Travel-planning apps promise endless information to help us execute the perfect trip. Yet, our research shows us that these apps haven’t yet reached their fullest potential. How can destinations make the most out of their apps? The answer might be as simple as developing trust and personalization.

Every year brings new, cutting-edge technological advancements. As many of us know by now, smartphones are reliable and capable tools to assist with day-to-day tasks and provide a plethora of knowledge. It feels like technology is always one step ahead of us, keeping us connected and organized.

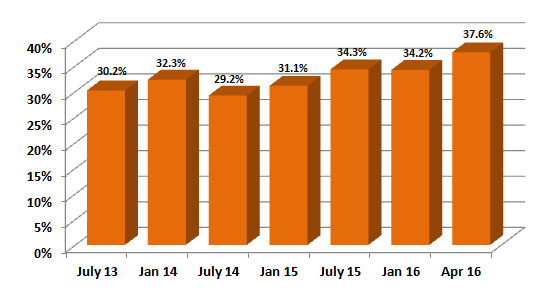

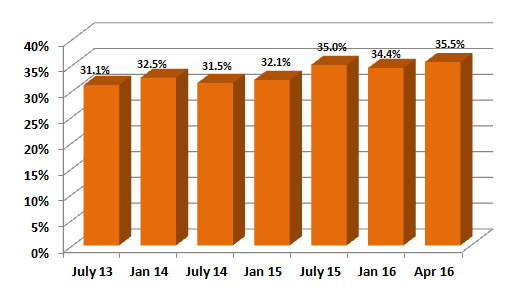

But according to our recent The State of the American Traveler survey, technology isn’t always the preferred source of knowledge used when it concerns travel planning. The report, published every quarter, asks a representative sample of 2,000 American leisure travelers about their travel plans for the upcoming year. The Spring 2019 findings show a notable decrease in American traveler’s use of apps to plan their trips compared to Spring 2018.

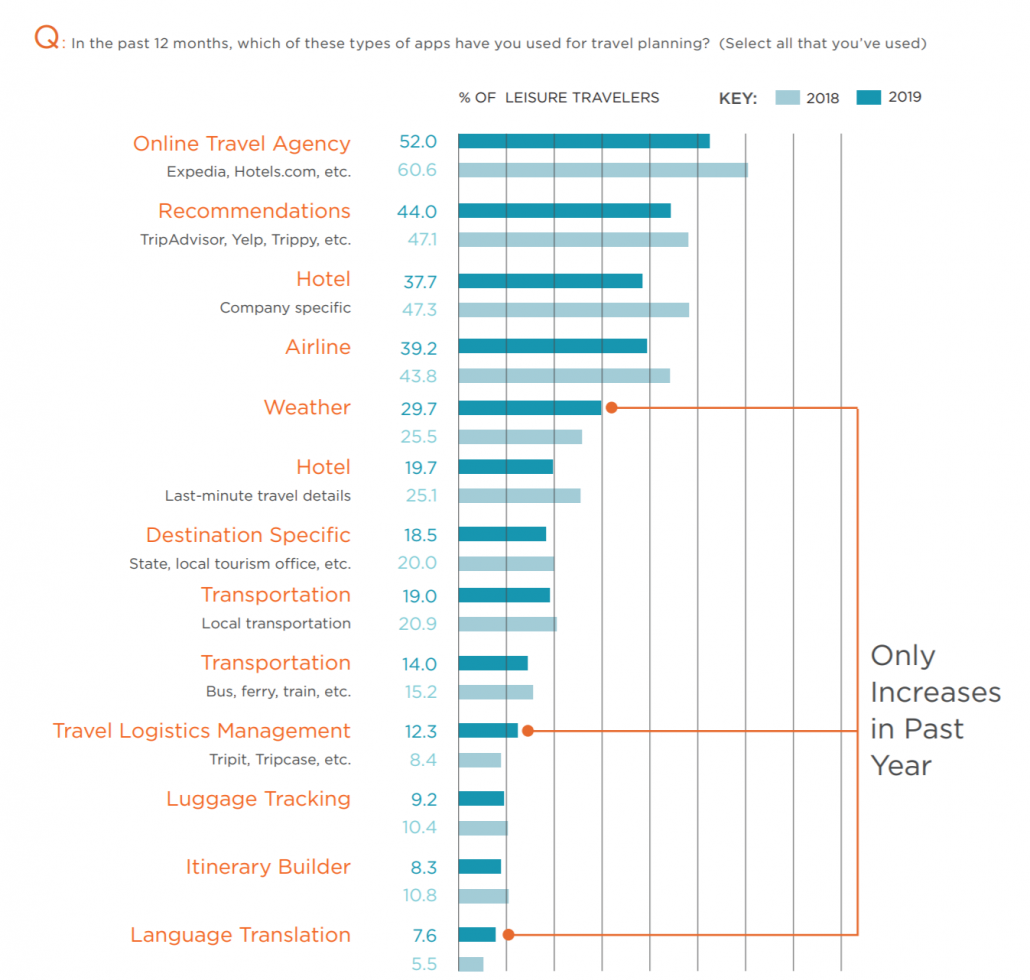

The most drastic difference compared to Spring 2018 is the decrease in use of company-specific hotel apps. There was a 13 percent drop in usage among travelers between Spring 2018 and 2019. Additionally, while a solid 60.0 percent of American leisure travelers used an online travel agency last year, this year the corresponding figure has sharply dropped to 52.0 percent. Similarly, only 44.0 percent of travelers report using online recommendations such as TripAdvisor, Yelp, or Trippy compared to 47.1 percent one year earlier. Airline and last-minute travel detail hotel apps both decreased somewhat as well.

