Even more Americans than last month—over 70%—are now saying “YES!” to summer vacation. From fewer trips to less concern about crowds, the pandemic both wanes and lingers in travelers’ psyches and consequent trip decisions.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15, 2020, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected April 23rd-25th.

Key Findings to Know:

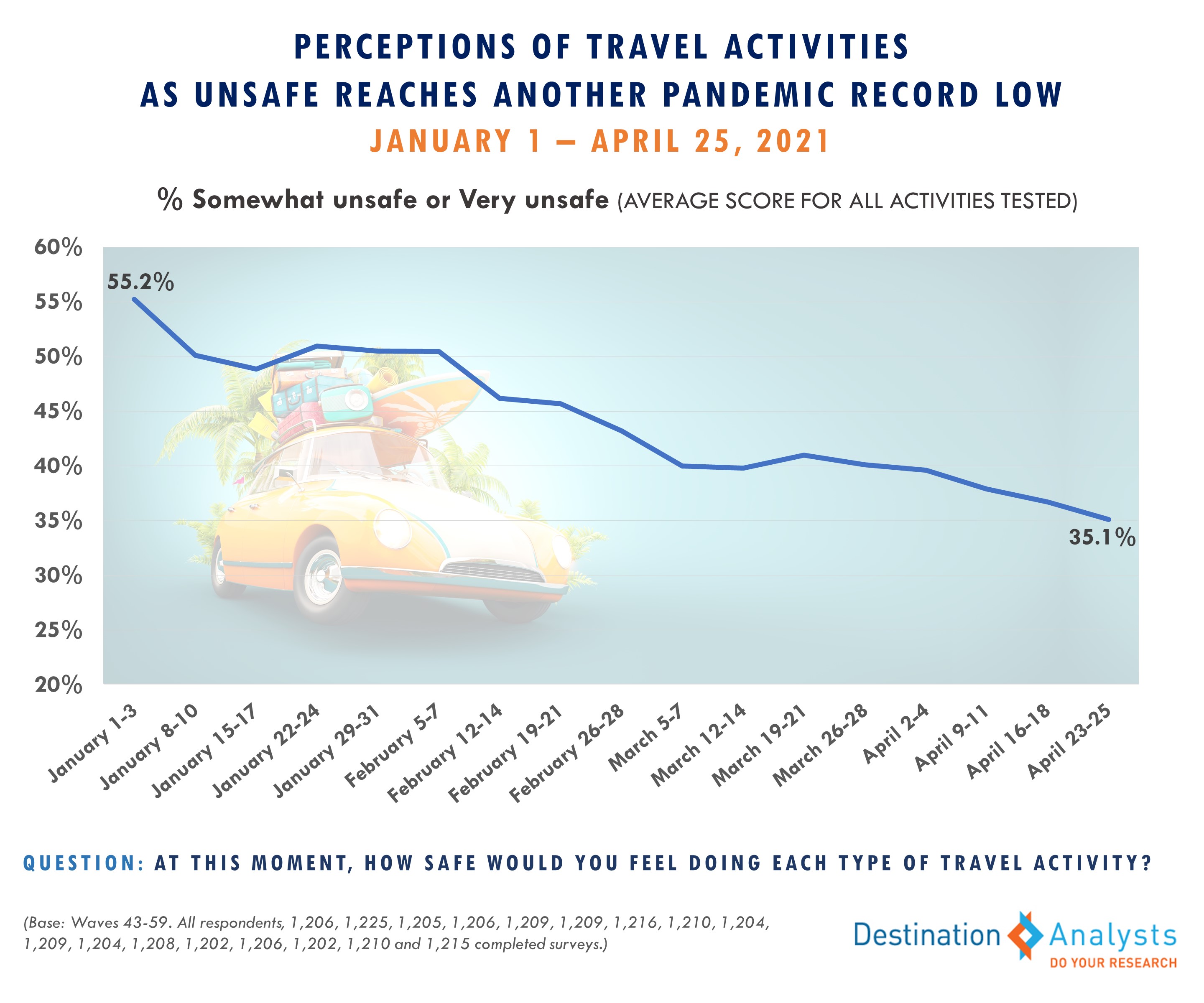

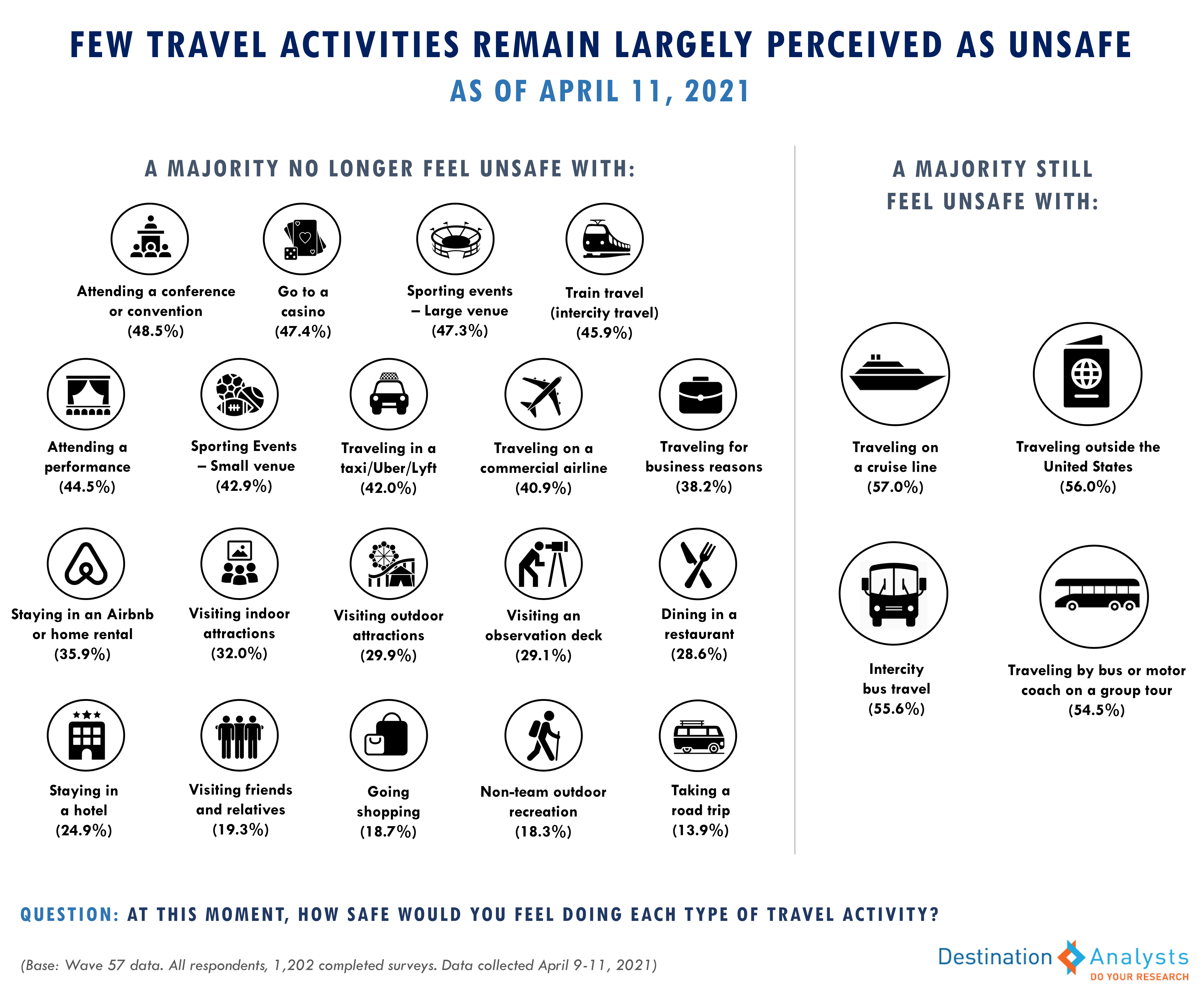

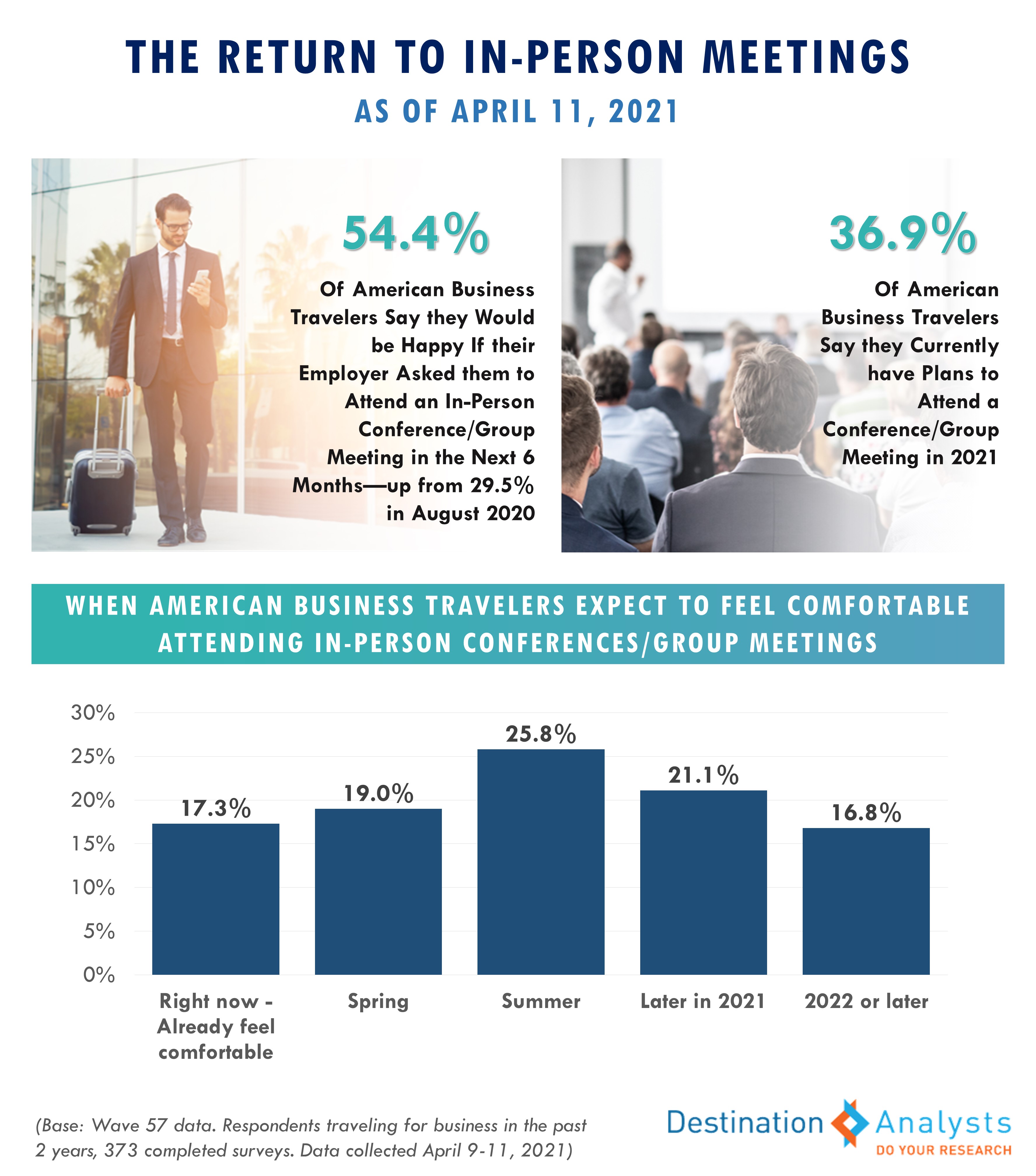

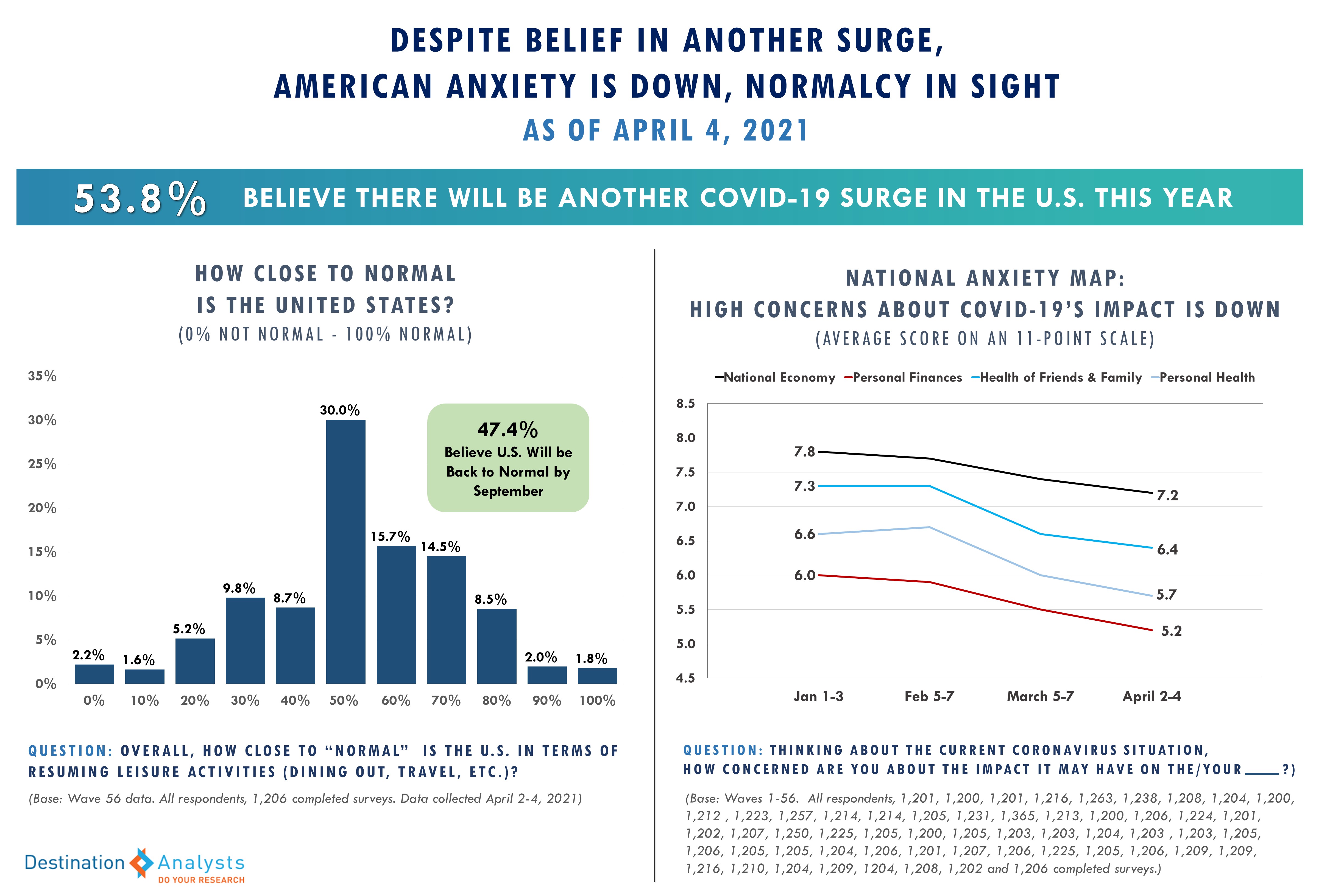

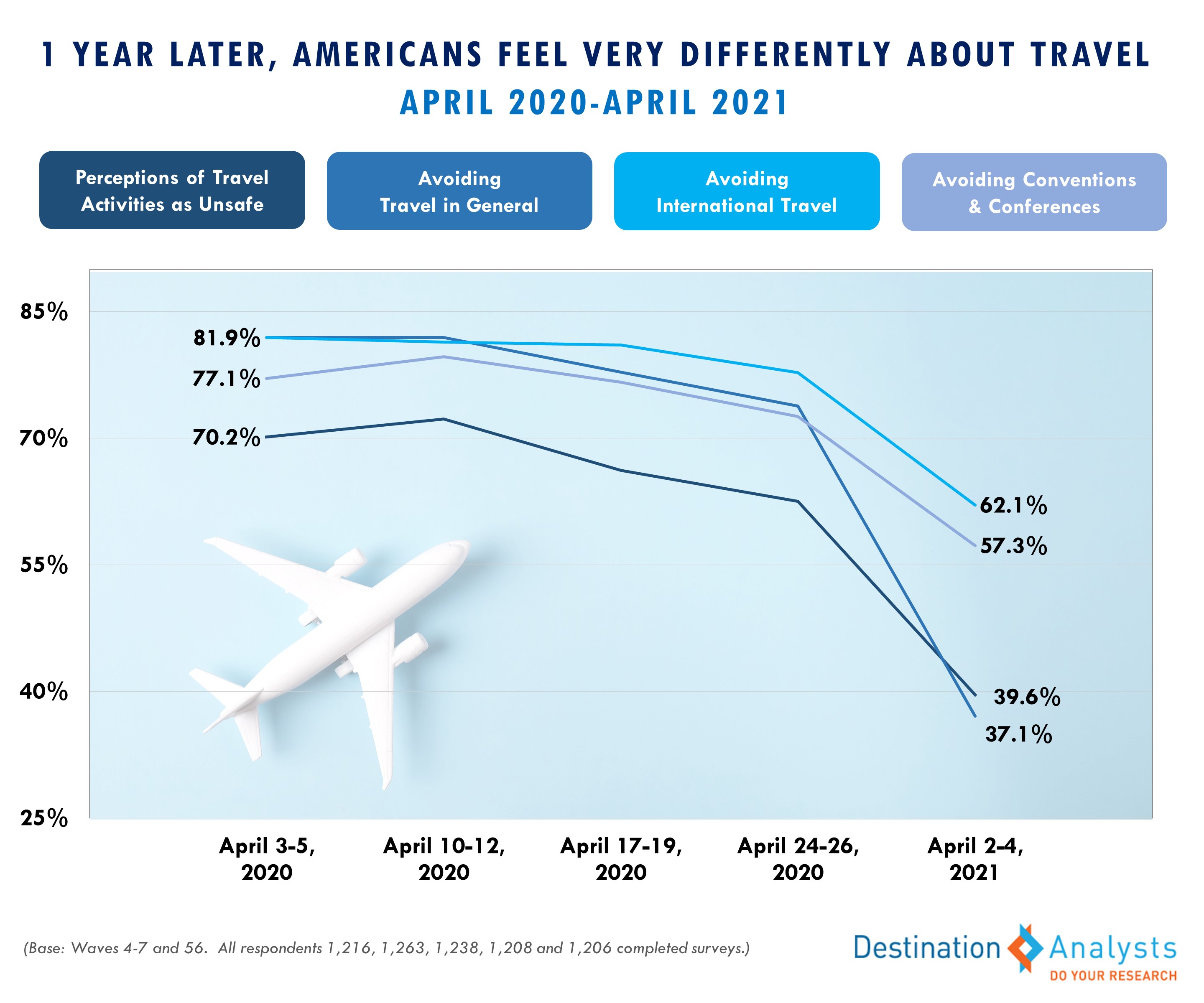

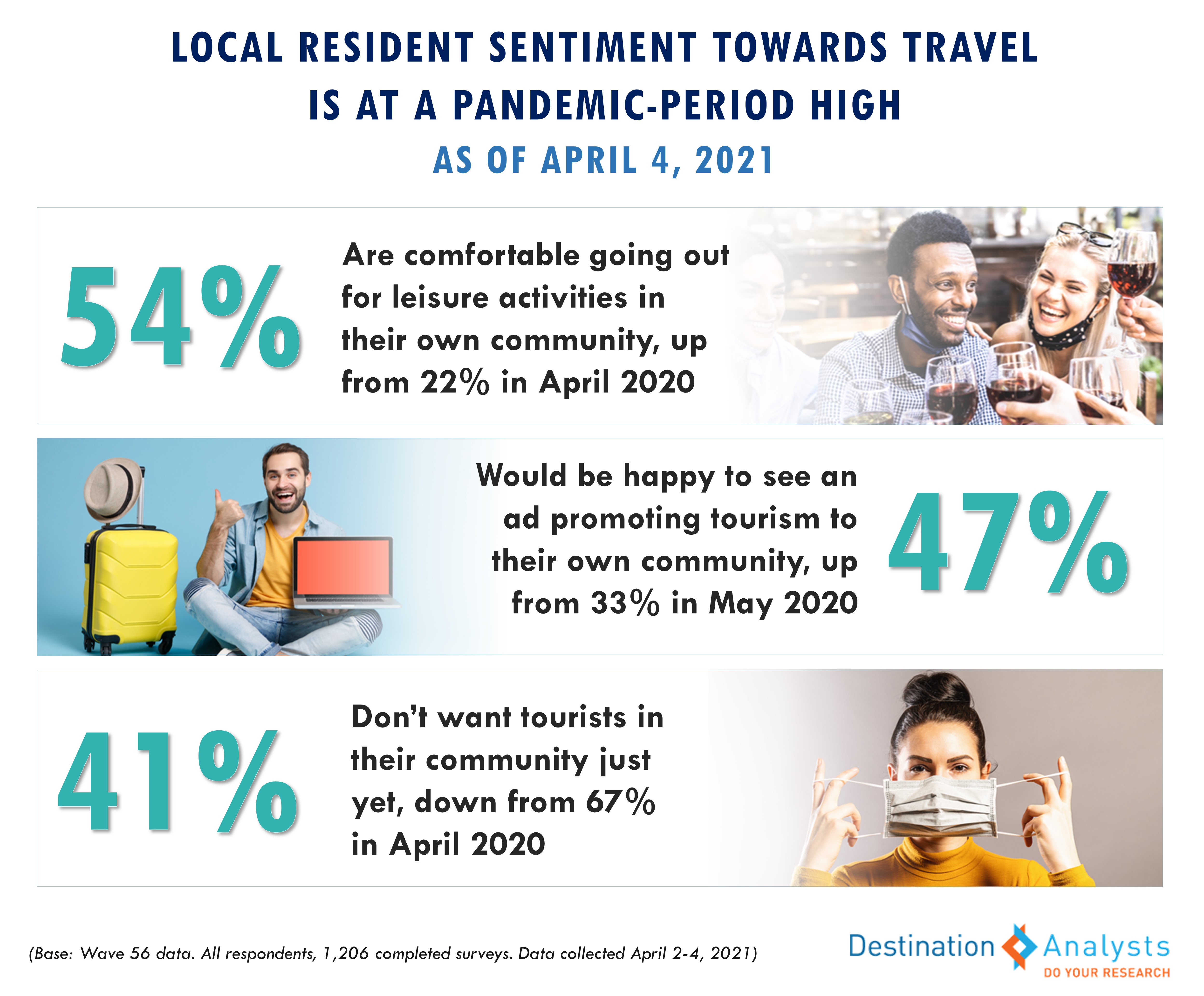

It has been one year since the height of cumulative concerns about coronavirus and thereby travel and leisure. With over half of American adults at least one dose into their COVID-19 vaccine as of this week (and 60% of travelers), Americans’ anxiety about contracting the virus and the pandemic’s financial impact are the lowest they have been. Americans’ perceptions of travel activities as unsafe dropped again this week to another coronavirus-era low—now at just 35.1%, down from 57.8% in January and 69.4% one year ago. Over 43% say they would not feel guilty traveling right now—another pandemic record.

