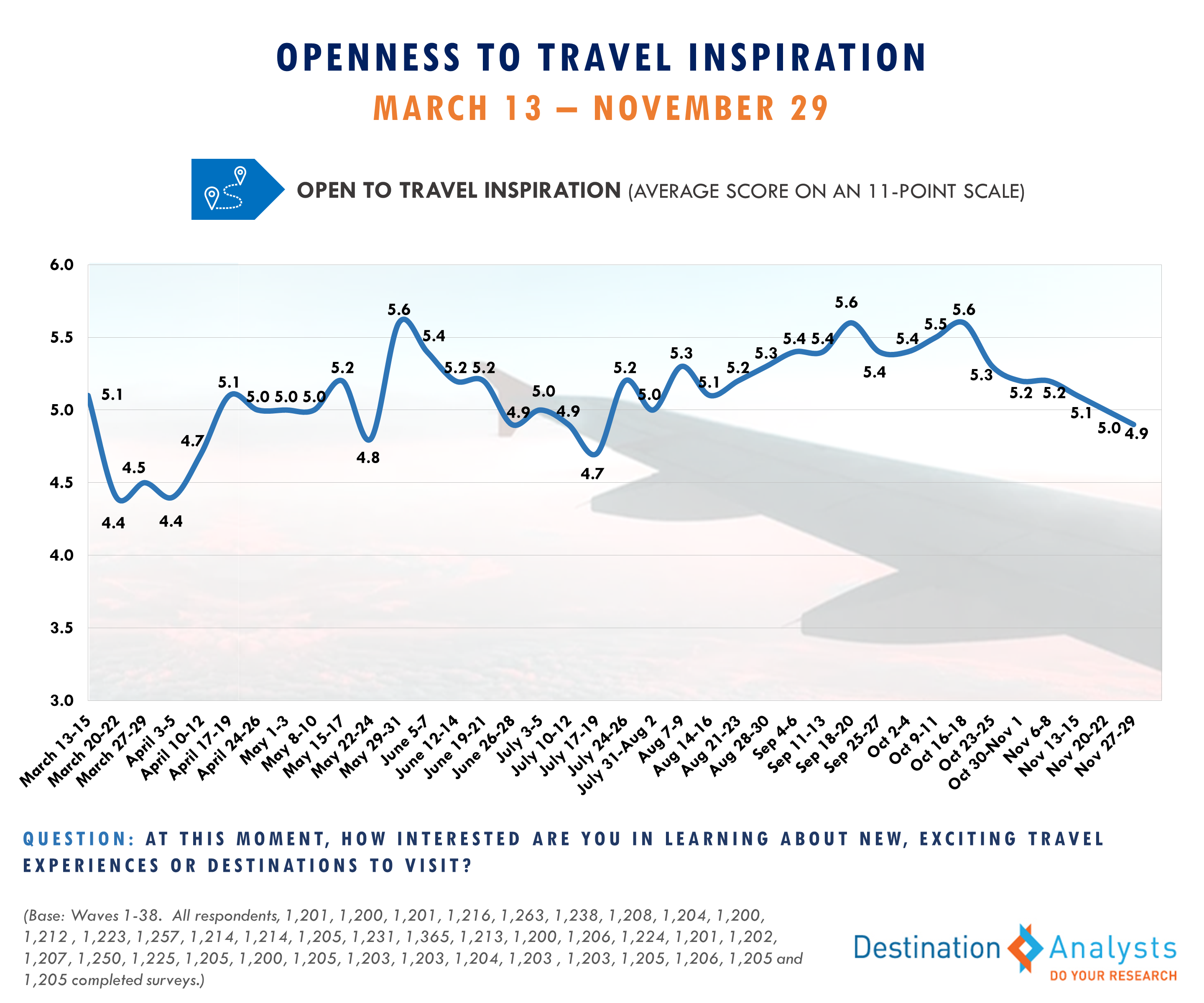

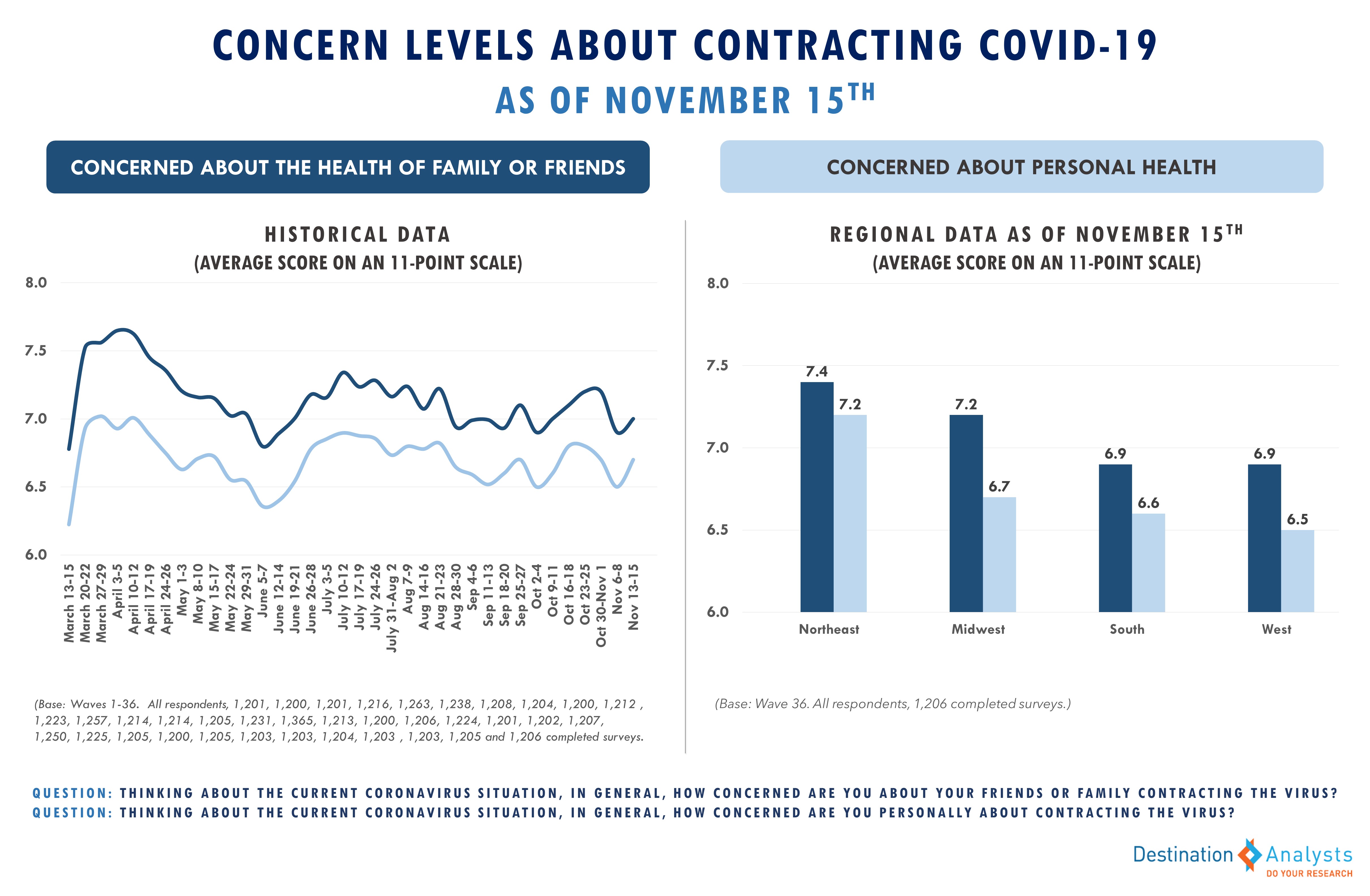

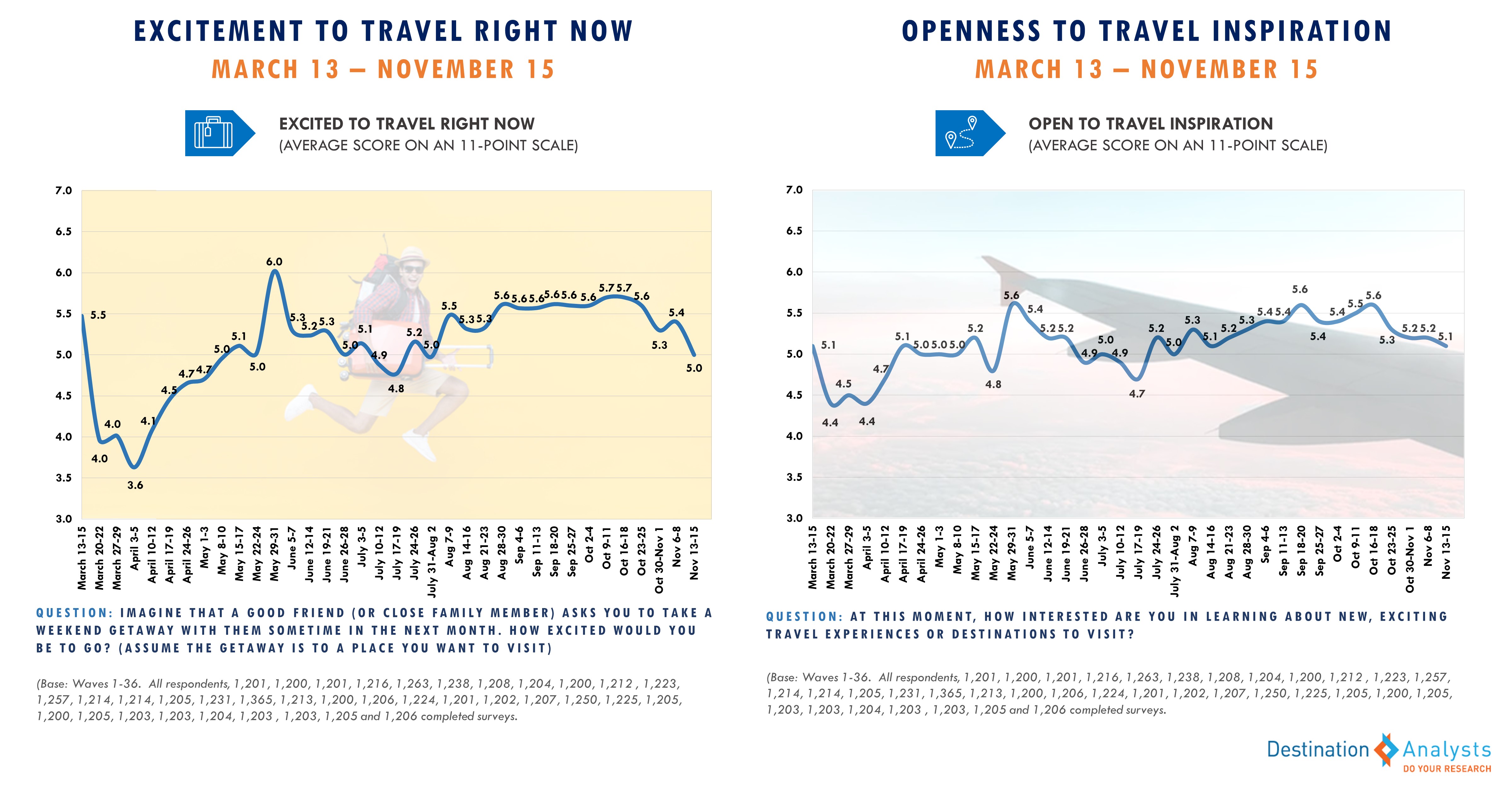

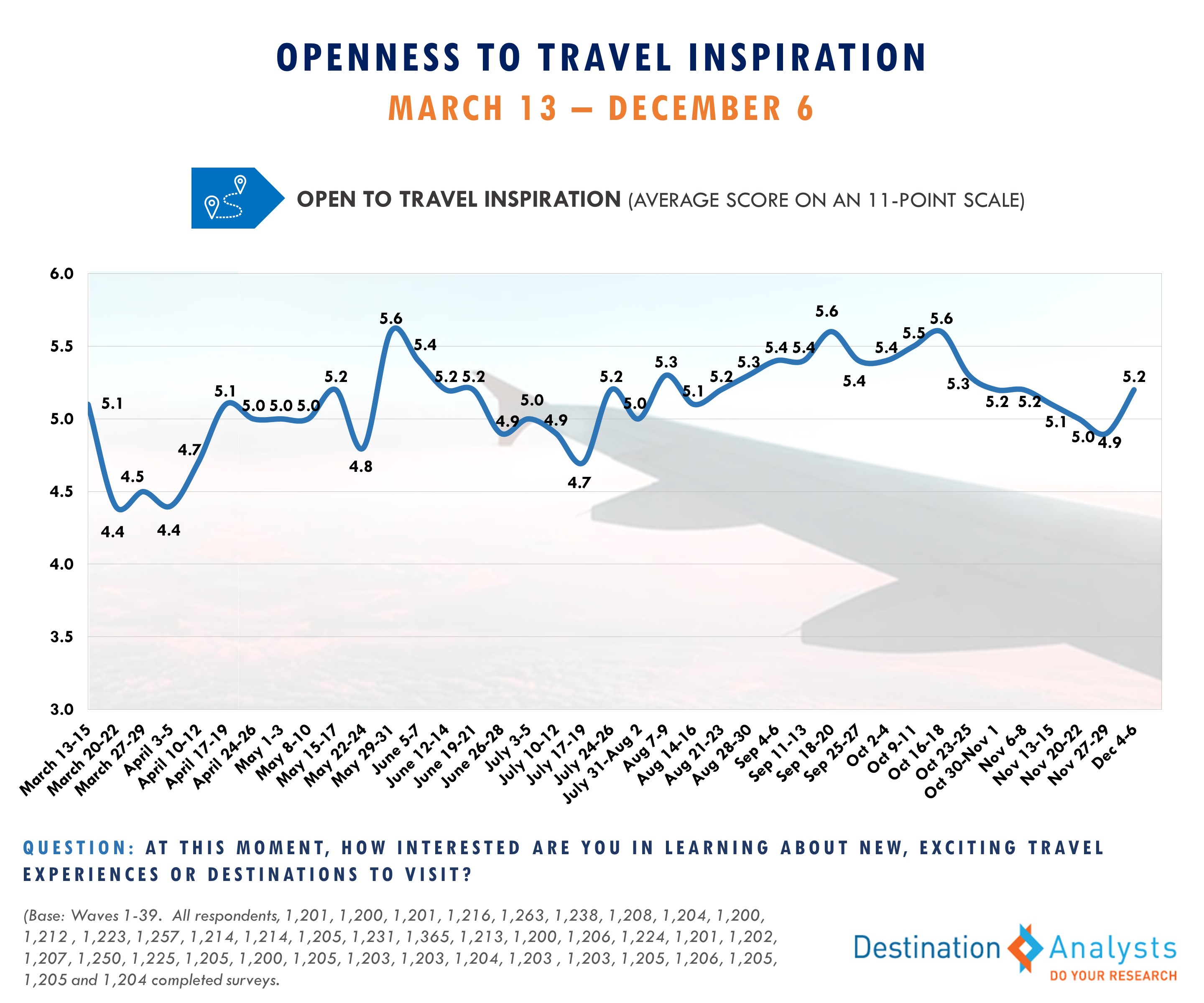

COVID-19 continues to impact the way Americans experience travel and has muted their desire for travel inspiration. The chart below illustrates American travelers’ interest in learning about new, exciting travel experiences and destinations since the onset of the pandemic from our Coronavirus Travel Sentiment Index Study. On an 11-point scale, Americans’ level of openness to travel inspiration has not exceeded 5.6 on an 11-point scale, and even then has only reached this level at three points during the nine-months of the pandemic thus far.

