Update on American Travel in the Period of Coronavirus—Week of August 31st

Updated 8/31 at 11:30AM EST

As Americans see travel as a means to achieving their desired emotional states, their prioritization of travel in their personal budgets is growing. But safety confidence in travel is still greatly needed.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected August 28th-30th.

Key Findings to Know:

- American travelers recorded another measured gain in optimism about the pandemic’s course in the next month.

- The perception of travel activities as unsafe is the lowest it has been since June 15th.

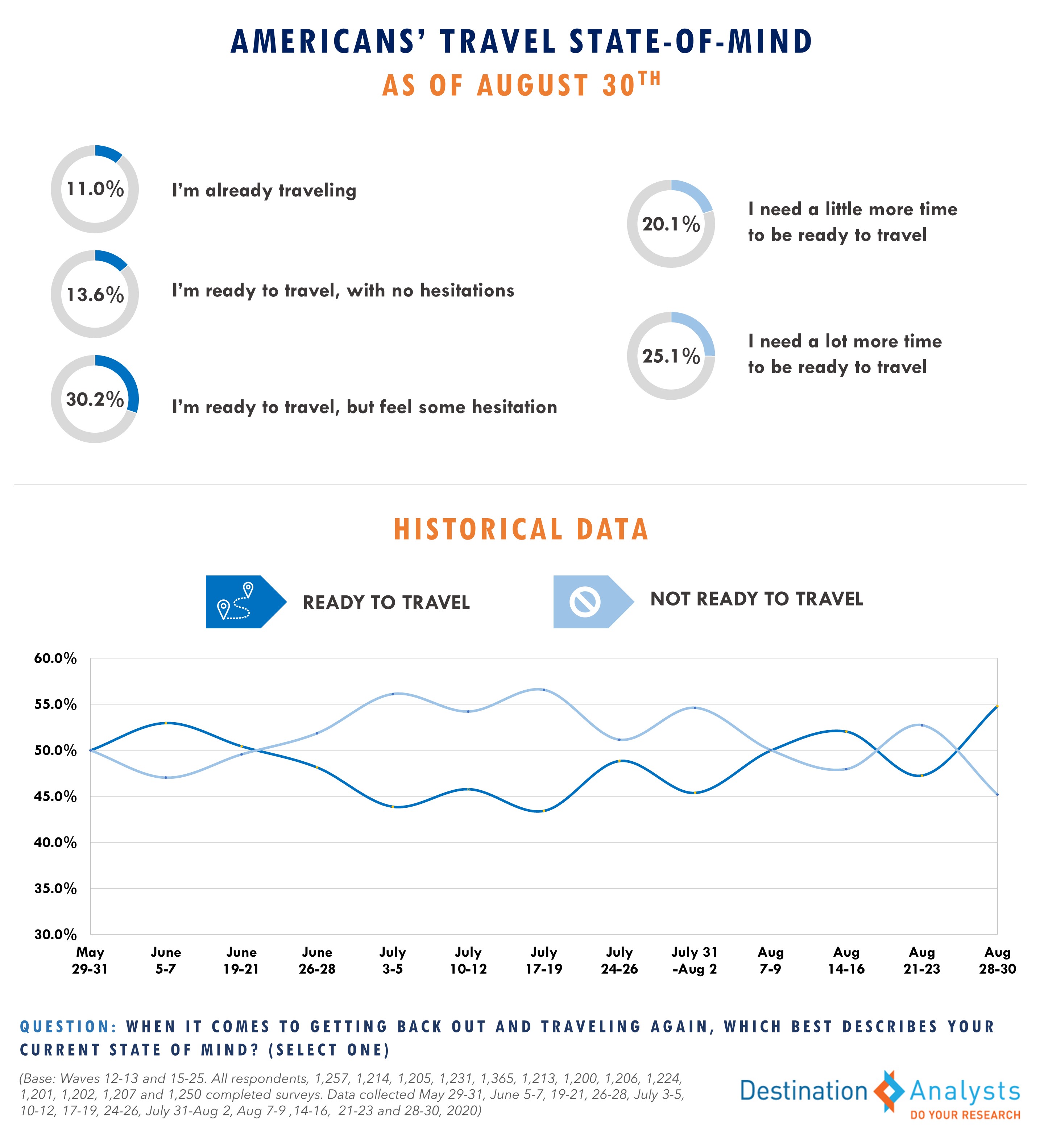

- Americans have also demonstrated improvement in their state of mind around travel readiness, and Fall travel expectations improved to 35.9% from a low of 29.8% last week.

