Despite feeling safer and increasingly more positive, many Americans do expect a longer term impact from the pandemic on their travel, from spending less to sticking outdoors.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected March 19th-21st.

Key Findings to Know:

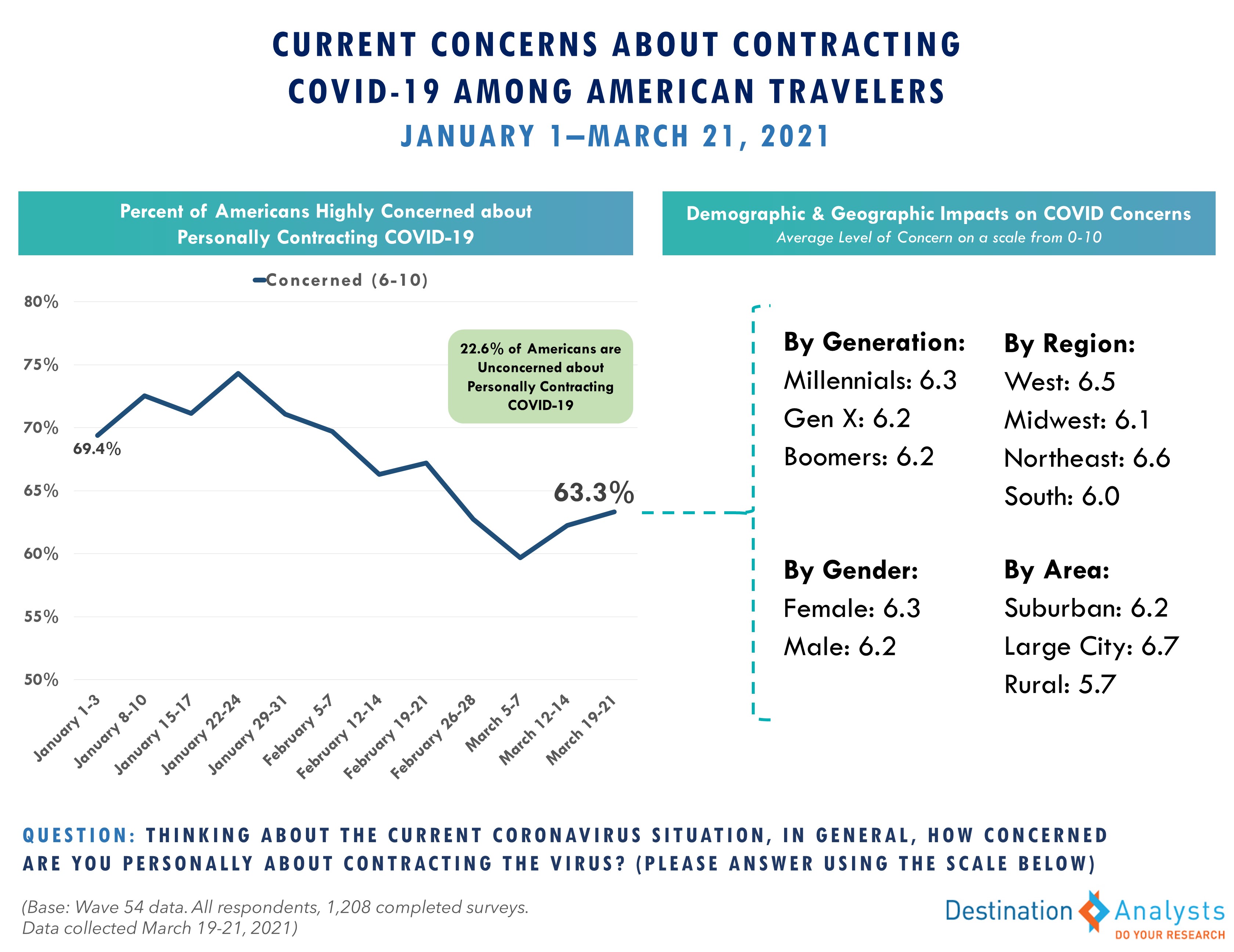

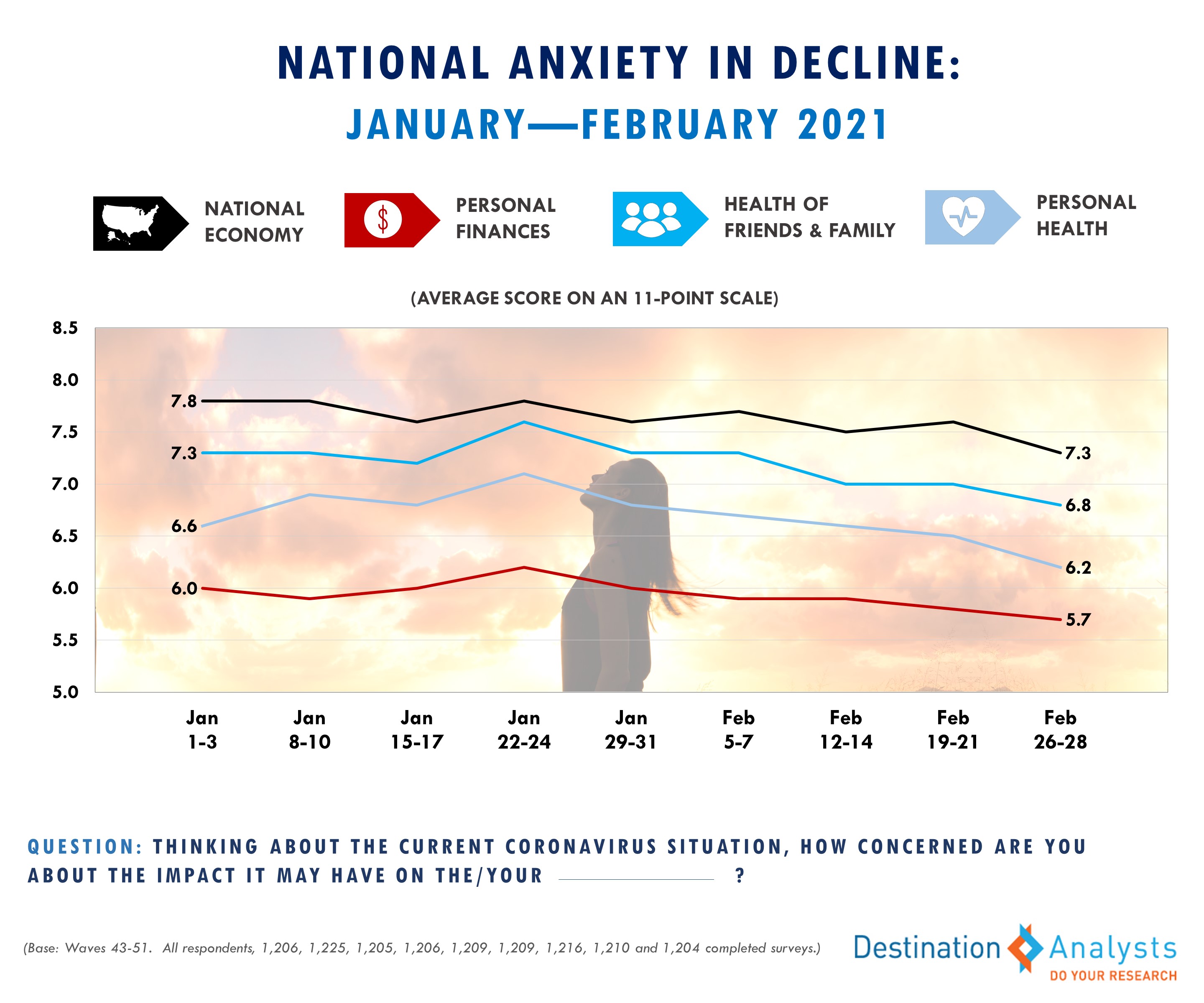

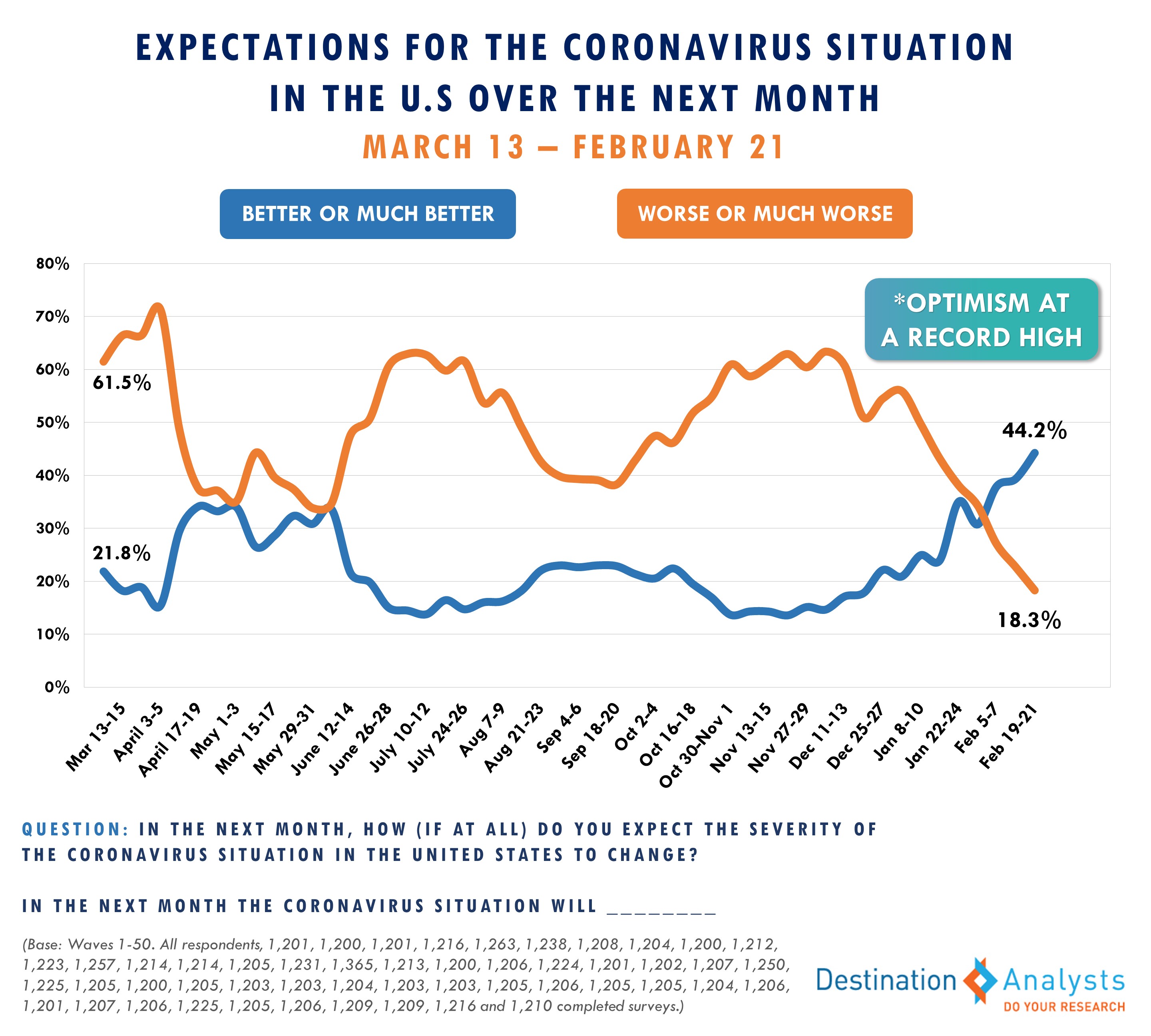

New COVID variants, uncertainty on the current COVID vaccines’ effectiveness with such variants, a European third wave, and Spring Break rowdiness made headlines this week, likely contributing to a small but notable rise in pandemic-related anxiety among American travelers. The proportion of American travelers that feel the pandemic situation will get worse in the U.S. in the next month rose over 7% to 18.5%, after hitting a low of 11.1% last week. Similarly, those