During Destination Analysts’ April 21st presentation of the latest findings from our weekly Coronavirus Travel Sentiment Index Study, our CEO Erin Francis-Cummings interviewed a panel of travelers about their perspectives on travel and their upcoming travel plans in the wake of the the coronavirus pandemic. While not a formal study, it is a reminder that qualitative research adds such richness and depth to understanding about how customers think—something that is critical for brands and other businesses as they lead through and after the COVID-19 crisis.

Highlights from what these travelers shared about staycations, travel ads, and desired safety protocols follow below.

On Staycations:

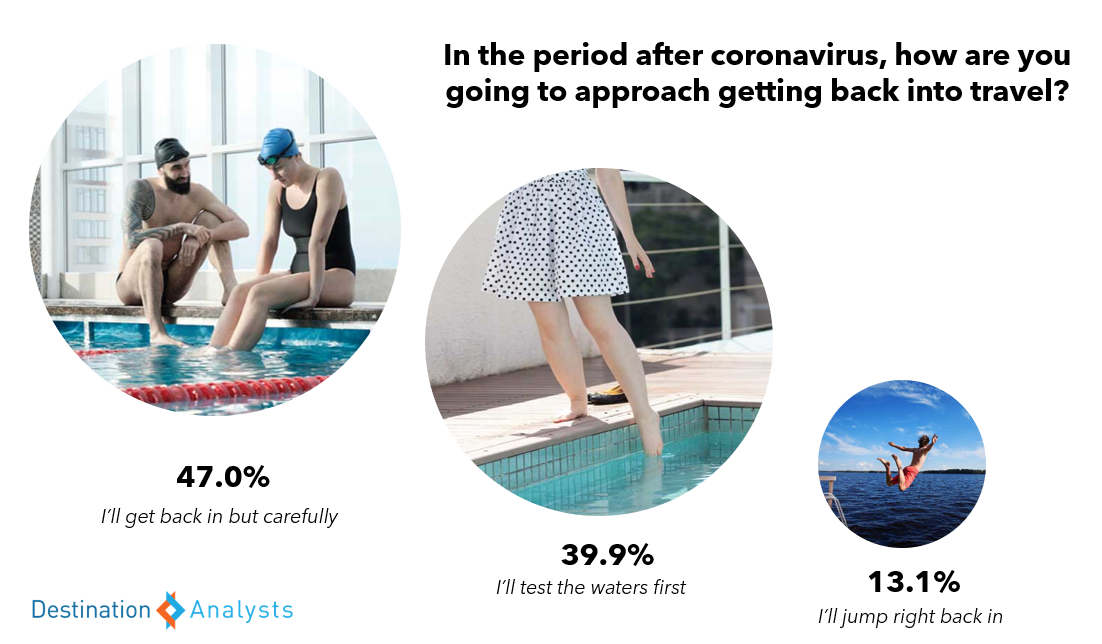

“Mine would probably entail camping up in the mountains or something that would still be avoiding crowds and things like that. I think it would be probably within the same state or relatively close. For me, it doesn’t mean staying in this small area in my house or in the little neighborhood I live in. That’s not really what I’m looking for because I’ve been here for the last six weeks and haven’t been able to leave. So it would be 30-40-50 miles at least up in the mountains–camping or fishing or more of a rural kind of experience I would say.”

“There are two ways that I personally define staycation. There is ‘you’ve been working several months straight and haven’t taken a day off, and staycation is where you decide to take a couple of days off and hang out at home’. The other way I look at it is that staycation is ‘going to visit a city near you or exploring your own city–staying the night there or just doing a day trip…about 40 miles away so its not too far’, I could stay the night there if I wanted to but I could also go home if I wanted to.”

“I would limit how far I was going initially until I had a handle on the area I was going to. Where we live, within a 2 hour drive, I can actually day trip to a lot of different destinations, and after being self-quarantined and sheltered for a while, it’ll be nice to do that. But when you get beyond the staycation, those are the type of criteria I would look at to make sure that I’m taking reasonable risks.”

On Discounts & Deals:

“If I can take an area that is safe, and a secondary of that safe, the discounts and incentives would have an impact…But I would rather pay the few hundred dollars more and go when it’s safe, so that would be my criteria, the safety first. But with all things being equal, obviously discounts and deals help to get people traveling again.”

“I think the best indicator for me is when I see that an area in particular is safe, but I think also if I see a great deal for say an international destination–and I’m talking about probably in Fall, I don’t really expect going anywhere international anytime soon. If I found great deal for somewhere like New Zealand which is also very safe right now, they controlled things very well. If I were looking at Iceland vs. New Zealand and if in this hypothetical scenario Iceland had a bad situation with COVID whereas New Zealand did not, I would pay a little bit more to go to New Zealand as opposed to Iceland. So yeah, but again it all comes down to if a particular area is safe or not.”

“Seeing a deal would definitely catch my eye initially, but I want to make sure the destination I’d be going to is safe, but not only that, I want to make sure that it is safe to leave where I am right now. I want to make sure that where I’m at, we have things under control around the decline, I want to make sure wherever I am going to is not heavily impacted right now, they’re not on an incline– then the deal would definitely be intriguing.”