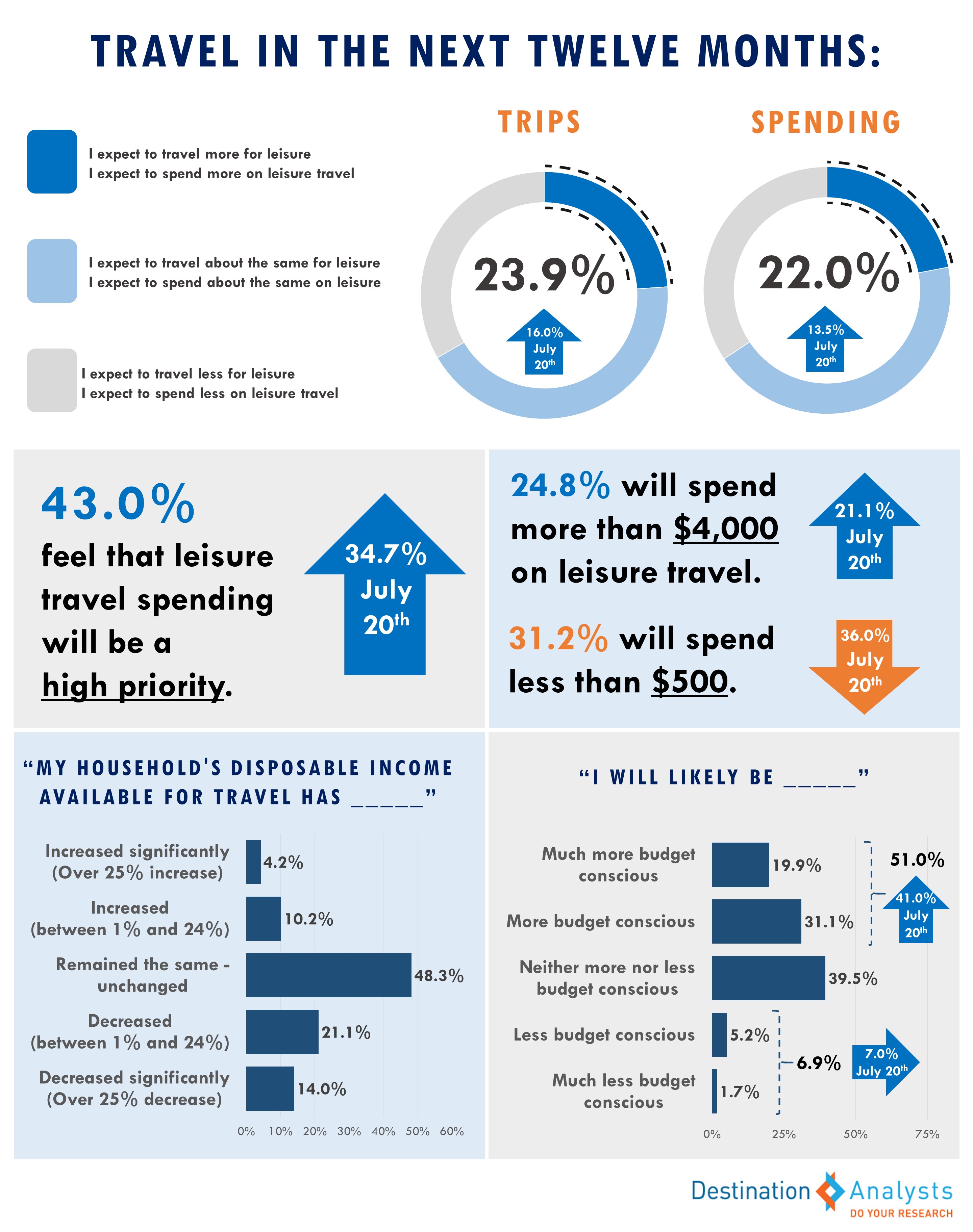

- Americans prioritization of travel in their personal budgets is growing. Now, 43.0% of American travelers say that leisure travel will be at least a somewhat high priority in their personal budget in the next year and a majority of American travelers say the pandemic has not negatively impacted the disposable income they have available for travel. However, they indeed plan on being more budget conscious on their trips than they were prior to the pandemic.

