Update on American Travel in the Period of Coronavirus—Week of September 28th

Although COVID-19 concerns are rising, nearly two-thirds of American travelers plan to take a trip this Fall, including some notable interest in workcations and schoolcations.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected September 25th-27th.

Key Findings to Know:

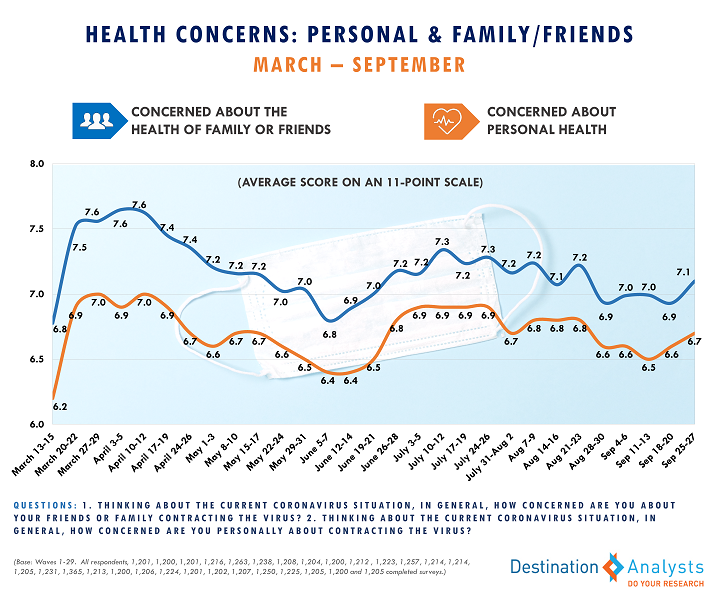

- After a month-long period of relatively lower levels of anxiety, the number of Americans with high degrees of concerns about contracting the coronavirus rose this week. Similarly, after a stable period in expectations for the virus’ course, the percent of Americans who feel things will get worse in the U.S. in the next month increased.

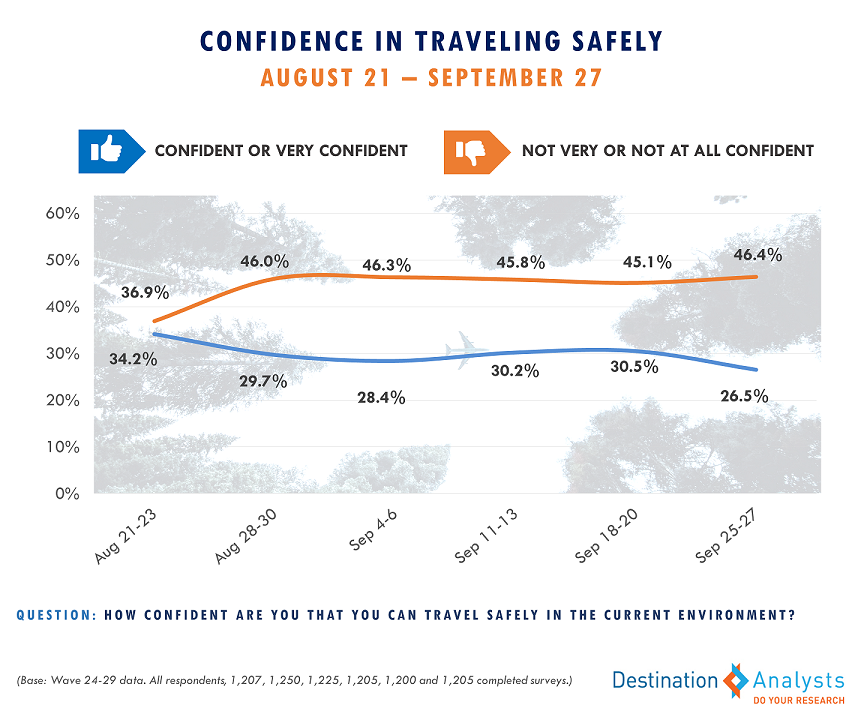

- These rising concerns appear to be affecting confidence that travel can be done safely and perceptions of travel. The percent in a “ready to travel” mindset fell to 52.2% after being above 54% for the last month.

