Update on American Travel in the Period of Coronavirus—Week of October 5th

Despite growing pessimism and the President’s diagnosis, willingness to travel continues to improve, business travel resumption has increased and urban destinations appear poised for a comeback. For those Americans still engaging in travel avoidance, the wide distribution of an effective COVID-19 vaccine is far and away their top ranked condition for being comfortable traveling again.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected October 2nd-4th.

Key Findings to Know:

- The September jobs report and the President’s announcement of his COVID-19 diagnosis did not appear to heighten American travelers’ concerns, with the percent of American travelers with high degrees of concern about personally contracting the coronavirus decreasing to 68.0% and personal financial concerns dropping to a 30-week low.

- Despite growing pessimism about the pandemic’s course over the next month, Americans’ perceptions of travel’s safety, their confidence in traveling safely and their readiness to travel continued to improve, and over 40% anticipate their next trip will take place before the end of the year.

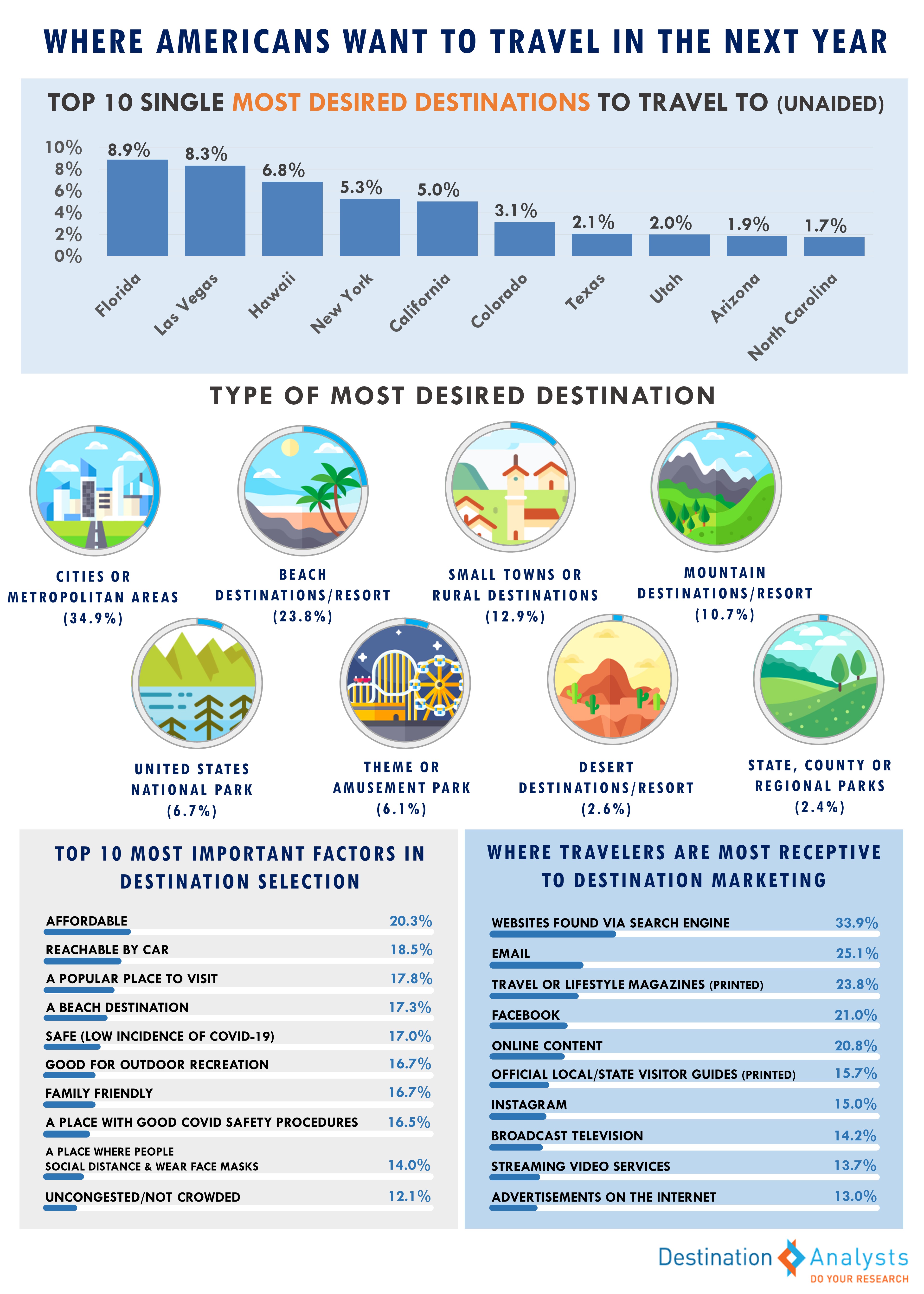

- As in pre-pandemic times, Florida, Las Vegas, Hawaii, New York and California dominate the hot list of where Americans want to go, although outdoor-brand destinations like Colorado, Utah and North Carolina continue to displace some iconic cities for top spots.

- Nevertheless, urban destinations appear now poised for a comeback, with well over one-third of American travelers describing the destination they most want to visit in the next year as a city/metropolitan area.