highly concerned about their friends and family contracting the virus rose to 71.0% after being at a low of 65.4% two weeks ago. This week, 63.3% of American travelers are highly concerned about personally contracting COVID-19. Such concern is higher among women, Millennials, urban dwellers, and those residing in the West and Northeast regions of the U.S.

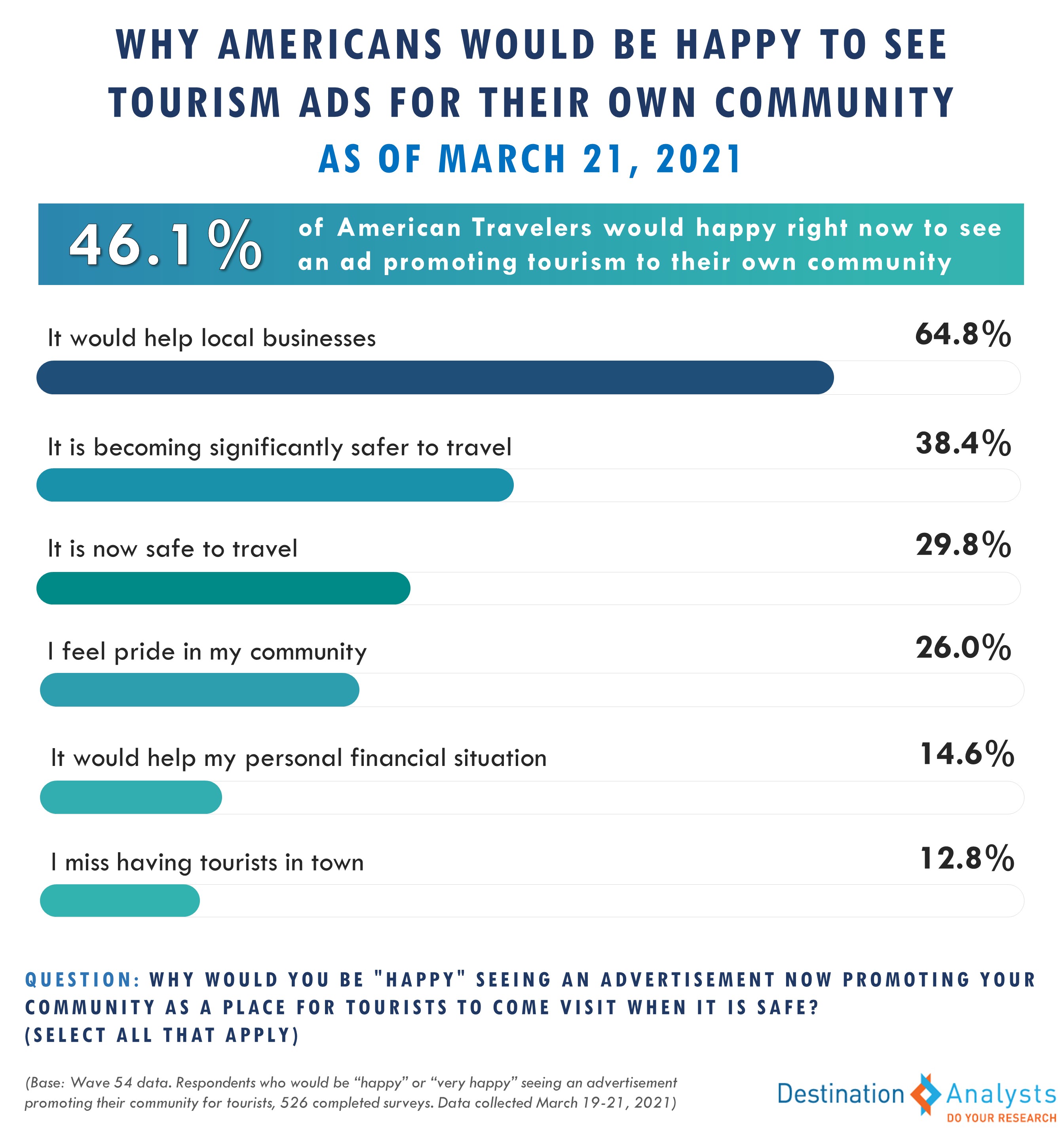

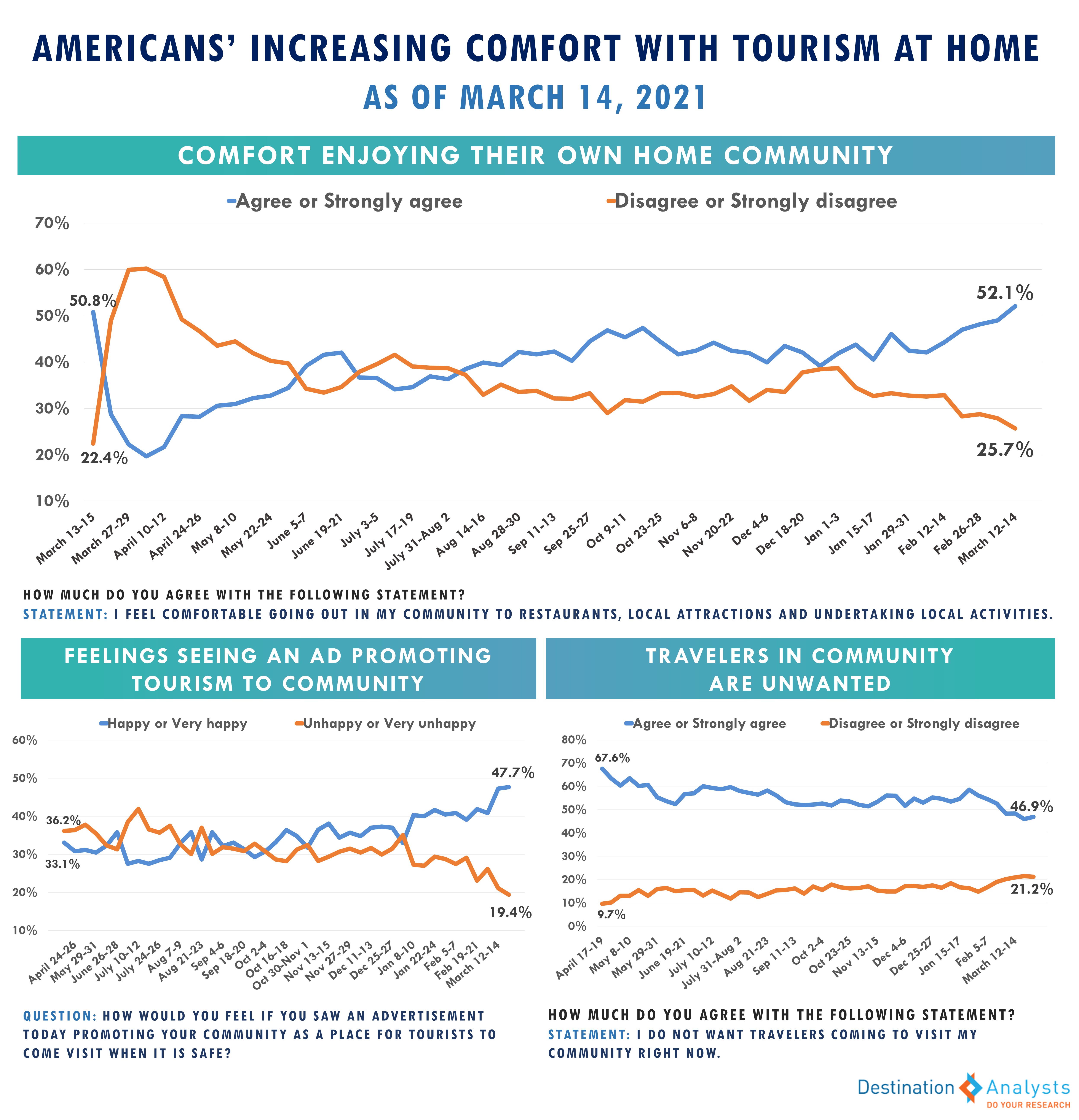

Americans highly concerned about the pandemic’s impact on our national economy also grew, reaching 79.6% this week. This may play a role in their feelings towards tourism in their own communities. Among the 46.1% of American travelers who report they would be happy to see an ad promoting tourism to their town of residence, by far the most common reason for this is that it would help local businesses (64.8%).