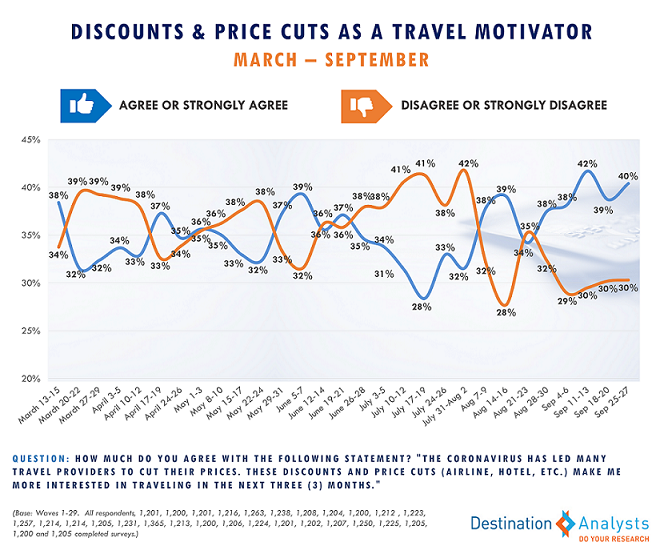

- Nevertheless, three-quarters of American travelers continue to report having at least tentative trip plans—primarily over the next 6 months—as well as exhibit a perception of travel as a means to meet their emotional needs. The percent that agree price cuts and discounts can motivate them to consider a new trip is as high as it has been during the pandemic.