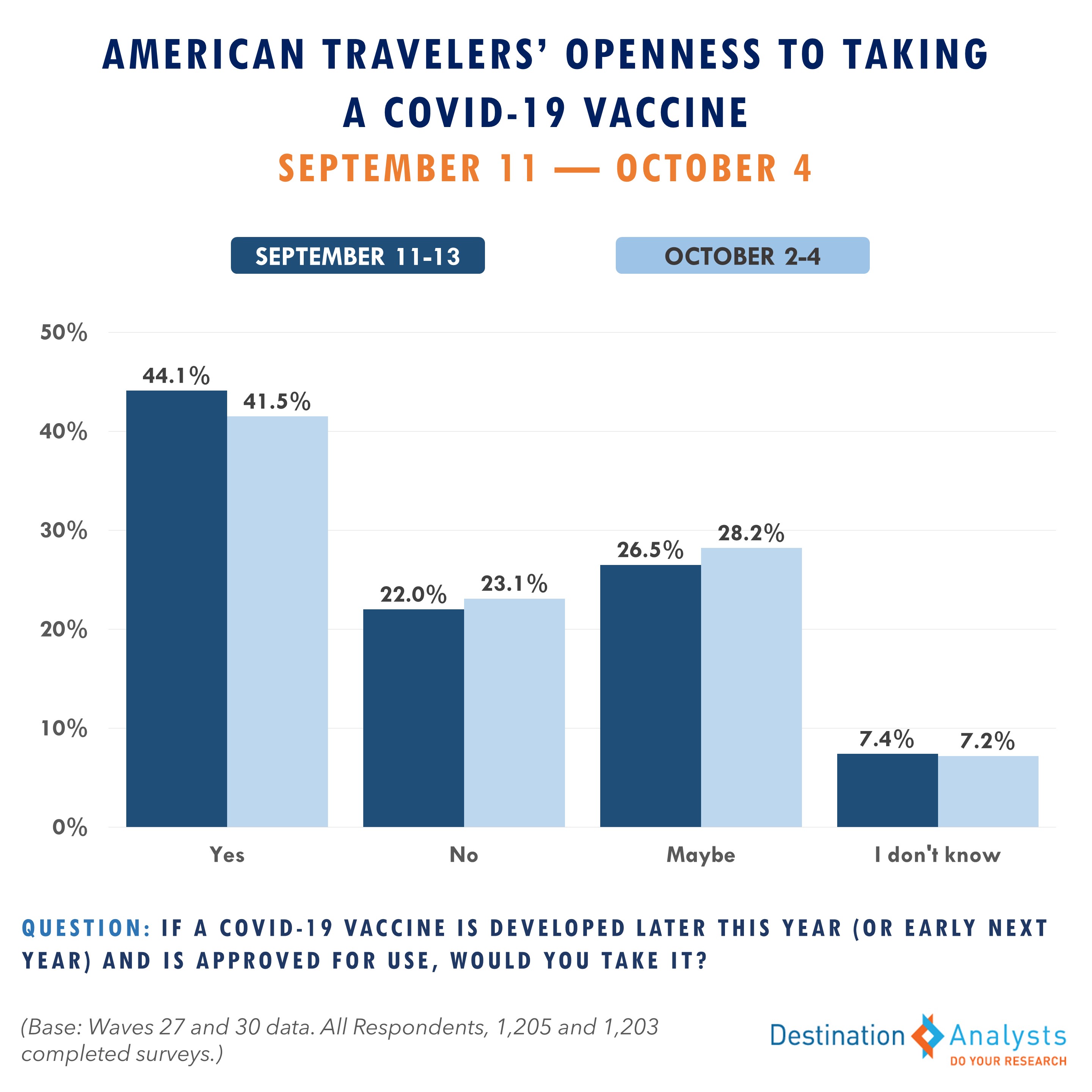

- For those still engaging in travel avoidance, the wide distribution of an effective COVID-19 vaccine is far and away their top ranked condition for being comfortable traveling again. Unfortunately, willingness to take a vaccine that is developed in the next few months has declined somewhat among the general American traveling population.