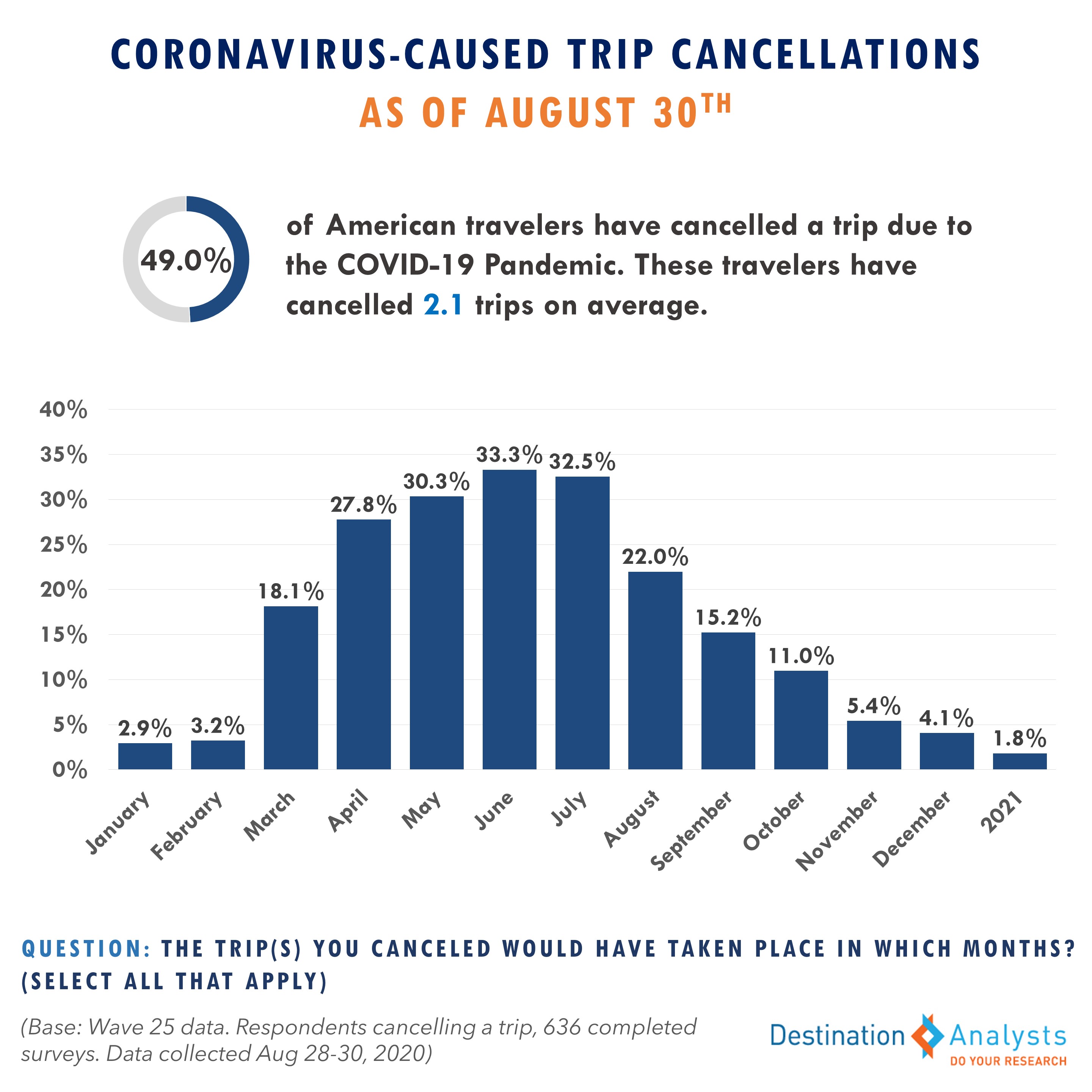

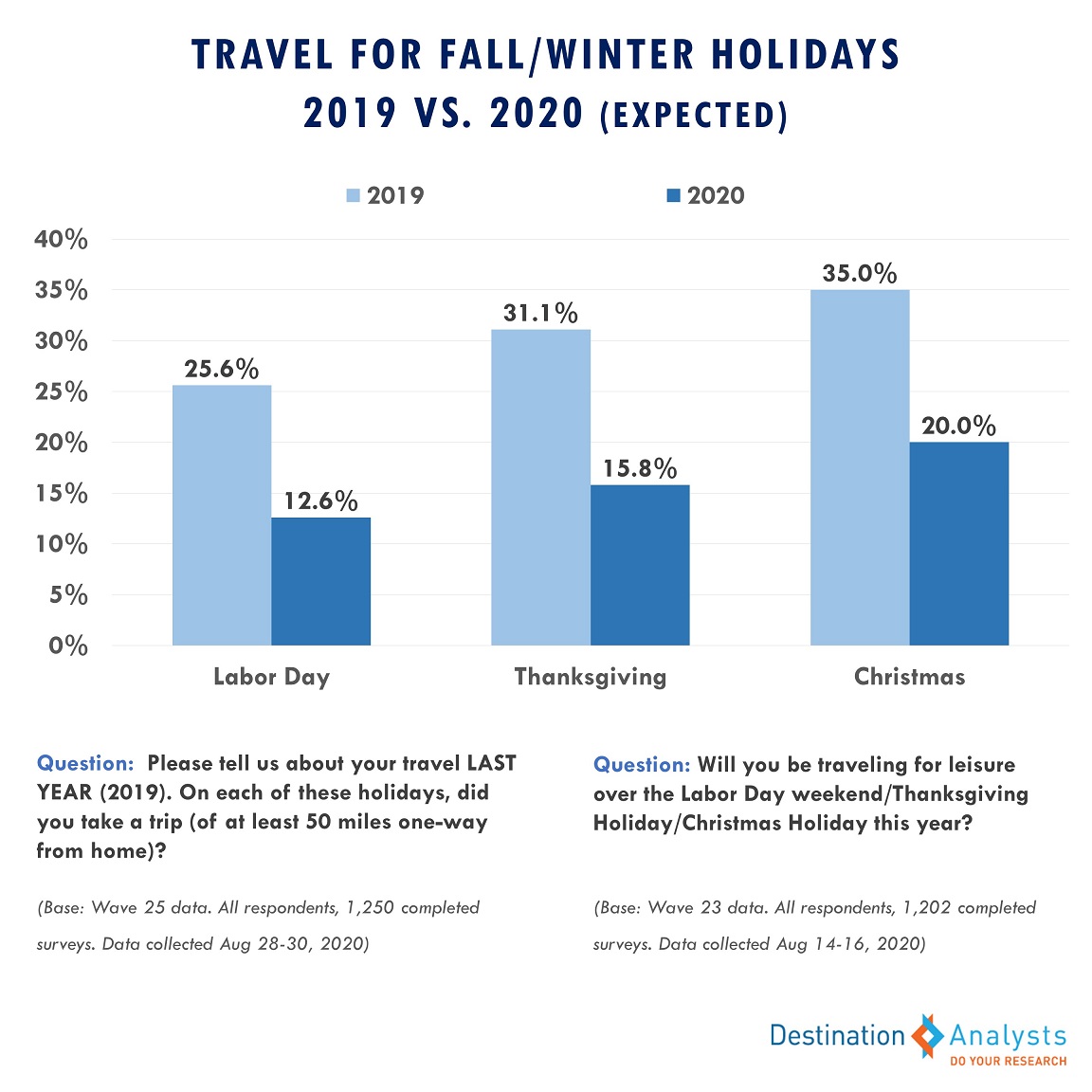

- Although sentiment is turning more positive, the pandemic is nevertheless still impacting travel at a high rate. 49% of American travelers have cancelled a trip due to COVID-19 and trips for the upcoming national Labor Day and Thanksgiving holidays currently look to be off by half relative to 2019.

