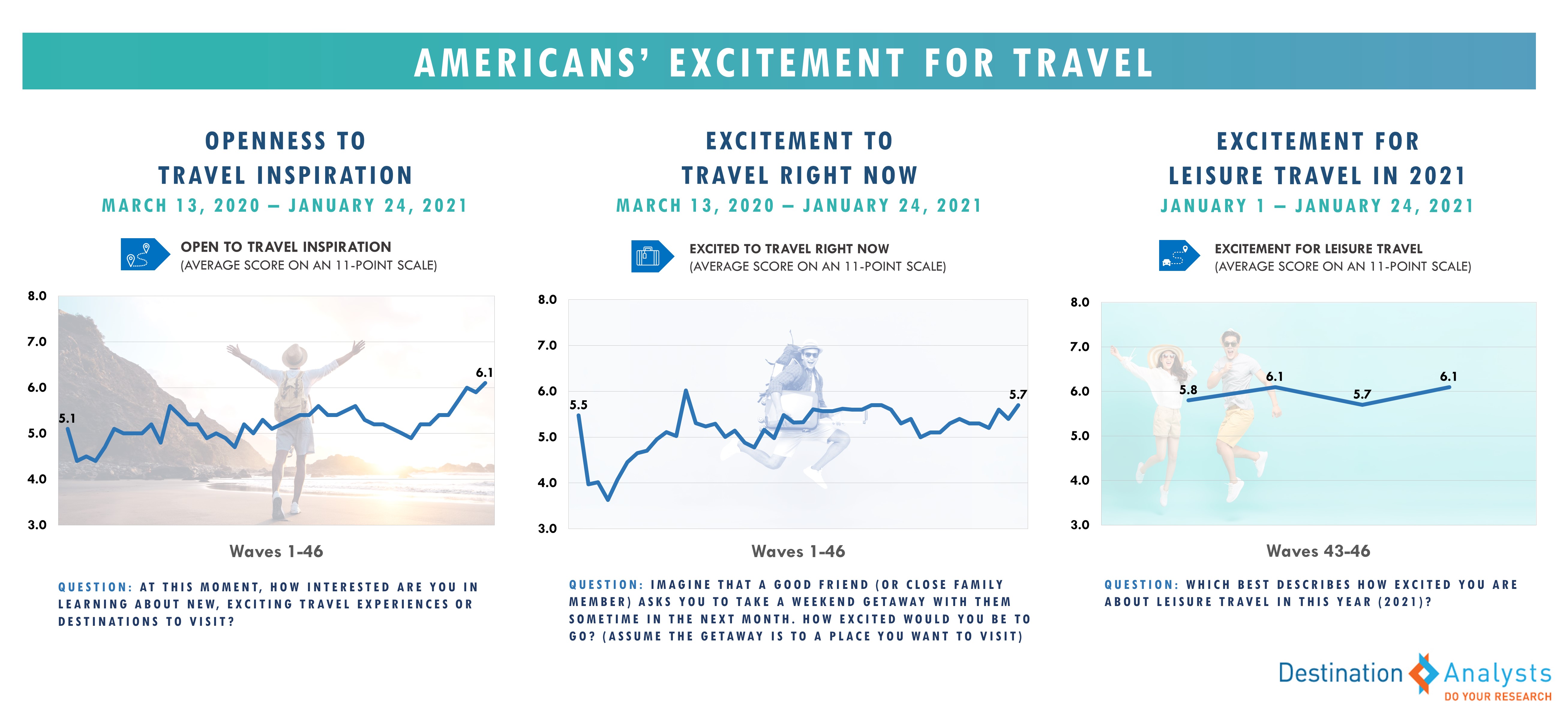

As anxiety wanes and optimism gains, Americans are feeling more and more love for travel—and the advertising that inspires their wanderlust.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected February 12th-14th.

Key Findings to Know:

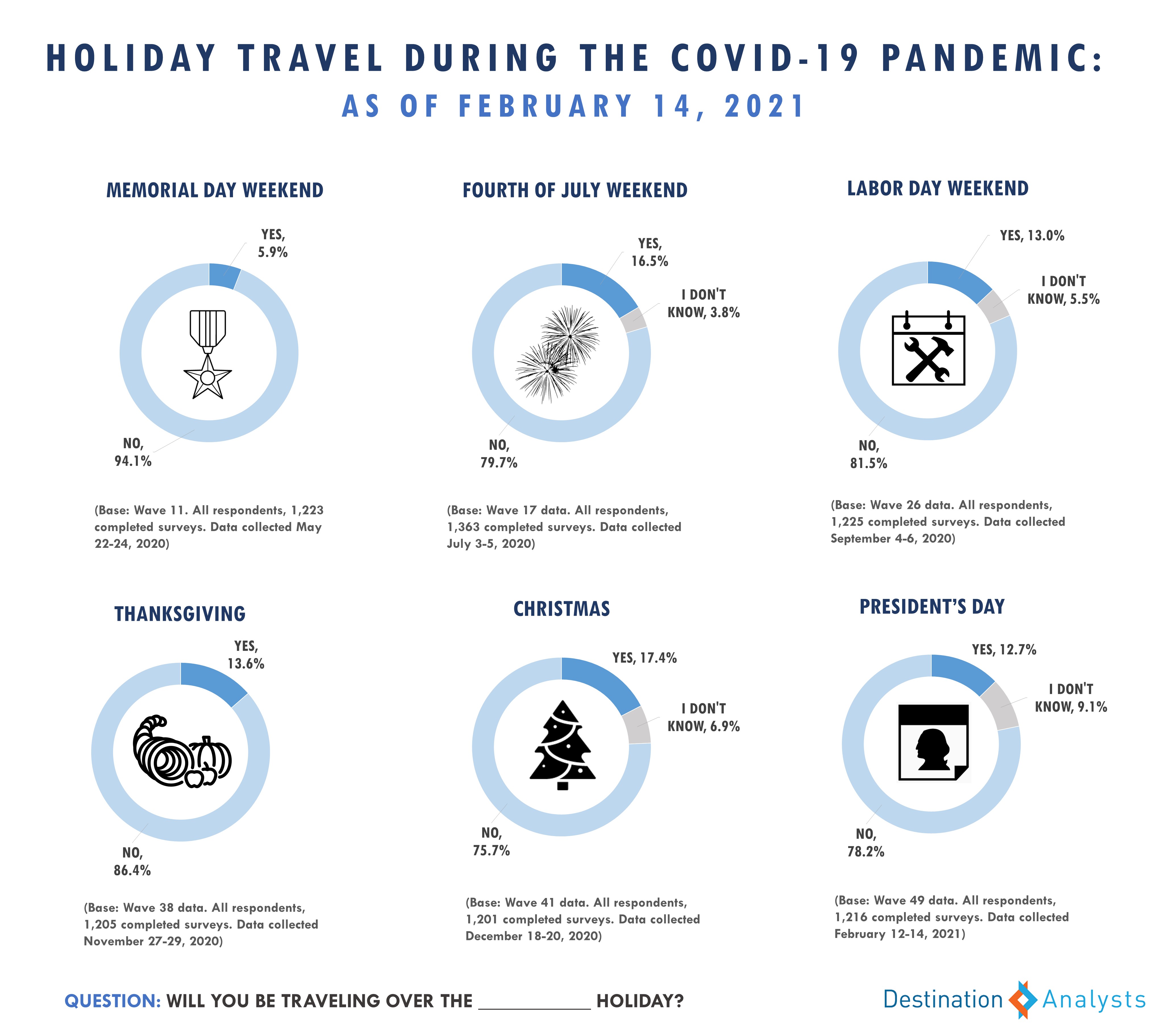

Americans celebrated both Valentine’s Day and President’s Day…was love in the air for travel during this holiday? In total, 12.7% said they took a trip for the long weekend—double what was reported for Memorial Day weekend in the early pandemic period, and a similar rate to Labor Day weekend, which followed the summer coronavirus case surge.