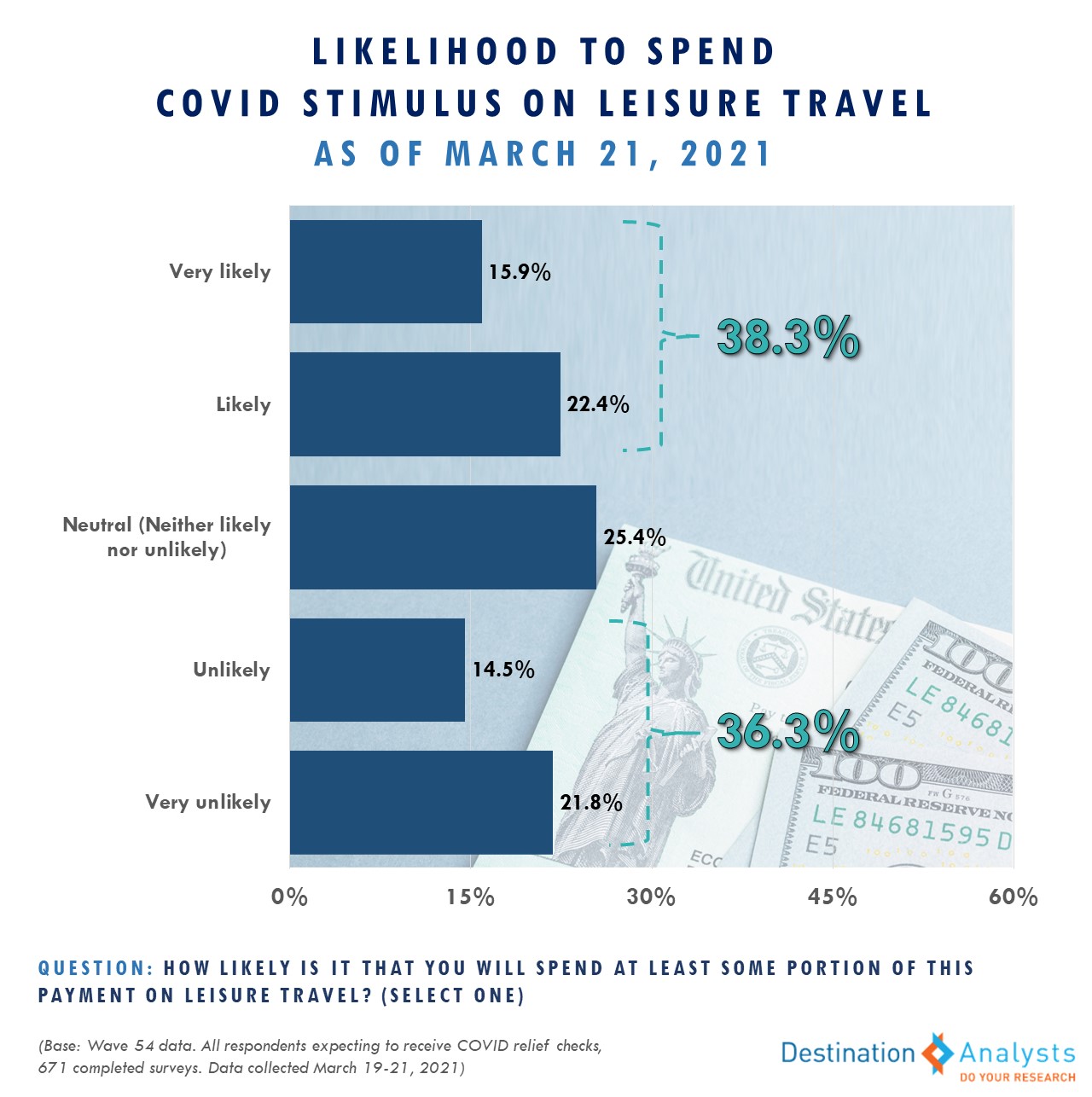

Also happening in the last week: Americans began receiving stimulus checks due to the recently passed American Rescue Plan Act. Over half of American travelers surveyed believed they would receive some payment from this legislation. Travel looks to certainly benefit from this injection of money into citizen’s hands, as 38.3% of those who have or are expecting a stimulus check say they are likely to spend some portion of it on leisure travel. This is even more prevalent among Millennial age travelers, who are, in fact, twice as likely as Boomer age travelers to spend their stimulus money on travel (48.4% vs 24.9%).