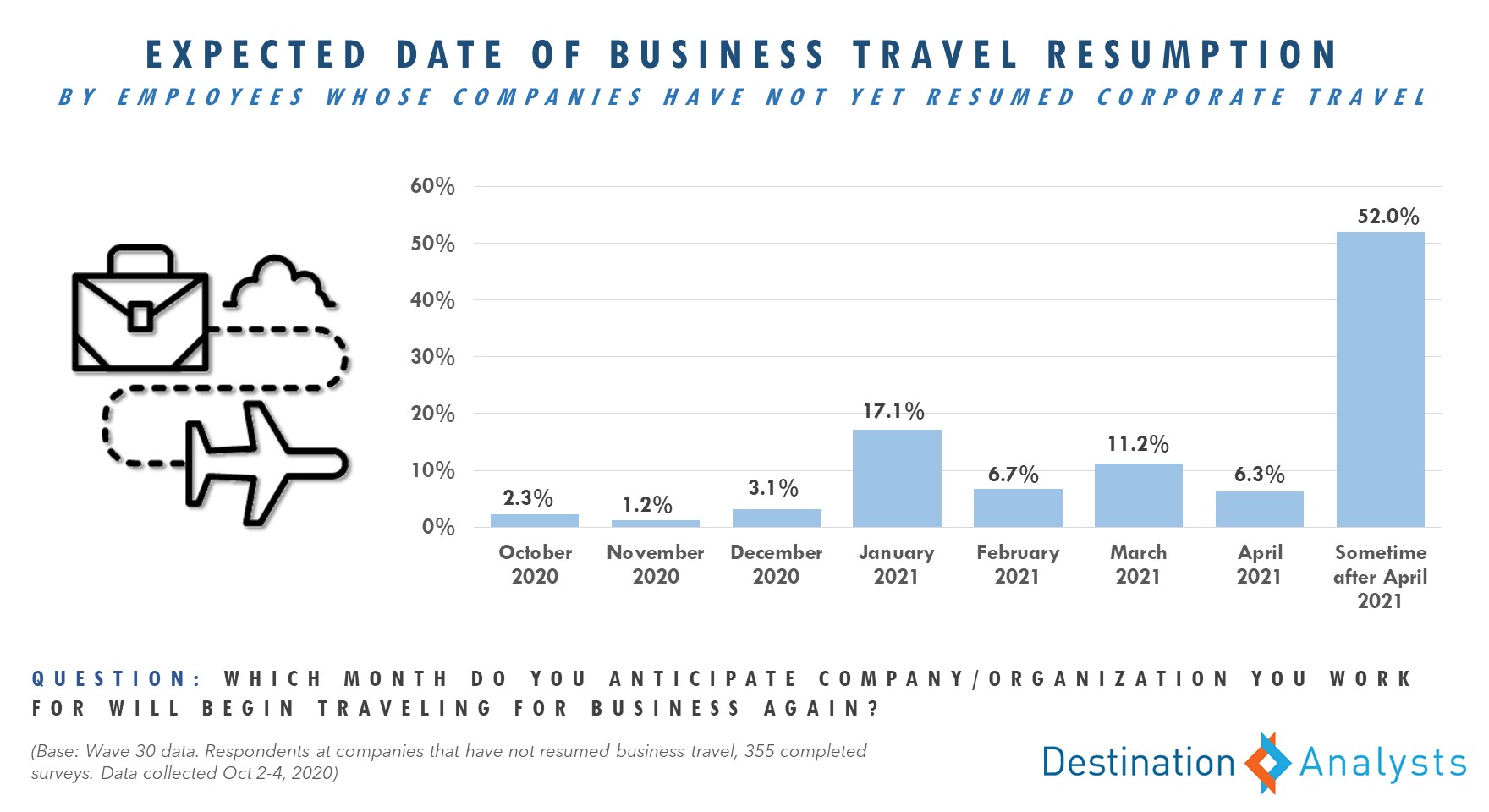

- Looking for indicators of business travel’s recovery, 26.7% of American travelers who work for companies in which employees travel for business say that this travel has started again, up from 24.2% one month ago. However, among those whose companies are not yet back to business travel, now well more than half expect that it won’t be until after April that it resumes.