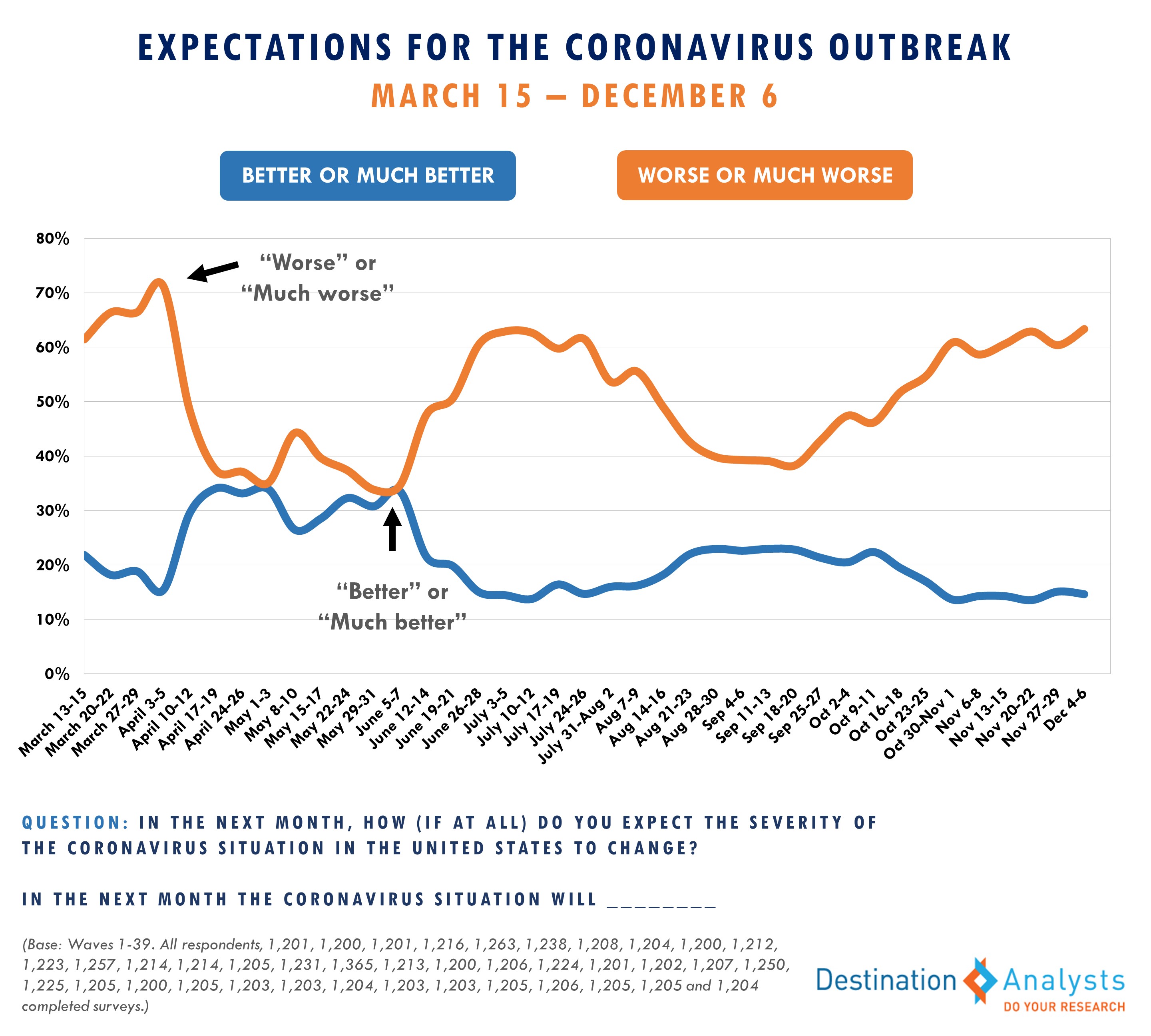

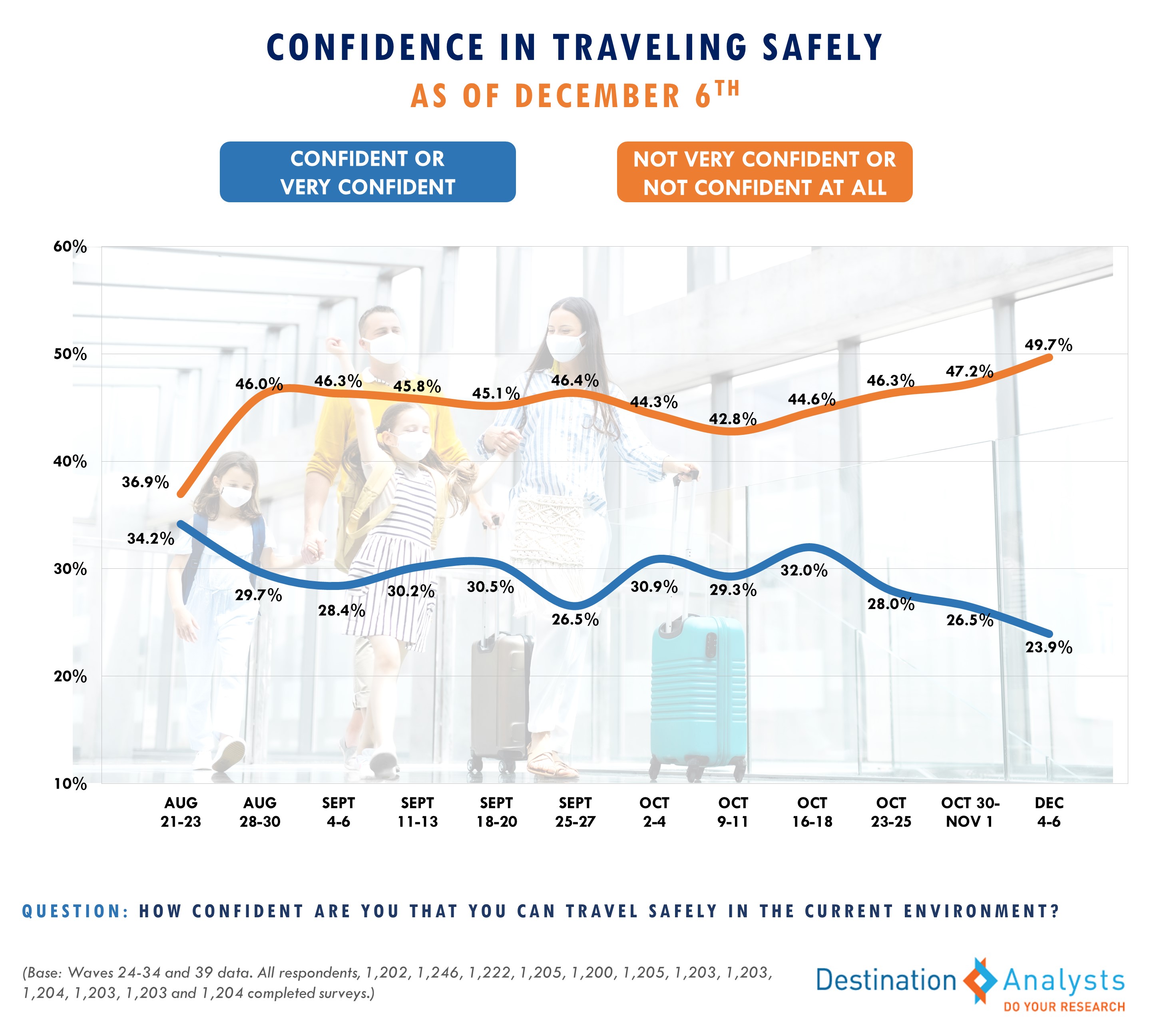

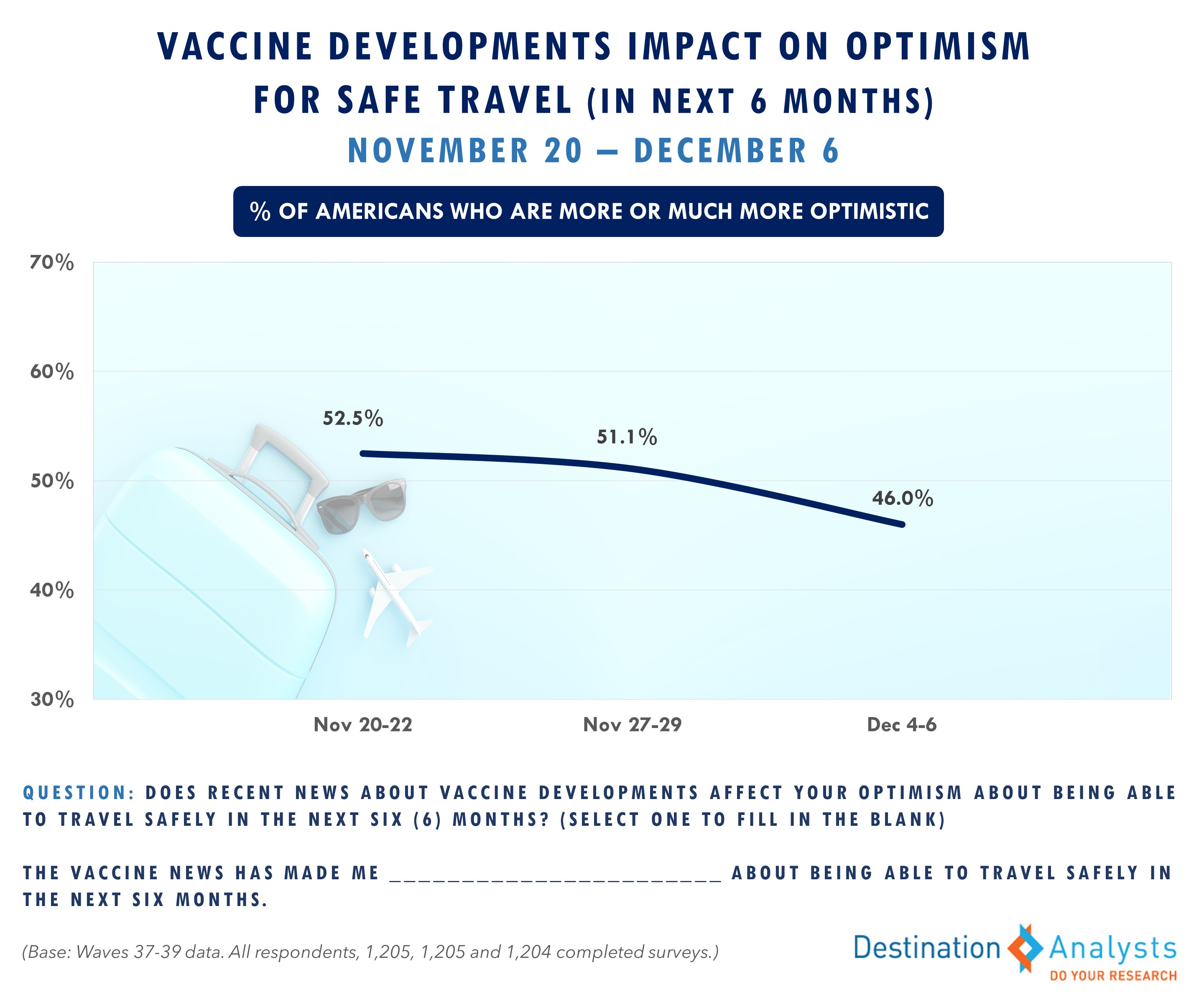

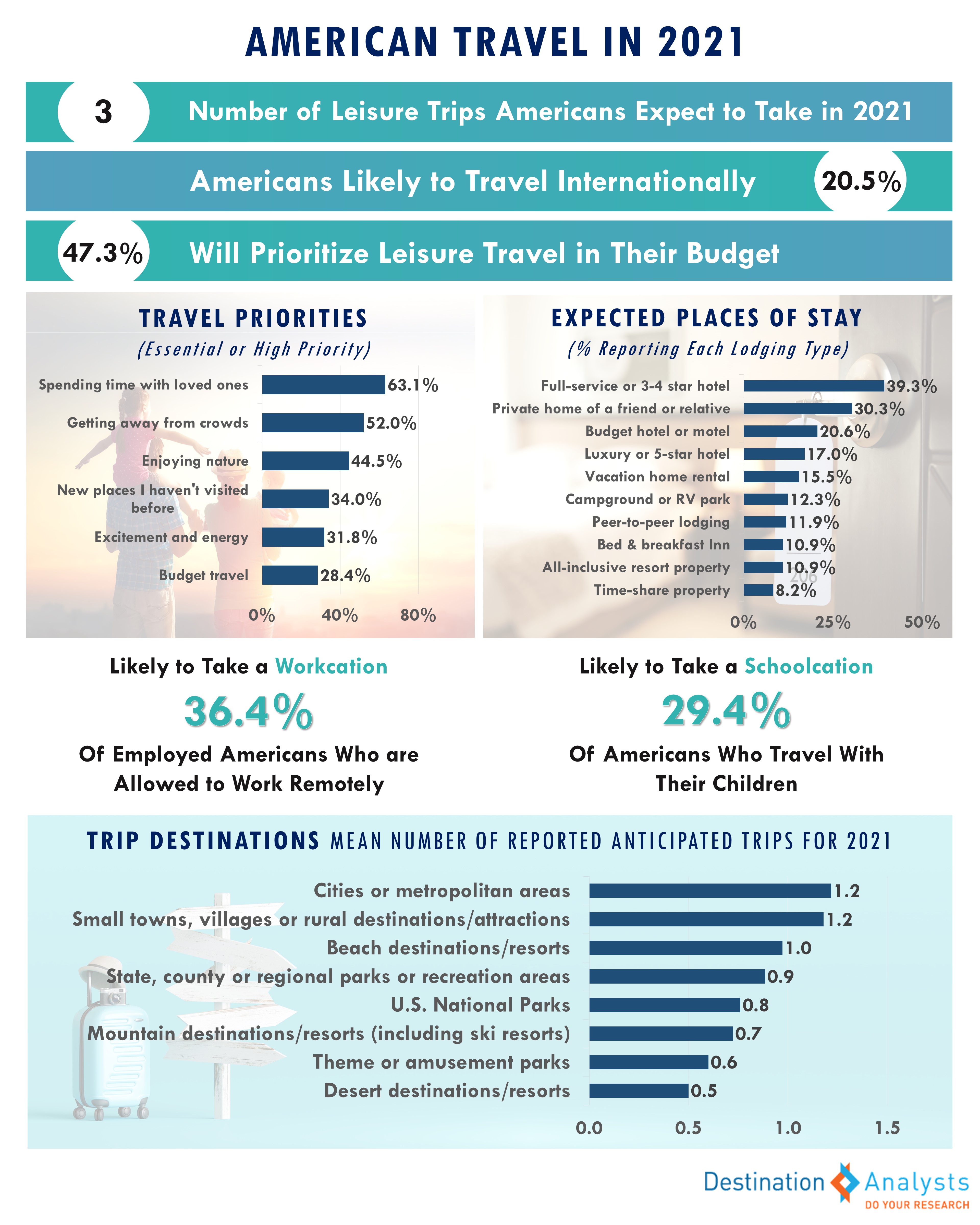

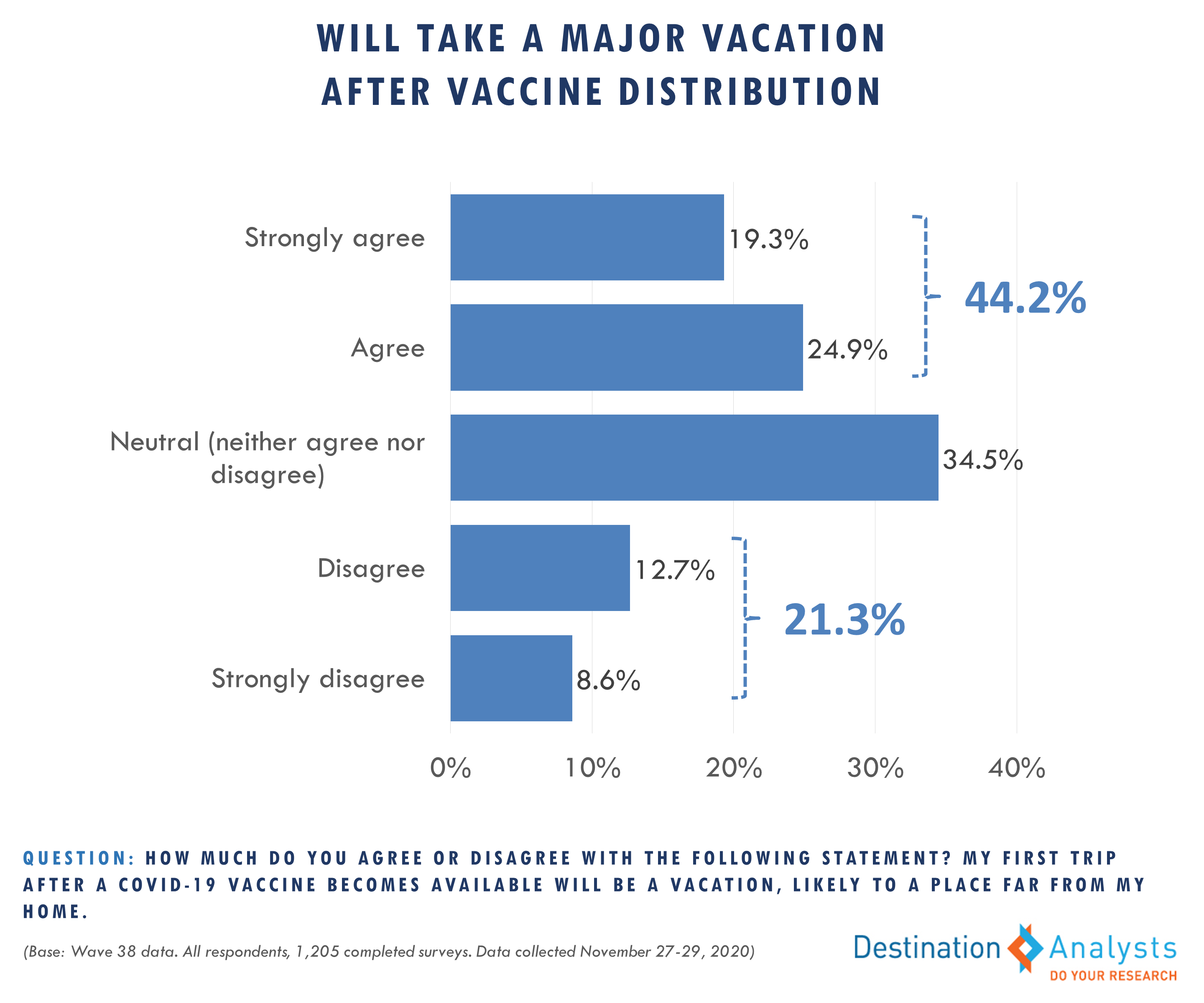

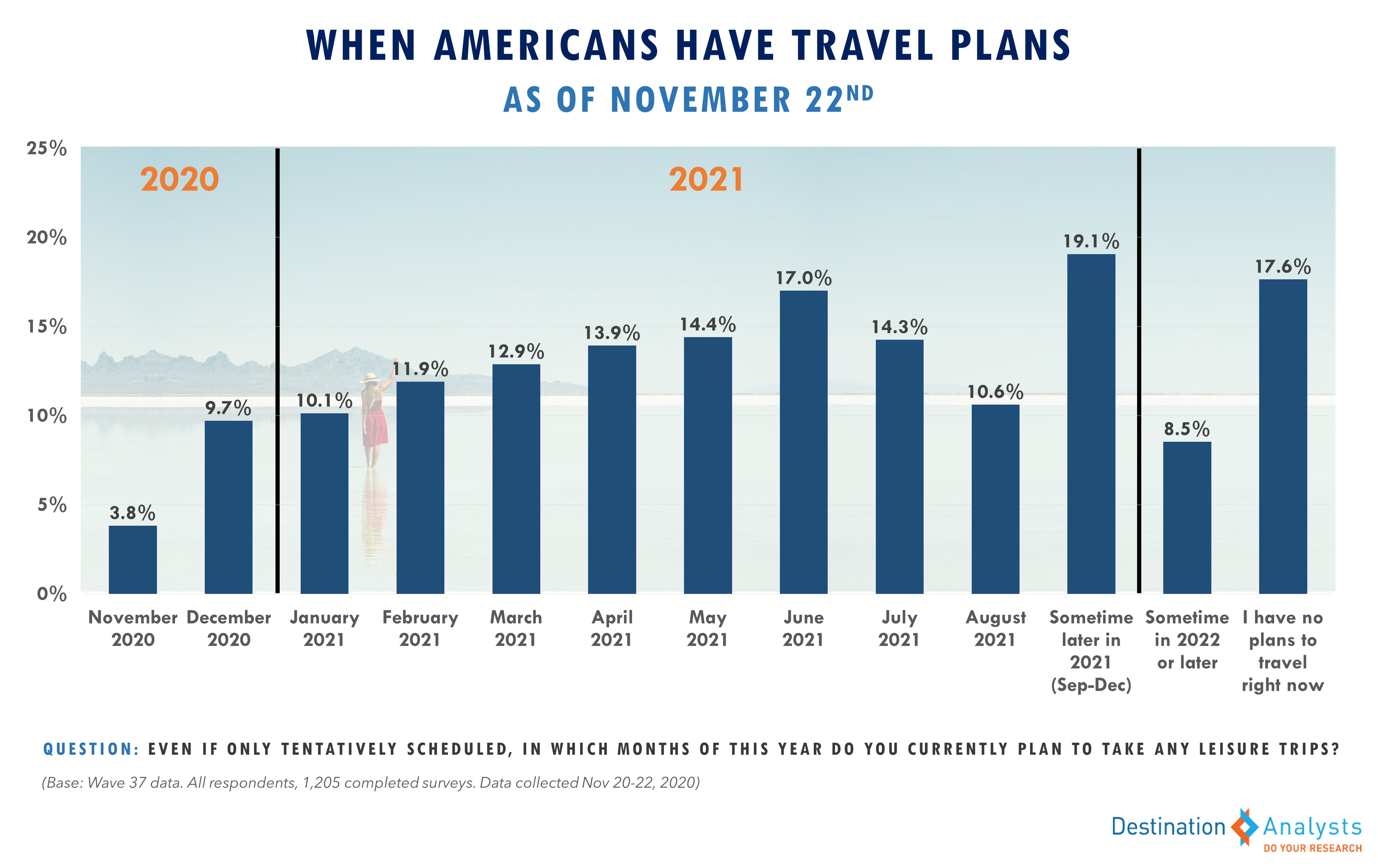

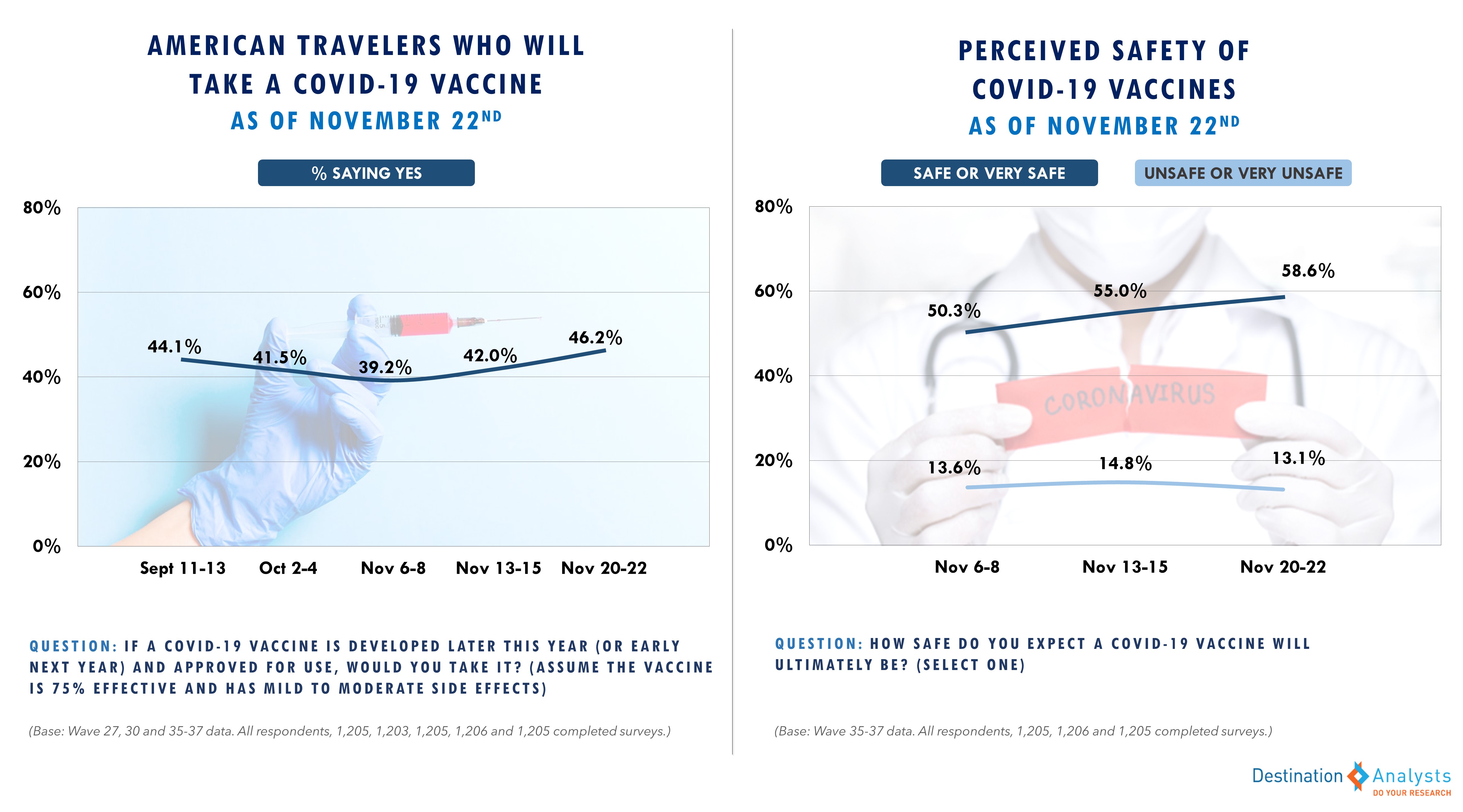

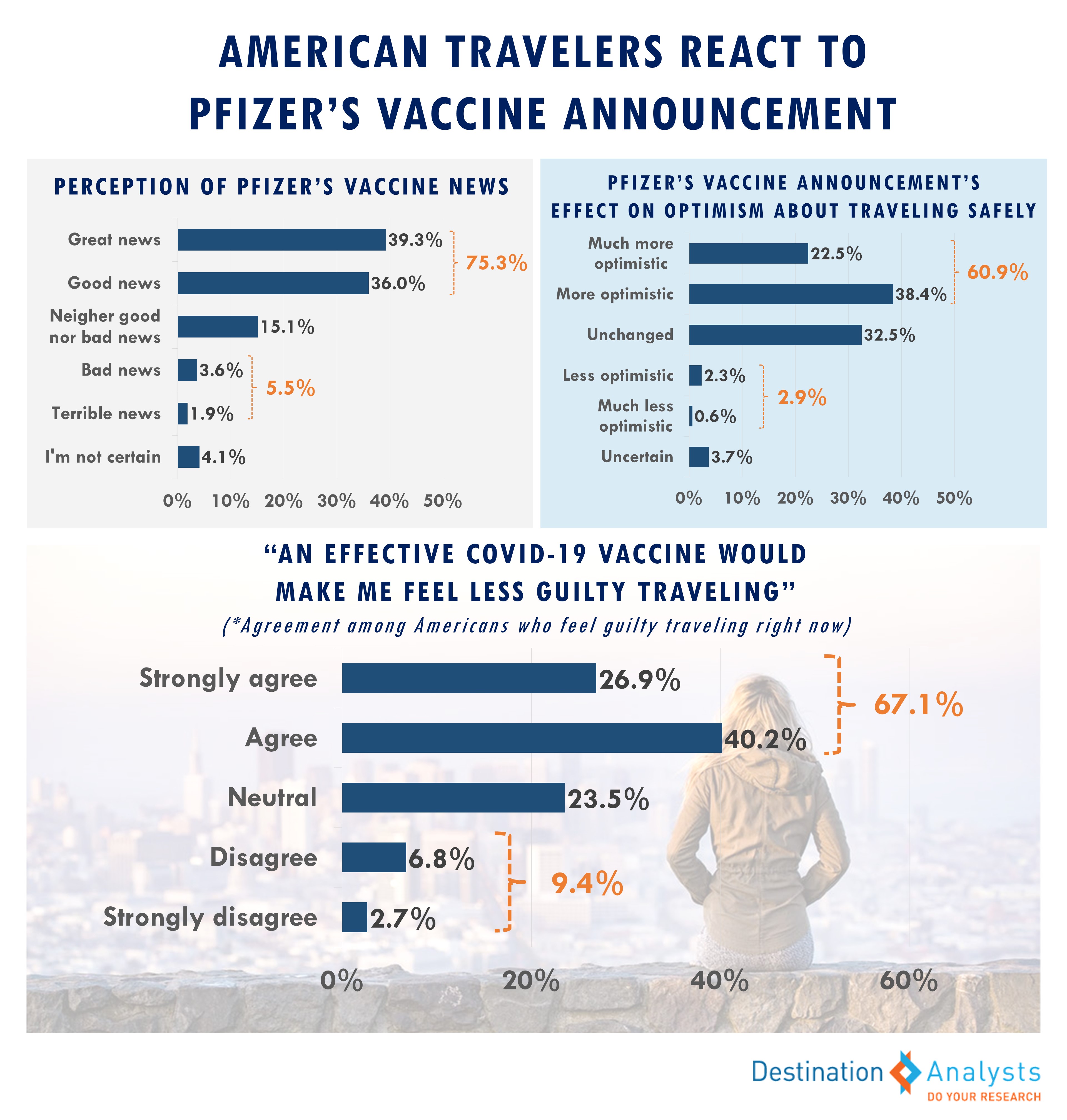

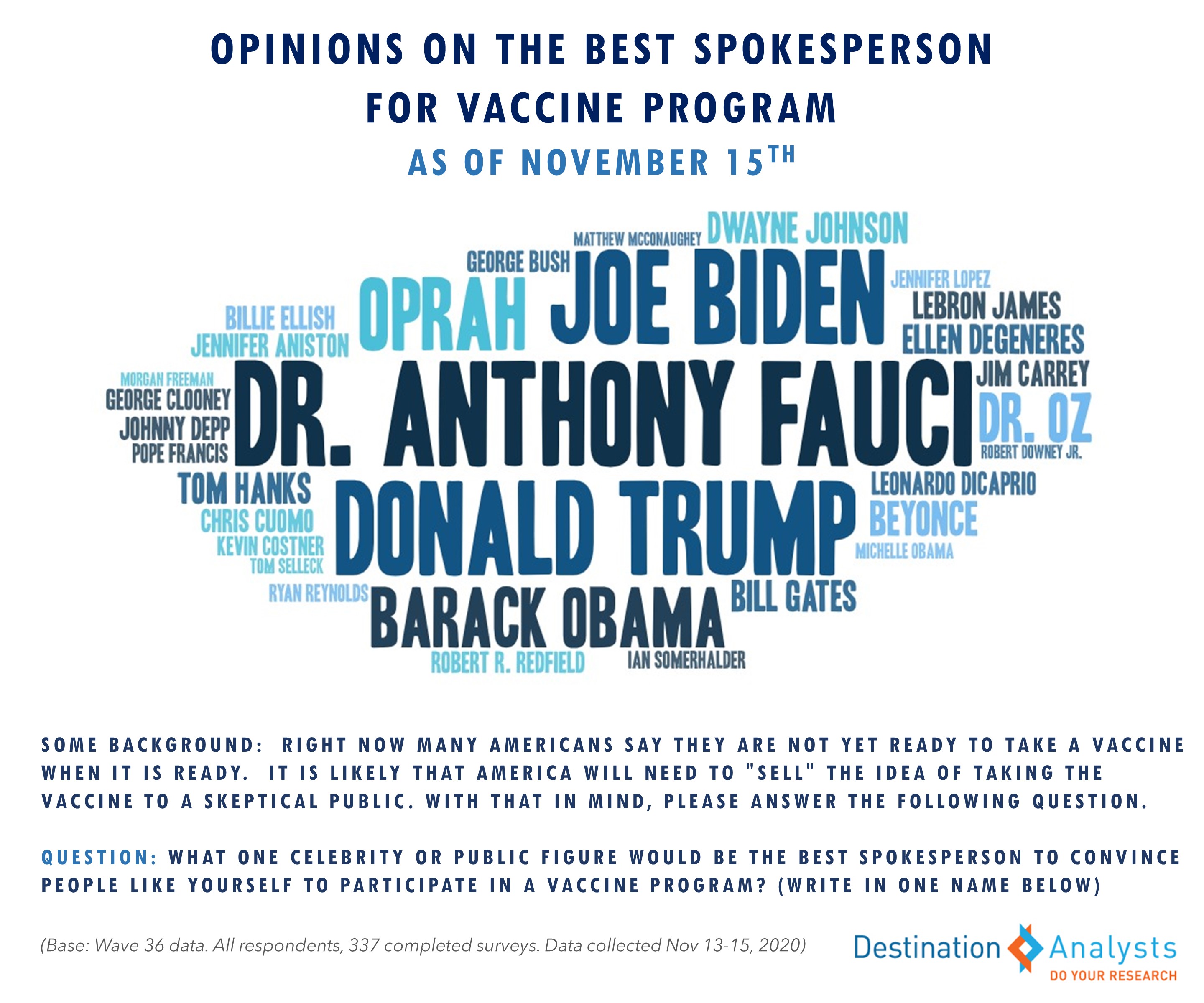

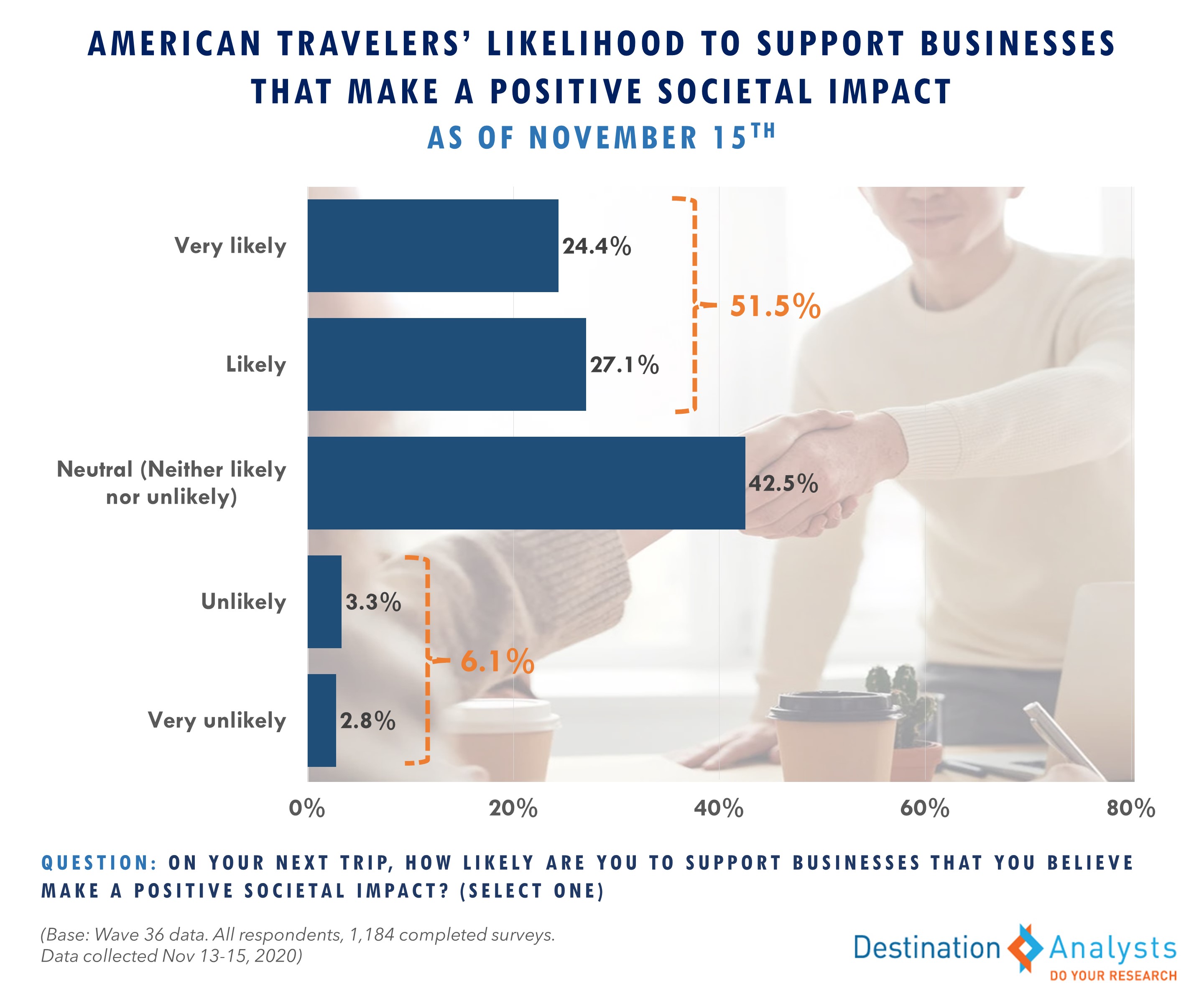

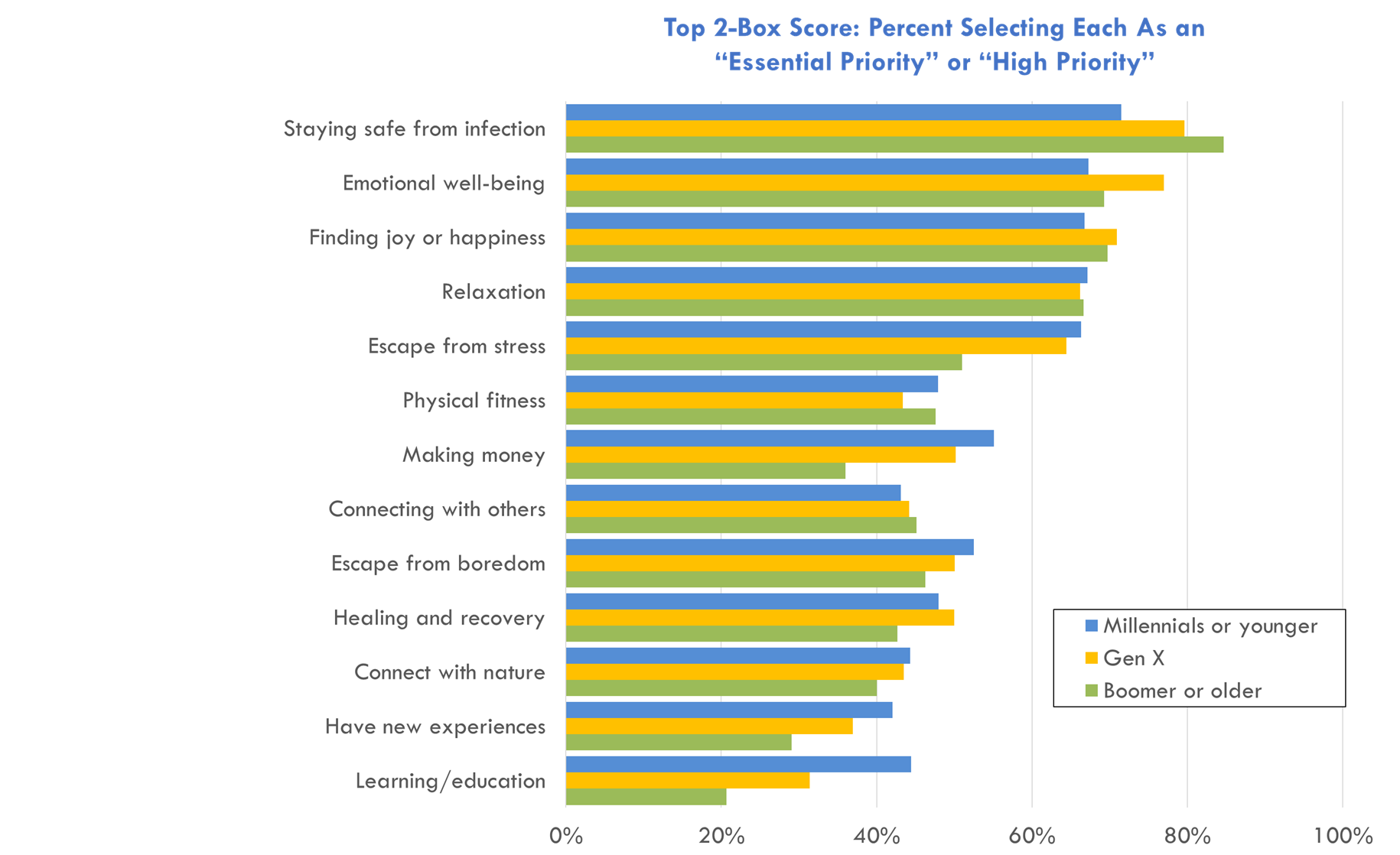

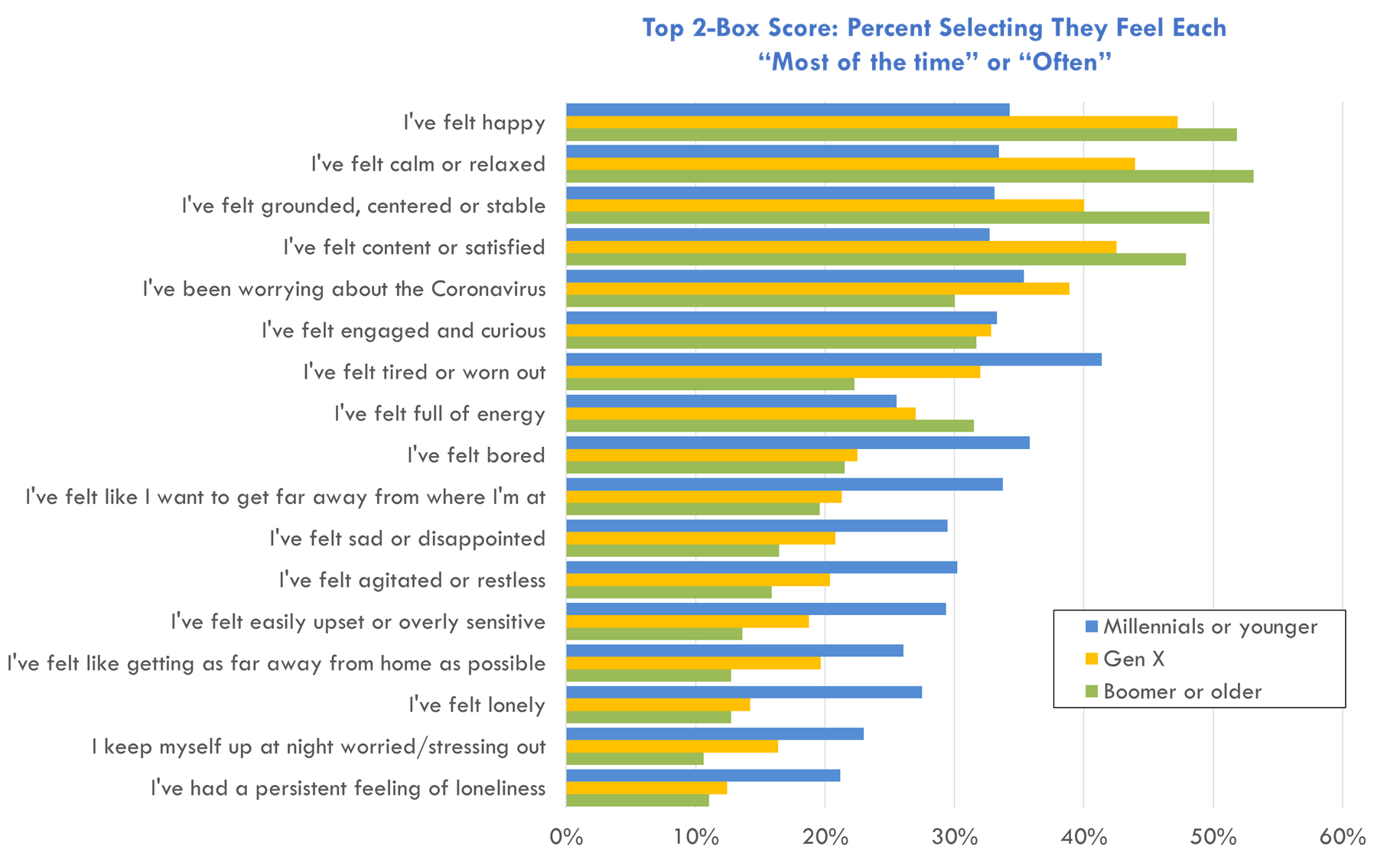