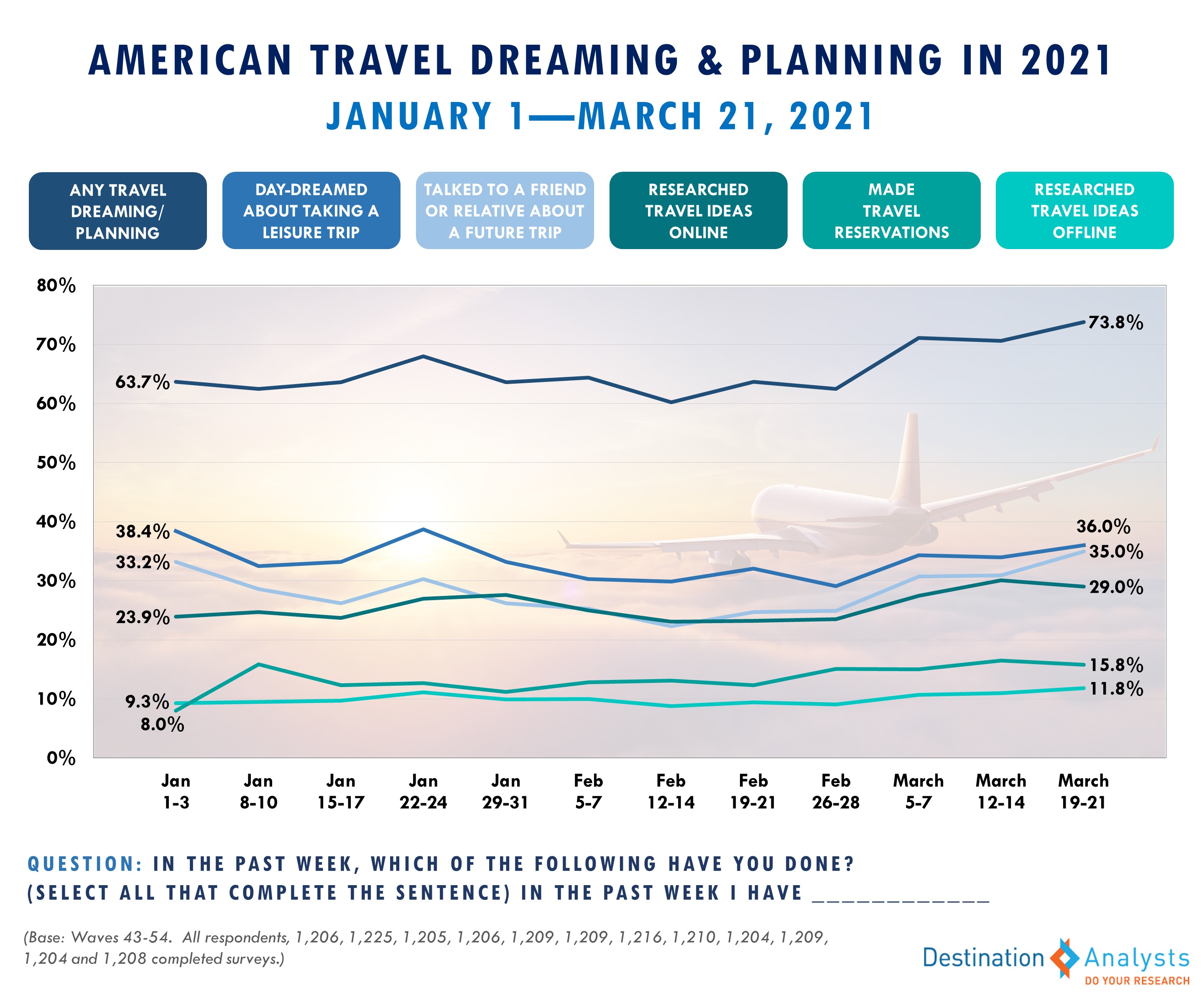

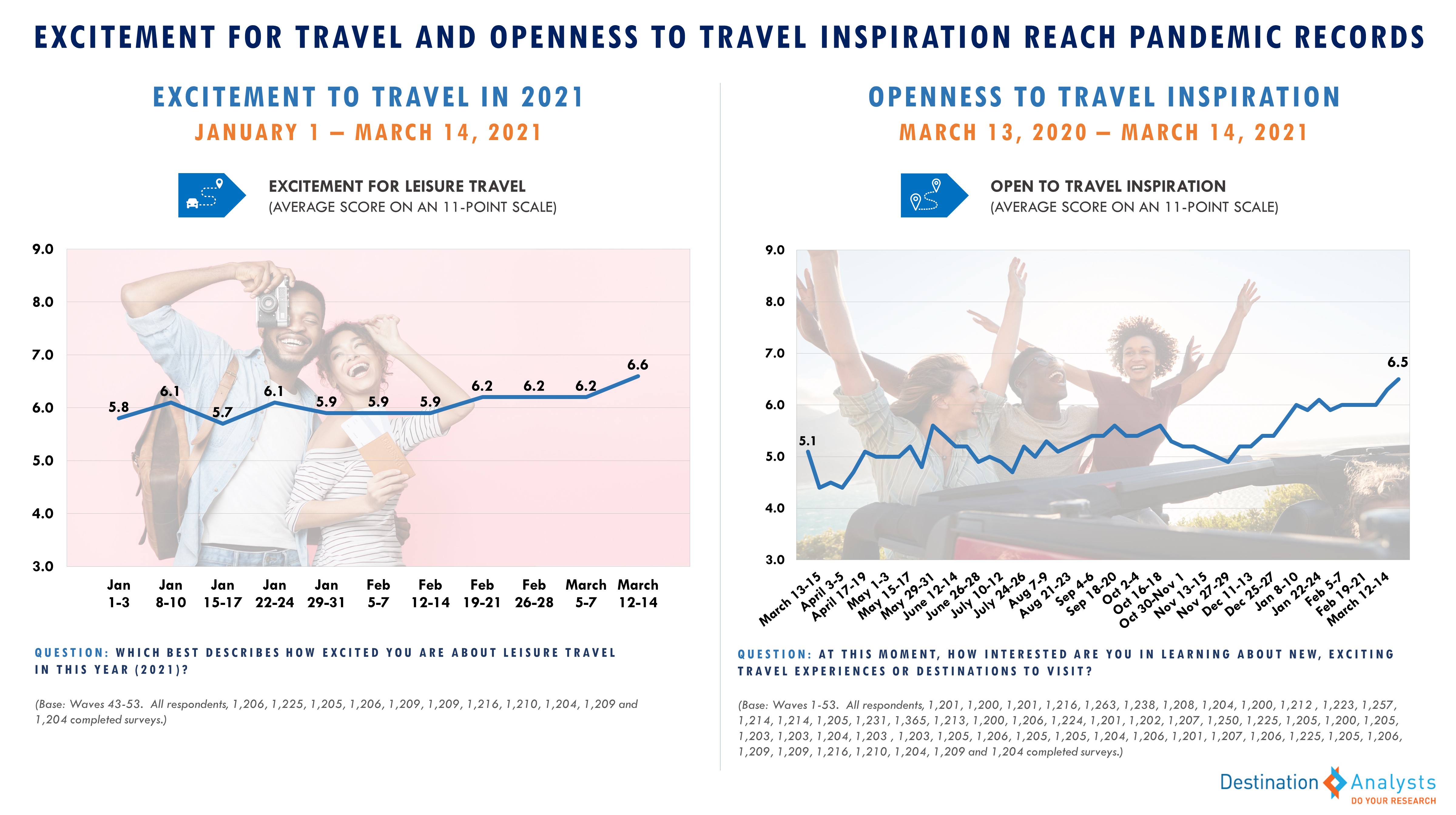

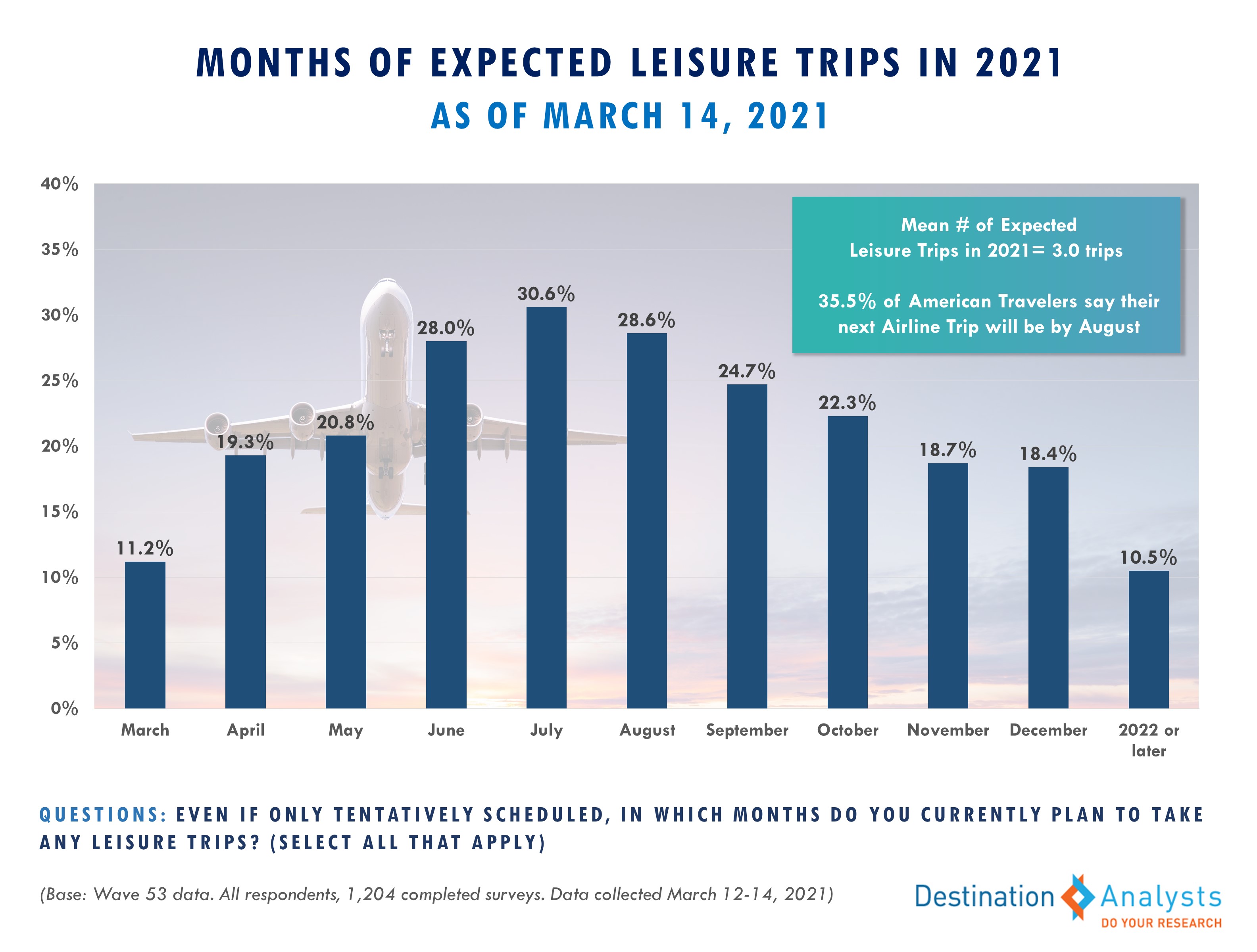

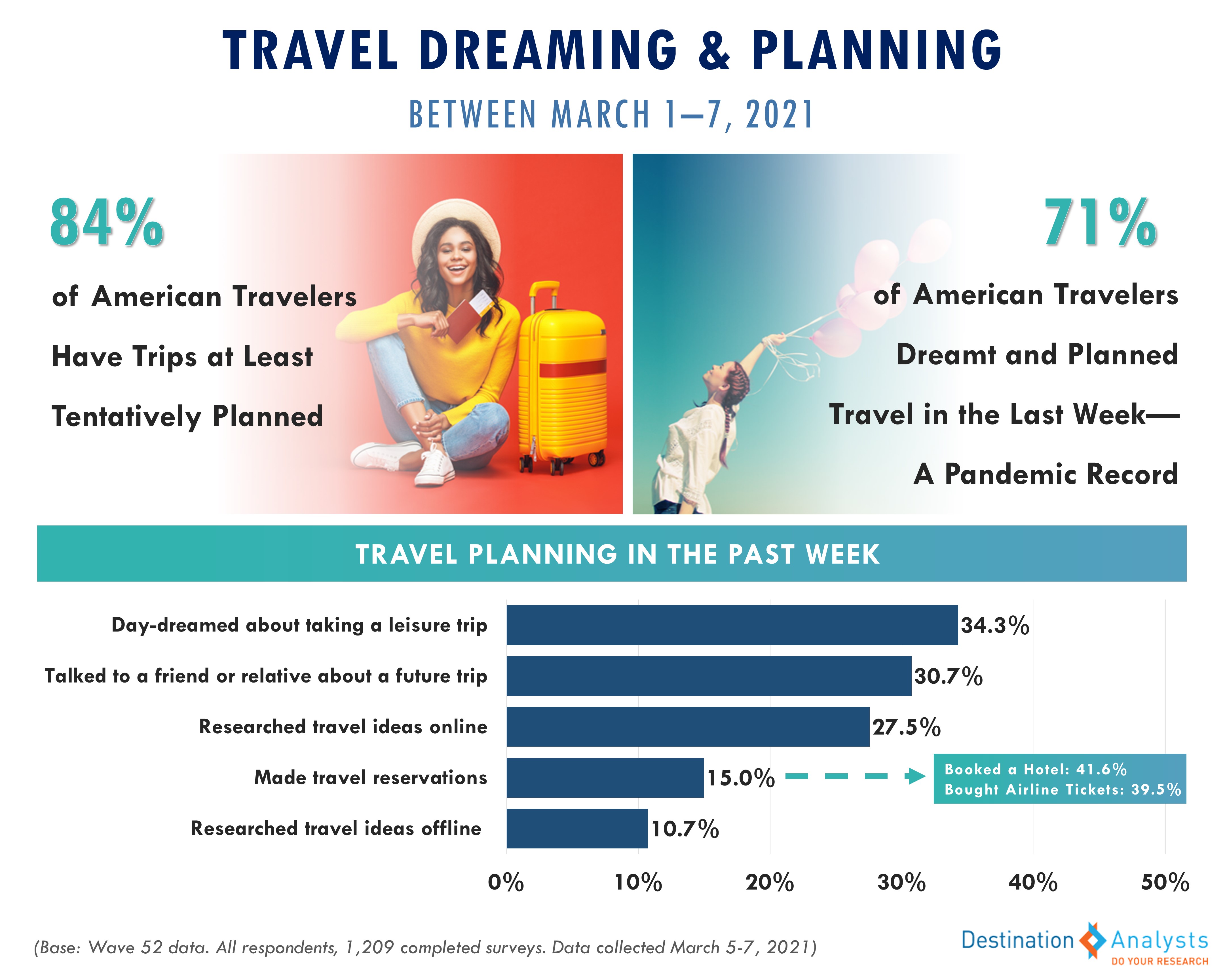

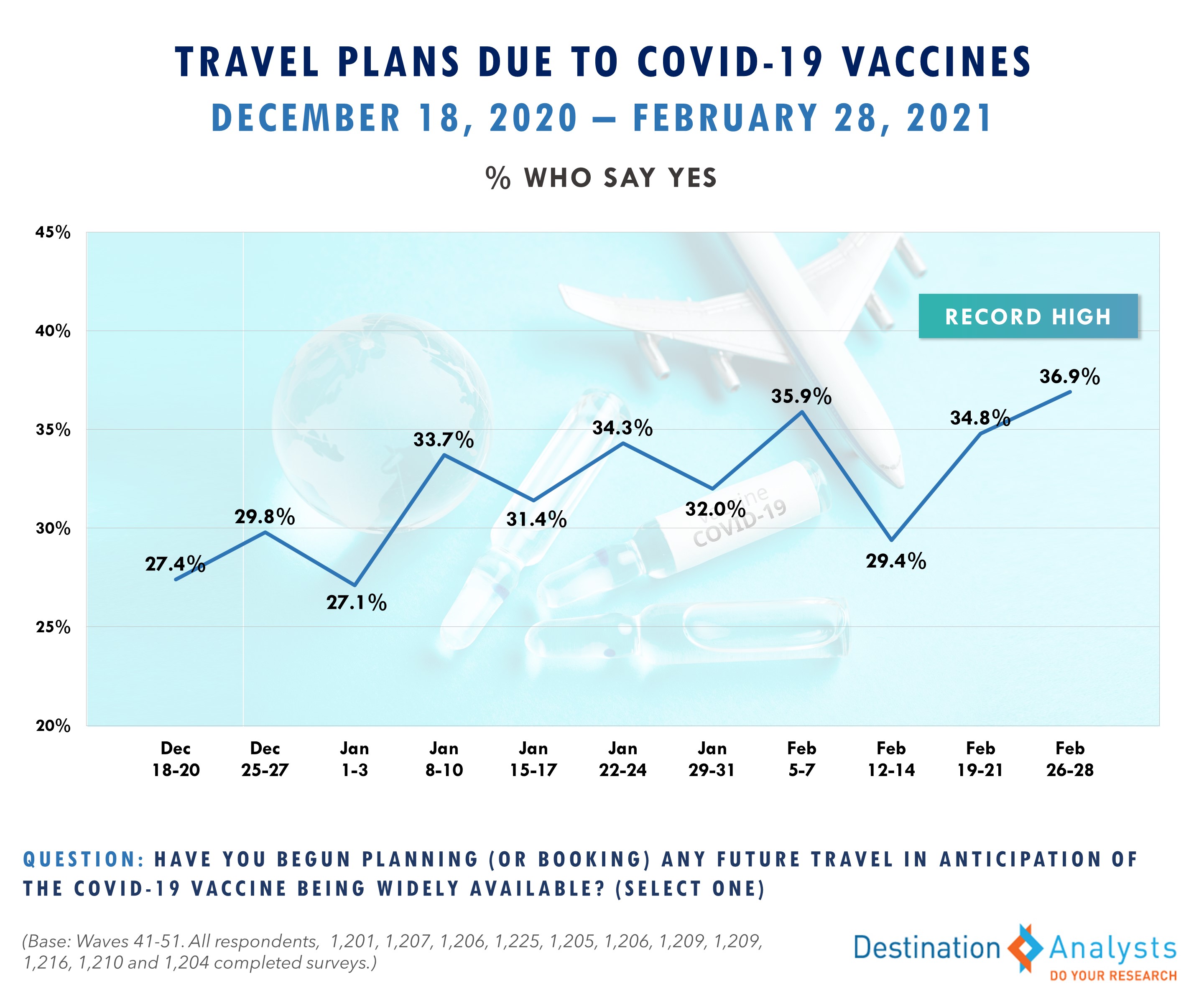

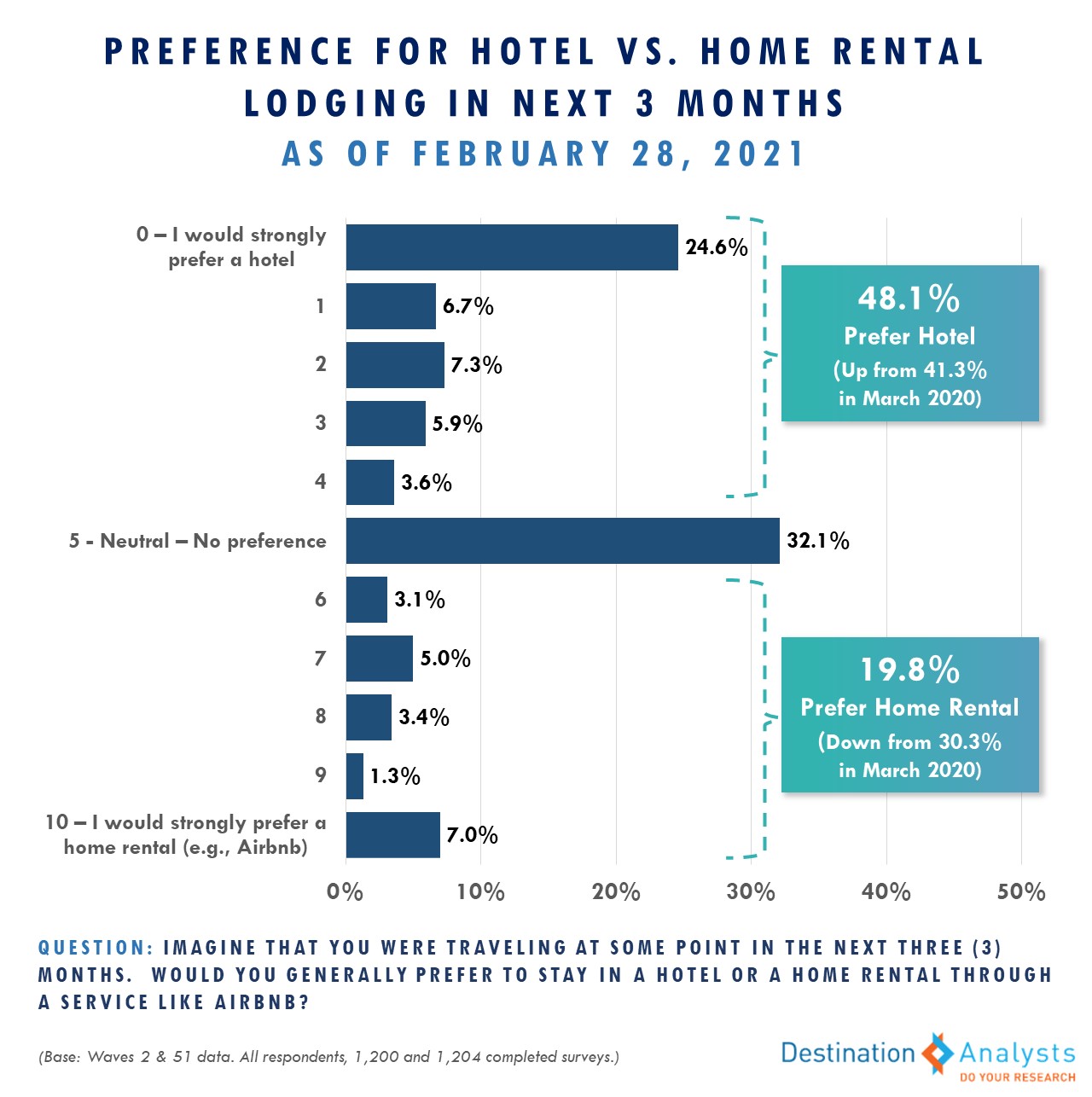

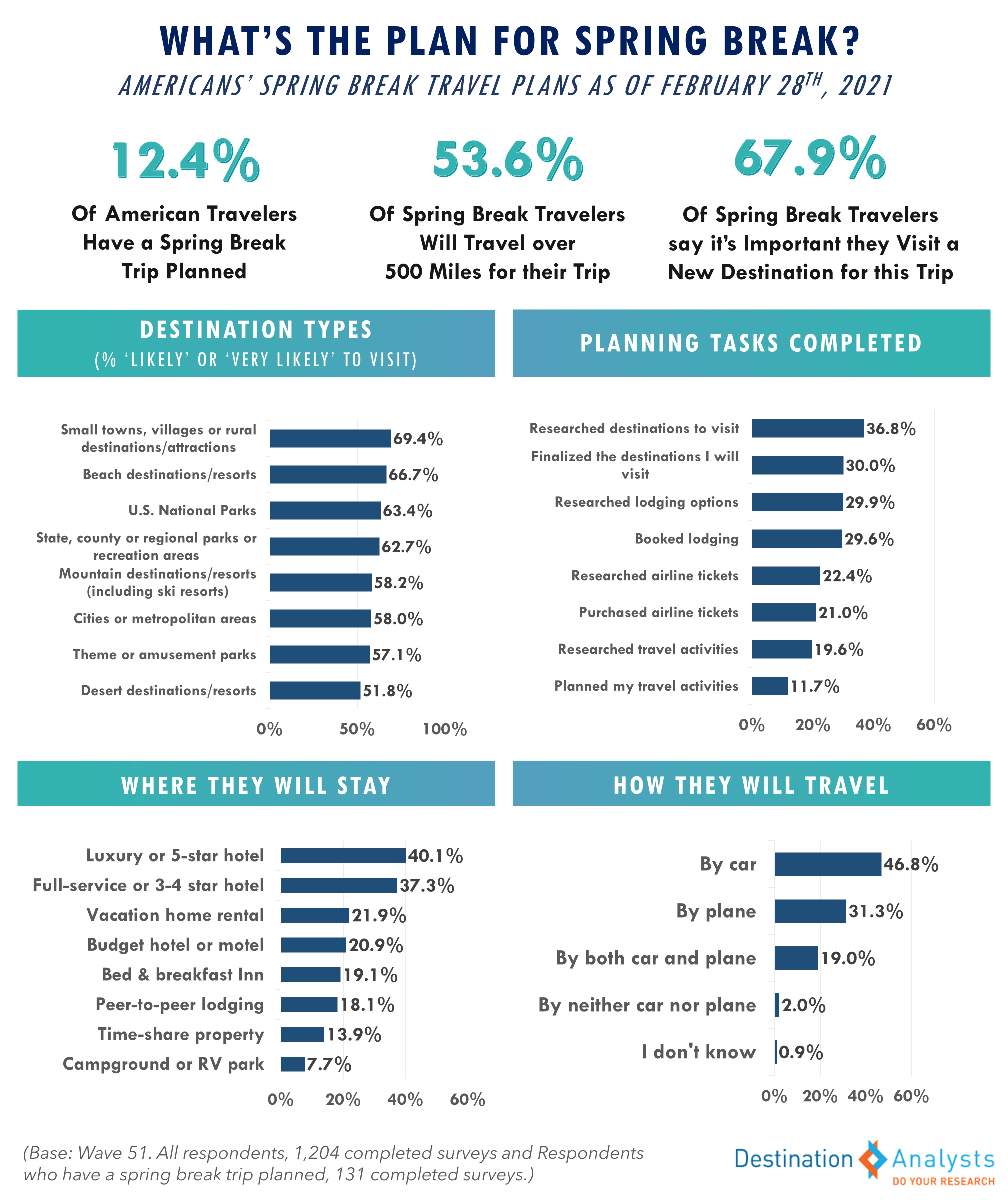