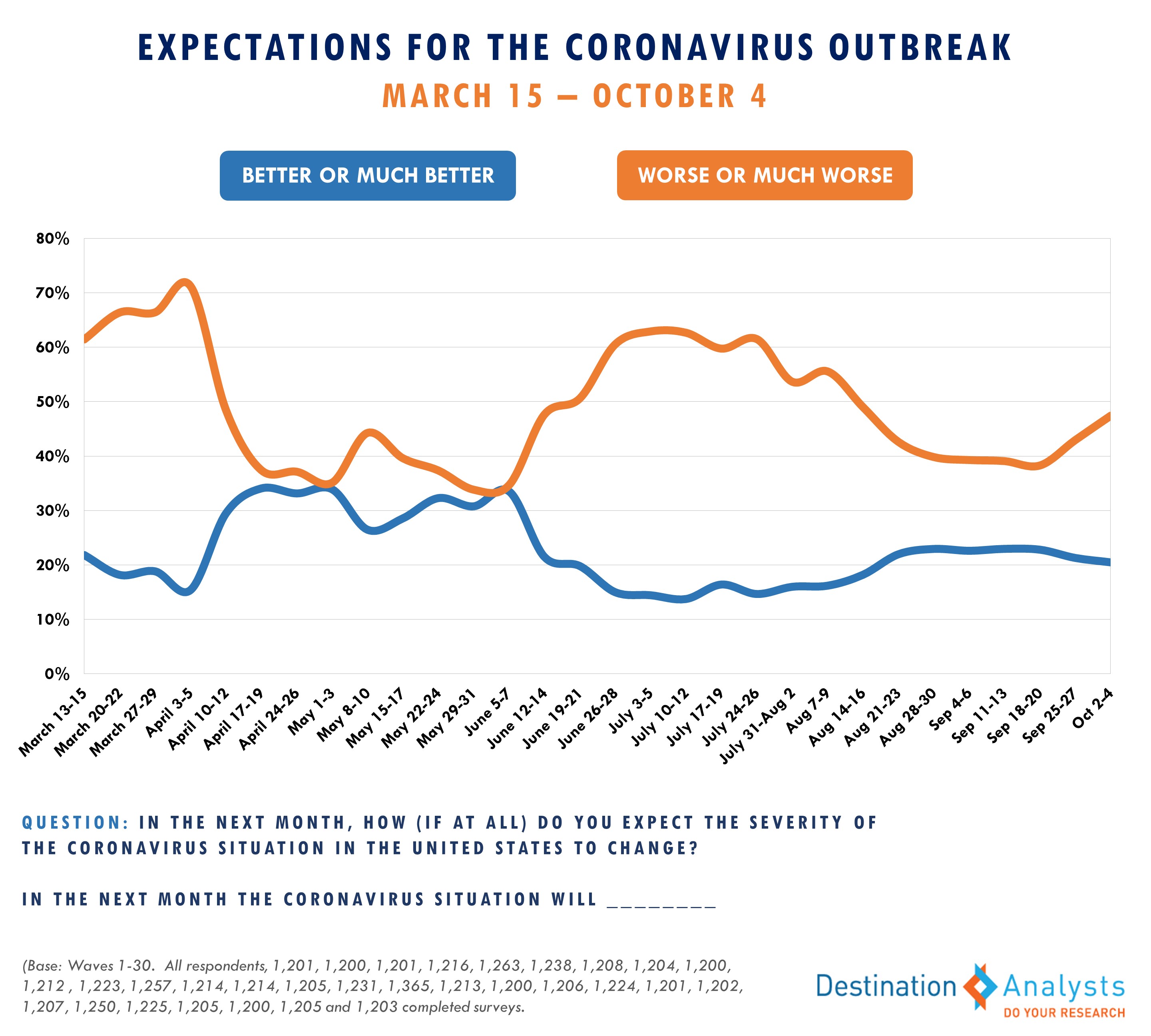

The President’s announcement of his COVID-19 diagnosis did not appear to heighten American travelers’ concerns about contracting the virus as of yet. In fact, the percent of American travelers with high degrees of concern about personally contracting the coronavirus decreased to 68.0% from 70.9% one week ago. American travelers also appeared largely unfazed by the September jobs report, as personal financial concerns dropped to a 30-week low. However, expectations for the pandemic’s course in the next month darkened—now 47.5% feel it will get worse, up from 43% last week.