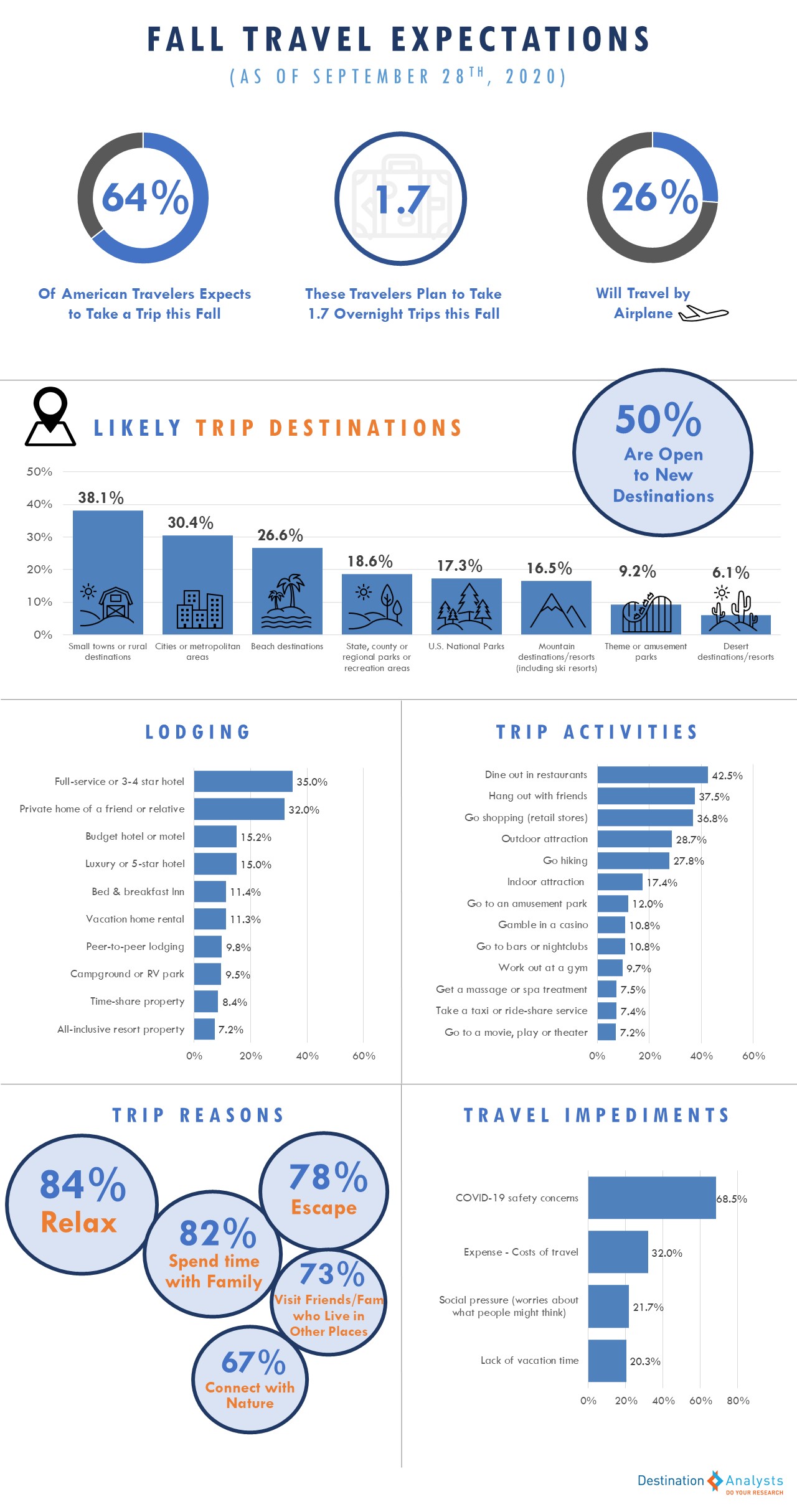

- Looking at American travelers’ specific expectations for Fall, nearly two-thirds expect to travel this season, and these travelers anticipate taking 1.7 overnight trips on average. The top motivations for these Fall trips are relaxation, spending time with family and escapism, although younger travelers are also likely to be seeking connecting with nature and having new experiences.

- Nearly 40% of likely Fall travelers say they will visit a small town or rural area on their Fall trips, with beach visitation less likely than in the summer months and urban travel increasing.