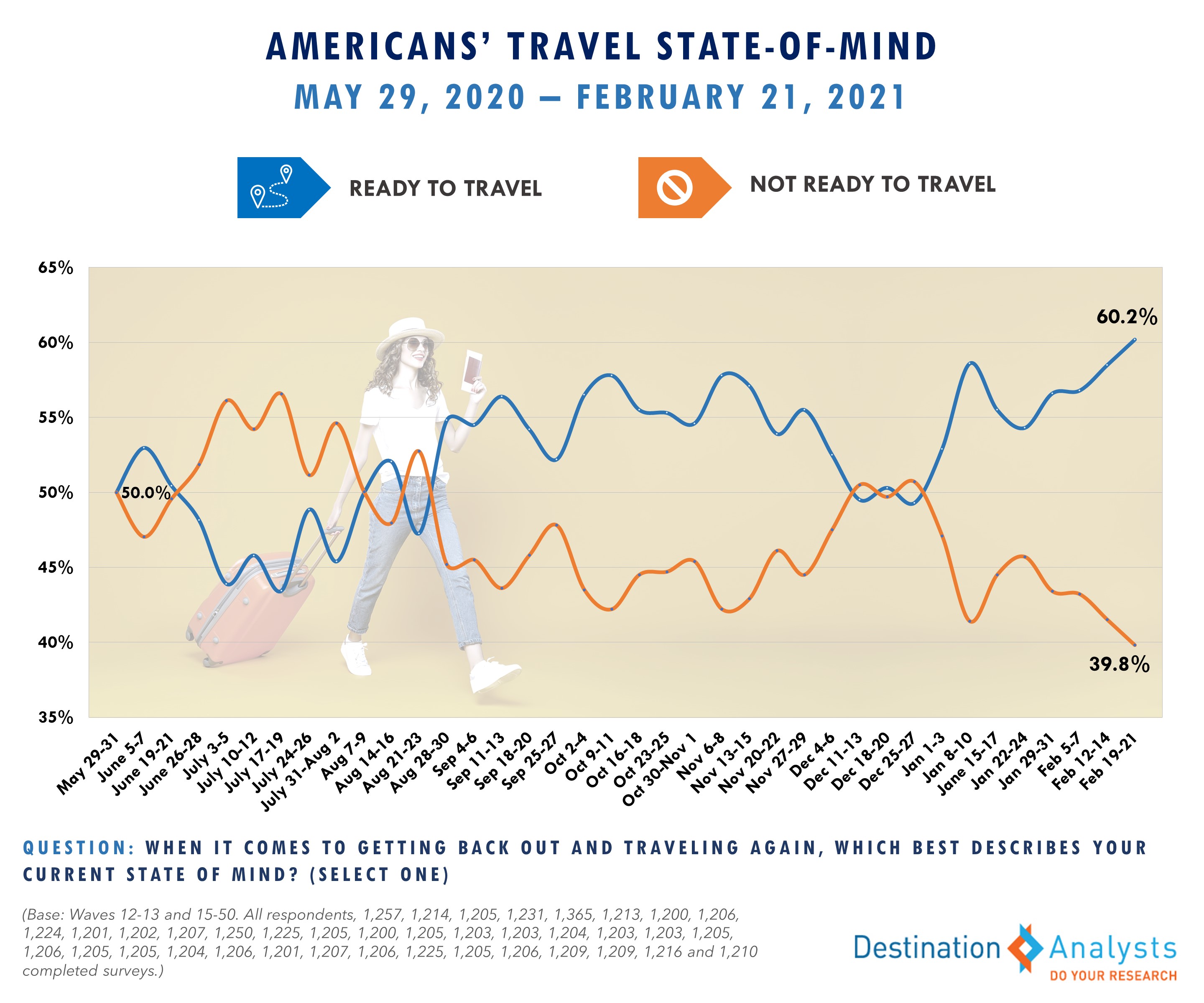

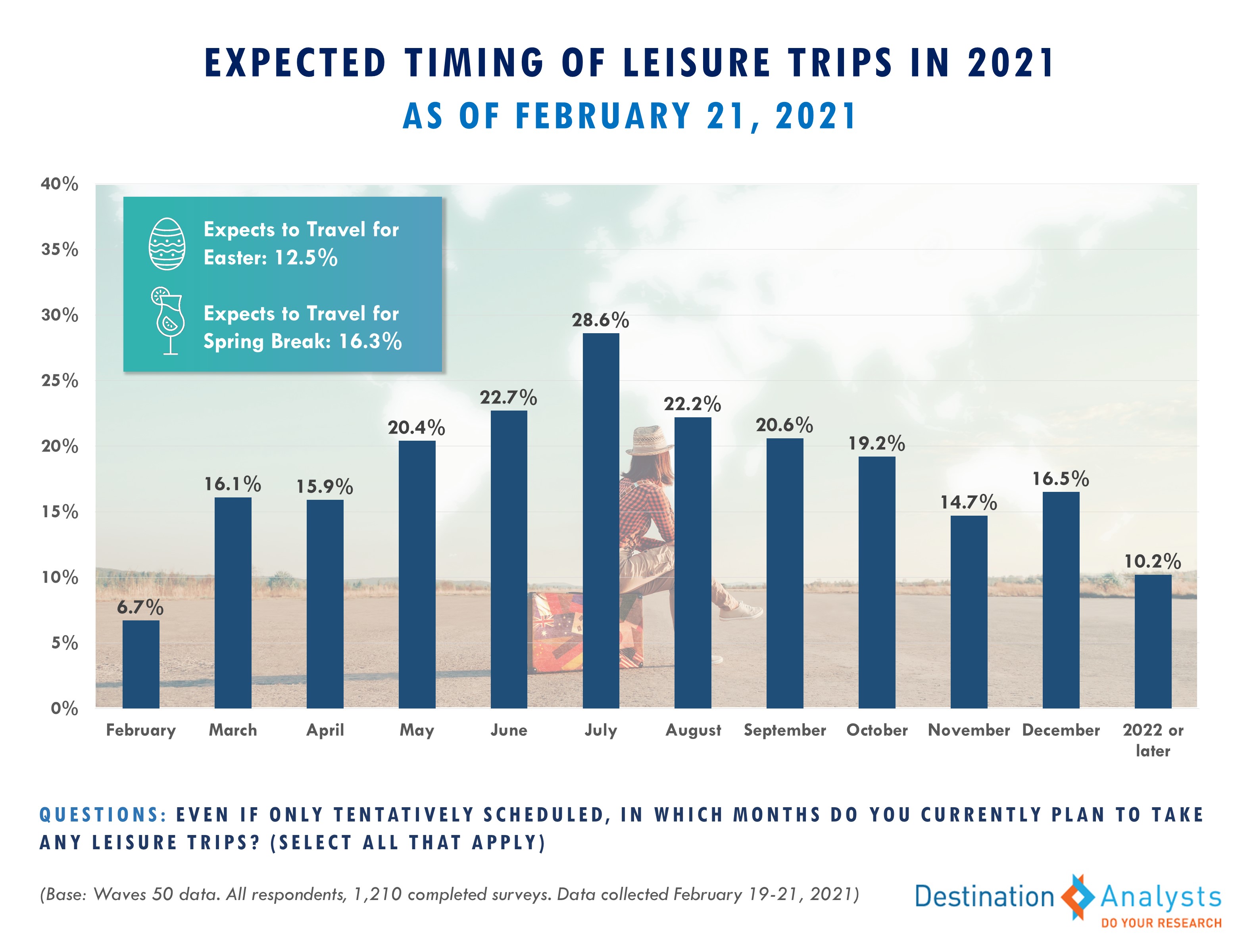

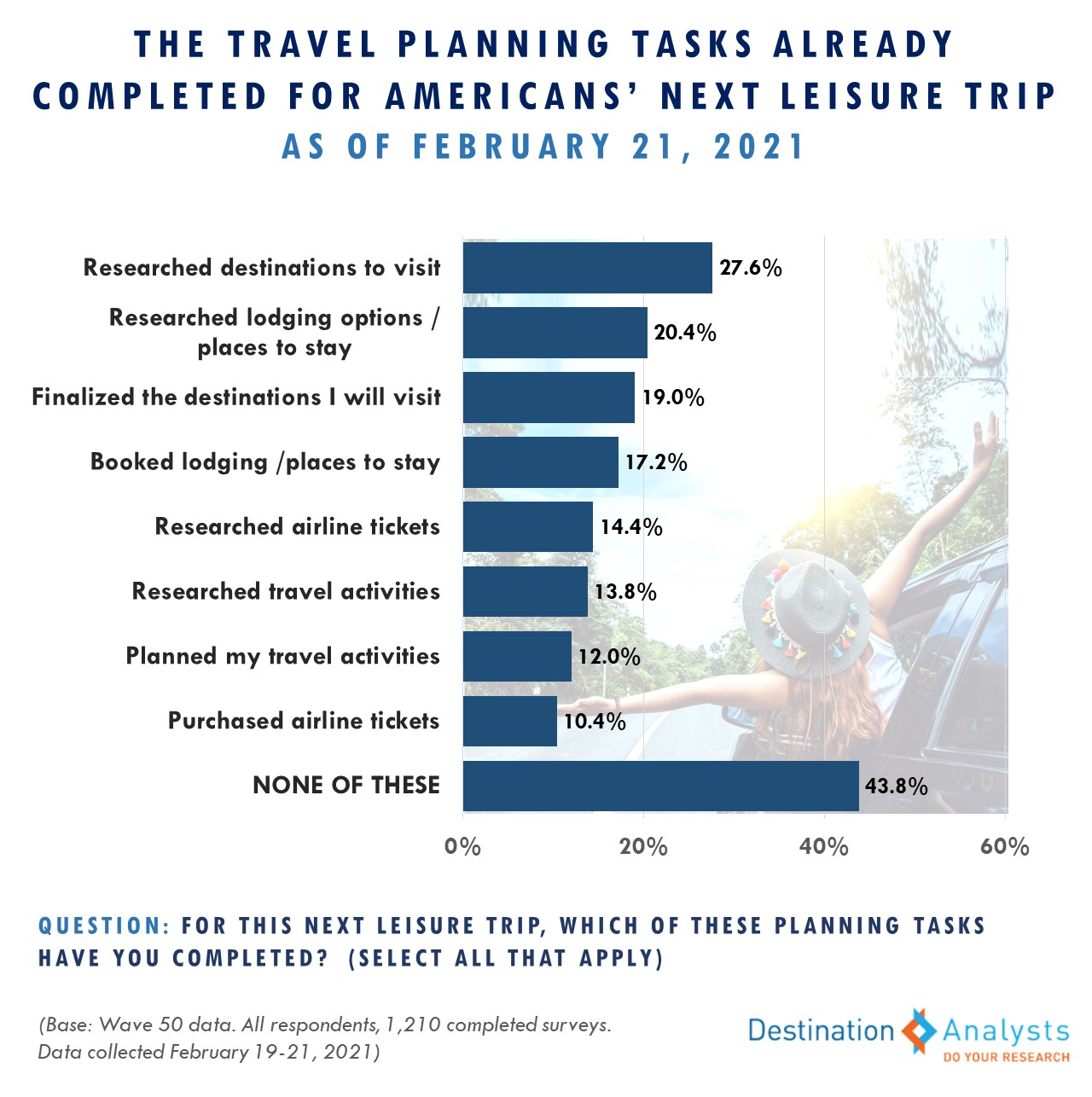

With nearly two-thirds both in a ready-to-travel mindset and highly open to travel inspiration, Americans are dreaming, planning and booking travel at increasingly higher rates. A 2021 record-high 73.8% of American travelers did some travel planning and dreaming in the last week alone. Day-dreaming about vacationing and talking to people about their future trips were each reported by over one-third of American travelers. Nearly 30% researched travel ideas online. Meanwhile, 15.8% said they made a travel reservation in the last week; of this group, 57.0% booked a hotel room while 42.1% bought airline tickets. In each of the months from May through October, over 20% of American travelers report having at least tentative trip plans.