- Americans may need more information and assurances to move them to take trips, as 46.1% report that they are “not very” or “not at all” confident that they can travel safely in the current environment. In comparison, 29.7% feel confident or very confident they can travel safely.

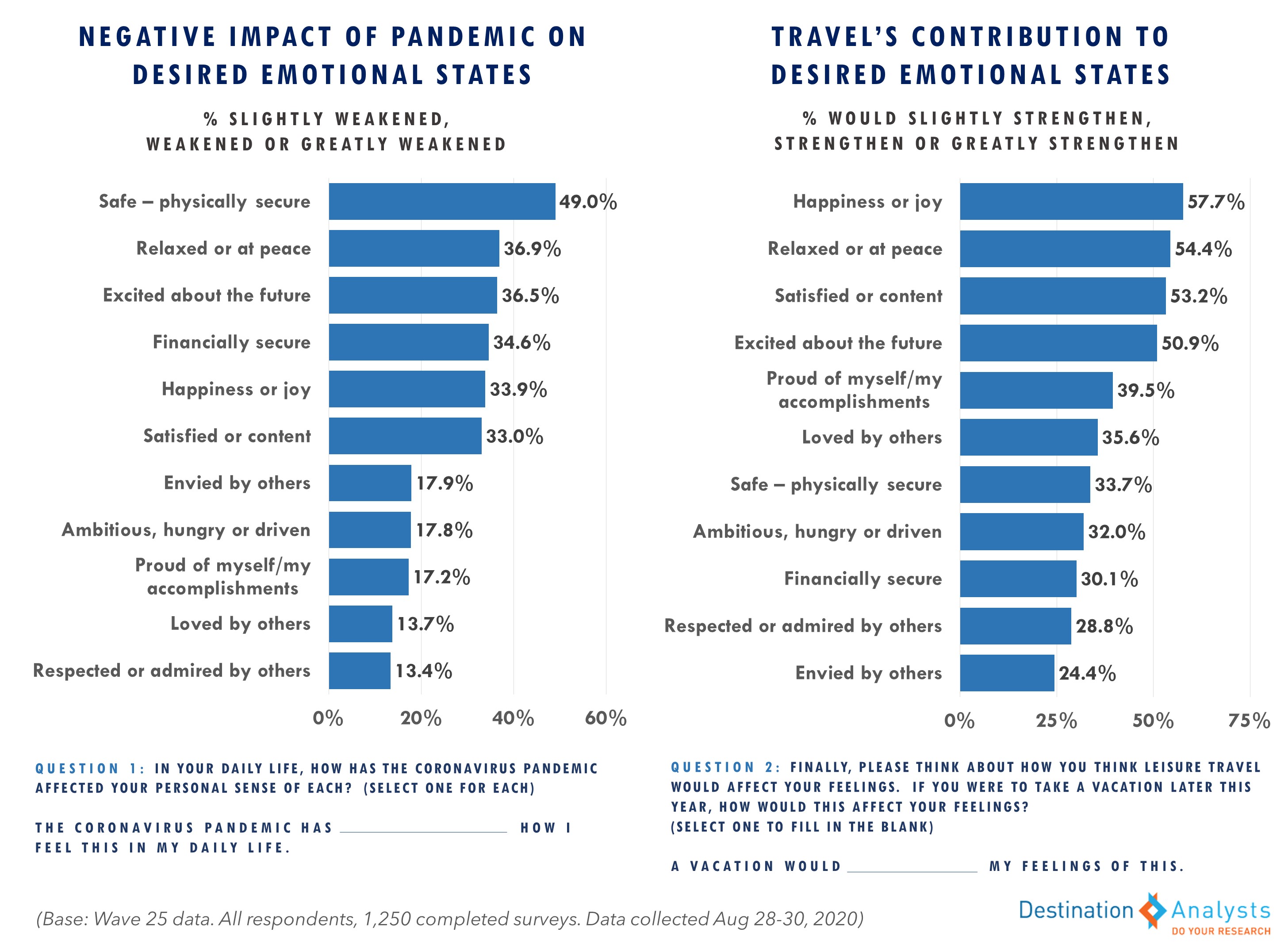

- Americans see travel as a means to achieving their desired emotional states, with over a third of American travelers feeling that if they took a trip this year, the emotions most negatively impacted by the pandemic would strengthen.