Three apps did, however, appear to be on the rise. Weather apps increased in Spring 2019 from 25.5 percent in 2018 to 29.7 percent. Travel logistics and management apps increased from 8.4 percent in 2018 to 12.3 percent. Lastly, language translation apps increased to 7.6 percent, which is up from 5.5 percent one year ago.

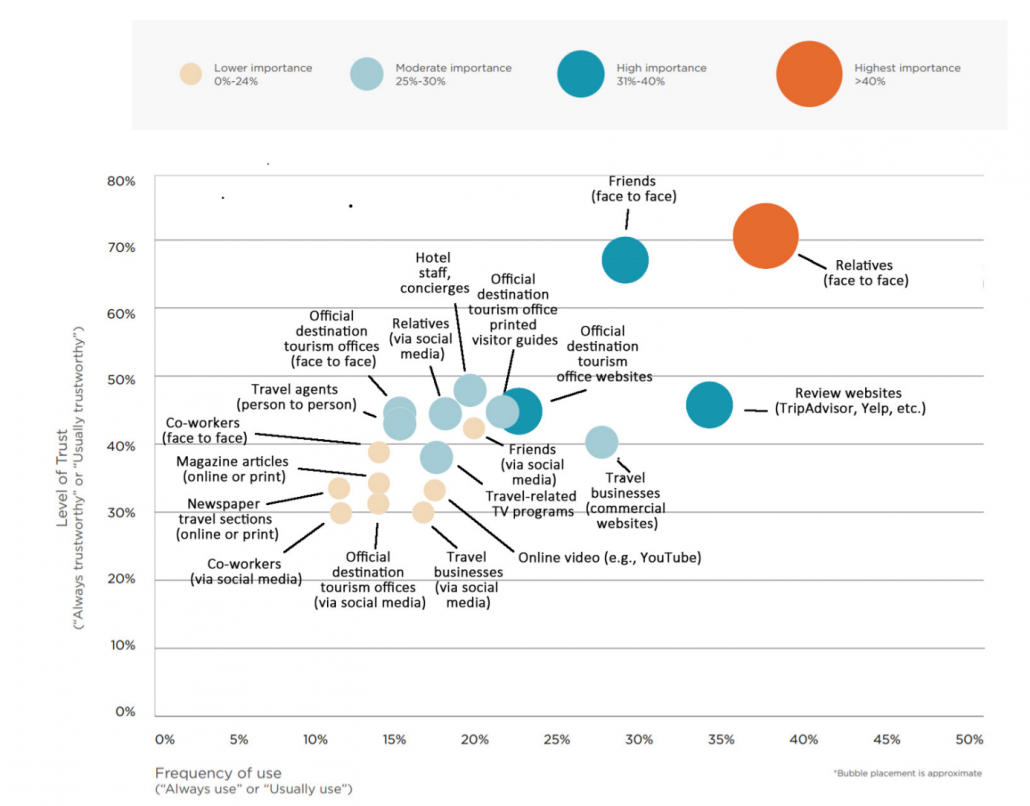

So, why is this? Naturally, travelers want to feel a certain level of trust familiarity when receiving recommendations to plan their trips. As seen in the graph below, face-to-face interactions with relatives and friends score high in frequent use and assert the highest level of trust. But when travelers observe friends and family over social media to glean travel advice, both use and trustworthiness decrease.

Word of mouth is clearly the dominant travel-planning source, because leisure travelers value face-to-face interactions when receiving travel advice and use it to plan their trips more frequently. It makes sense: why would you take advice from a stranger through a screen when you could take that of a family member’s, who is more likely to know your idea of a perfect vacation?

Travel apps have the potential to provide greater variety and quantity of information compared to the knowledge and experience of a fellow traveler, there is no doubt about that. Recommendation Apps such as TripAdvisor and Yelp offer a plethora of honest opinions from real-life travelers. Travelers clearly appreciate the quantity of information travel apps provide, but maybe these applications haven’t yet reached their potential to include what travelers would consider a “quality” recommendation.

So, how can travel marketers generate the same level of trust as word of mouth? Providing user-generated content on the app or website, such as photos and videos of the traveler’s experience, could increase trust beyond a recommendation they write. Another idea is having filter options that allow the user to “customize” their ideal vacation experience and then receive recommendations based on their results. If destination marketing organizations and travel brands could incorporate the relatability and personalization of word of mouth, while maintaining the quick, accessible plethora of information that is appealing about travel-planning apps, it could have a significant impact on the future of travel planning.