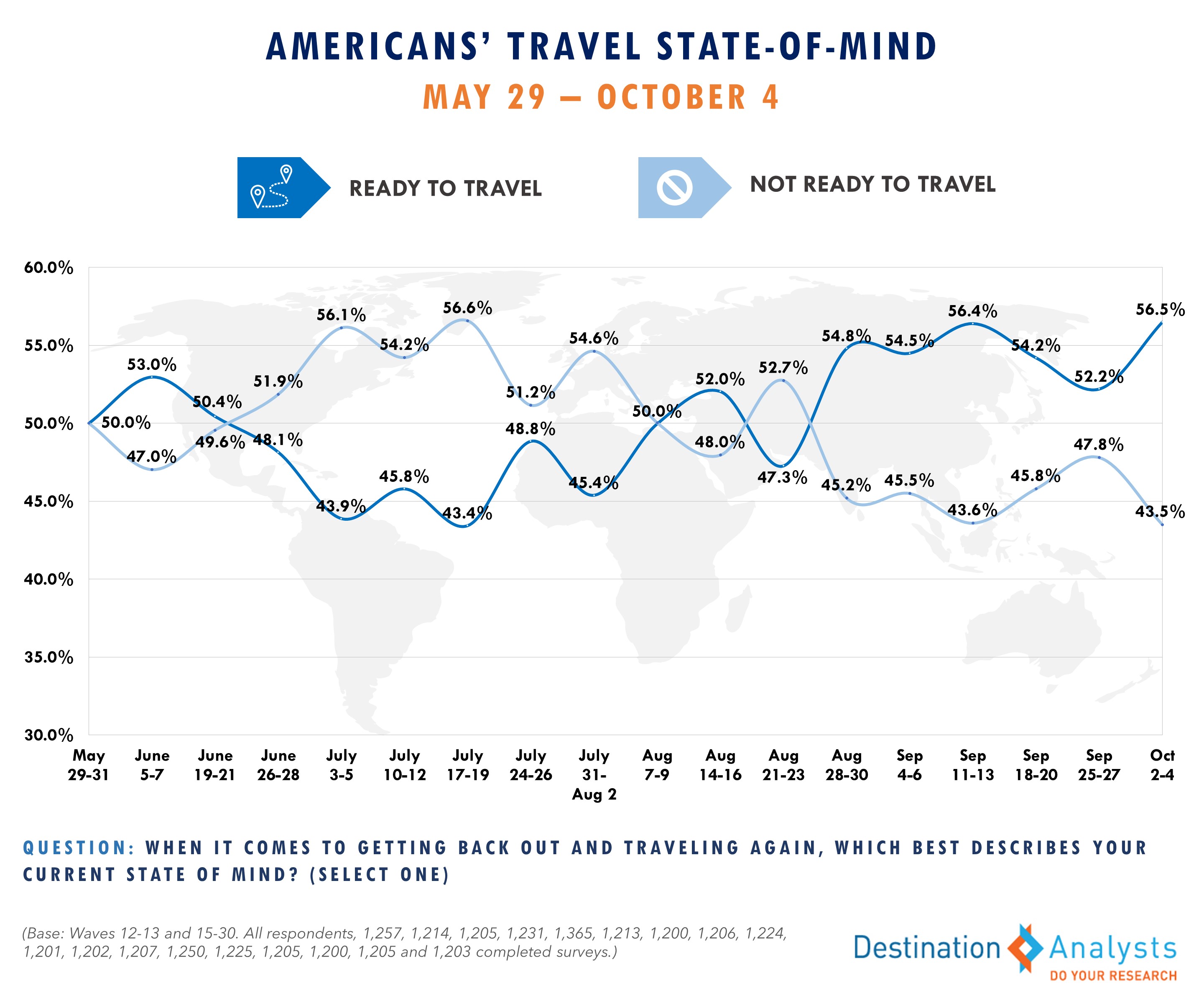

The growing pessimism about the virus did not seem to impair Americans’ travel plans. As comfort heading out for leisure activities within their own communities is the highest it has been since March 15th, the perception of the safety of travel activities also continued to improve and 30.9% feel confident or very confident they can travel safely in the current environment. After dropping for the last two weeks, the proportion in a “ready to travel” state of mind returned to 56.5%. Over 40% of American travelers anticipate their next trip will take place before the end of the year. In addition, nearly 60% feel that having a vacation planned for sometime in the next six months will bring them happiness.

Exploring where Americans want to travel to domestically as they look out over their next 12 months, the hot list looks more like it did pre-pandemic—with Florida, Las Vegas, Hawaii, New York and California dominating—although outdoor-brand destinations like Colorado, Utah and North Carolina continue to displace some iconic cities for top spots. Nevertheless, urban destinations appear now poised for a comeback, with well over one-third of American travelers describing the destination they most want to visit in the next year as a city/metropolitan area. The pandemic will still likely weigh on destination decisions for some time, as when asked what was important to their desires to visit specific places, traditional attributes like affordable and popular are joined by low rates of COVID-19, mask-wearing and social distancing. In terms of how American travelers can be reached, search engine and content marketing, email and social media are prime, in addition to printed resources such as travel/lifestyle magazines and visitors guides.