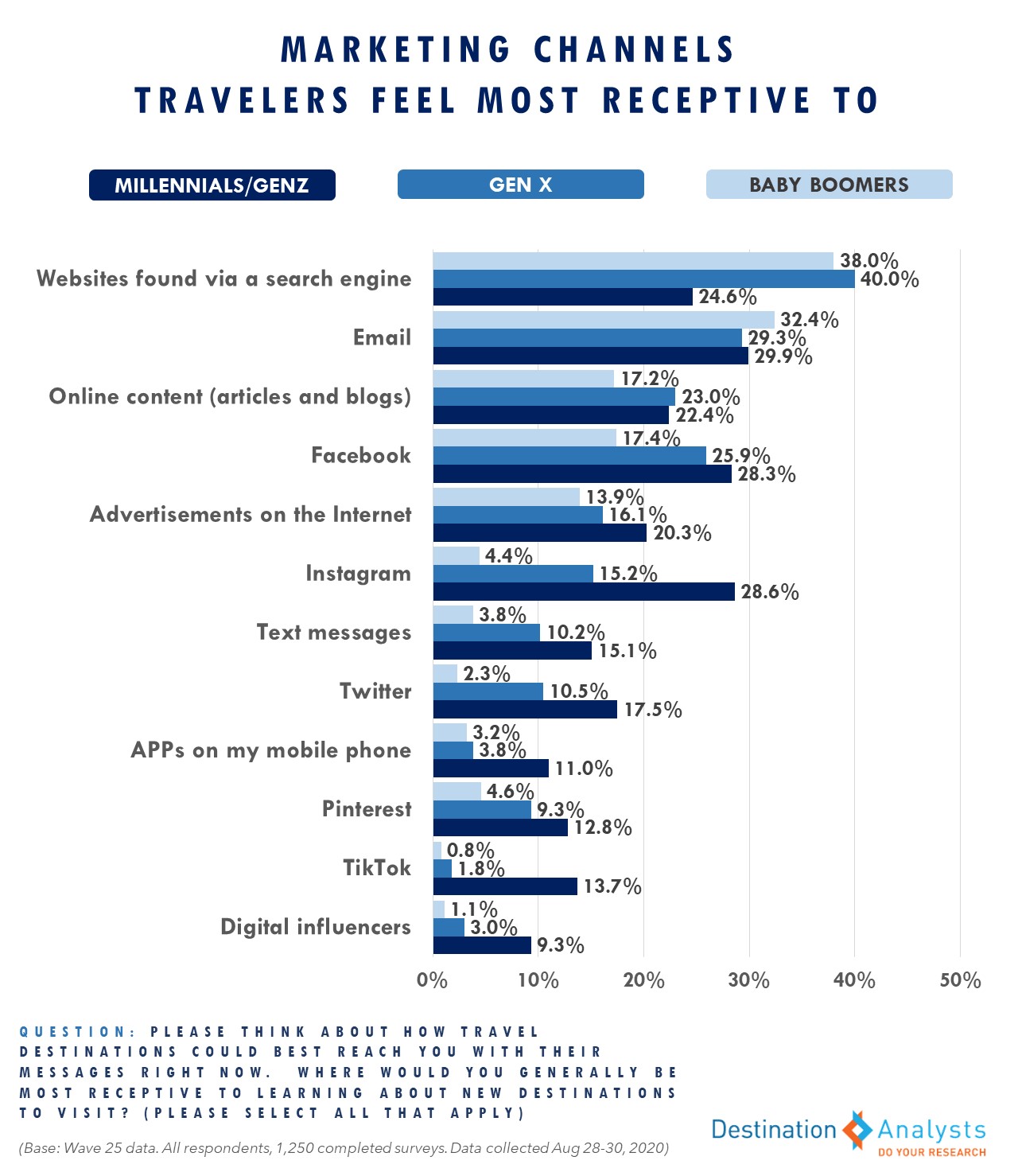

- When asked how travel marketers could best reach them, email is productive across all generations. Gen X and Boomers appear particularly receptive to search engine marketing right now, while Millennial and younger travelers like travel marketing via Facebook and Instagram.