On Seeing Travel Ads Right Now:

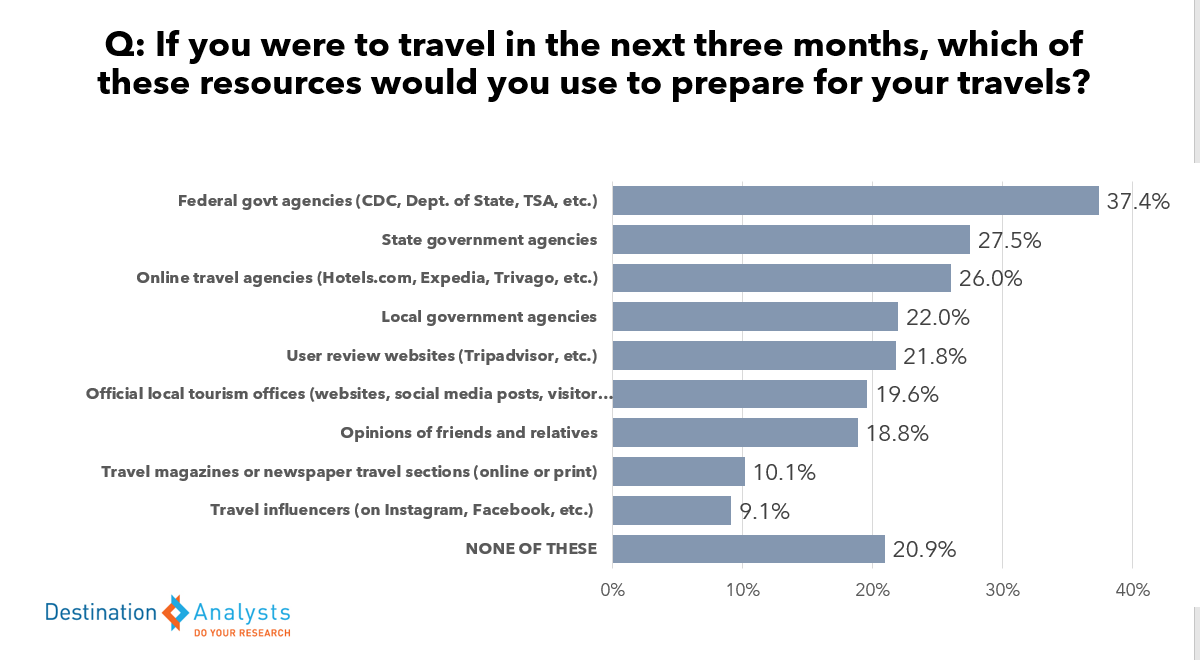

“Online is the best way. I’m on social media so you know seeing random ads on Instagram and seeing blogposts on Facebook, I follow certain bloggers, like the Points Guy and Travel Pirates. You’ll see a random article sometimes scrolling saying ‘Hey there are last minute flights’, those are the best ways to get my attention.”

“Publications and online, I think things like Travel and Leisure, even I do a lot of spotting on United, they’re sending out updates-the emails work. Even things like the travel channel or the weather channel little targeted ads, I think it’s something that clearly with the world locked up people will be happy to get out again.”

“Mostly online. I respond best to articles, blogposts, something with a little more description, little more like ‘here are things to do, here is a destination.’ And I think that something that is targeting or somewhat aligned with the notion of health in a particular area. So say there is a blogpost saying ‘come visit here and these are what the statistic are on COVID in this particular region.’ If some sort of advertisement can reassure me without me having to search and see how that destination is handling it, that area is relatively safe then that’s not only going to give me more assurance to go to that place but that’s going to give me more of a reason to trust whoever is advertising to me that they are putting some thought towards my safety, and I think that is important for me.”