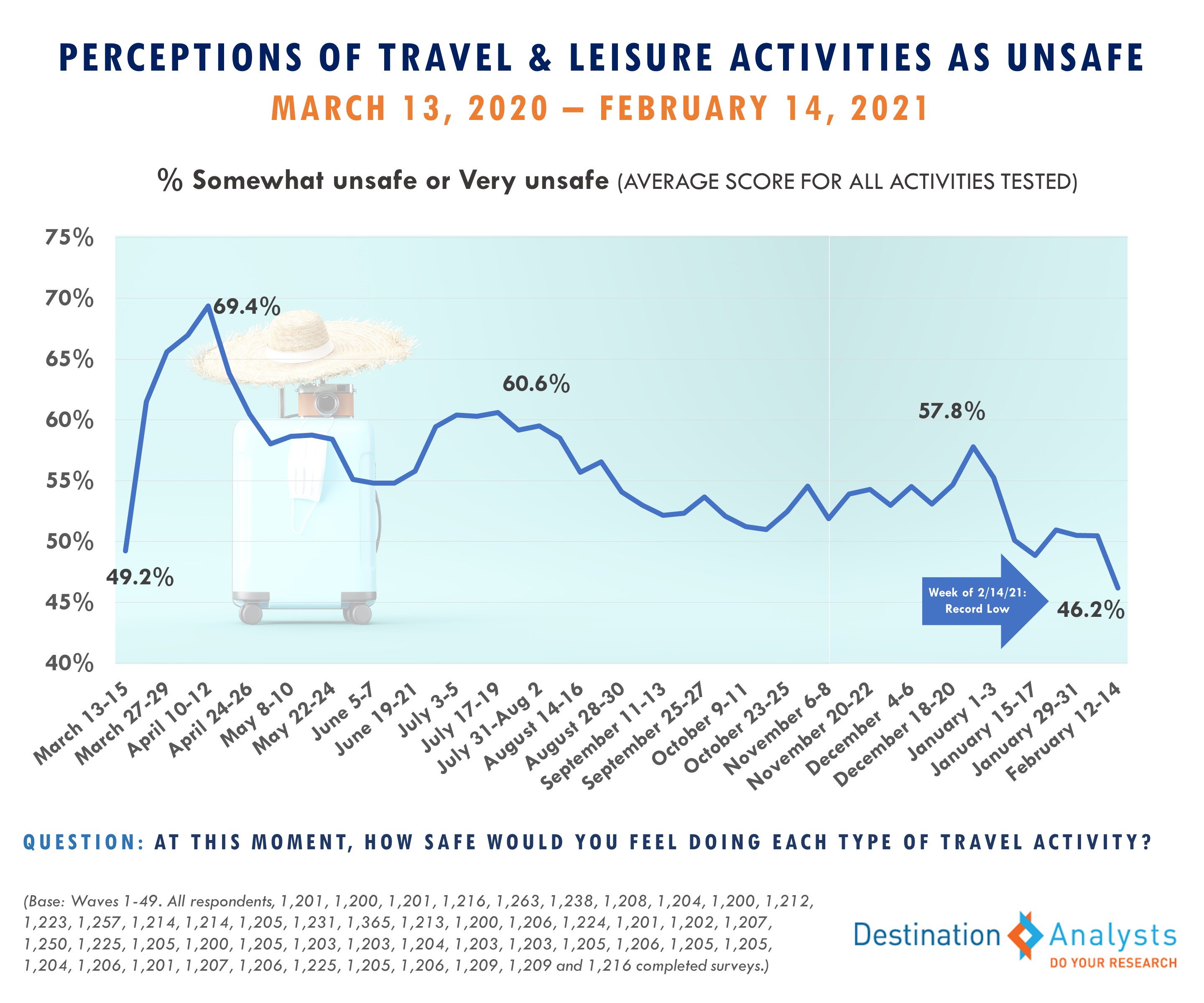

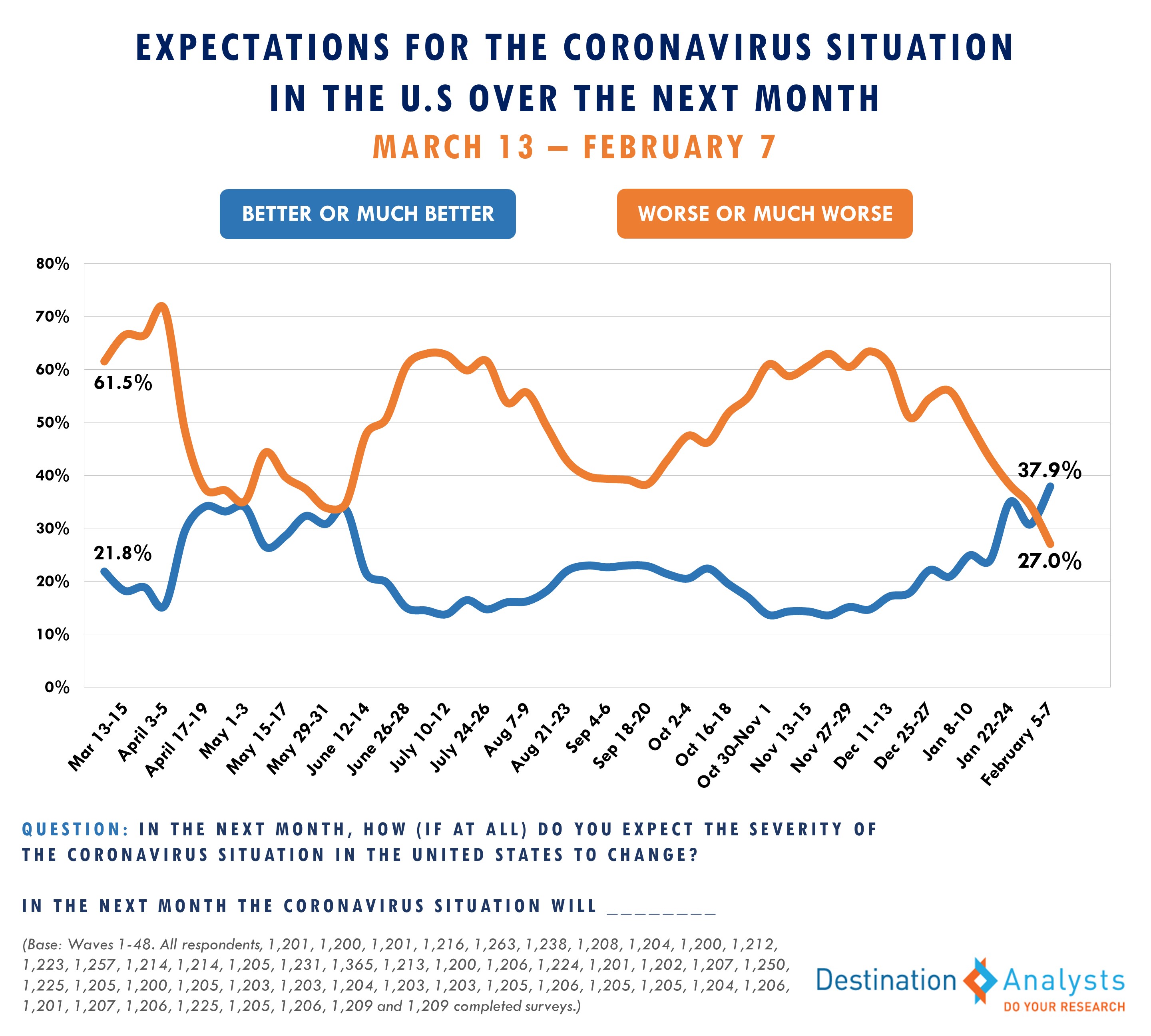

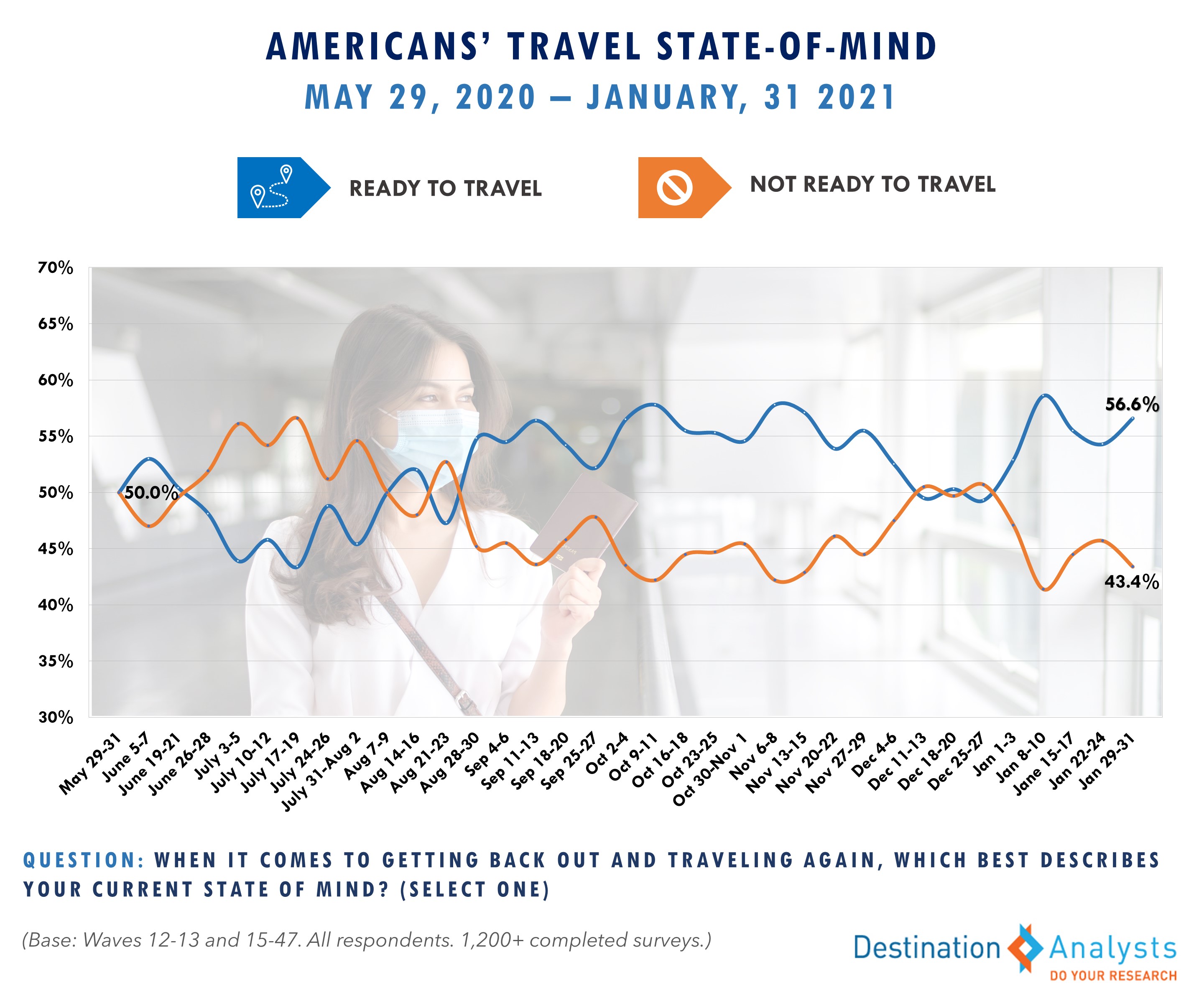

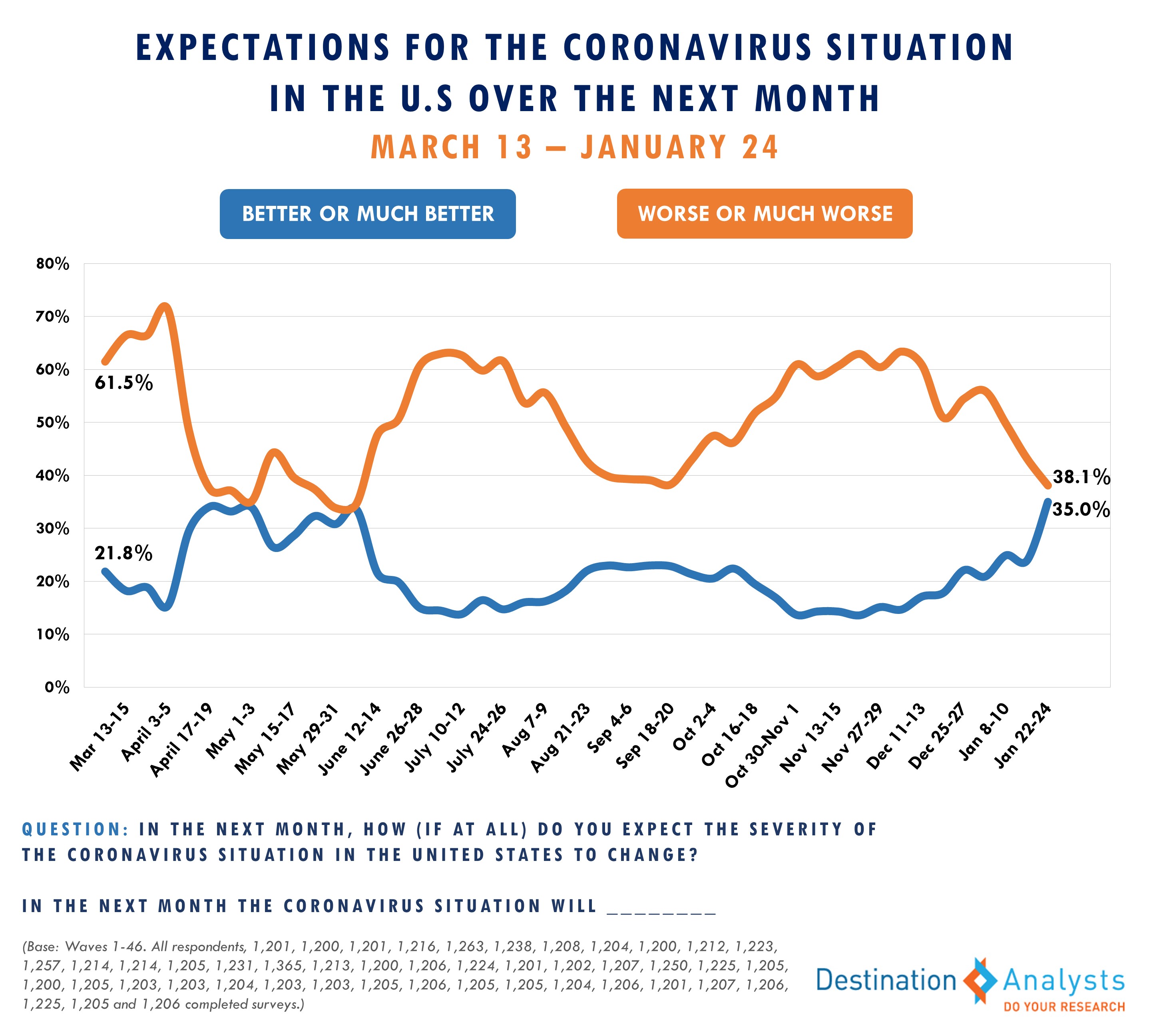

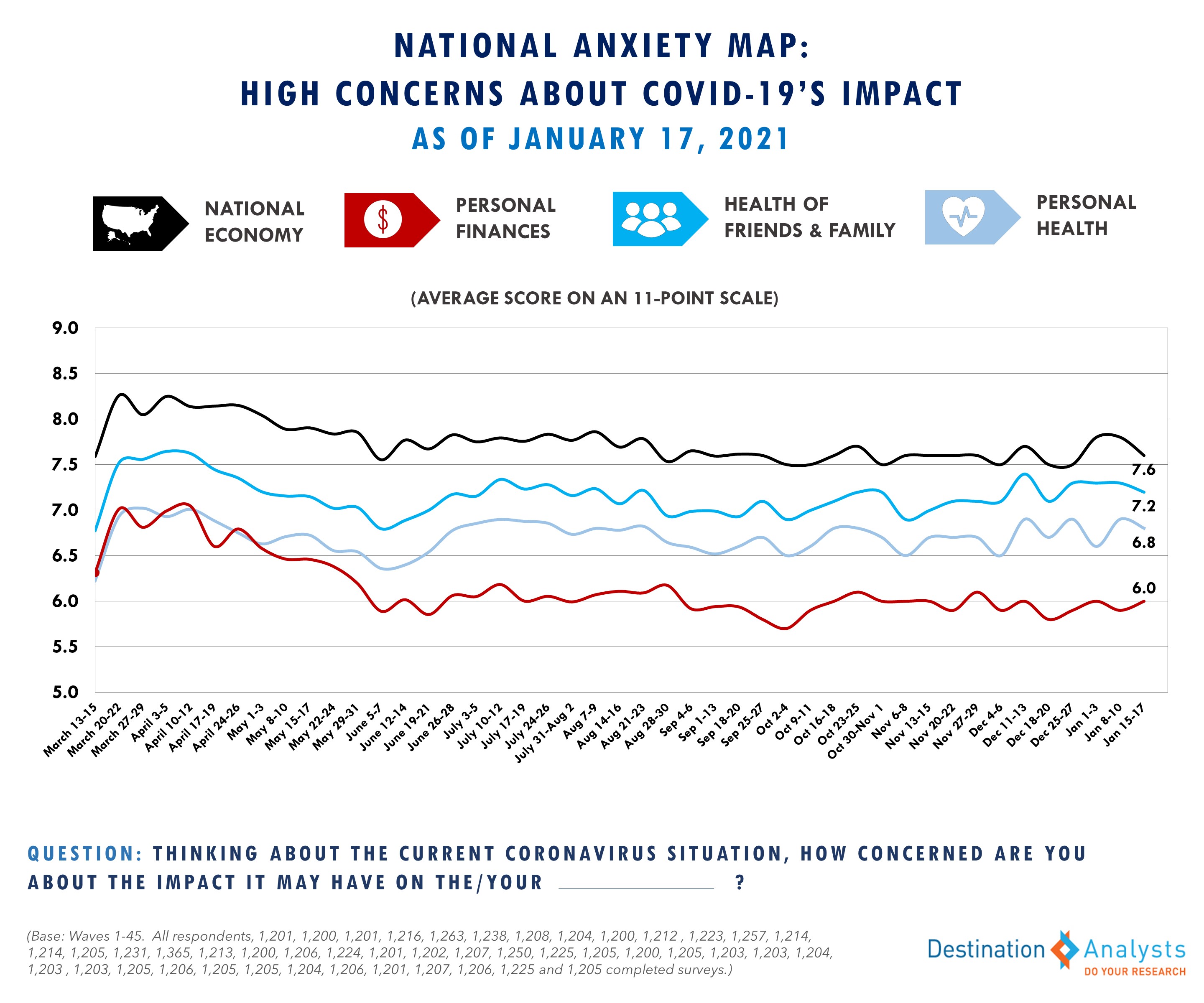

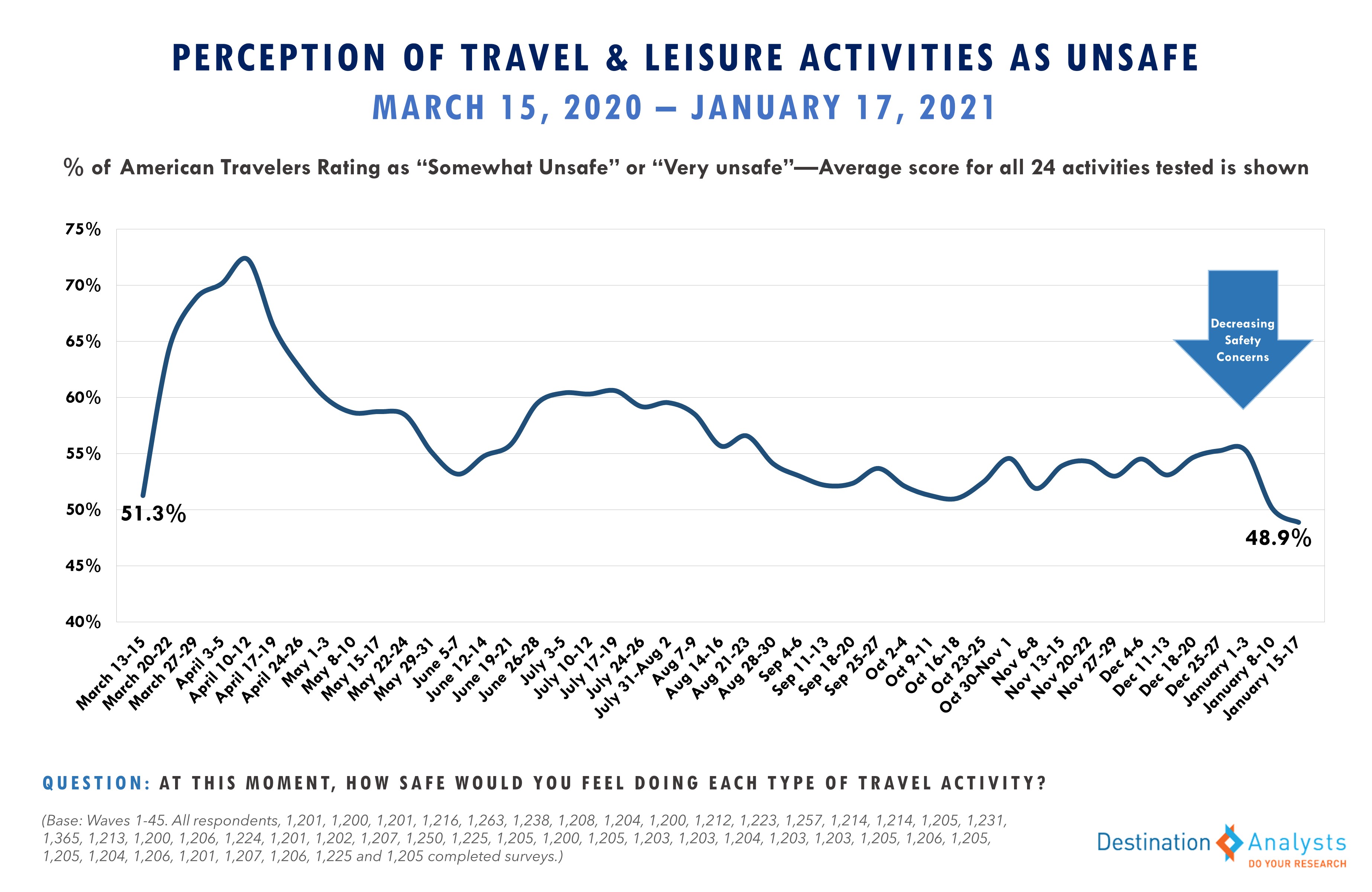

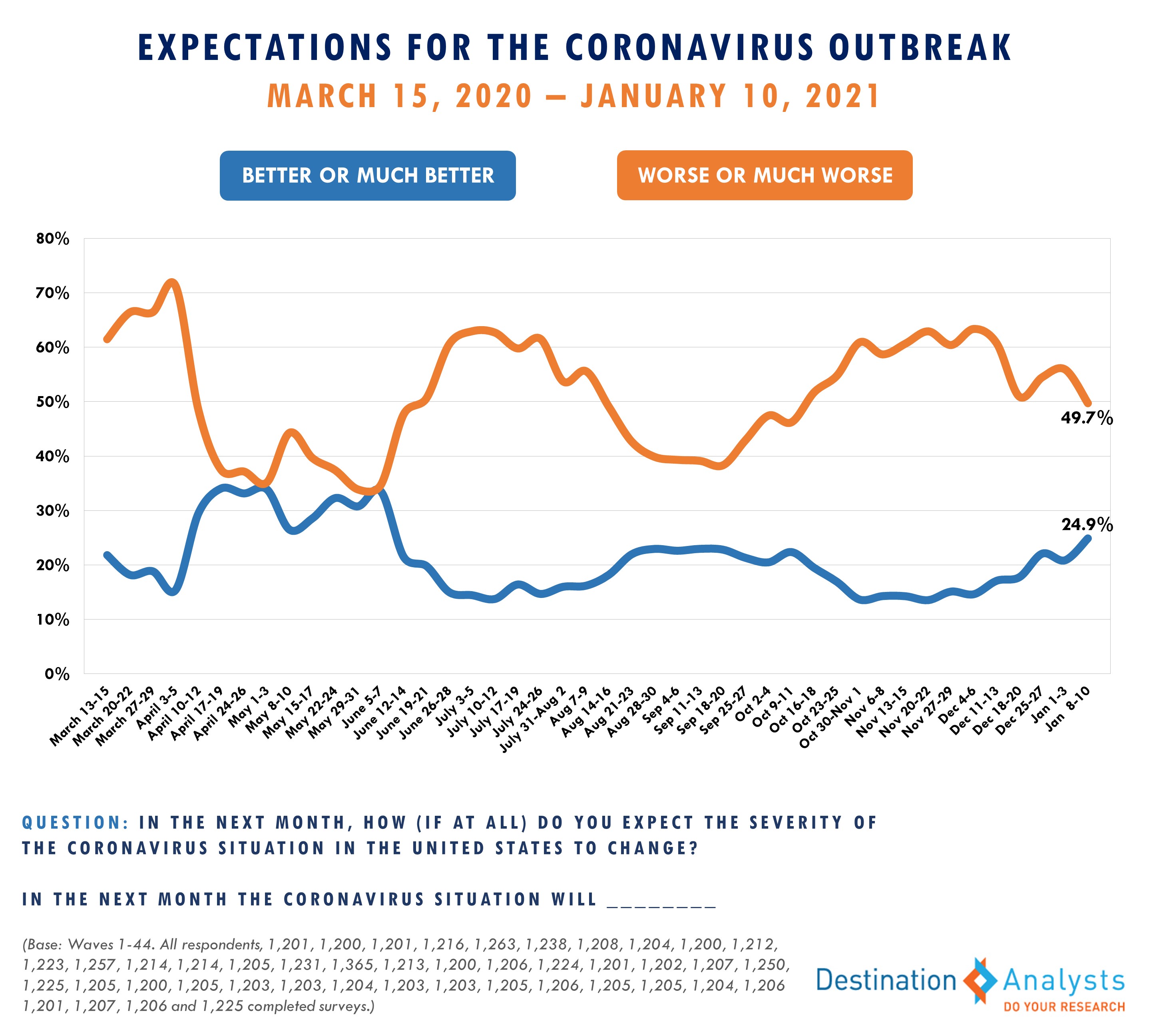

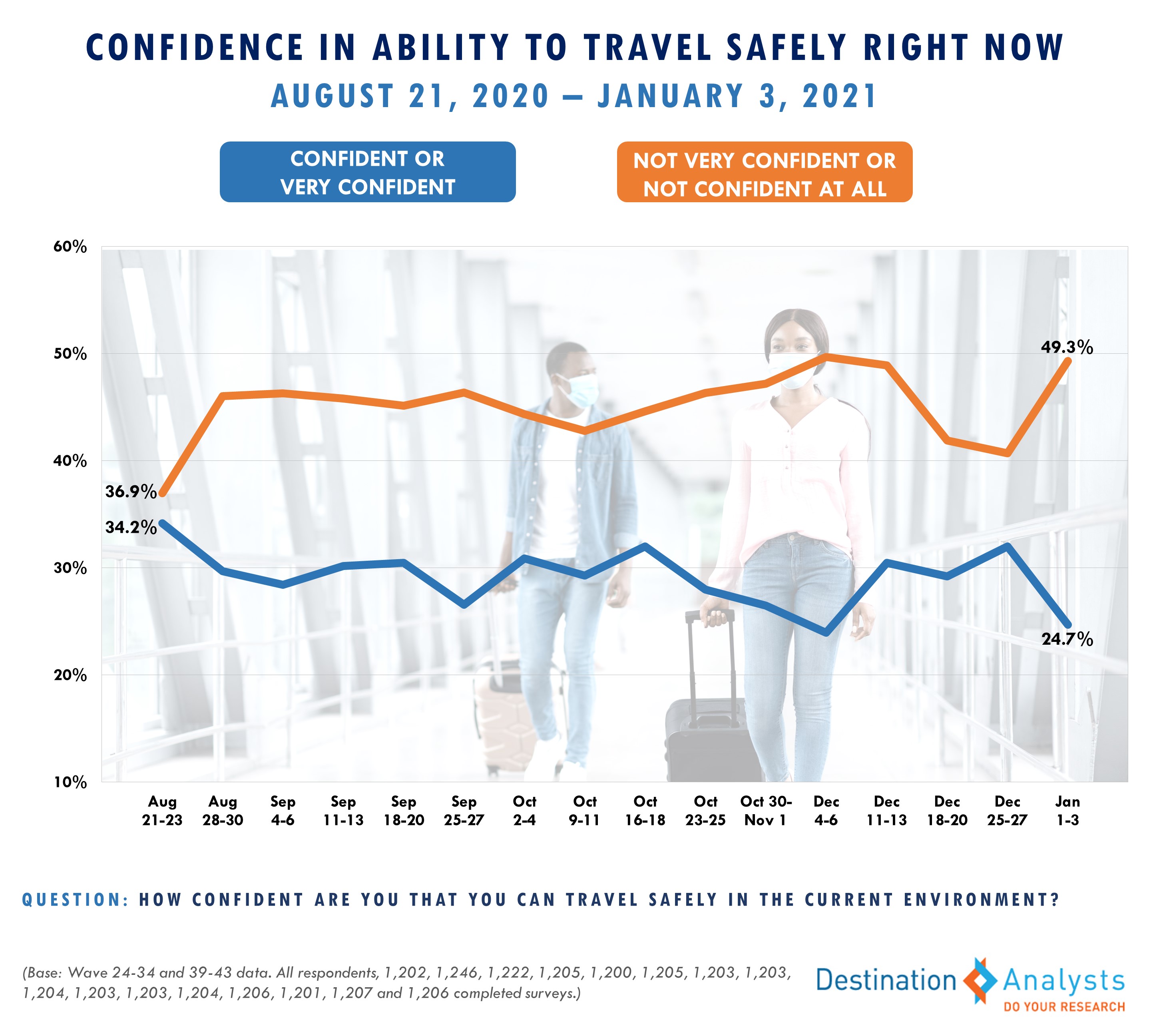

As daily new cases have dropped dramatically over the last month and vaccines continue to be administered, Americans’ anxiety about the pandemic—from both the financial and health impact perspectives—continues to decline. Now a record 39.3% of Americans feel the situation will get better in the next month—and only 22.7% feel it will get worse. The highest optimism about the pandemic’s course had ever previously been prior to this period was the week of May 4th, 2020, when 35.1% believed things would get better in the next month. And even then, pessimism still outweighed optimism, unlike today. These better feelings translate to travel. Perceptions of travel and leisure activities as unsafe has fallen to an average of 46.2% —a record low since the start of the pandemic. About 60% of American travelers feel at least somewhat confident they can travel safely in the current environment, and those who would have travel guilt has declined to 44.0% from a recent peak of 54.6% the week of December 14th. Now 58.5% are in a travel readiness state of mind.