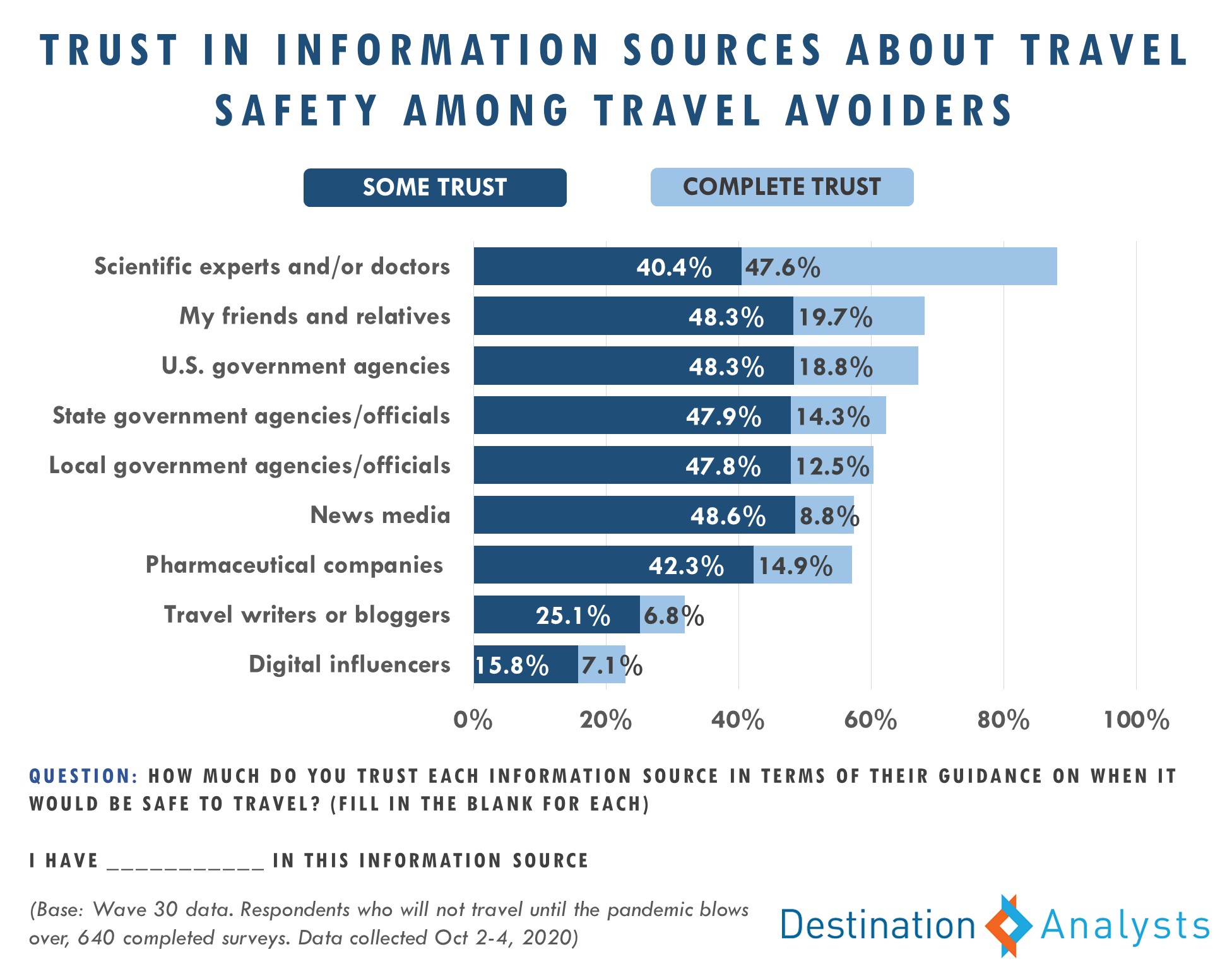

As the travel industry looks to recover, still some 53.0% of American travelers continue to agree they will engage in some travel avoidance. Information may play an important part in this, as these travel avoiders are not highly satisfied with the information available to travelers to help them decide when it is safe to travel, rating their satisfaction level a 5.8/10 on average. They place the highest degree of trust in information and guidance on travel safety from doctors and scientific experts.

However, for those still engaging in travel avoidance, the wide distribution of an effective COVID-19 vaccine is far and away their top ranked condition for being comfortable traveling again. Unfortunately, willingness to take a vaccine that is developed in the next few months has declined somewhat among the general American traveling population to 41.5% from 44.1% three weeks ago.

Looking for indicators of business travel’s recovery, 26.7% of American travelers who work for companies in which employees travel for business say that this travel has started again, up from 24.2% one month ago. However, among those whose companies are not yet back to business travel, just 6.1% report that their employer has announced a timeline for return. While about a quarter anticipate their company’s business travel to return by January, now well more than half expect that it won’t be until after April.