- Americans with trips planned for the remaining 4 months of 2020 showed the most enthusiasm for beaches and mountains—the latter notably higher than what was typical pre-pandemic.

American travelers recorded another measured gain in optimism about the pandemic’s course. This week, 23.0 percent feel the situation in the United States will improve in the next month and 37.2 percent think it will stay the same. While 39.9 percent continue to think it will get worse, this is down markedly from 53.7 percent one month ago. The proportion of American travelers with high degrees of concern for their personal and friends/family’s safety against the virus has dropped back to June levels after being heightened over the last two months while cases surged. However, concerns about the virus’ impact on their personal finances strengthened (60.2% are highly concerned, up from 56.0% last week).

When considering travel, the perception of travel activities as unsafe is the lowest it has been since June 15th. Americans have also demonstrated improvement in their state of mind around travel readiness—over half feel in a readiness mindset versus needing more time to feel up to consider it. For the near-term, excitement to take a potential getaway in the next month and openness to travel inspiration levels increased for the second week in a row, and Fall travel expectations improved to 35.9% from a low of 29.8% last week.

As they look out over the next 12 months, Americans continue to demonstrate greater optimism about their travel future. Now, 43.0% of American travelers say that leisure travel will be at least a somewhat high priority in their personal budget, up from 34.7% just six-weeks ago. Fortunately, a majority of American travelers say the pandemic has not negatively impacted the disposable income they have available for travel (62.7%). In fact, reported annual budgets for leisure travel have increased to an average of $3,258 from $2,721 in July. However, with over a third of American travelers and concerns about the virus impact on finances still elevated, American travelers are indeed planning on being more budget conscious on their trips than they were prior to the pandemic.

Although sentiment is turning more positive, the pandemic is nevertheless still impacting travel at a high rate–49% of American travelers have cancelled a trip due to COVID-19–with concerns about personally contracting the virus the primary driver for abandoning travel plans. The peak summer period bore a particularly significant share of the scrapped trips.

In addition, trips for the upcoming national Labor Day and Thanksgiving holidays currently look to be off by half relative to 2019. Americans’ travel plans for the Christmas holiday also appear to be muted relative to last year.

Perhaps most importantly, Americans may need more information and assurances to move them to take trips, especially as the strong majority do not believe the pandemic will be resolved before the end of the year. In total, 46.1% of American travelers report that they are “not very” or “not at all” confident that they can travel safely in the current environment. In comparison, 29.7% feel confident or very confident they can travel safely in the current environment.

When marketing travel right now, it’s especially beneficial to consider travelers’ emotional state, particularly those which they are most desiring of. Right now, feelings of safety, financial security, happiness, peace of mind and satisfaction are most important to American travelers right now. Unfortunately, the pandemic has significantly weakened Americans sense of the latter three emotional states, as well as excitement about the future. But Americans see travel as a means to achieving their desired emotional states, with over a third of American travelers feeling that if they took a trip this year, the emotions most negatively impacted by the pandemic would strengthen.

When asked how travel marketers could best reach them, email is productive across all generations. Gen X and Boomers appear particularly receptive to search engine marketing right now, while Millennial and younger travelers like travel marketing via Facebook and Instagram. As for what types of destinations that have the highest likelihood of generating excitement right now, Americans with trips planned for the remaining 4 months of 2020 showed the most enthusiasm for beaches and mountains—the latter notably higher than what was typical pre-pandemic*. While excitement about cities and theme park destinations still exists, enthusiasm for these destination types is farthest off from pre-pandemic norms, at least for the rest of 2020.

*Note: Our latest findings on aspiration for ski/snow destinations can be found here.