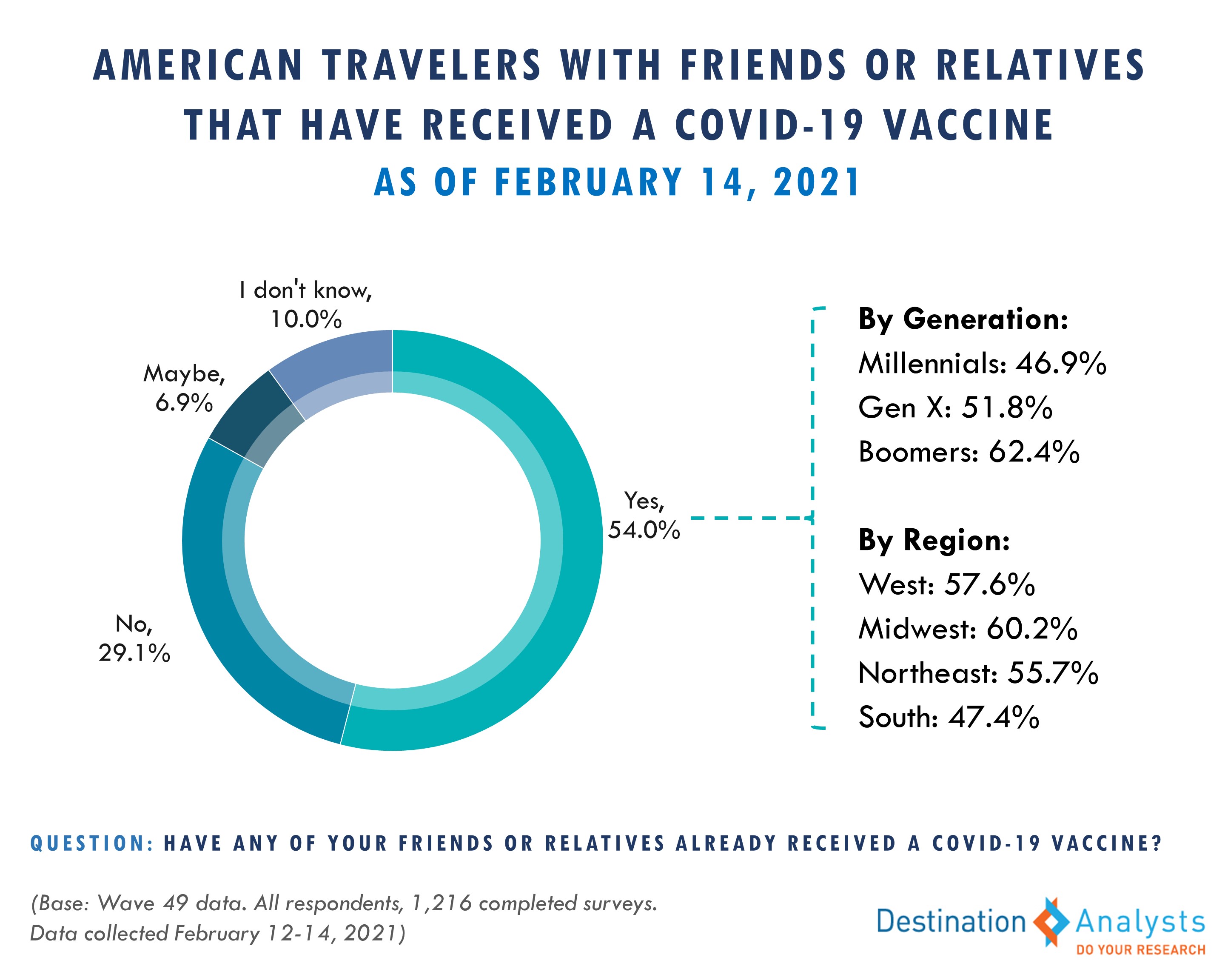

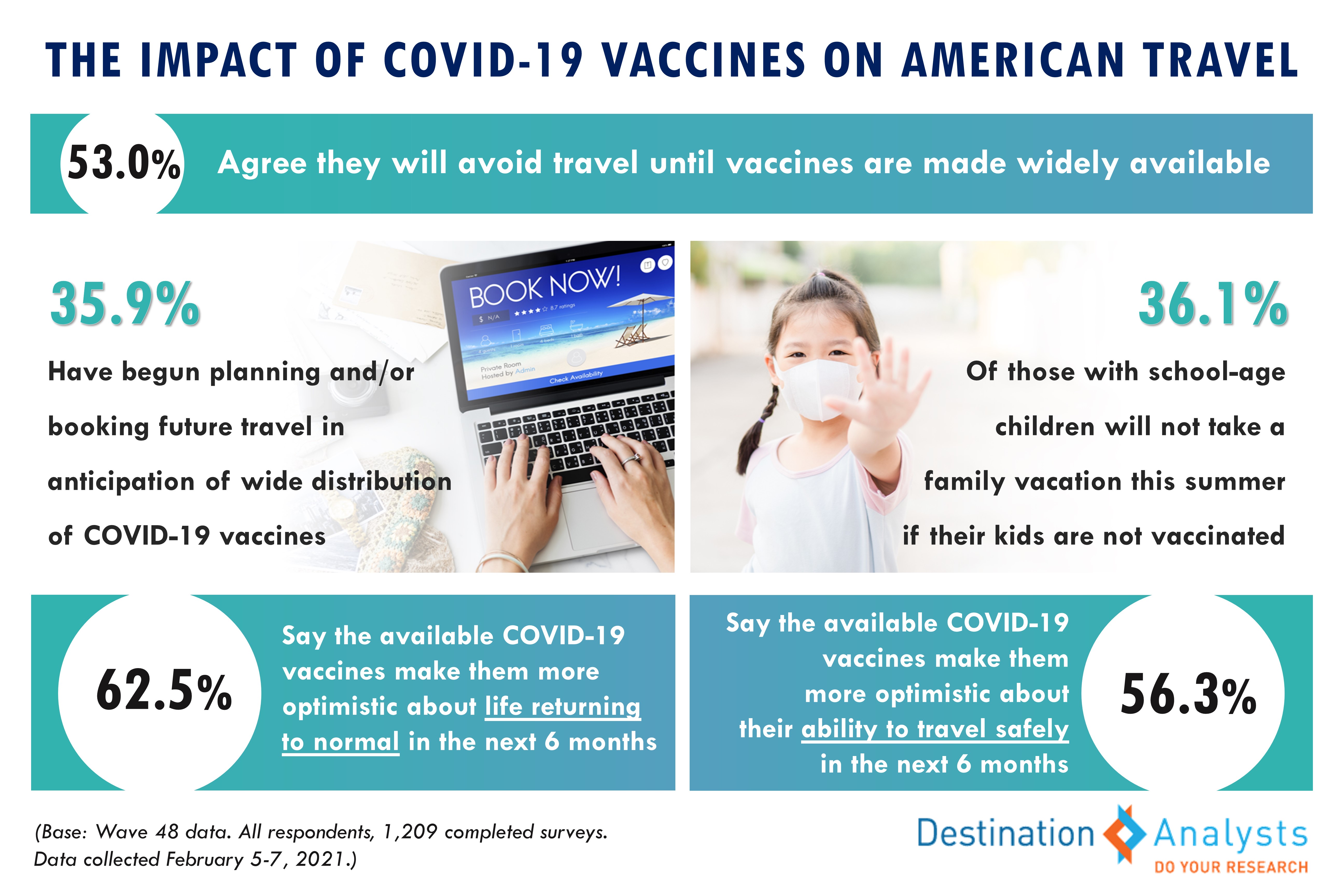

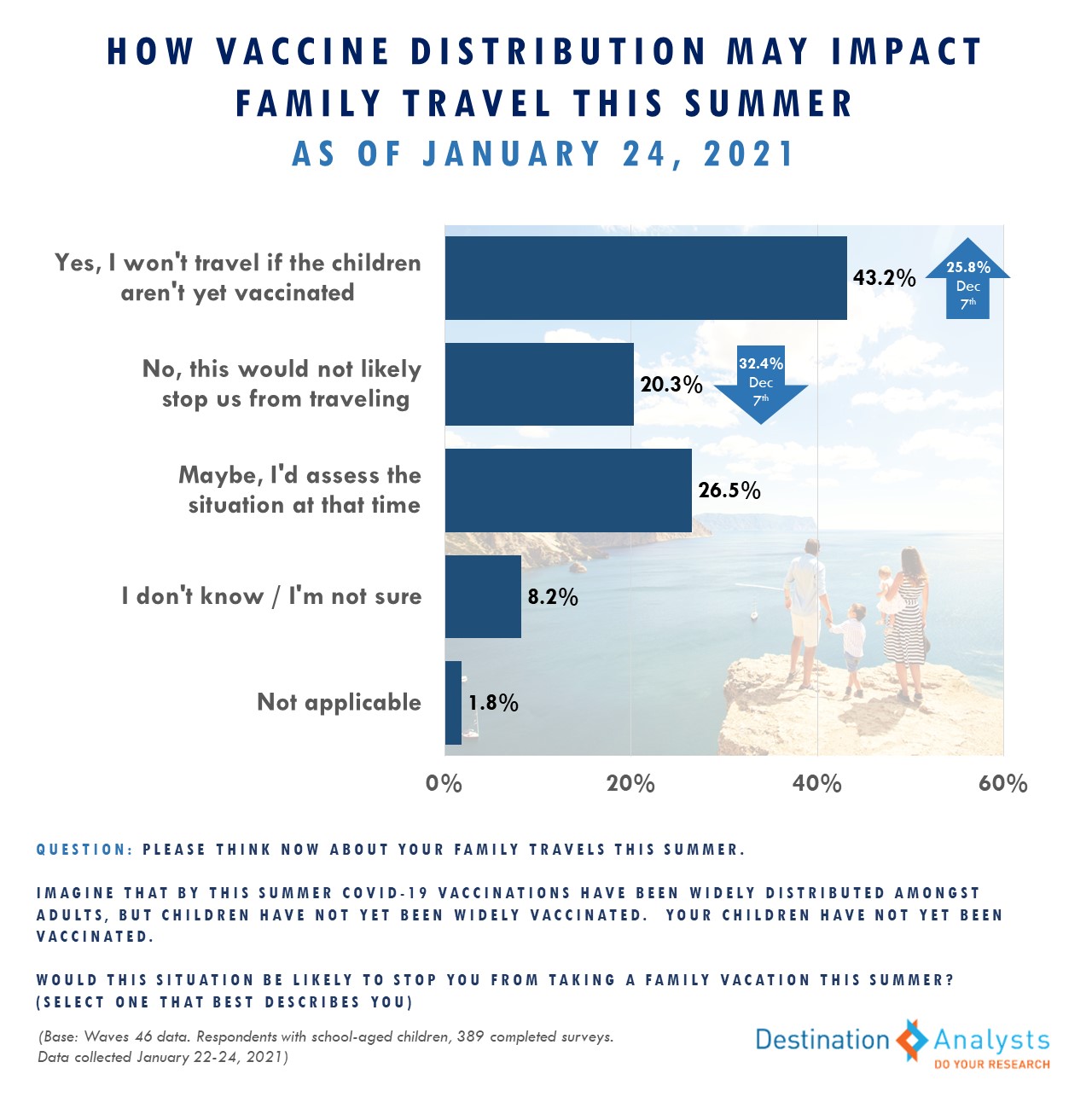

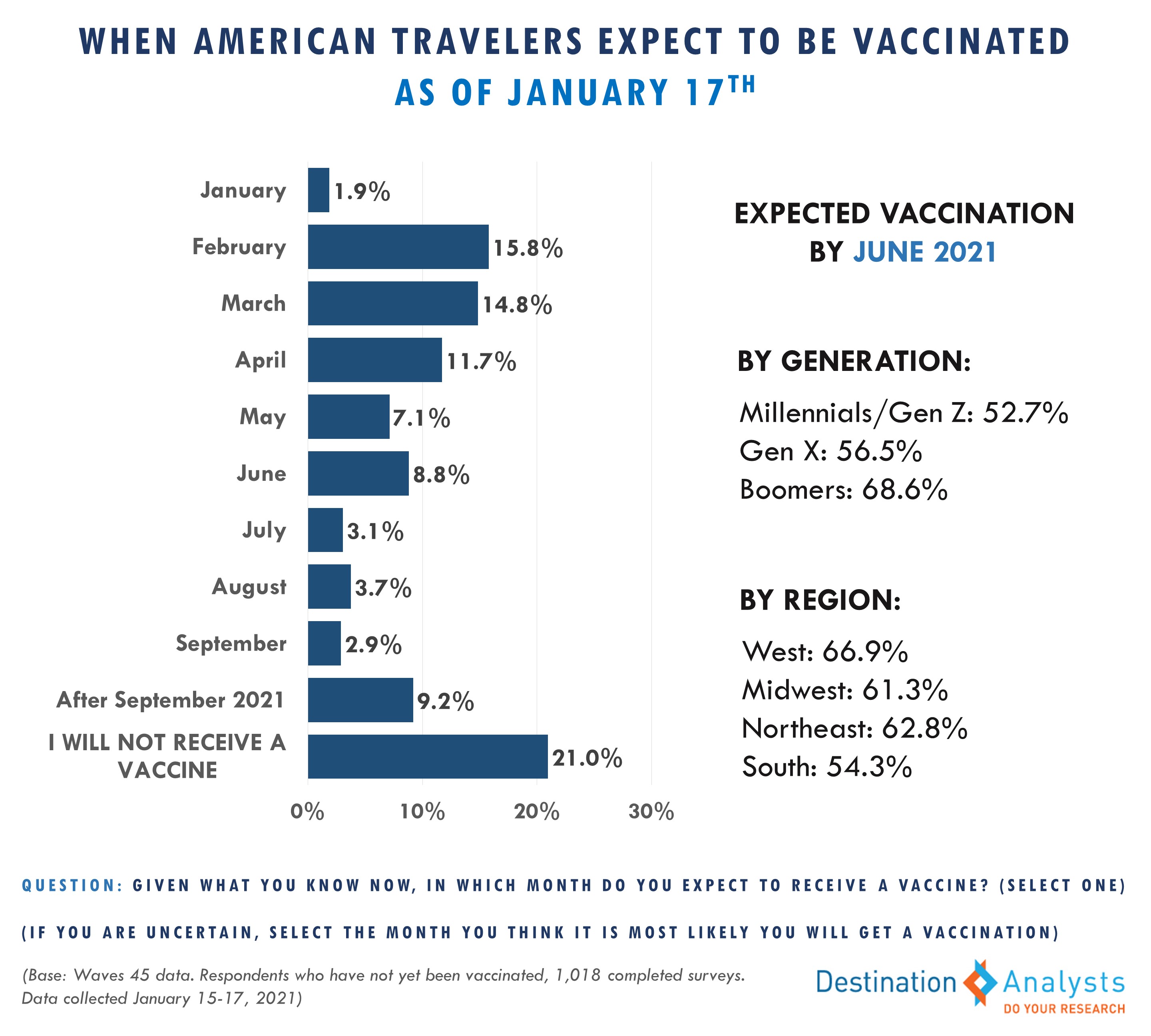

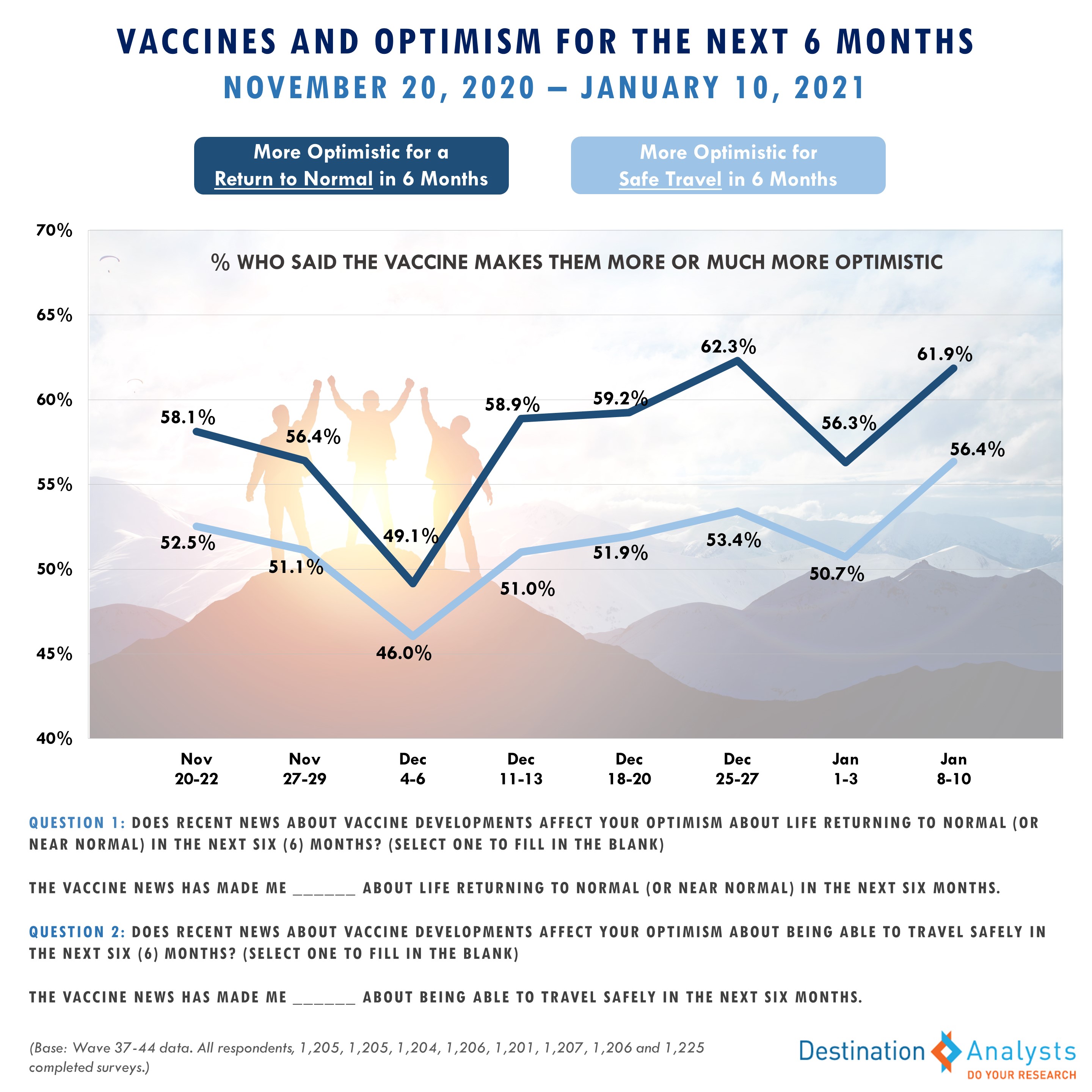

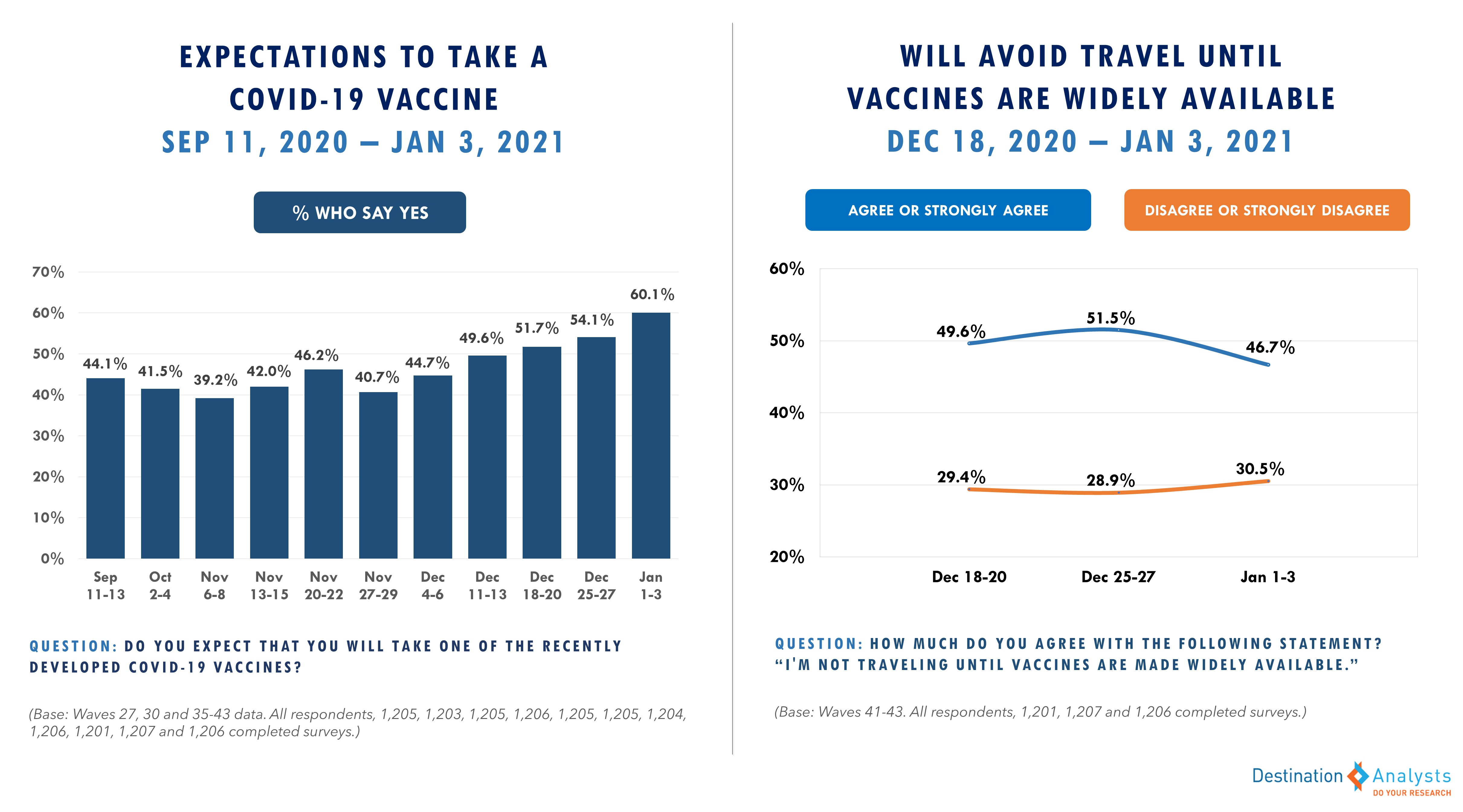

Vaccines continue to keep optimism up among a majority of American travelers. Nearly 6-in-10 travelers say COVID-19 vaccines make them more optimistic about life returning to normal in the next six months and 52.9% say it makes them more optimistic about the ability to travel safely in that same time. This week, 54.0% of American travelers report that they have a friend or relative who has received the vaccine. This rate is even higher among older travelers, as well as among those residing in the Western half of the U.S. Seeing people we know get vaccinated against COVID-19 clearly benefits travel sentiment. Those who know others who have already been vaccinated are likelier to have been or plan to be vaccinated themselves. These travelers are even more optimistic about their travel future and have begun planning travel specifically in anticipation of a wider vaccine rollout at higher rates than others. They are also more likely to have done any travel dreaming and planning in the last week, and have more trips planned for 2021 (3.0 vs 2.6).