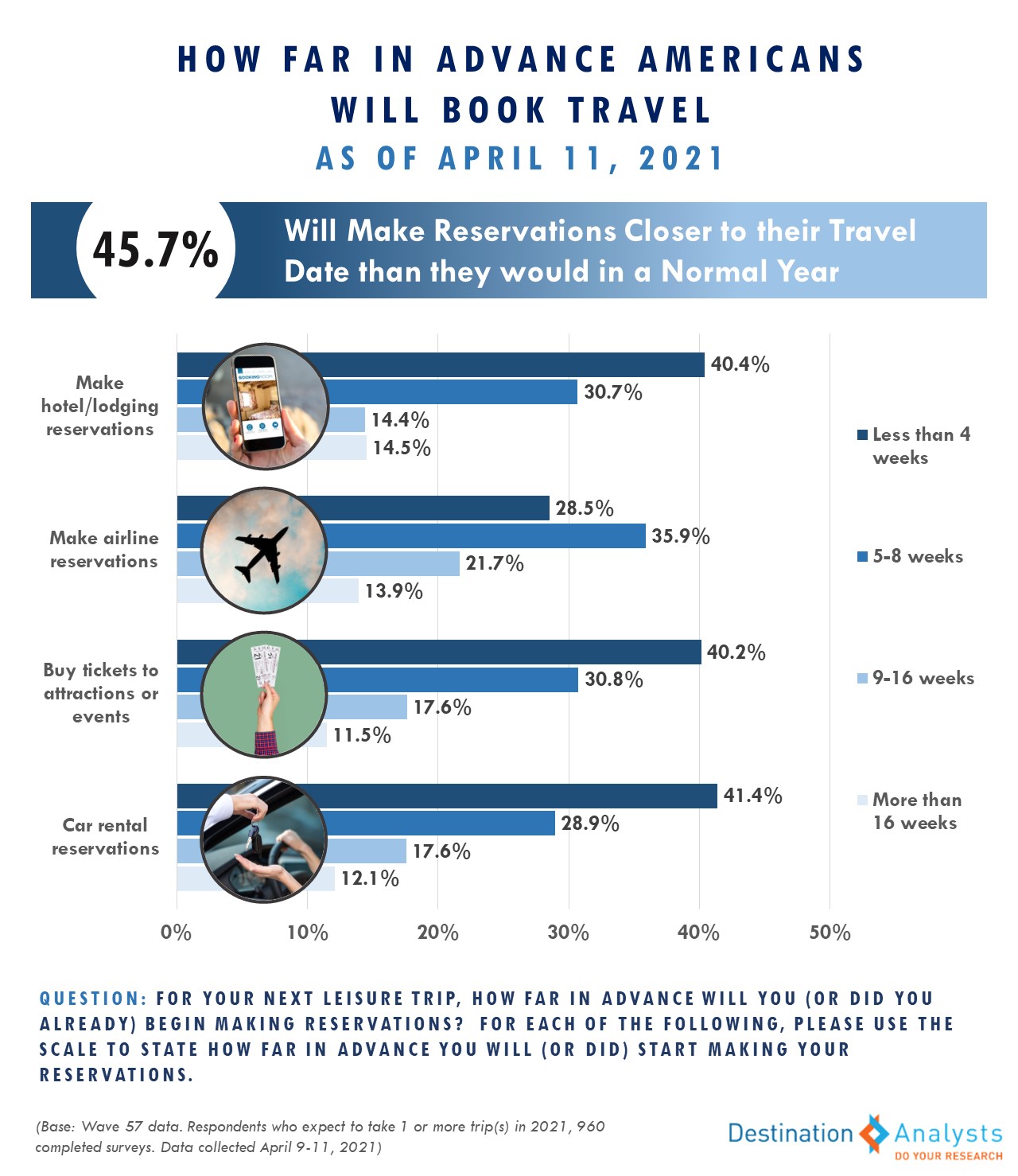

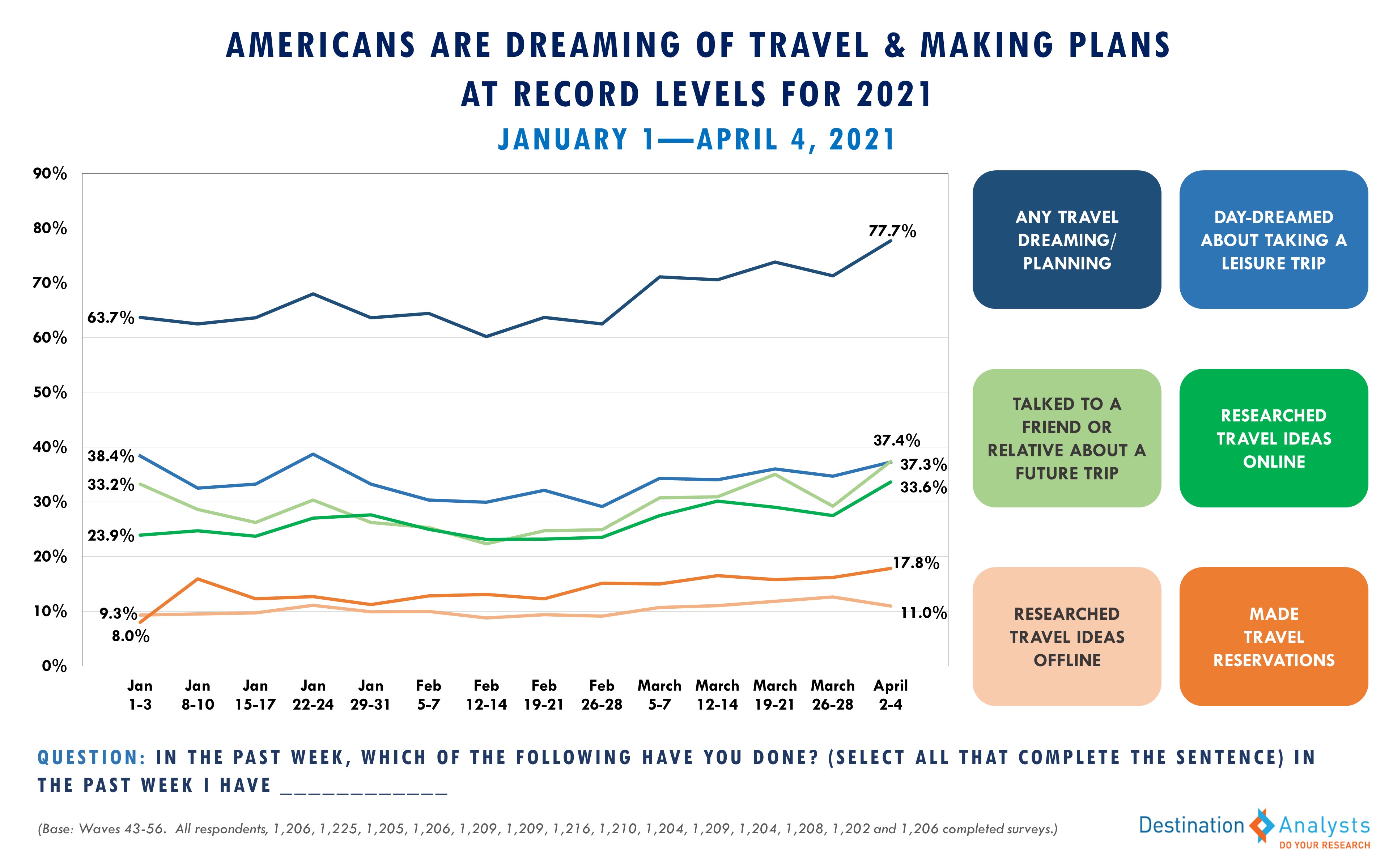

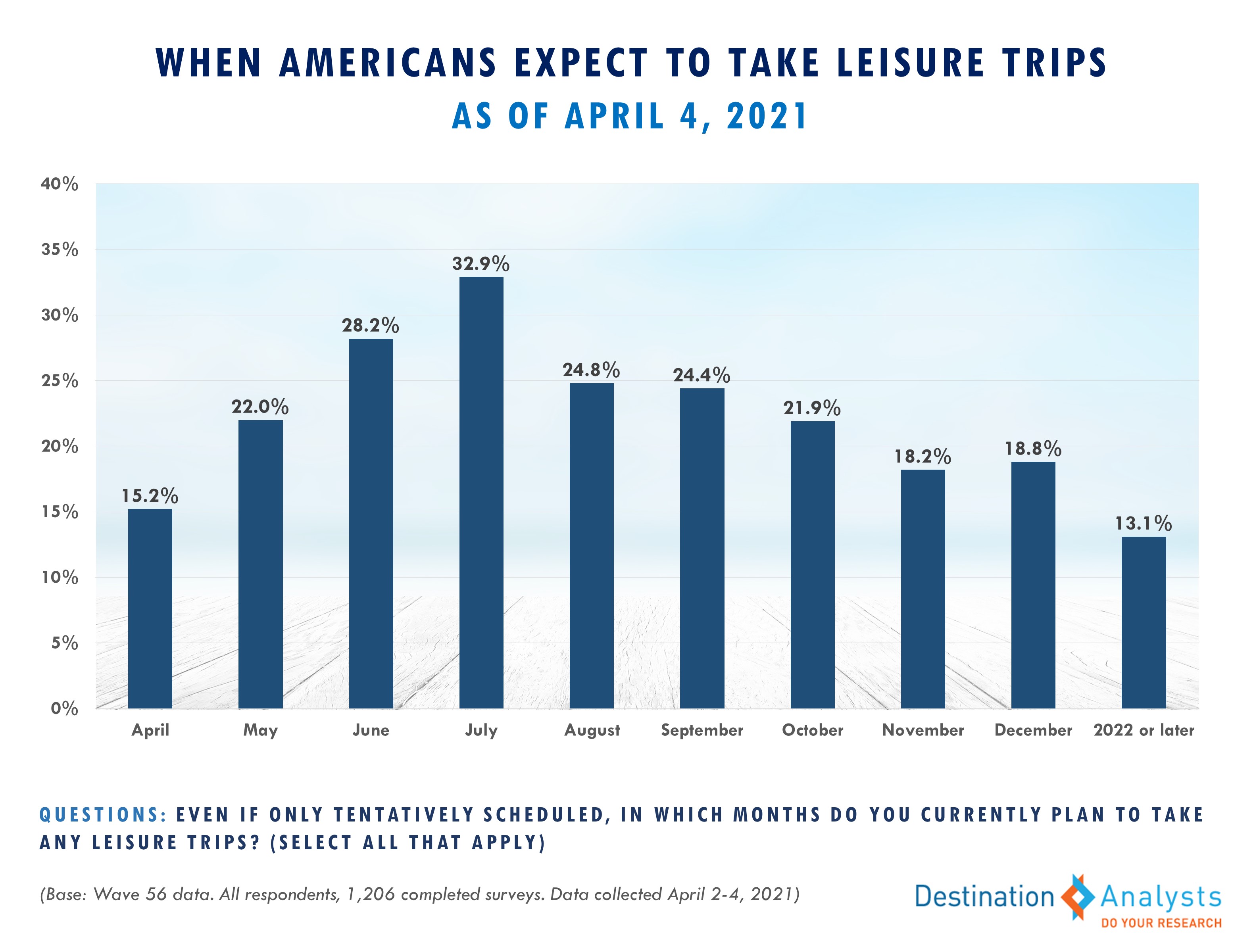

American travel is indeed definitively on the rise. Seven-in-ten Americans are in a ready-to-travel state of mind and two-thirds say they are highly open to travel inspiration. In the last week, over 75% have actively dreamt and/or planned travel, including the nearly 18% who made a booking or reservation for an upcoming trip. As of this week, nearly 88% have at least tentative leisure trip plans right now and over 71% will be taking at least one trip within the next 3 months. In fact, the typical American traveler is likely to take nearly 2 leisure trips by the time August rolls around.

