During our presentation of the week of April 6th findings of our Conronavirus Travel Sentiment Index, we invited three meeting planners to join us to discuss their perspectives on the impact of COVID-19 on the meetings industry now and into the future, as well as their advice for CVBs right now. Following are key highlights from what they said.

1. Don’t stop promoting your destination. Out of sight is out of mind.

- Pausing marketing communications would be a mistake. Planners still want to hear from DMOs right now, even if it’s just a touch base on what is currently going on in the destination.

- In an environment with such uncertainty, planners appreciate positivity in messaging, but also acknowledge the need for a softer tone.

“It would be a bad move to not participate. You have to be in our face. You have to let us know you know what’s going on and be in control.”

“Personally, I wouldn’t pause your marketing. You might change the tone until things get back to normal. I love what some destinations are doing with putting out virtual visits so people who can’t travel can watch videos of the destination.“

2. Don’t let fear control you. Look for opportunities and be creative. These are uncertain times, but with uncertainty comes opportunity.

- In the immediate aftermath, regional travel will flourish and create opportunities for resort destinations as well as second and third tier destinations.

- Many small meetings are likely to move online in the future. In response, DMOs should be promoting their capabilities in providing a more holistic meeting experience. There may be opportunities to partner with good clients to assist with enhancing their virtual meeting.

“In the short term I expect a huge spike in virtual meetings because people do see that this will work. It will be an impact for us moving forward but in the long term, people will still need that face-to-face interaction, but they won’t need it for every meeting.”

“A critical role the DMO can have is providing an experience. Not just sitting around talking. It includes dinner, activities, team-building aspects, to a face to face meeting. That’s where DMOs should stress the total experience rather than just exchange of information.”

3. Start and lead a local conversation. Put on your leader hat and help bring planners and hotels together to solve two intractable problems:

- Force majeure issues are hamstringing planners.

- CVBs need to have a lot of conversation around allowable higher attrition or even waived attrition penalties for programs that continue to operate in 2020.

“These things are affecting our entire industry. We need to look at encouraging groups to meet and taking away some of the objections. Maybe CVBs can be starting that conversation with their hotel partners. It would encourage clients to keep their meetings in place.”

4. Hit the ground running when the situation improves. Have a strategy and a plan.

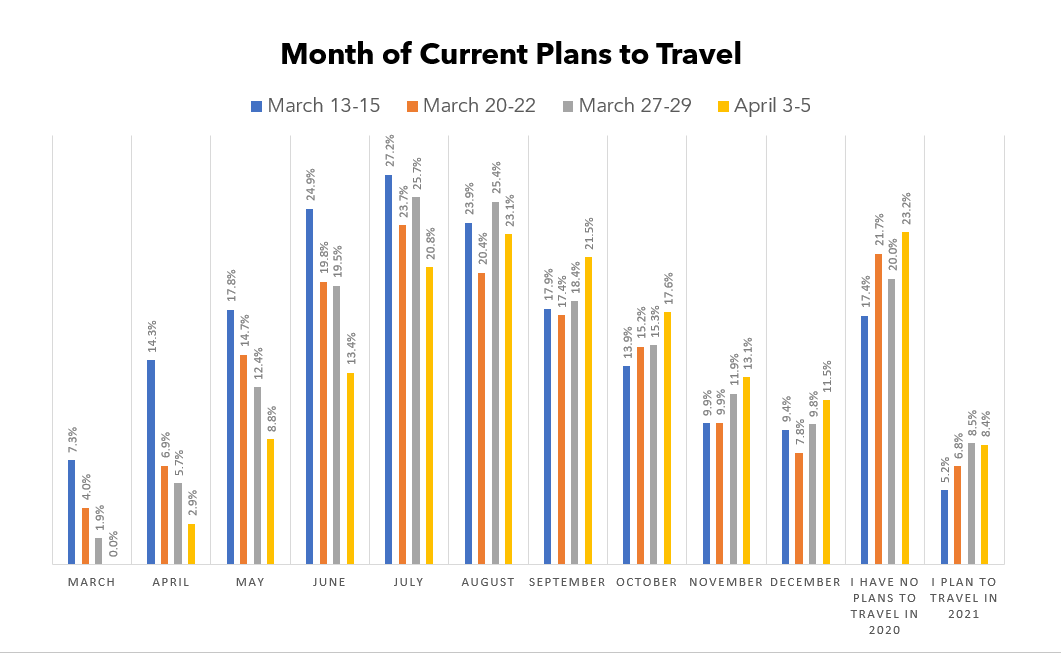

- June is in peril. While April and May meetings are pretty much cancelled at this time, June meetings may follow very soon. There is talk that meetings may likely resume in the fall. If that is the case planners believe business will pick up quickly thereafter.

“I’m thinking third quarter we will be back to normal or the new normal. We need to conduct business so it is very important to have a strategy in place now to help us move forward.”

“CVBs need to be letting meeting planners know what they are going to do about reopening hotels. Information about when it can come back online. How quick can they be up and running again?”

“[DMOs] need to lead by example. It’s just putting on your leader hat, period, and doing what leaders do. You have to be tenacious. It’s a fight. This is not a time to be relaxed. Put your energy into it and it will work out.”