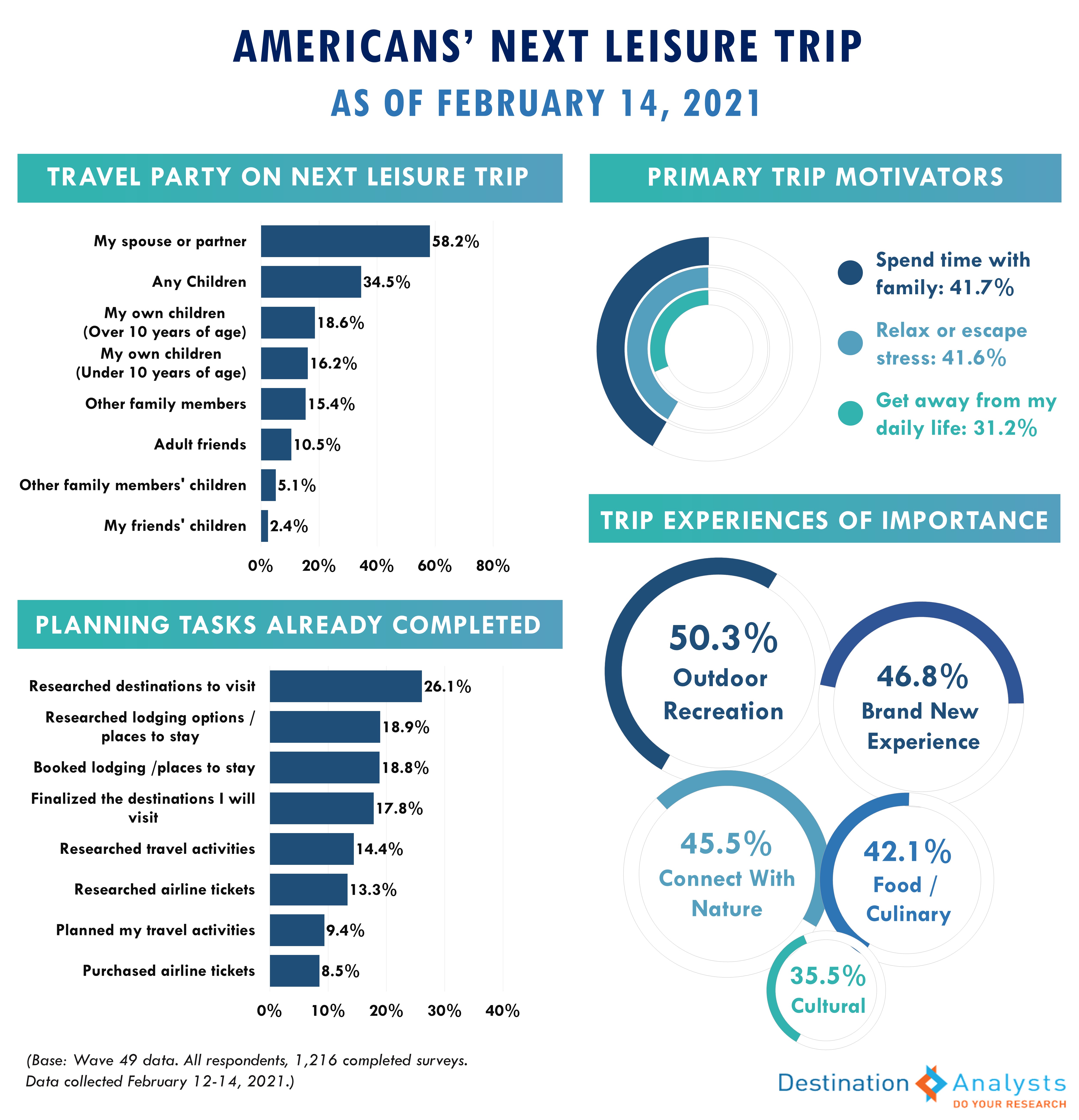

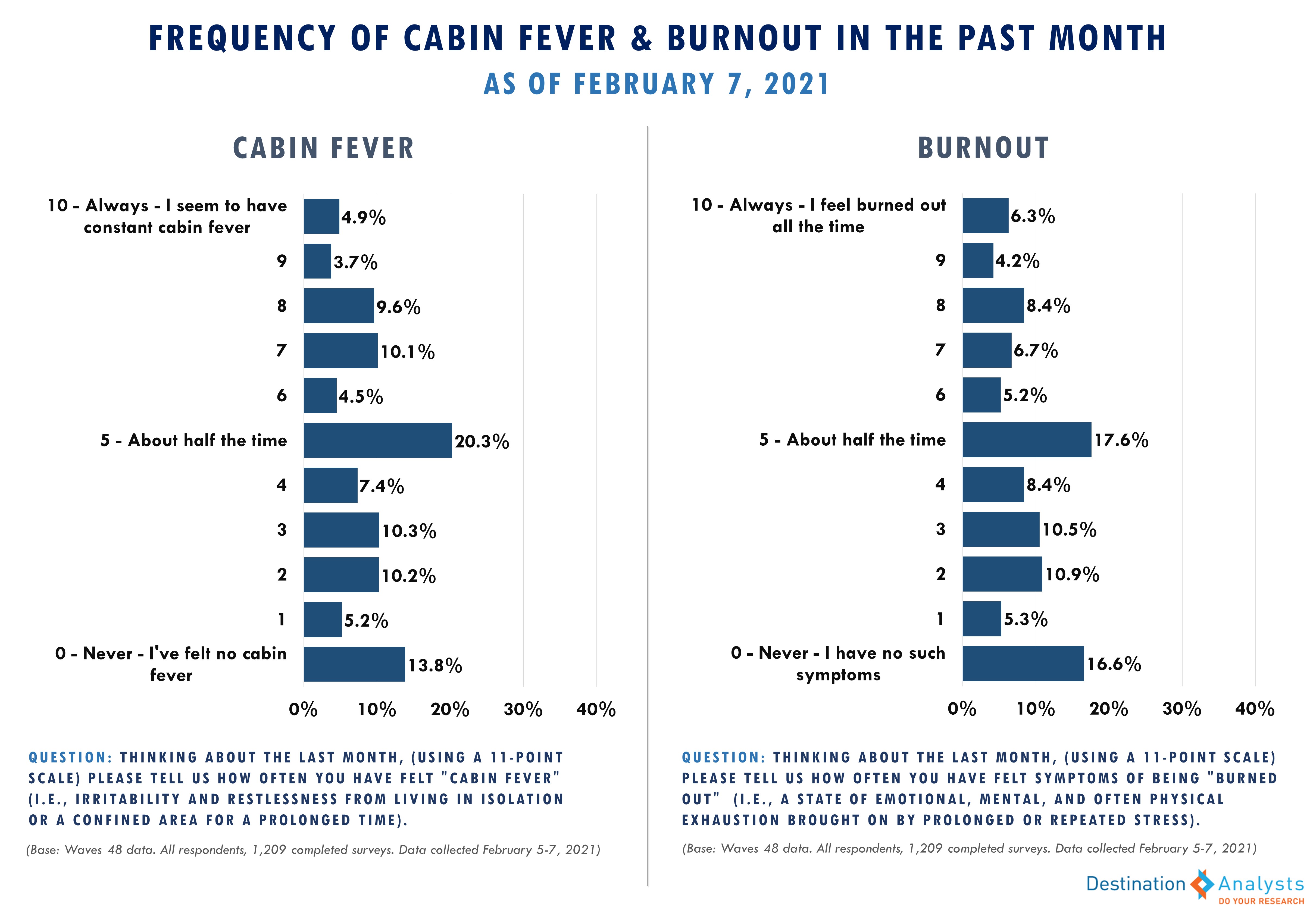

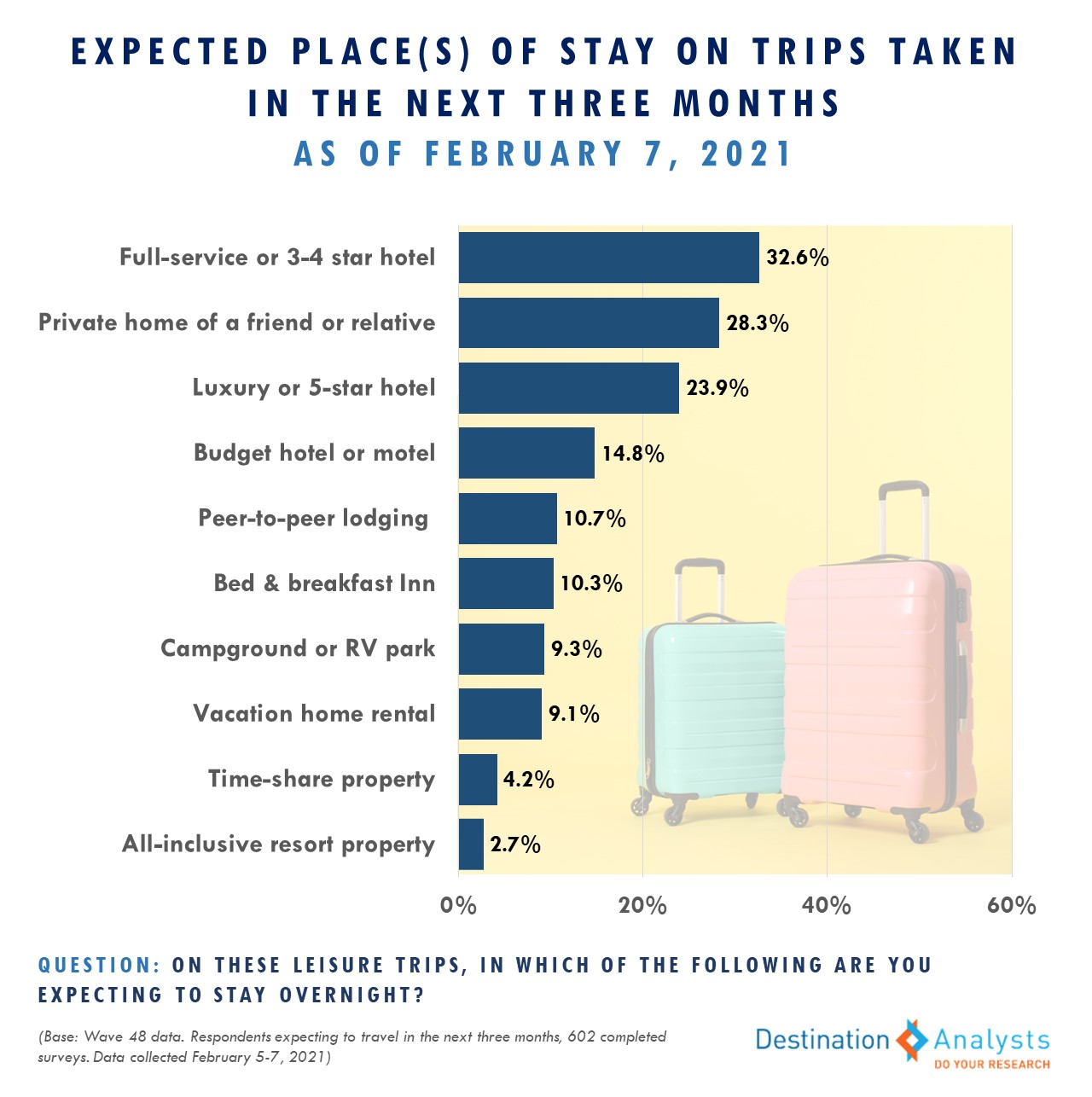

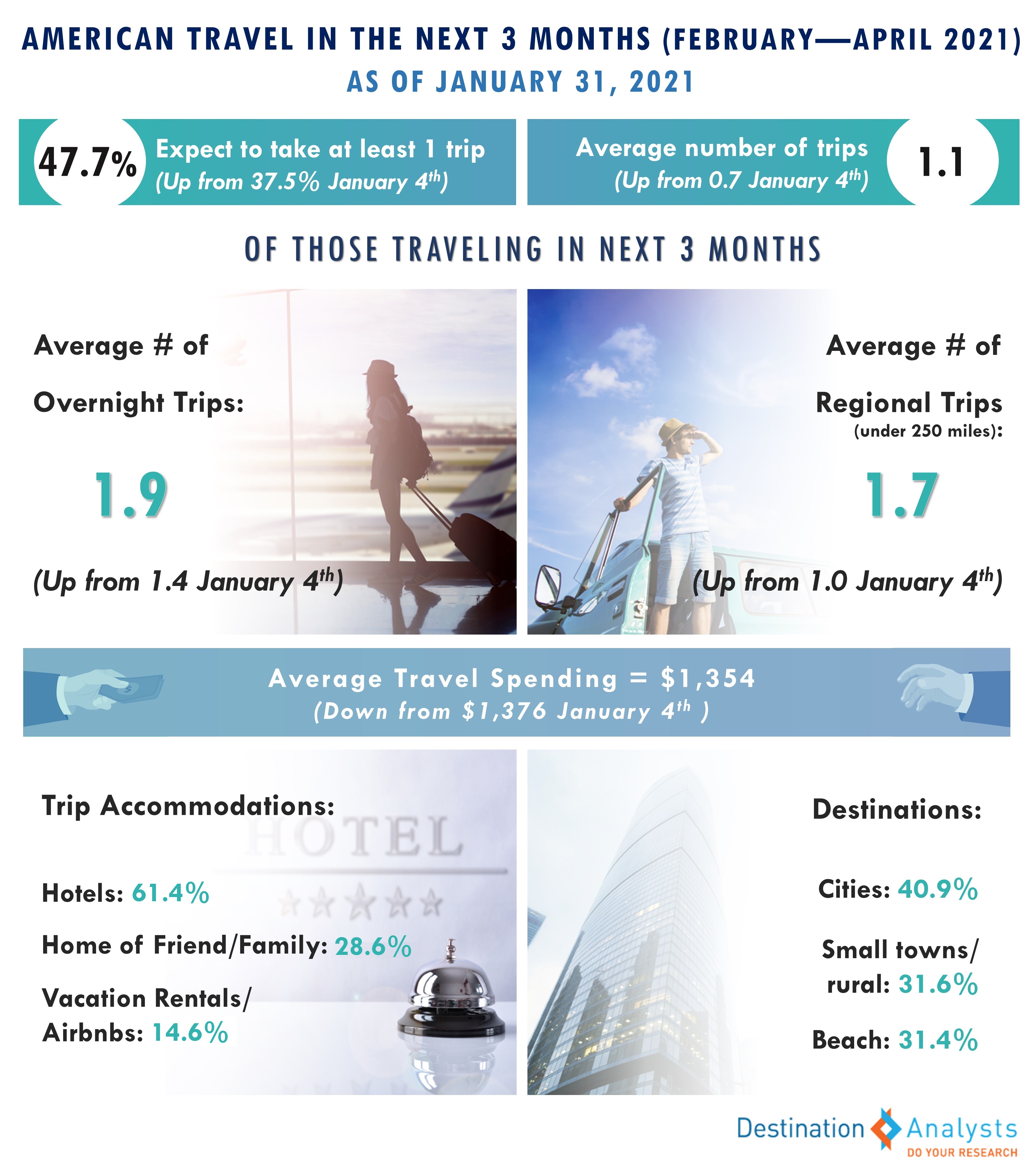

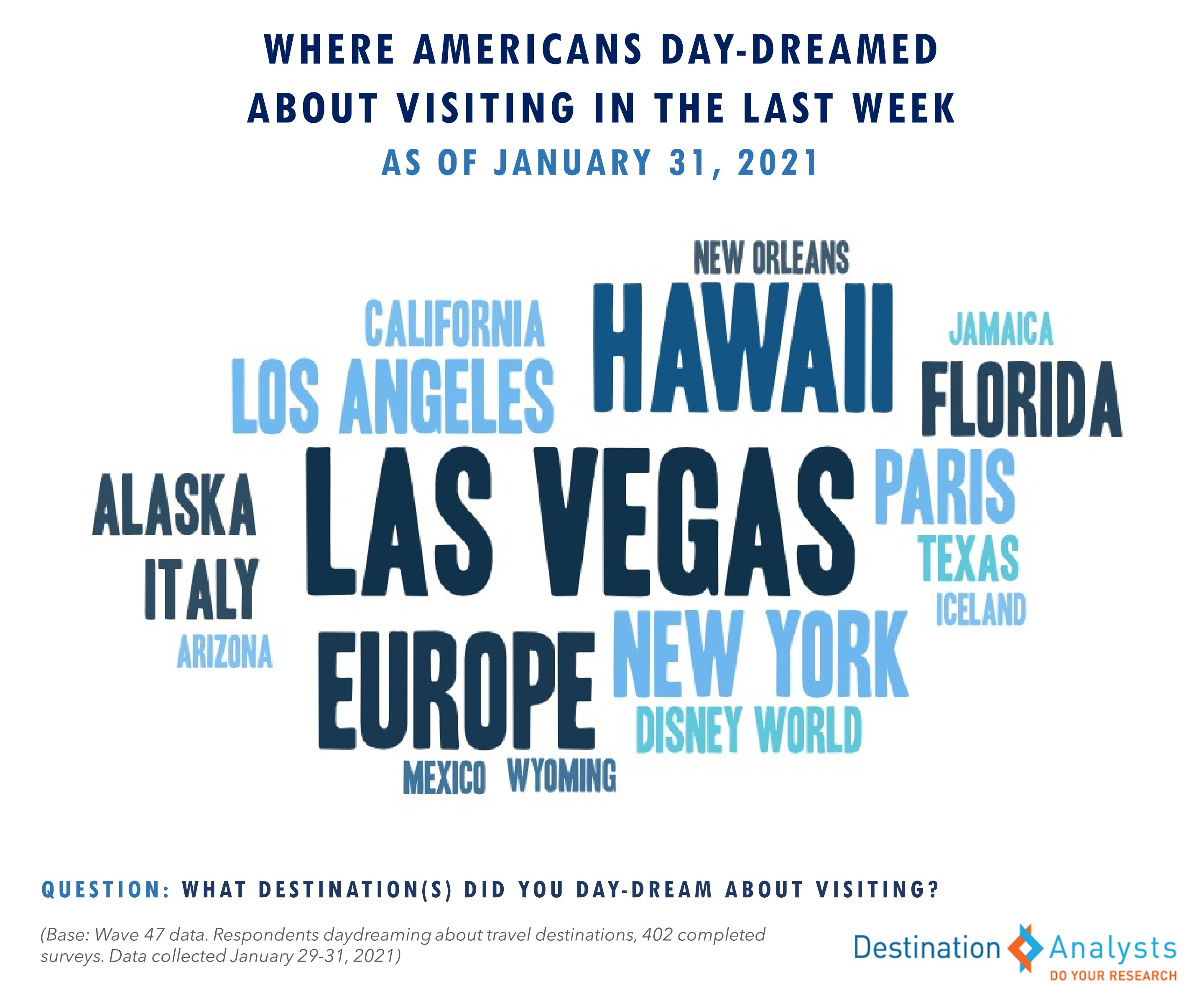

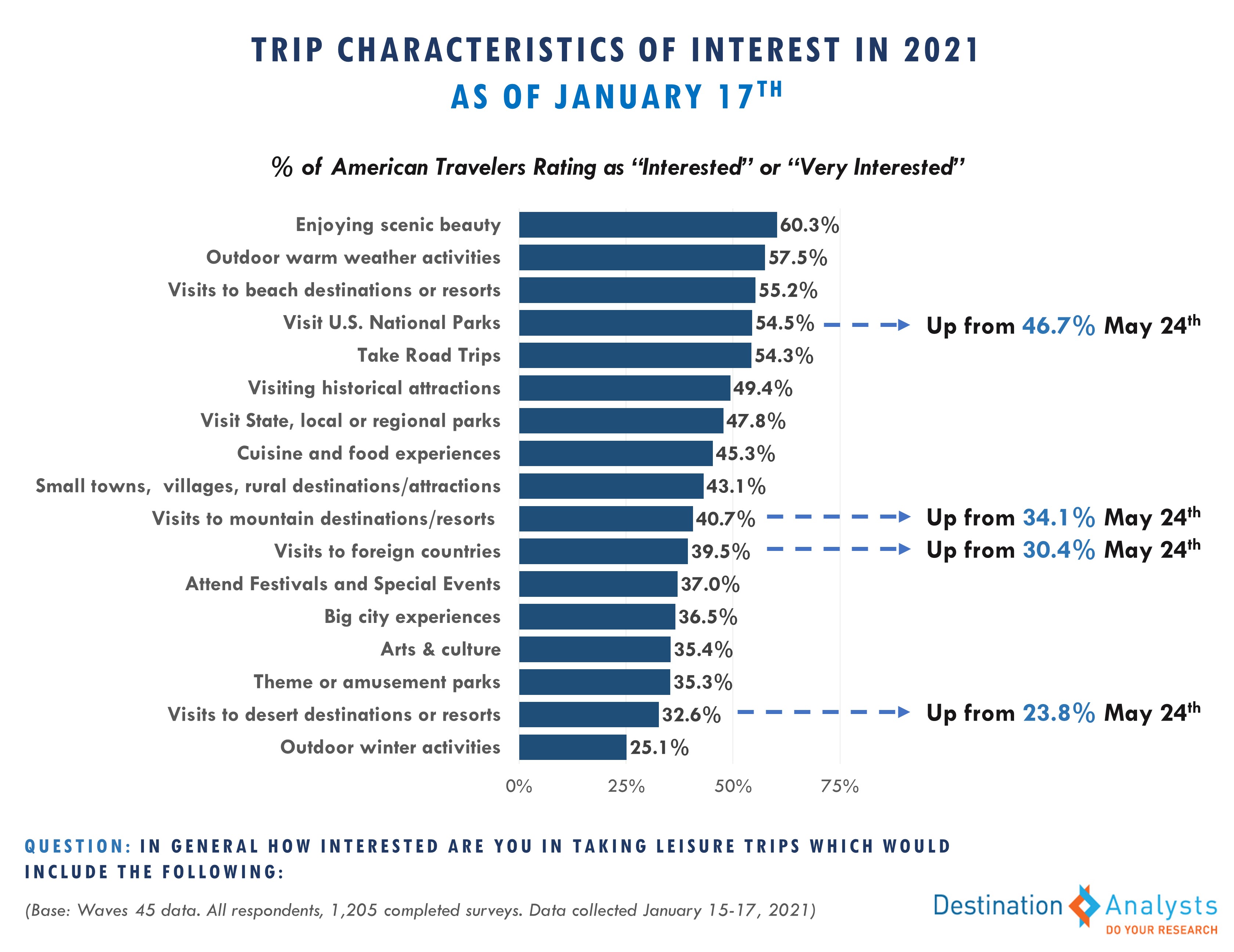

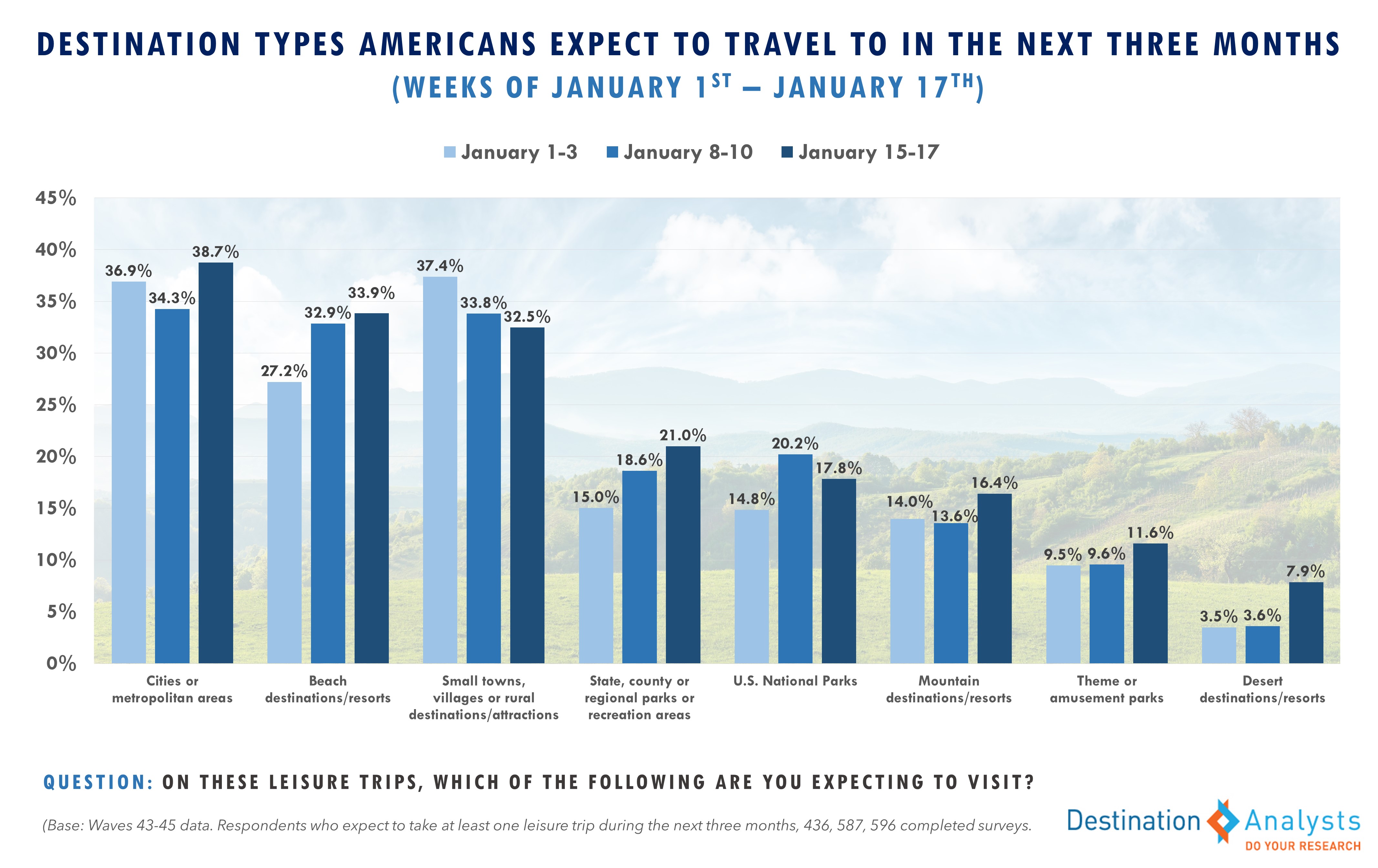

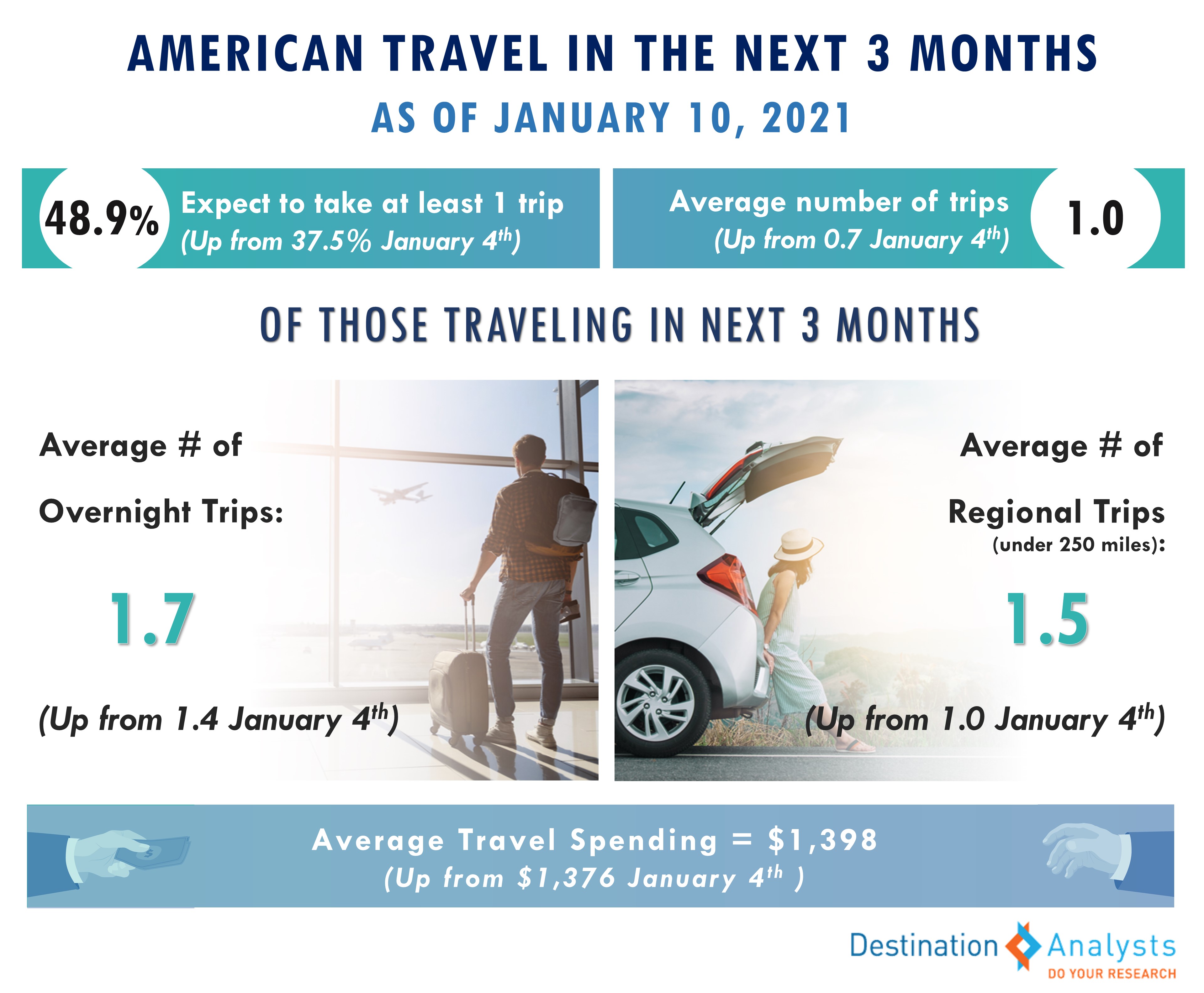

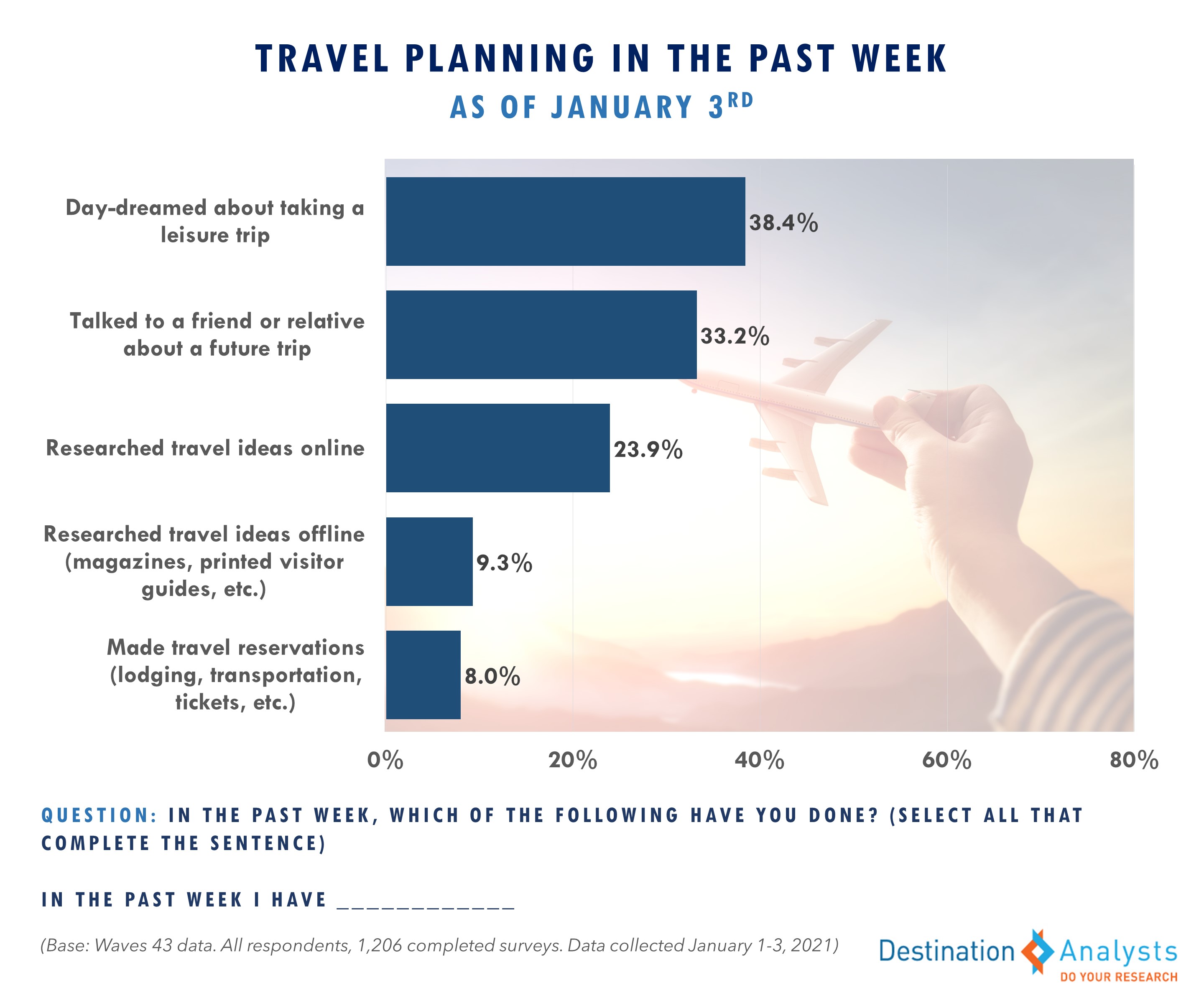

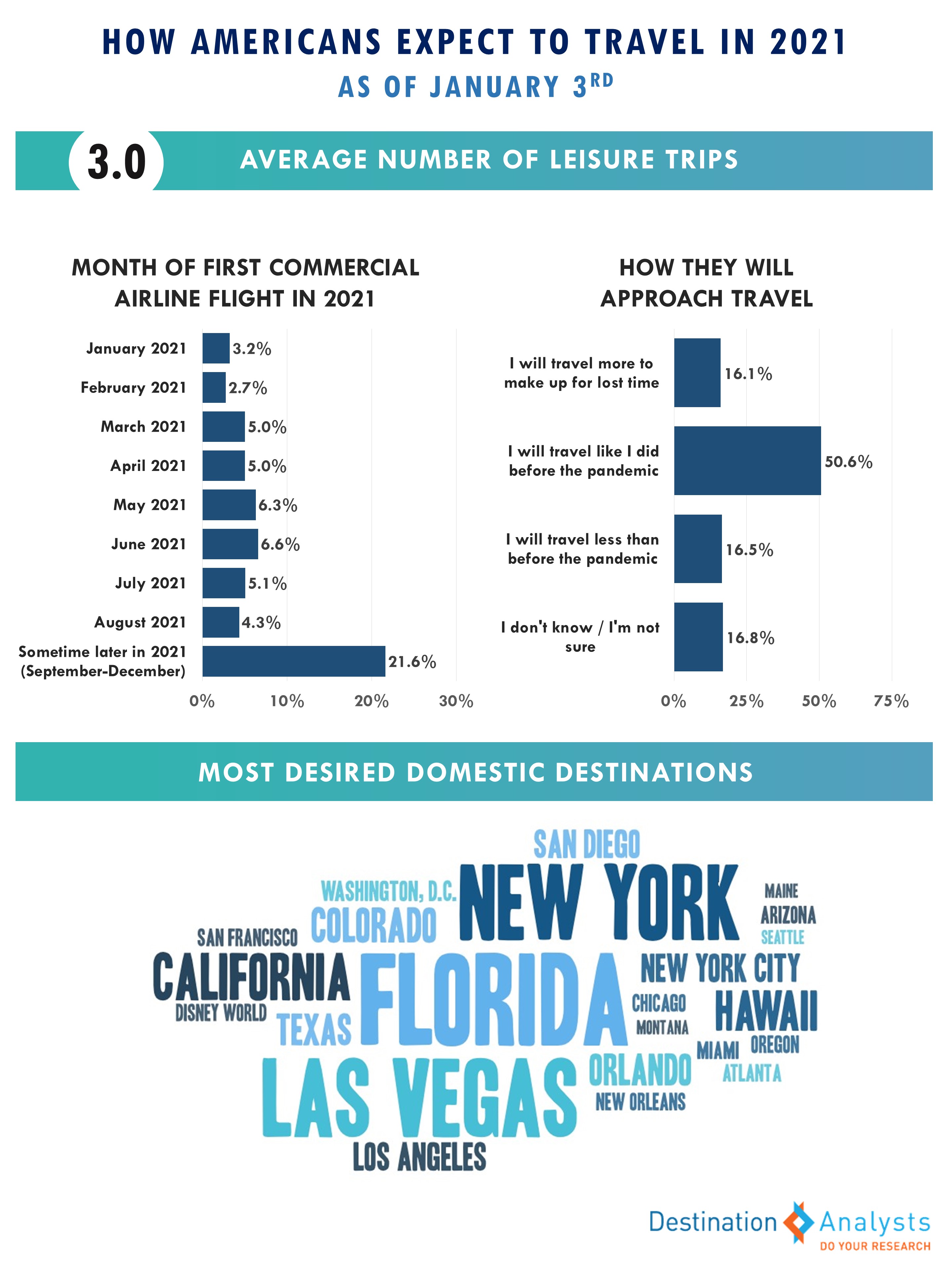

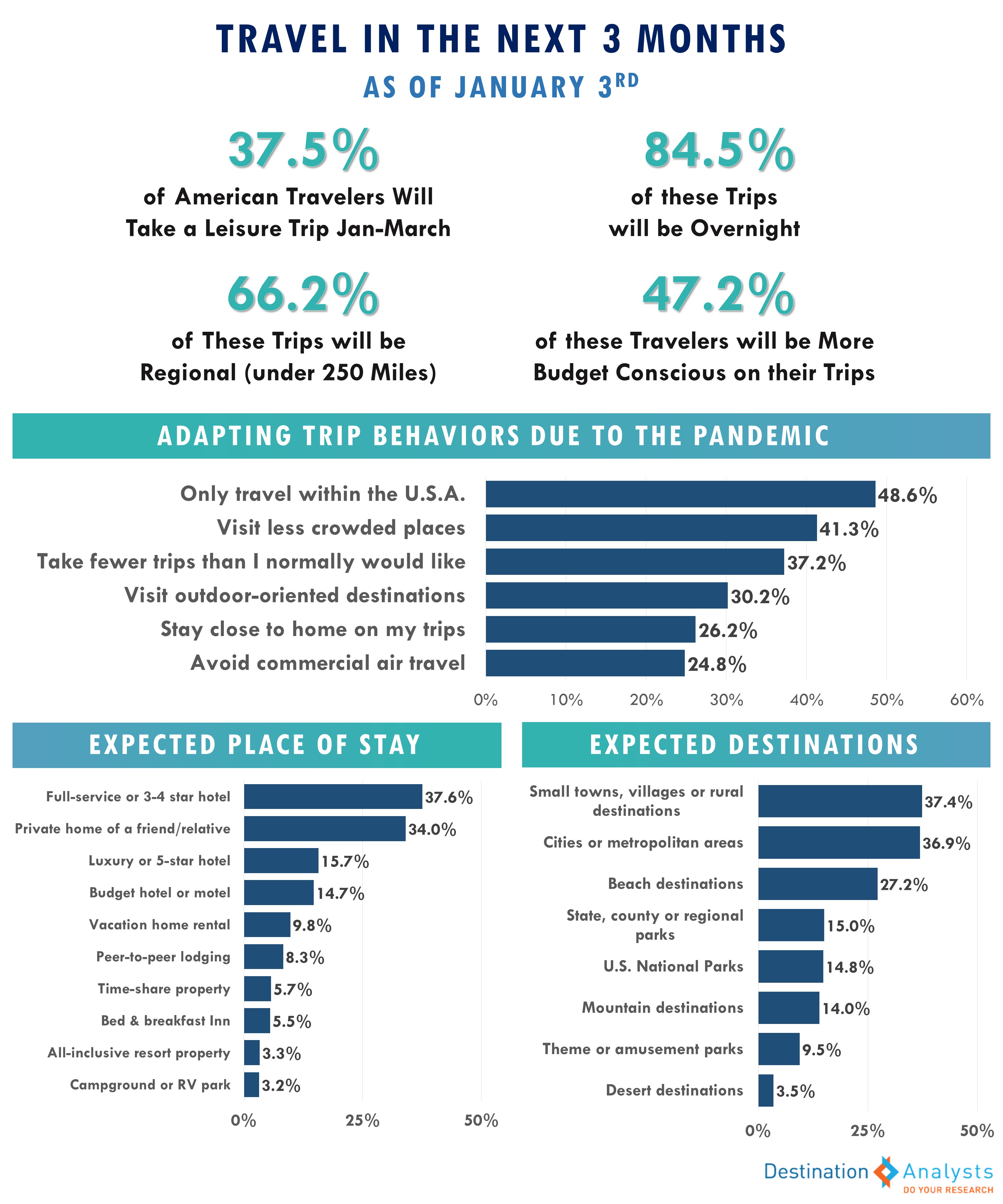

Right now, 80.2% of Americans have plans for one or more upcoming trips, with July still looking like the peak travel month this year. While nearly a quarter of the next road trips Americans will take will be within the next 3 months, the majority of American travelers still anticipate their very next air trip to be after June. More than half of Americans have taken some action towards their very next leisure trip, including researching destinations to visit (26.1%), booking lodging (18.8%) and researching travel activities (14.4%). The primary motivators for these next leisure trips are to spend time with family, relax and escape stress and simply get away from the routineness of daily life. Thus, Americans express how important it is to have such experiences on their trips. In terms of other experiences they want to have on their next trip, outdoor recreation and connecting with nature, food and culinary and any brand new experiences overall are key for many.