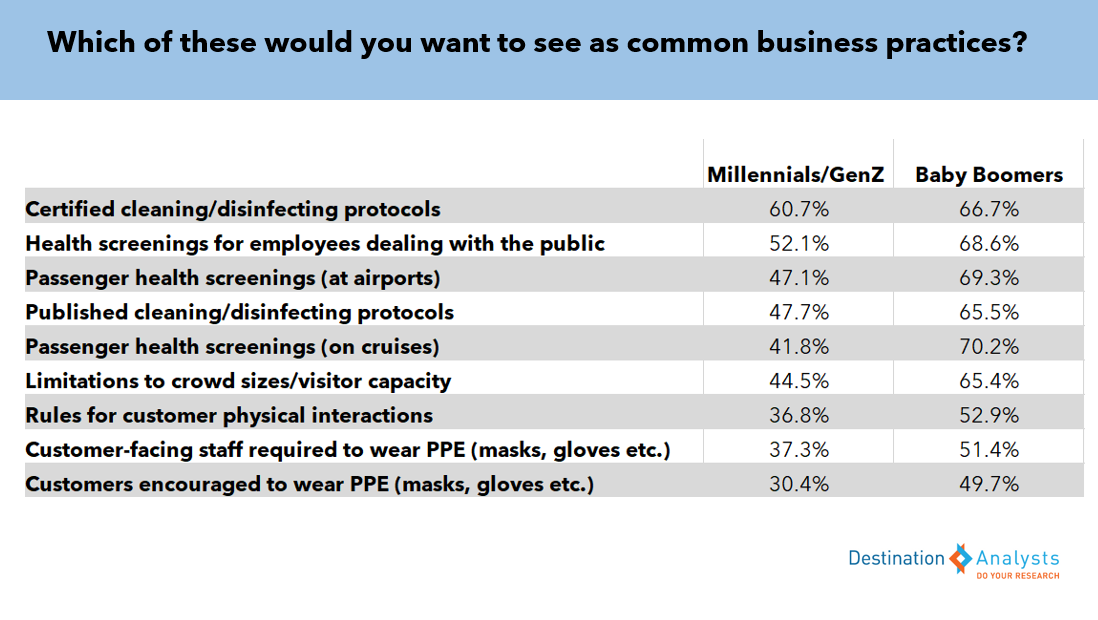

On Safety and Protocols:

“I want to avoid crowds…just general anxiety over catching the virus and whether or not I show symptoms sort of unwillingly spreading it to the people I do interact with.”

“The airlines sent me an email saying ‘we’re doing the best that we can, we’re taking extra precaution, we’re scrubbing down the planes with disinfectants and whatnot,’ and I expect larger ones to probably put out some type of memo saying the same thing. As far as the AirBnB, those are mom and pop. I am very big on trying to support local businesses or small businesses, but I think that is probably going to be a little bit riskier. But I’ll be sure to bring my Lysol wipes to disinfect everything. I’m not big on touching remote controls and public telephones, but I’ll be sure to scrub those down extra just in case.”

“I miss going to those live shows, music concerts. I think with everything going on, it’s smart to have extra handwashing stations, to have extra sanitizer around for people to make sure that they’re staying clean. Extra trash cans around to make sure people throw their wipes and they’re bringing masks or gloves and they’re dispensing of that properly. You see a lot of people disposing them in the streets right now and it does not do us any good if you’re disposing of your protective equipment by just littering and exposing other people. We got to make sure that the resource is there to make sure we stay clean, but you have to make sure we can dispose of it properly as well.”

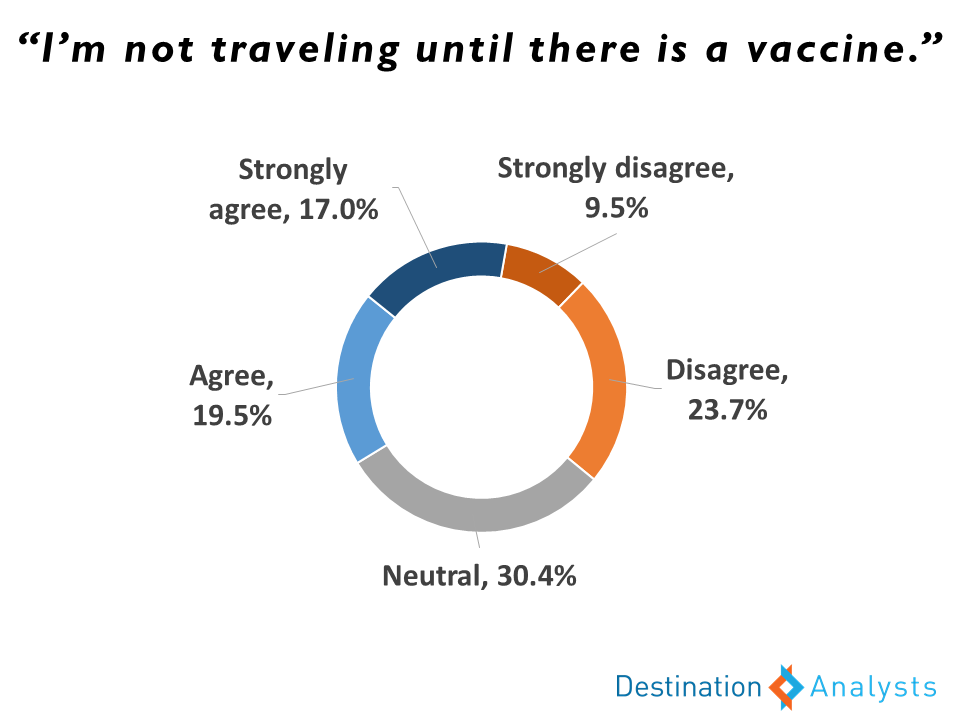

“I think people are just going to have to be more conscious about what a new normal is, and it does not mean that you can’t get this under control. Again different criteria: if you get a problem and you have a pill that is one level. If you have a vaccine that’s a perfect level. But in the meantime, it’s a matter of just being prudent. It’s carrying yourself in a prudent way, because you got a responsibility, again, not only for yourself but to your whole circle.”