While interest in learning about new travel experiences and destinations may still be depressed right now, Americans are expressing signs of optimism regarding their future travel. Due to recent vaccine developments, over half of Americans are more optimistic that they can travel safely in the next six months and 44.2% agree that their “first trip after a COVID-19 vaccine becomes available will be a vacation, likely to a place far from home.” With vaccine distribution likely to begin shortly, American travelers are hoping 2021 will provide a turning point to escape the boredom, misery and fear that defined 2020.

And it looks like many would love nothing more than to experience their favorite destinations once again. In the August 10th edition of our Coronavirus Travel Sentiment Index Study, American travelers surveyed were asked to list the three U.S. destinations that they most want to visit in the next twelve months. The following are the 11 most commonly named:

The most desired destinations represent a diverse range—from beach and urban destinations, to desert and mountain locations across the entire United States.

Florida, Las Vegas, California and New York are the top destinations American travelers most want to visit in the next year, with one-in-ten or more who wrote in these destinations. Hawaii and Texas follow closely behind as destinations these travelers would most want to experience, while Los Angeles, Colorado, Orlando, Alaska and Arizona round out the U.S. destinations travelers most want to visit in the next twelve months. Perhaps in the greatest testament to a movement towards “normal,” this most recent Destination Hot List looks nearly identical to pre-pandemic times.

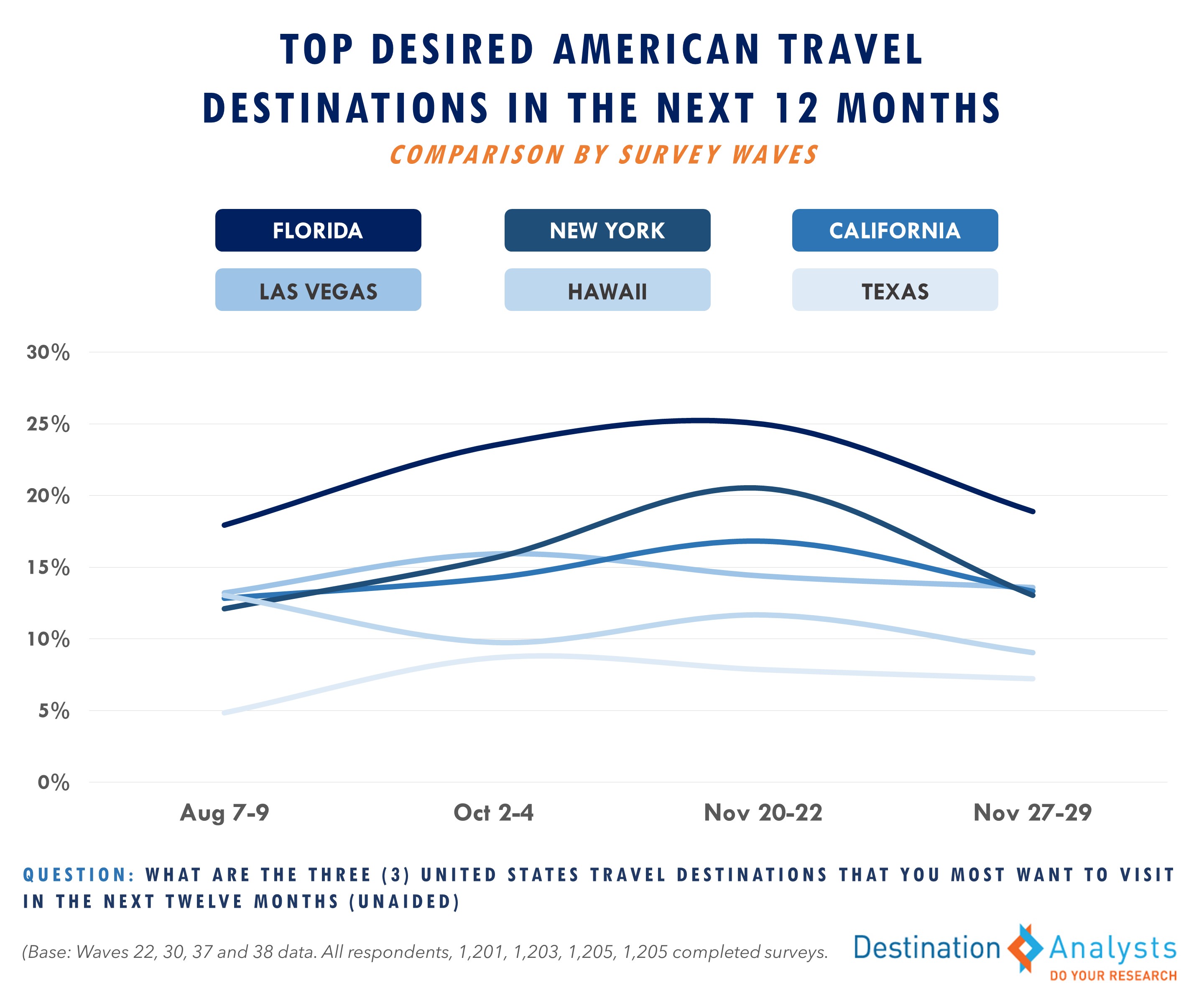