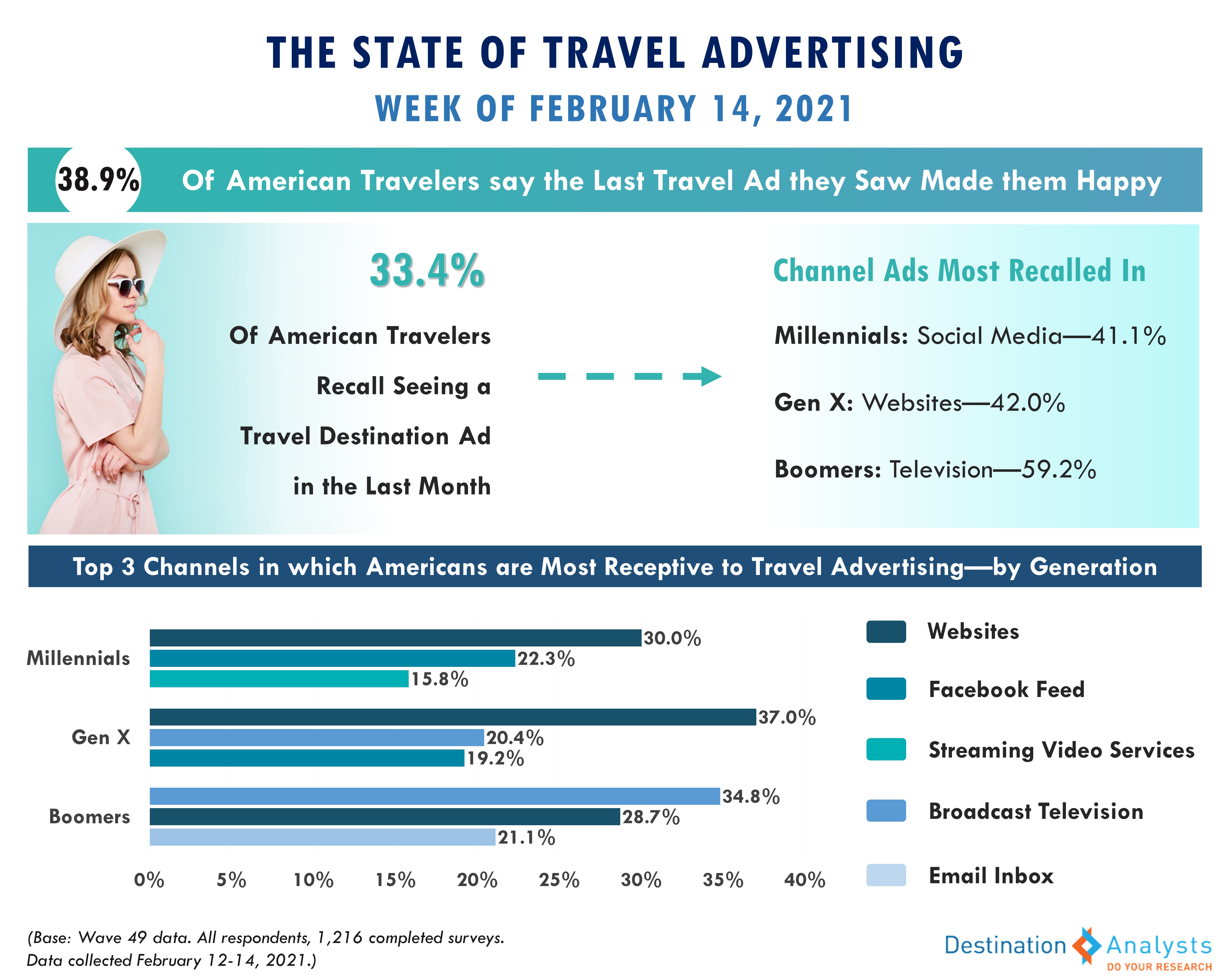

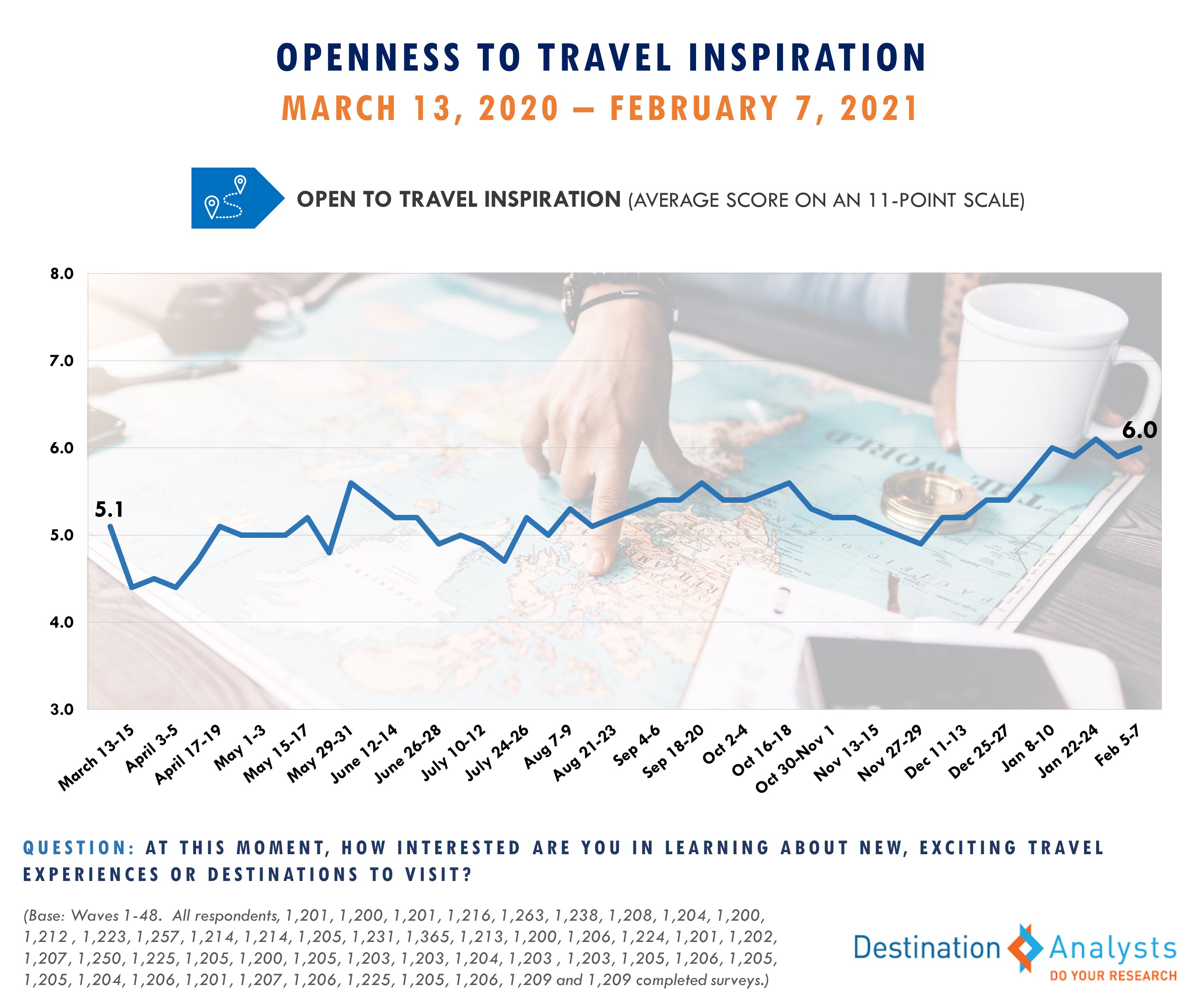

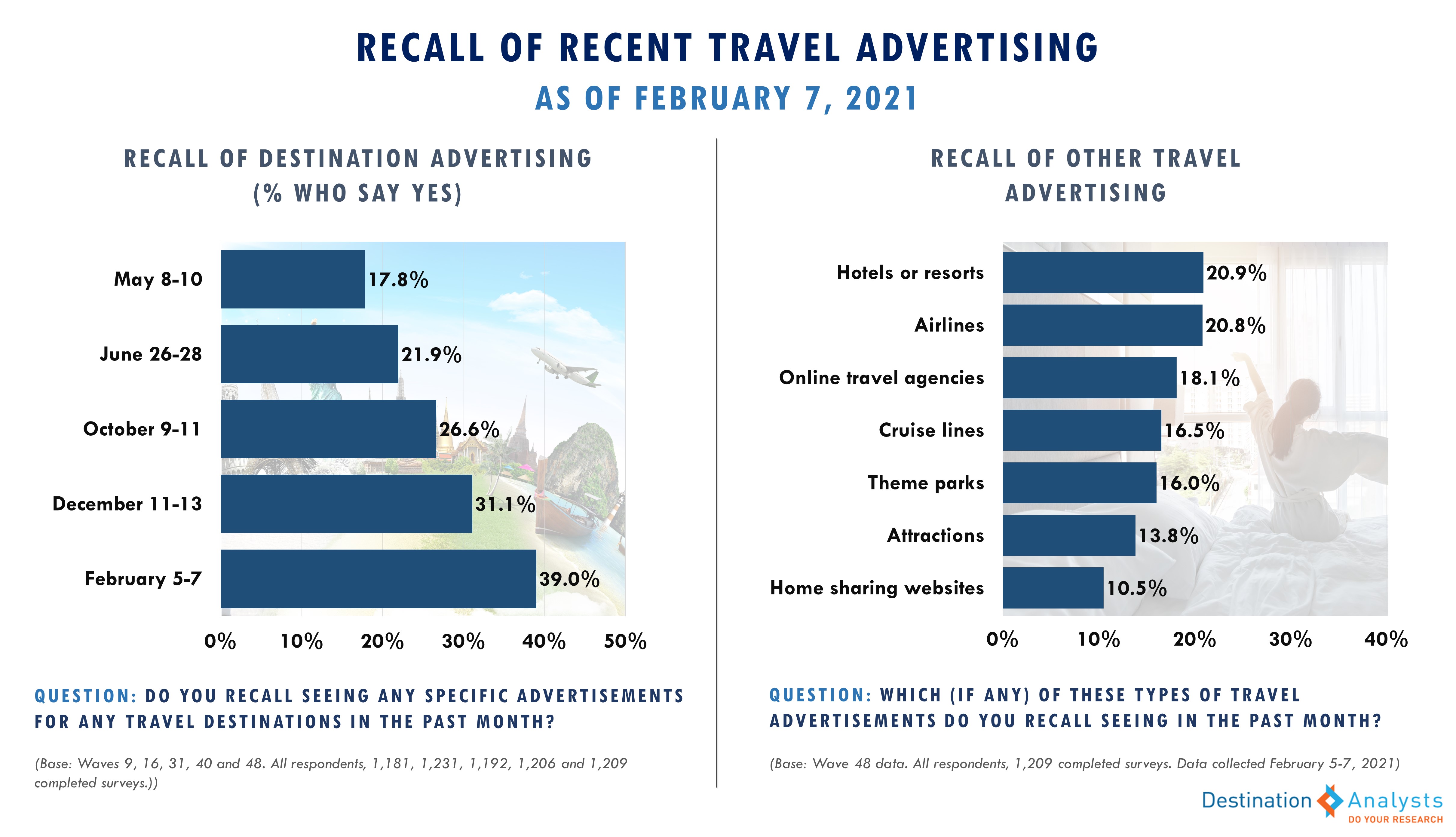

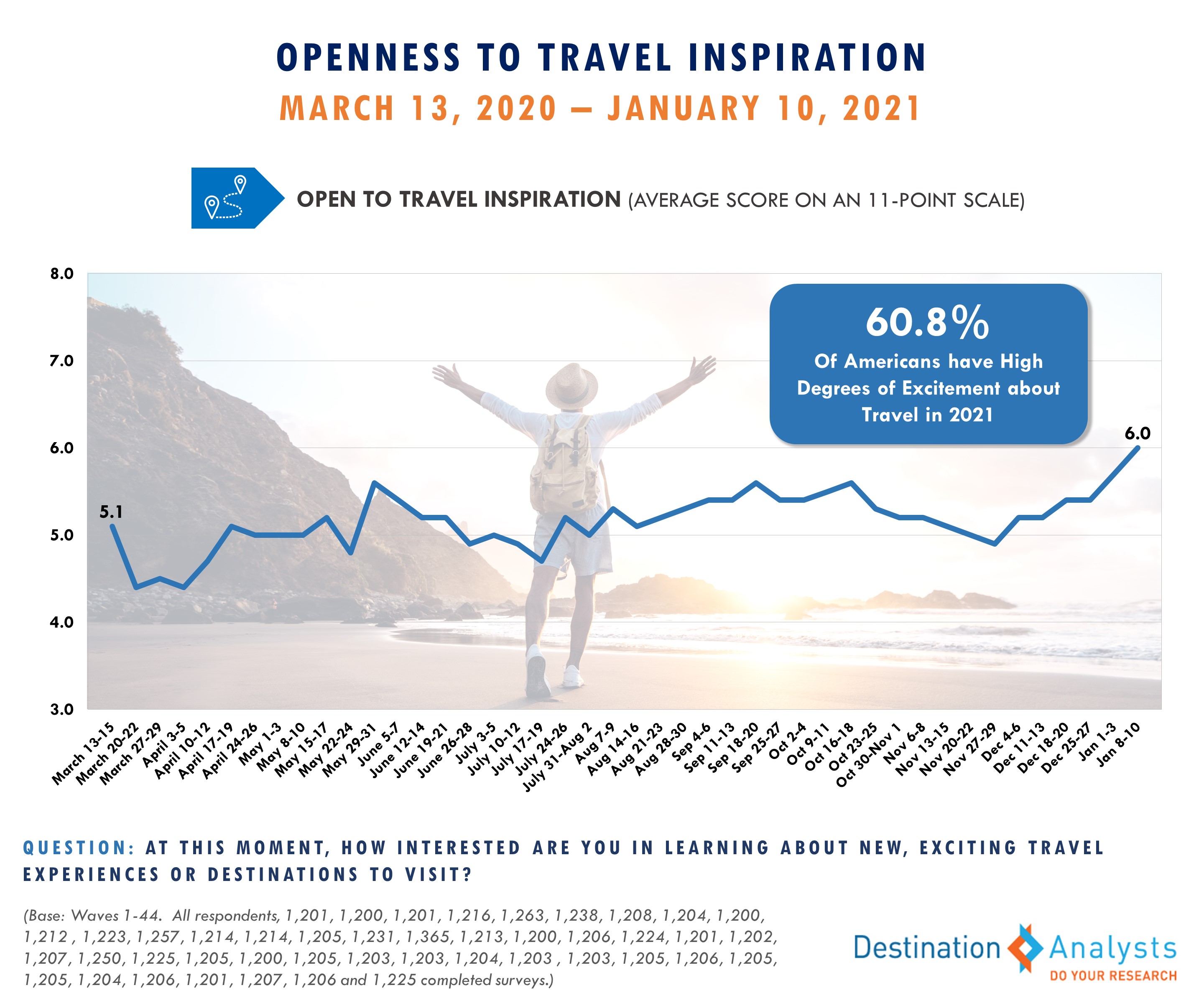

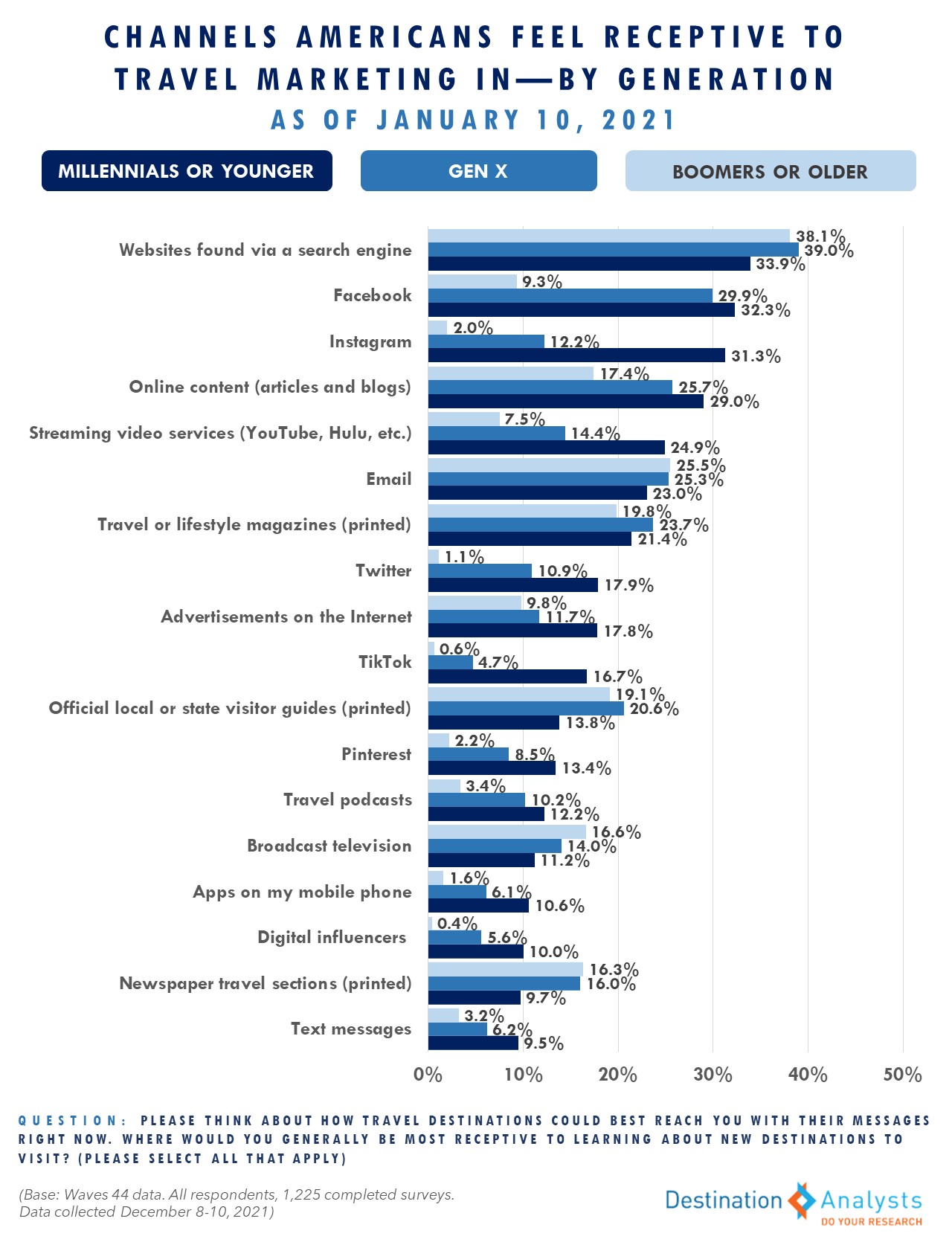

What could inspire even more Americans to travel, and to travel more? Advertising certainly plays a role. This week, 55.8% report being highly open to travel inspiration. Well over a quarter of all American travelers —and over 35% of those Millennial age or younger —say that an advertisement has specifically motivated them to travel to a destination. In fact, 38.9% say the last travel destination ad they saw made them feel “happy” or “very happy.” This week, one-third of American travelers recalled having seen an ad for a travel destination in the past month, most commonly on broadcast television, social media and elsewhere on the Internet. Where American travelers feel most