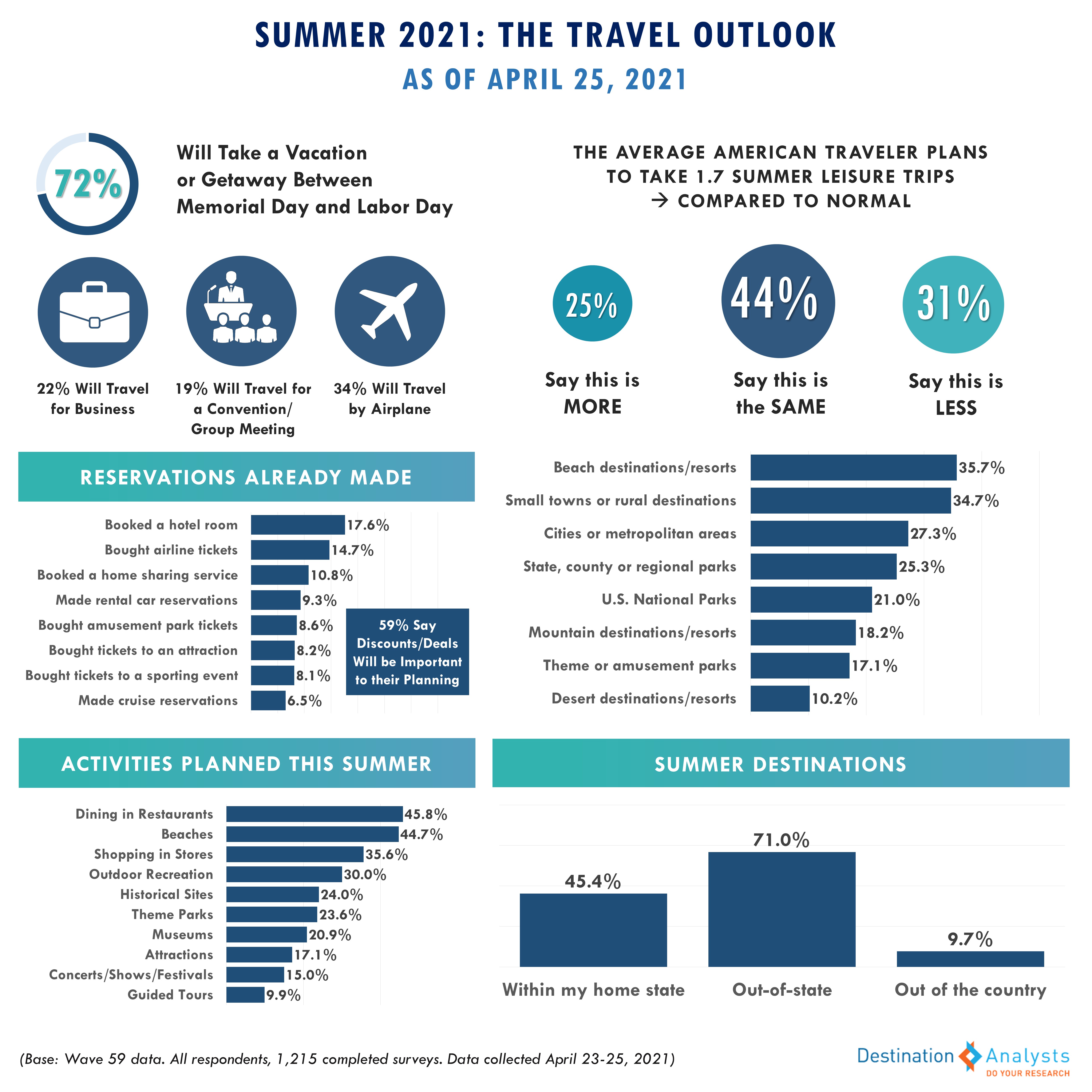

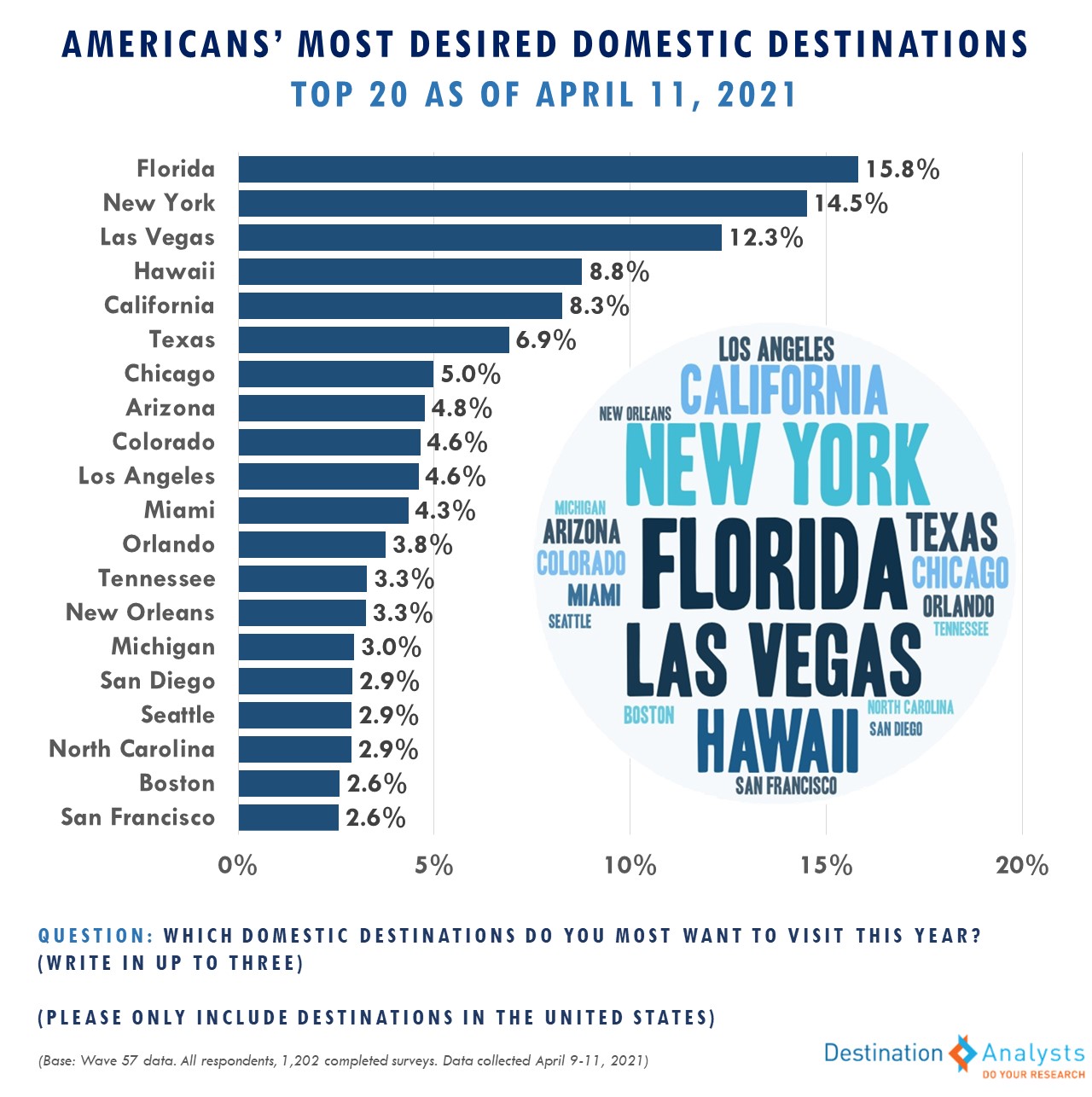

With April coming to a close, Summer 2021 draws even nearer. Last month we were able to report that many American travelers are saying “YES” to summer vacation, and the number has grown even further in the four weeks since. Now 71.6% say they will take a vacation or getaway between Memorial Day and Labor Day, up nearly 10 percentage points from last month and up nearly 36 percentage points from 2020. Across all American travelers, the average number of leisure trips being taken this Summer is 1.7. July remains the peak month, with over half of American travelers planning to take one or more trips in that month. Only 36.4% say their very first Summer trip is well-developed already; about 44% have not yet made any major trip reservations yet for their Summer travel yet. Over 70% of Summer travelers plan to head out of state (and one-in-ten will travel abroad) so, while car is still the predominant transportation method, 34.2% will be getting on an airplane. Beaches, of course, remain the top destination and planned activity, although 27.3% say they will be visiting cities. Restaurants and retail stores look to be attracting tourists this Summer, as well. Interestingly, Americans are split in their expectations for travel prices this season. While 36.3% agree prices will be low this Summer, 30.6% disagree. Nevertheless, two-thirds of Summer travelers will actively look for discounts and 58.8% say such deals are important to their travel planning.