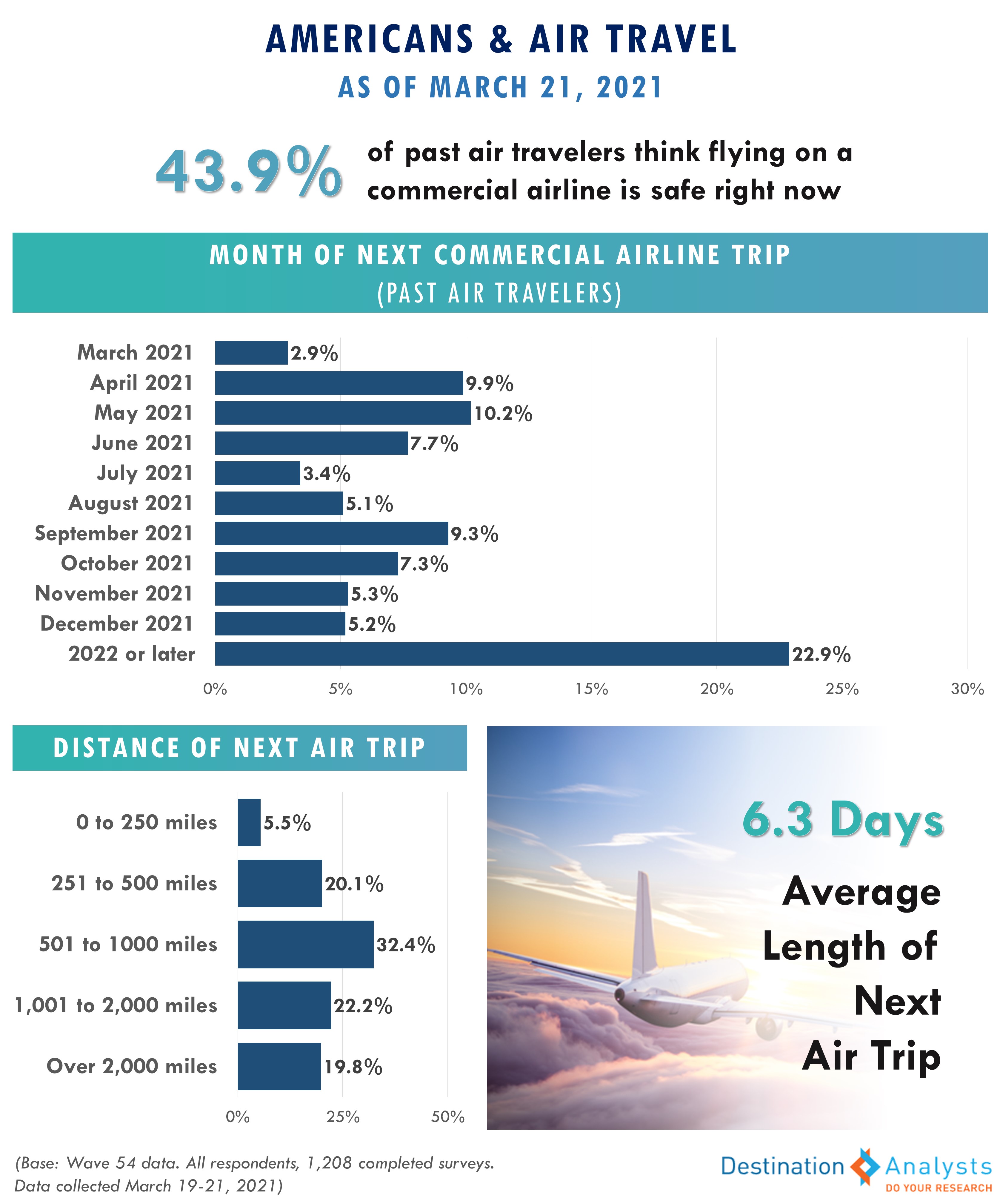

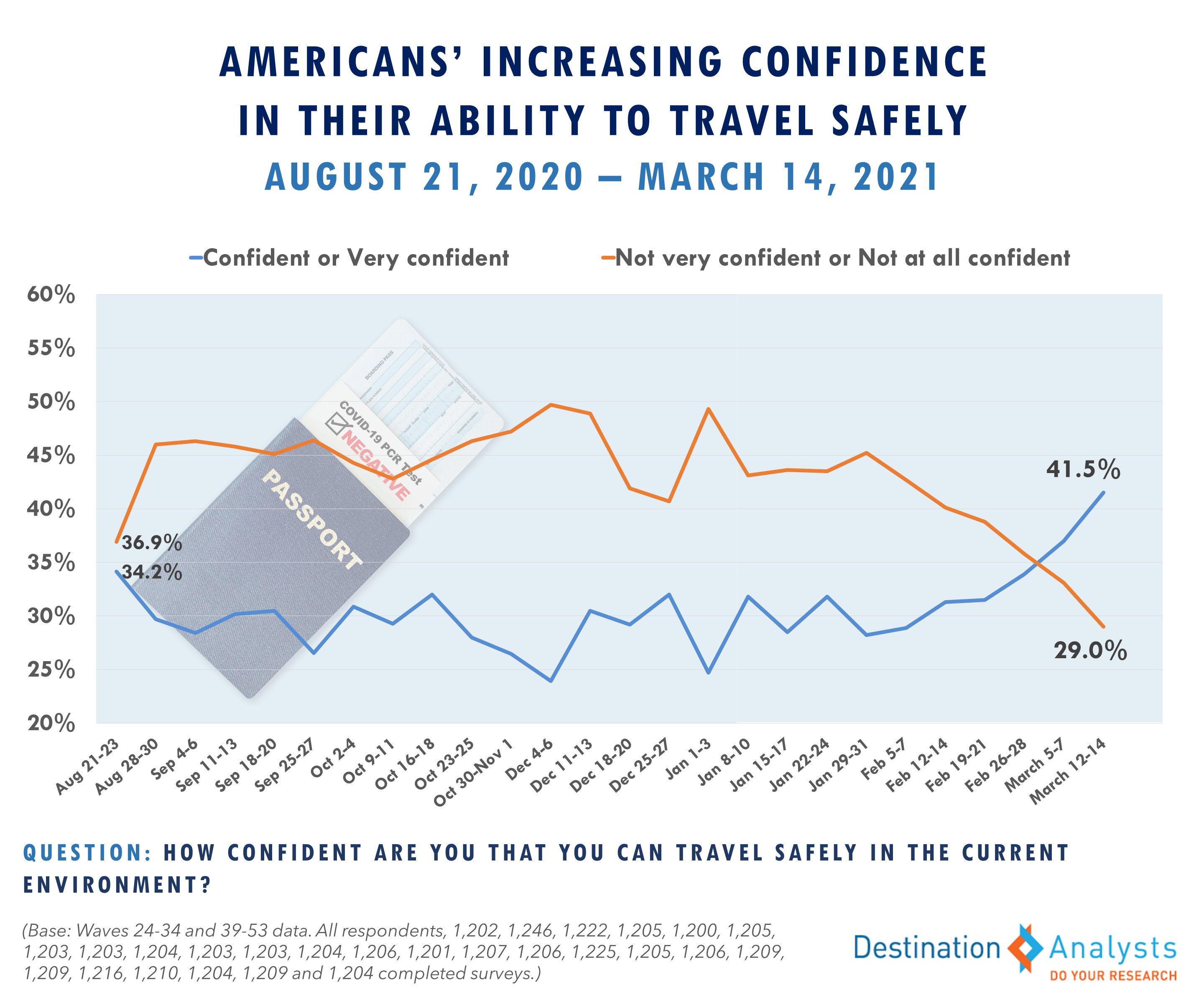

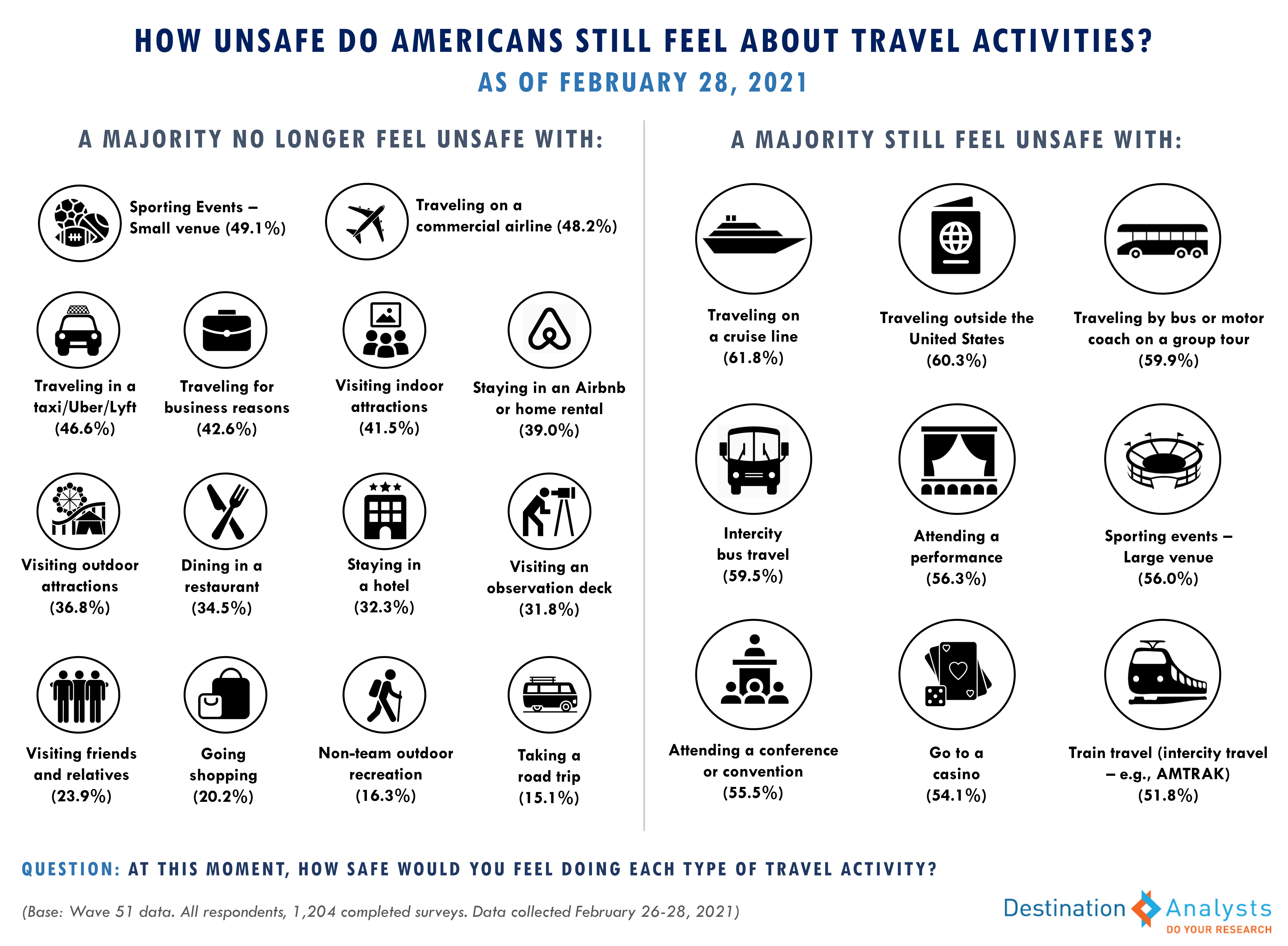

As Americans are feeling far safer with travel than they were just a few months ago, unlike earlier in the pandemic, they are including air travel in their plans. Right now, 43.9% of air travelers deem flying on a commercial airline safe. Over 45% of air travelers say their very next trip by commercial airline will be by the end of Summer. For this next air trip, 42.0% report that they will be flying to a destination over 1,000 miles away for nearly a week on average.

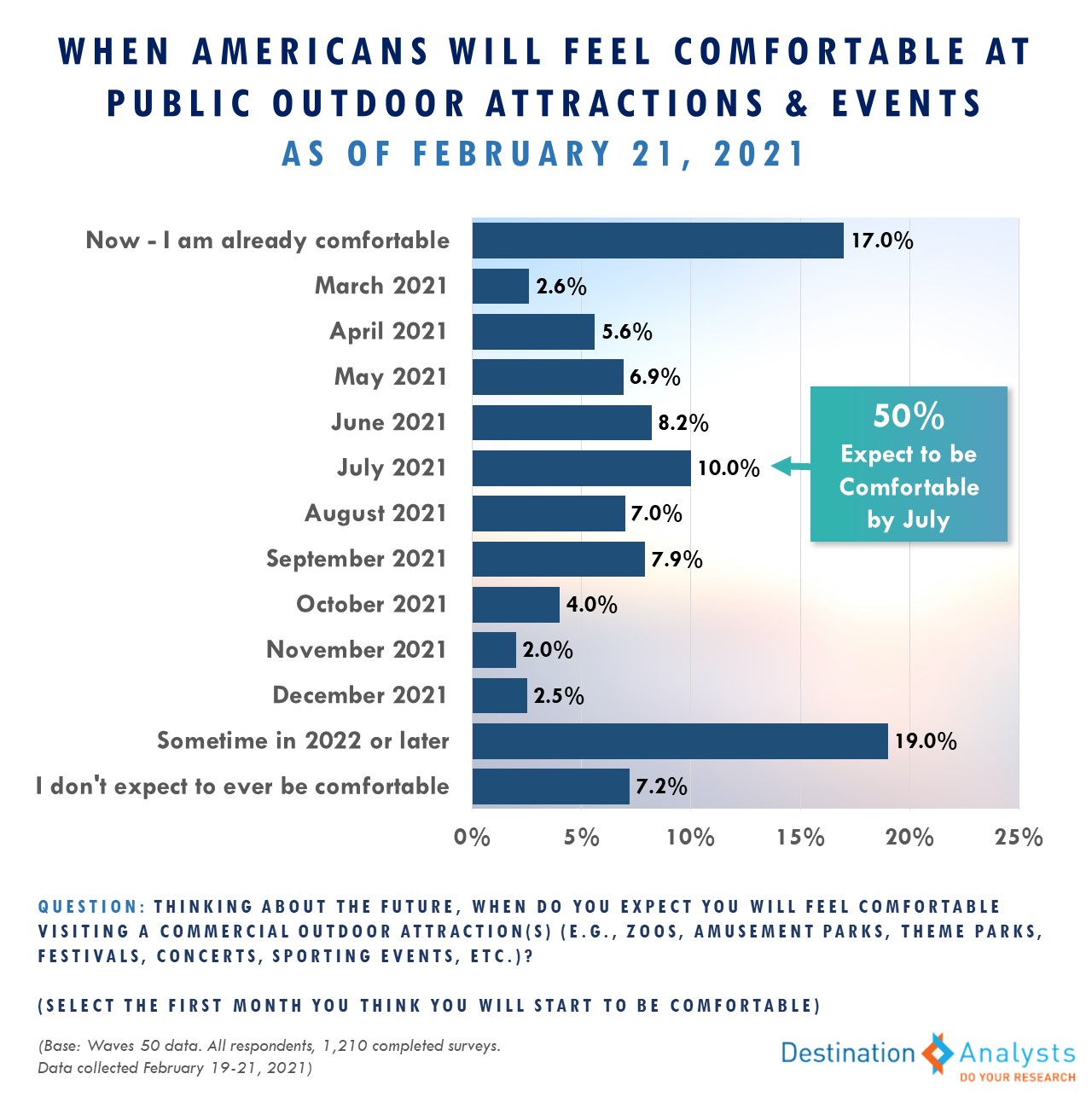

Despite feeling safer and increasingly more positive, many Americans do expect a longer-term impact from the pandemic on their travel. Nearly 60% agree that the pandemic has changed their outlook on life overall, with over 20% saying significantly. As a result, 46.9% agree they will put more effort into visiting places on their travel bucket list in the next few years. Many in the travel industry have pondered a more permanent tie to public health—they may be on to something as nearly three-quarters of American travelers agree they will be more safety-conscious while traveling going forward. When asked if the pandemic had changed their opinions about the types of destinations they want to visit for leisure in the future, 41.8% of American travelers said yes, to at least some degree. For beach, National Park and other outdoor destinations, this is welcome news as 52.2% of Americans agree they will be visiting these types of destinations more as a result of the pandemic. Urban, entertainment and theme park-focused destinations will face greater challenges in the recovery, as 44.6% of American travelers report they are less likely to visit these places in the next few years because of the pandemic. In addition, about four-in-ten American travelers expect they will be sticking closer to home and spending less on their leisure travel in the coming years.