receptive to travel advertising varies by age, but websites, social media (particularly Facebook), both broadcast and streaming television, and email are common.

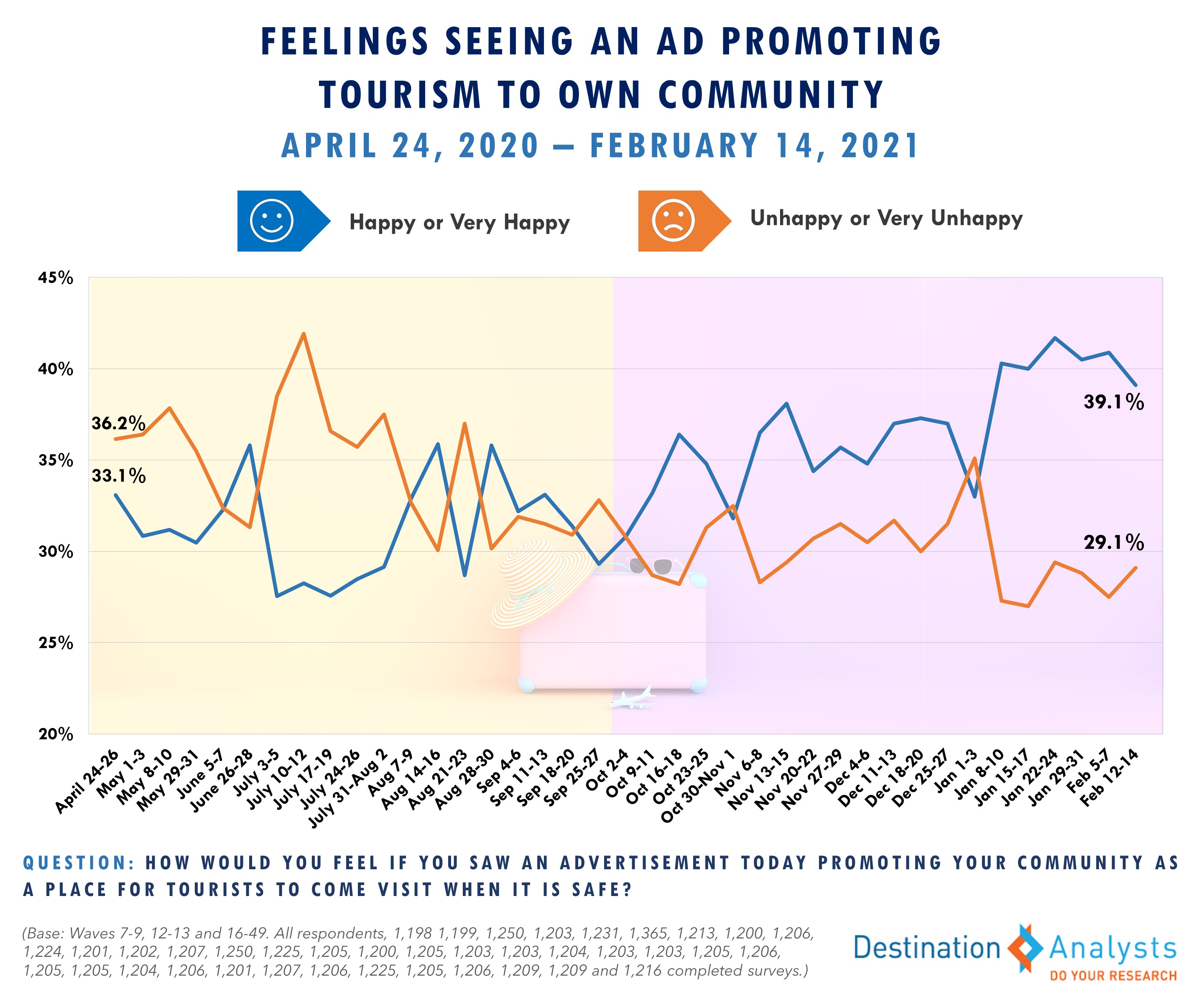

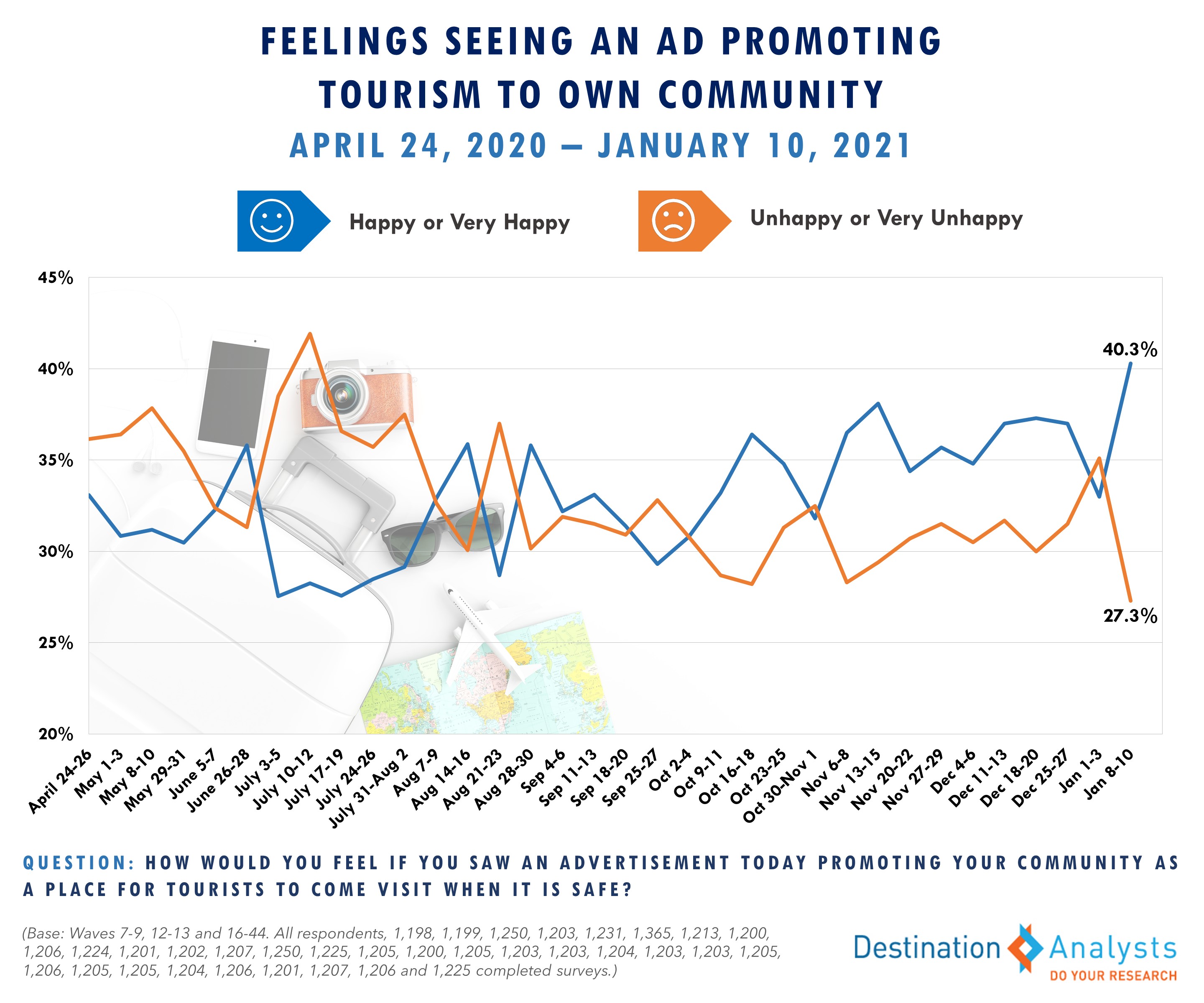

In addition to how they are feeling about traveling, how Americans perceive travel within their own communities is also critical to understanding the travel industry’s recovery. This week 44.3% agree they feel comfortable going out for leisure activities where they live. In addition, a larger proportion of Americans continue to say they would be happy to see their community advertised for tourism (39.1% vs 29.1% who would be unhappy). Those residing in urban areas are far likelier to feel happy about travel advertisements of their city compared to those residing in suburban or rural areas (50.1% vs 35.6% for rural and 34.7% for suburban).