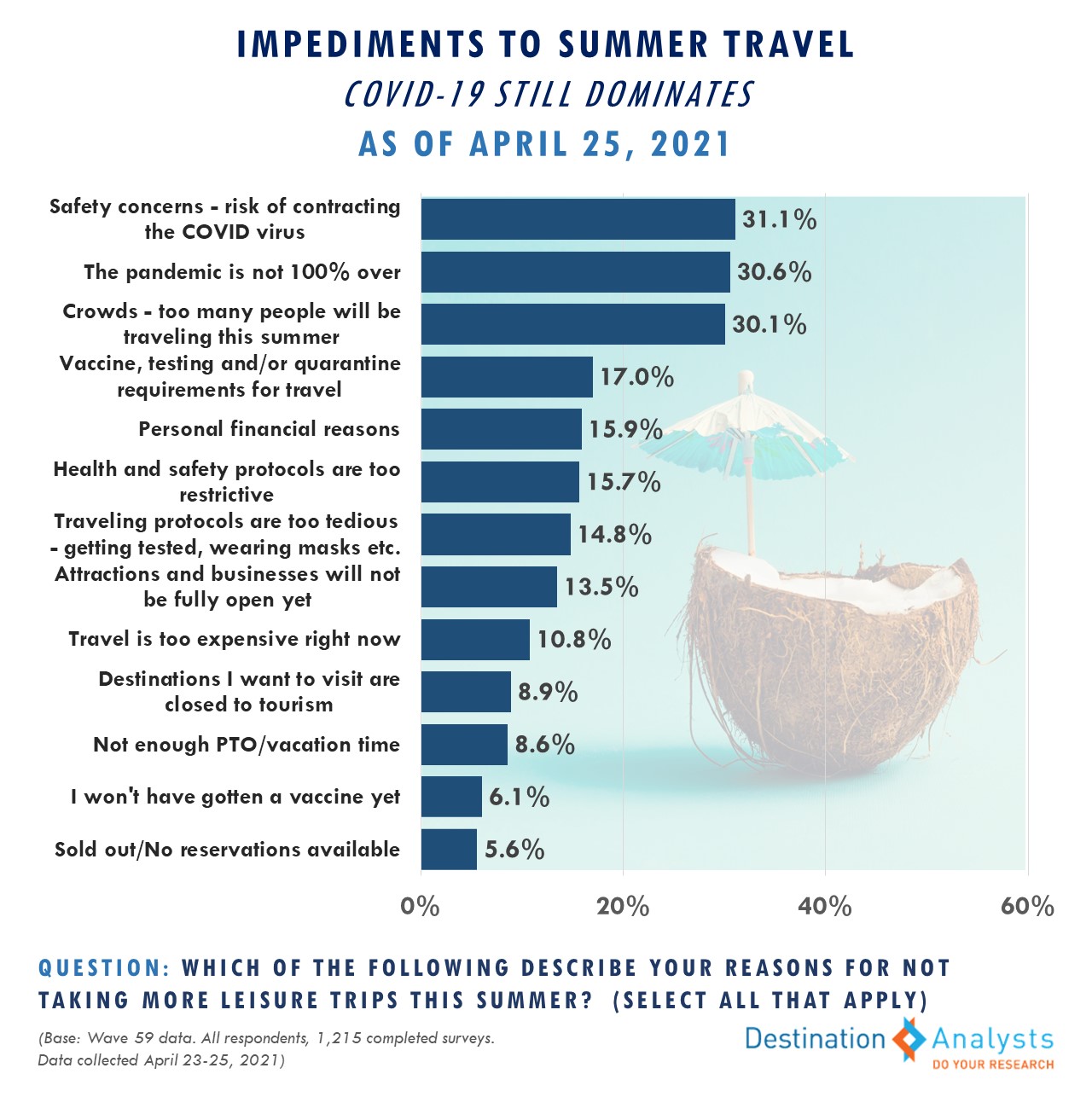

Still, the pandemic lingers in Americans’ mindset. While 43.6% say the number of summer trips they are taking this year is what they would do normally—and over a quarter say it’s even more—nearly one-third of American travelers say their summer trip volume is less than a typical non/pre-pandemic year for them. 43.7% even plan to staycation. When asked for reasons as to why they are not planning more travel this summer, the top 2 cited were directly pandemic-related—safety concerns about contracting COVID-19 and that the pandemic is not 100% over. The amount of people traveling this Summer is also deterring some, as are COVID-related restrictions, protocols and limited openings.

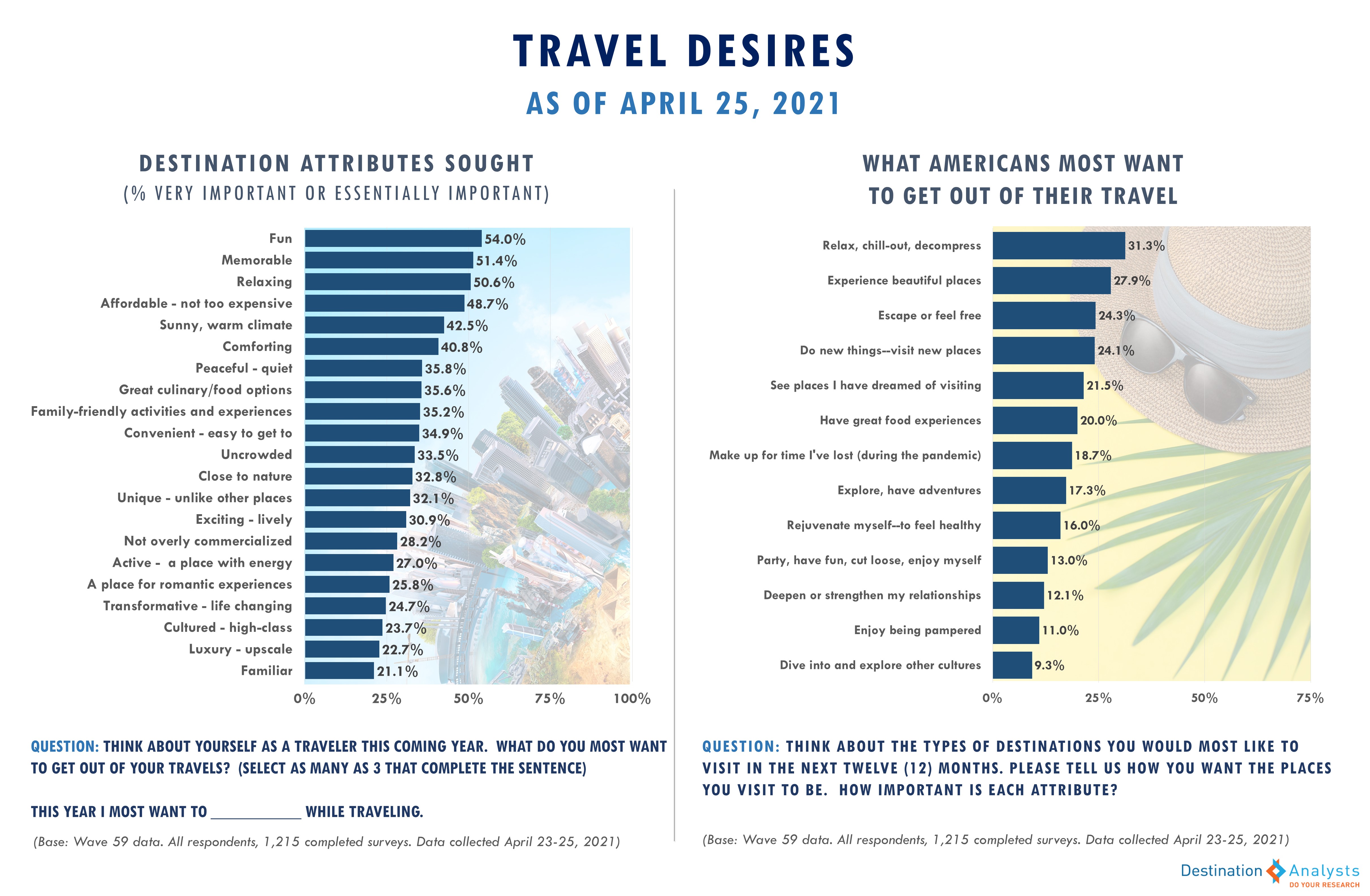

And yet, the pandemic is also in retreat in Americans’ psyche. When asked the important attributes in destinations they will choose to visit this year, the percent saying “uncrowded” has fallen 20 percentage points since June 2020 (now at 33.5%). Also in decline is the percent saying they want a place that isn’t overly commercialized. Instead, Americans are focused on finding places that are fun, memorable, relaxing, affordable, warm and comforting. Indeed, over these next 3 months, Americans are as likely to visit cities on their trips as small towns and beaches. When asked what they most want out of travel this year, Americans are largely looking to escape and relax, experience beautiful places, do new things and visit places they have been dreaming of.