But how has the Destination Hot List changed over the course of the pandemic? This same open-ended question was asked in the November 30th edition of the Coronavirus Travel Sentiment Index Study.

The top four destinations of Florida, Las Vegas, California and New York were largely always the top four, however they have seen the most fluctuation since August. For example, a quarter of American travelers surveyed November 20-22 reported Florida as a place they most wanted to visit in the next year; however, this dropped to 18.9% the week following.

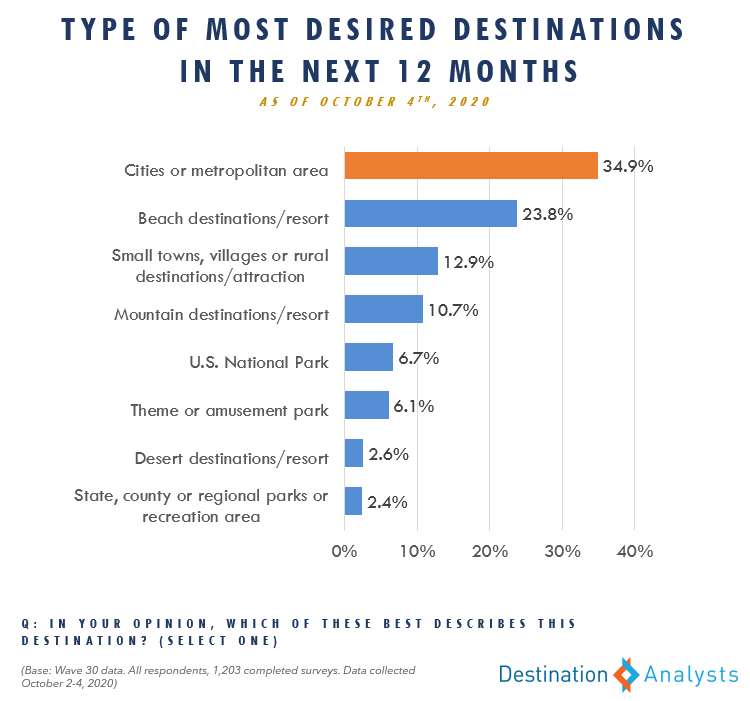

There has also been a noted consumer shift towards cities again, after beaches and outdoor destinations dominated the first phase of the pandemic. As shown in the chart below, over a third of American travelers said the destination they most wanted to visit in the upcoming year was a city or metropolitan area.

While travel is still suppressed due to the lingering coronavirus, American travelers show signs of hope about their travel future and are keen to visit “hot” destinations in the next 12 months.