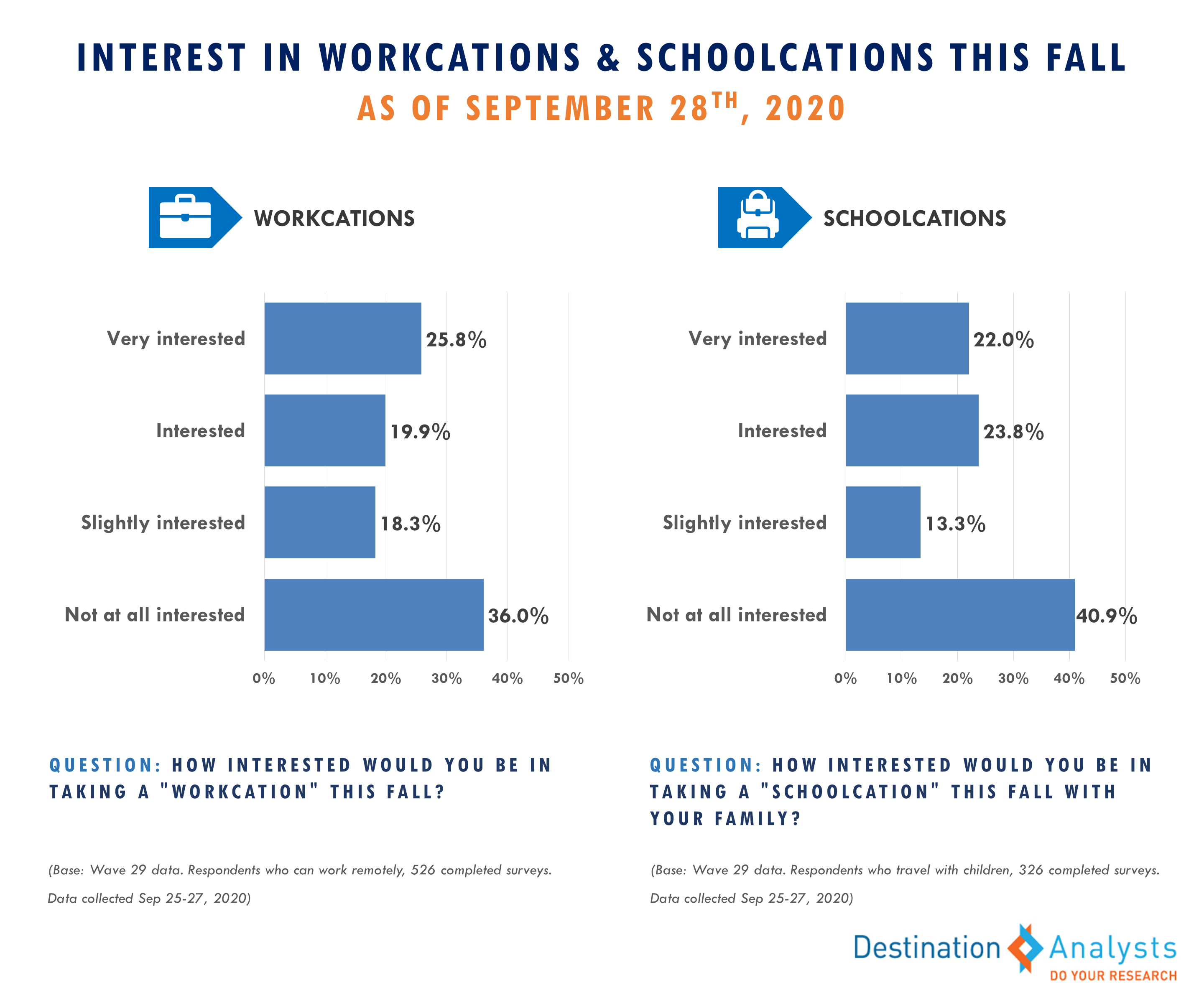

- Interest in workcations among those who can work remotely and schoolcations among parents who travel with children is at similar levels—just under half have a more elevated degree of interest. In total, 52.2% of those interested in schoolcations reported some likelihood to take one this Fall, while 46.0% of those interested in workcations said they were likely to actually take one in these coming months.

- American travelers’ comfort with enjoying their own communities for leisure activities and having tourists visit their regions are at pandemic period highs.

It’s officially Fall and Americans are increasingly hearing predictions and plans for the coming months while we remain in a global pandemic. After a month-long period of the lowest levels of concerns since May, the number of Americans with high degrees of concerns about contracting the coronavirus rose this week. Similarly, after a stable period in expectations for the virus’ course, the percent of Americans who feel things will get worse in the U.S. in the next month increased to 43.0% from 38.3% the week prior, and the percent who feel things will get better decreased to 21.3%.

These rising concerns appear to be affecting confidence that travel can be done safely and perceptions of travel. While the majority of American travelers do not view several core travel activities—such as staying in a hotel or going to a restaurant—as unsafe, the overall average “unsafe” rating of the two dozen travel activities we track has ticked up this week to 53.7%. Now 26.5% of American travelers are confident or very confident they can travel safely, down from 30.5% last week. After dropping below 40% for the last three weeks, 41.1% of American travelers now have some agreement they need a vaccine to travel. And the percent in a “ready to travel” mindset fell to 52.2% after being above 54% for the last month.

Nevertheless, three-quarters of American travelers continue to report having at least tentative trip plans—primarily over the next 6 months—as well as exhibit a perception of travel as a means to meet their emotional needs. Over 57% of American travelers agree that having a vacation scheduled in the next six months would make them feel there is something happy to look forward to. And another indicator that travel can be inspired under the right conditions is that the percent that agree price cuts and discounts can motivate them to consider a new trip is as high as it has been during the pandemic.

Looking at American travelers’ specific expectations for Fall, nearly two-thirds expect to travel this season, and these travelers anticipate taking 1.7 overnight trips on average. Citing what is keeping them from traveling even more than this, COVID-19 safety concerns—and relatedly, social pressure—is expectedly principal. The top motivations for these Fall trips are relaxation, spending time with family and escapism, although younger travelers are also likely to be seeking connecting with nature and having new experiences. Nearly 40% of likely Fall travelers say they will visit a small town or rural area on their Fall trips, with beach visitation less likely than in the summer months and urban travel increasing. Over a quarter of these likely Fall travelers—and nearly one-third of those Millennial or younger—plan to travel by airplane. As in summer, about a third expect to stay in a friend or relative’s home on these trips but hotels and other paid lodging options will be most common. While 41.9% report they will be more budget conscious on their Fall trips, dining out in restaurants, shopping and visiting outdoor attractions are among the top planned trip activities.

With nearly 60% of American travelers we surveyed reporting they can work remotely and many children remaining in online school, this week we looked into workcations—travel where people visit a vacation destination while still working remotely—and schoolcations—travel where students can vacation with their families while attending classes online. Interest in workcations among those who can work remotely and schoolcations among parents who travel with children is at similar levels—just under half have a more elevated degree of interest. In total, 52.2% of those interested in schoolcations reported some likelihood to take one this Fall, while 46.0% of those interested in workcations said they were likely to actually take one in these coming months. When asked to describe the ideal characteristics of a destination for these types trips, a beach/lake/waterfront location are of strong interest. For potential workcationers, they are seeking reliable high speed internet in relaxing and even remote environments. For potential schoolcationers, a destination that is fun while also peaceful is optimal.

Looking closer to home, American travelers’ comfort with enjoying their own communities for leisure activities is the highest it has been since March 15th. American travelers are also the most comfortable with tourism to their own regions than they have been in the pandemic—although 52.2% still agree they don’t want tourists visiting right now.